[ad_1]

AwanBiru Technology Berhad’s (KLSE:AWANTEC) inventory is up by a substantial 14% over the previous three months. However, we determined to concentrate to the corporate’s fundamentals which do not seem to offer a transparent signal concerning the firm’s monetary well being. Particularly, we will probably be taking note of AwanBiru Technology Berhad’s ROE right now.

Return on fairness or ROE is a crucial issue to be thought-about by a shareholder as a result of it tells them how successfully their capital is being reinvested. Simply put, it’s used to evaluate the profitability of an organization in relation to its fairness capital.

Check out our latest analysis for AwanBiru Technology Berhad

How Do You Calculate Return On Equity?

Return on fairness might be calculated through the use of the formulation:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above formulation, the ROE for AwanBiru Technology Berhad is:

2.3% = RM4.4m ÷ RM194m (Based on the trailing twelve months to September 2022).

The ‘return’ is the revenue over the past twelve months. That signifies that for each MYR1 price of shareholders’ fairness, the corporate generated MYR0.02 in revenue.

Why Is ROE Important For Earnings Growth?

Thus far, we’ve realized that ROE measures how effectively an organization is producing its income. Depending on how a lot of those income the corporate reinvests or “retains”, and the way successfully it does so, we’re then in a position to assess an organization’s earnings development potential. Assuming every part else stays unchanged, the upper the ROE and revenue retention, the upper the expansion fee of an organization in comparison with firms that do not essentially bear these traits.

AwanBiru Technology Berhad’s Earnings Growth And 2.3% ROE

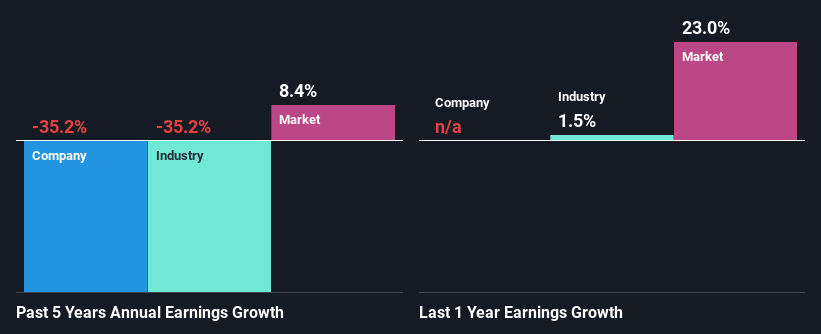

It is difficult to argue that AwanBiru Technology Berhad’s ROE is way good in and of itself. An trade comparability reveals that the corporate’s ROE isn’t a lot totally different from the trade common of two.3% both. Therefore, it may not be unsuitable to say that the 5 12 months internet revenue decline of 35% seen by AwanBiru Technology Berhad was presumably a results of the disappointing ROE.

Next, on evaluating with the trade internet revenue development, we discovered that AwanBiru Technology Berhad’s earnings appears to be shrinking at an identical fee because the trade which shrunk at a fee of a fee of 35% in the identical interval.

Earnings development is a crucial metric to contemplate when valuing a inventory. It’s essential for an investor to know whether or not the market has priced within the firm’s anticipated earnings development (or decline). This then helps them decide if the inventory is positioned for a vivid or bleak future. One good indicator of anticipated earnings development is the P/E ratio which determines the worth the market is keen to pay for a inventory primarily based on its earnings prospects. So, you could wish to check if AwanBiru Technology Berhad is trading on a high P/E or a low P/E, relative to its trade.

Is AwanBiru Technology Berhad Using Its Retained Earnings Effectively?

AwanBiru Technology Berhad would not pay any dividend, which means that the corporate is conserving all of its income, which makes us marvel why it’s retaining its earnings if it may’t use them to develop its enterprise. It appears like there is likely to be another causes to elucidate the shortage in that respect. For instance, the enterprise may very well be in decline.

Summary

On the entire, we really feel that the efficiency proven by AwanBiru Technology Berhad might be open to many interpretations. Even although it seems to be retaining most of its income, given the low ROE, buyers might not be benefitting from all that reinvestment in any case. The low earnings development suggests our idea appropriate. That being so, the most recent trade analyst forecasts present that the analysts predict to see an enormous enchancment within the firm’s earnings development fee. To know extra concerning the firm’s future earnings development forecasts check out this free report on analyst forecasts for the company to find out more.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by basic information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person buyers like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link