[ad_1]

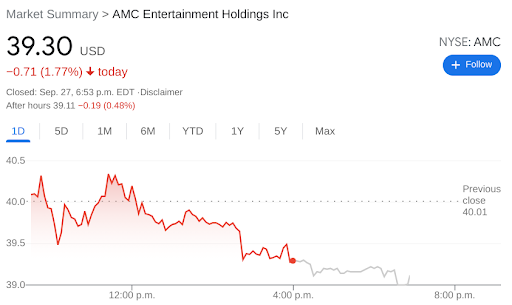

- NYSE:AMC fell by 1.77% during Monday’s session.

- AMC investors pause as Disney refuses to commit to theaters beyond 2021.

- AMC is stuck in a bearish downtrend as meme stocks are losing support.

NYSE:AMC started the week off on the back foot, as the stock erased its gains that were made late last week. On Monday, shares of AMC fell by 1.77% and closed the trading day at $39.30. It has been a tough month for AMC, as shares are down nearly 10% in that time. Still, AMC Apes should not really be complaining as the stock is up over 1,855% year to date. It was a mixed day for the broader markets as the S&P 500 and NASDAQ both closed lower to start the week and the Dow Jones made a modest gain as the only major index to finish in the green.

Stay up to speed with hot stocks’ news!

AMC’s on again off again relationship with movie companies like Walt Disney (NYSE:DIS) continues. Last week Disney CEO Bob Chapek spoke at a Goldman Sachs conference and while he reiterated that Disney would be sticking to theatrical releases for the rest of 2021, he refused to commit beyond this year. If Disney decides to utilize its Disney+ streaming service for simultaneous releases, it could cause a major setback for AMC and other movie theater chains in the future.

AMC stock price forecast

As much as AMC Apes are looking for another squeeze, the stock is currently stuck in a bearish downtrend. Shares are trading well below both the key 8-day and 21-day moving averages, which signals a short-term bearish descent. Technical analysis has been tricky to use with meme stocks, particularly those with a loyal following like AMC. It’s difficult to tell when the stock will see a wild swing, especially since it is not trading in accordance with the business fundamentals.

[ad_2]

Source link