[ad_1]

Technology corporations within the United States have seen an enormous bull run from the start of 2023. In comparability to the S&P 500 and the Dow, which posted returns of 14.9% and a pair of.4%, respectively, the tech-heavy NASDAQ composite and the NASDAQ 100 Technology Sector Index have gained a respective 30.7% and 37.0% within the year-to-date interval.

Federal Reserve’s hawkish stance to counter multi-decade excessive inflation induced know-how corporations to bleed in 2022. These corporations are delicate to rates of interest on account of excessive expenditures in analysis and improvement, hiring and different associated expenditures. During a excessive rate of interest regime, borrowing prices enhance, which impacts the profitability of the businesses.

Currently, the buyer worth index, probably the most accepted measure of inflation, is at a two-year low, rising 4% within the 12 months ended May. As inflation charges transfer towards a extra favorable course, rates of interest are anticipated to be steady within the days forward. These facets together with a brand new wave of synthetic intelligence, cloud computing, superior applied sciences like machine studying, the Internet of Things, robotics and autonomous autos, will revolutionize the know-how landsape.

All these crucial applied sciences will enhance productiveness many folds and thereby enhance profitability. Since buyers have already factored in these facets, we’ve recognized three top-rated shares like Thermon (THR – Free Report) , Vipshop (VIPS – Free Report) and Veeco Instruments (VECO – Free Report) which have a low price-to-earnings ratio (P/E) in comparison with the trade and have outperformed the S&P 500 Index.

On that notice, allow us to have a look at the businesses

Thermon is headquartered in San Marcos, TX. This Zacks Rank #1 (Strong Buy) firm is engaged in offering engineered thermal options, generally known as warmth tracing, for course of industries, together with power, chemical processing and energy era. You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermon has a price-to-earnings ratio (P/E) of 14.81 in contrast with 30.00 for the trade.

THR’s shares have gained 81.3% over the previous 12 months in contrast with the S&P 500’s rise of 14.7%.

Image Source: Zacks Investment Research

Vipshop is an internet low cost retailer for manufacturers within the People’s Republic of China. This Zacks Rank #1 firm gives a wide array of assorted well-known branded low cost merchandise, together with attire for ladies, males and kids, trend items, cosmetics, house items and different life-style merchandise, by its web site.

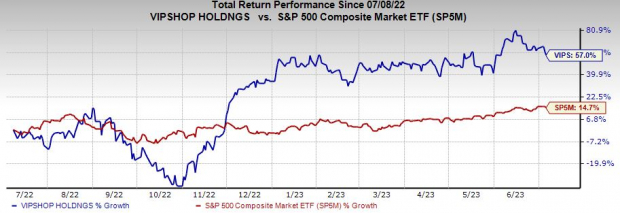

Vipshop has a P/E of 8.41 in contrast with 36.60 for the trade. VIPS shares have gained 57% over the previous 12 months.

Image Source: Zacks Investment Research

Veeco Instruments is headquartered in Plainview, NY. This Zacks Rank #1 firm is engaged within the design, improvement, manufacture and assist of skinny movie course of gear, primarily offered to make digital units.

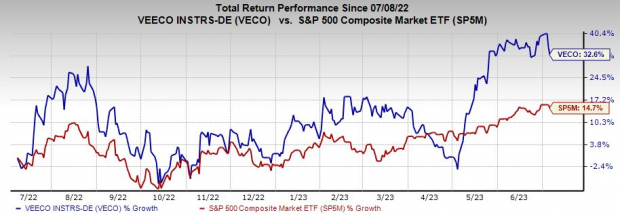

Veeco Instruments has a P/E of 18.89 in contrast with 22.30 for the trade. VECO’s shares have surged 32.6% over the previous 12 months.

Image Source: Zacks Investment Research

[adinserter block=”4″]

[ad_2]

Source link