[ad_1]

Manuel Augusto Moreno/Moment through Getty Images

India is witnessing a increase in its economic system, with inventory costs hovering and authorities funding in infrastructure, akin to airports, bridges, and roads, extremely seen. The authorities’s spending in clean-energy infrastructure can also be contributing to progress, with India’s GDP anticipated to extend by 6 p.c this 12 months, outpacing each the United States and China.

The Indian economic system has robust fundamentals that make it a sexy funding vacation spot. India’s youthful and rising workforce is a big asset, with almost 70 p.c of its 1.4 billion inhabitants within the working-age bracket. This demographic dividend is poised to gasoline consumption, notably among the many center class, which is projected to contribute round 40 p.c to international middle-class consumption by 2050. The economic system can also be on observe to turn out to be the world’s third-largest, signaling a wealth of alternatives for buyers.

The prospects for the Indian economic system are additional bolstered by strategic home reforms and a good place within the international market. The rollout of a nationwide items and providers tax and bold infrastructure improvement plans, akin to constructing 80 airports within the subsequent 5 years, are growth-boosting measures. Additionally, India’s pivotal place in Asian geopolitics amid rising Sino-American rivalry enhances its strategic significance. While fairness valuations are thought of wealthy, with Sensex corporations buying and selling at excessive price-earnings ratios, robust earnings progress is predicted to deliver these metrics down, making the excessive valuations much less of a priority over time.

For U.S.-based buyers, one exchange-traded fund, or ETF, that ought to get extra consideration to seize India’s potential is the VanEck India Growth Leaders ETF (NYSEARCA:GLIN). This fund gives publicity to a broad vary of Indian corporations exhibiting robust progress potential. GLIN seeks to duplicate the value and yield efficiency of the MarketGrader India All-Cap Growth Leaders Index (MGINGRNR), earlier than charges and bills. This index consists of Indian corporations that show robust fundamentals and enticing progress potential at an affordable value.

GLIN gives buyers a possibility to entry a various portfolio of Indian corporations with strong progress potential at an affordable value. It represents the complete Indian alternative set regardless of measurement, with the potential to outperform standard capitalization-weighted benchmarks by choosing top-ranked corporations.

Detailed Breakdown of the Fund’s Holdings

Top holdings within the fund embody:

-

Coal India Ltd: famend because the world’s largest coal producer, working as a state-owned entity within the coal mining and refining sector inside India.

-

Bharat Electronics Ltd: stands as a government-run company in India’s aerospace and protection trade, providing a various array of merchandise for each protection functions and civilian markets.

-

HCL Technologies Ltd: a distinguished international enterprise within the IT providers area, offering an enormous spectrum of providers akin to software program consulting, enterprise transformation, distant infrastructure administration, engineering, R&D providers, and enterprise course of outsourcing (BPO).

-

State Bank of India: a serious public sector entity specializing in banking and monetary providers, with its headquarters located in Mumbai, Maharashtra. It boasts a rating of 236 within the 2019 Fortune Global 500, showcasing the world’s strongest firms.

-

TATA Consultancy Services Ltd: a worldwide chief in IT providers and consulting, with its central headquarters in Mumbai, Maharashtra, India, and its largest operational base and workforce situated in Chennai, Tamil Nadu, India.

Sector Composition and Weightings

The largest allocations are within the Information Technology, Financials, and Industrials sectors.

-

Information Technology: 26.4%

-

Financials: 20.0%

-

Industrials: 17.6%

-

Energy: 8.1%

-

Health Care: 7.7%

-

Materials: 7.0%

-

Consumer Discretionary: 5.6%

-

Consumer Staples: 5.0%

-

Communication Services: 2.9%

-

Other/Cash: -0.2%.

Peer Comparison

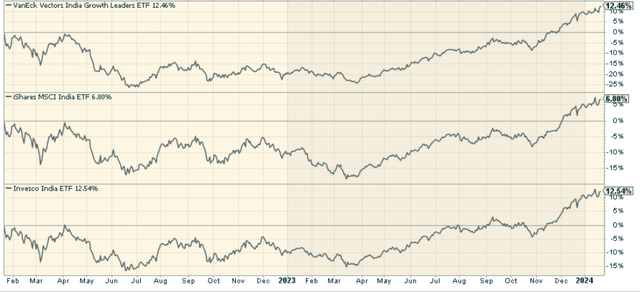

When in comparison with different comparable ETFs, GLIN stands out because of its concentrate on growth-oriented corporations in India. Other funds just like the iShares MSCI India ETF (INDA) and the Invesco India ETF (PIN) additionally provide publicity to Indian equities, however they aren’t as targeted on progress corporations as GLIN. Over the final 2 years, GLIN has outperformed the 2.

Pros and Cons of Investing in GLIN

Pros

-

Access to Growth-Oriented Companies: GLIN permits buyers to achieve publicity to high-growth Indian corporations at an affordable value. This might probably end in increased returns in comparison with investing in conventional capitalization-weighted benchmarks.

-

Diversification: The fund is diversified throughout numerous sectors, lowering the danger related to investing in a single sector.

-

Potential for High Returns: With India being the fastest-growing main economic system on the planet, investing in Indian corporations might probably yield substantial returns.

Cons

-

Country-Specific Risks: Investing in a single-country ETF exposes buyers to country-specific dangers akin to political instability, financial downturns, and modifications in regulatory insurance policies.

-

Emerging Market Risks: India, being an rising market, could also be extra risky and fewer liquid than extra developed markets.

-

Currency Risk: As the fund’s investments are denominated in Indian rupees, buyers are uncovered to forex danger. If the rupee depreciates in opposition to the greenback, the worth of the fund’s investments might decline.

Conclusion: Should You Invest in GLIN?

The VanEck India Growth Leaders ETF gives a singular alternative to spend money on high-growth Indian corporations at an affordable value. With India’s economic system rising at a speedy tempo, the potential for top returns is appreciable. However, like all investments, GLIN carries sure dangers. Investors ought to fastidiously take into account these dangers and their very own monetary circumstances earlier than deciding to take a position on this ETF.

Markets aren’t as environment friendly as standard knowledge would have you ever imagine. Gaps usually seem between market alerts and investor reactions that assist give a sign of whether or not we’re in a “risk-on” or “risk-off” atmosphere.

The Lead-Lag Report can provide you an edge in studying the market so you can also make asset allocation choices primarily based on award successful analysis. I’ll provide the signals–it’s as much as you to resolve whether or not to go on offense (i.e., add publicity to dangerous belongings akin to shares when danger is “on”) or play protection (i.e., lean towards extra conservative belongings akin to bonds/money when danger is “off”).

[adinserter block=”4″]

[ad_2]

Source link