[ad_1]

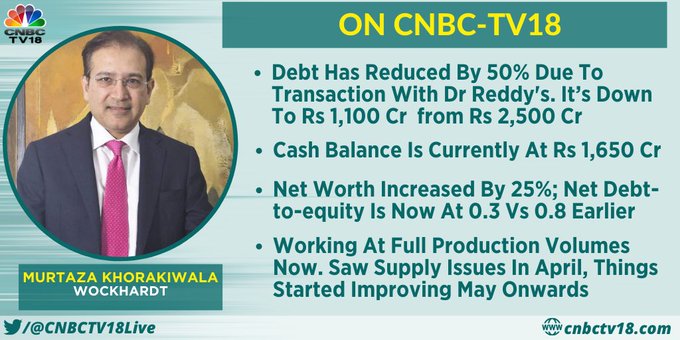

Company is working at full production volumes now, says Wockhardt. The shares are currently trading 2.78 percent lower to Rs 320.10 per share on the NSE.

Market Watch: Nooresh Merani of www.nooreshtech.co.in

“The two spreads which I am looking out for is a buy on Tata Consultancy Services (TCS) with a stop loss at Rs 2,230 and a target price of Rs 2,350. The stock has seen multiple attempts around Rs 2,280 to Rs 2,320 levels for the last few weeks and also for the last year and a half. We expect eventually this range to breakout on the upside so it is a preemptive buy at current levels.”

“Second is a buy on United Spirits which has made a good base around Rs 570-578 and we would expect a bounce towards Rs 625-630, so it would-be a buy at current levels with a stop loss at Rs 578.”

Future Group stocks zoom up to 20% over deal with RIL

The share price of Future Retail climbed as much as 20 percent after Reliance Industries’ subsidiary Reliance Retail announced it will acquire Future Group’s retail, wholesale, logistics, and warehousing businesses on a slump sale basis for Rs 24,713 crore. Future Retail climbed 20 percent to Rs 162.35 per share in the early trade on Monday. Among other Future Group stocks, Future Enterprises surged as much as 4.89 percent to Rs 22.50 per share on the NSE. Future Lifestyles, Future Consumer, Future Supply Chain Solutions, and Future Market Networks traded up to 5 percent higher. More here

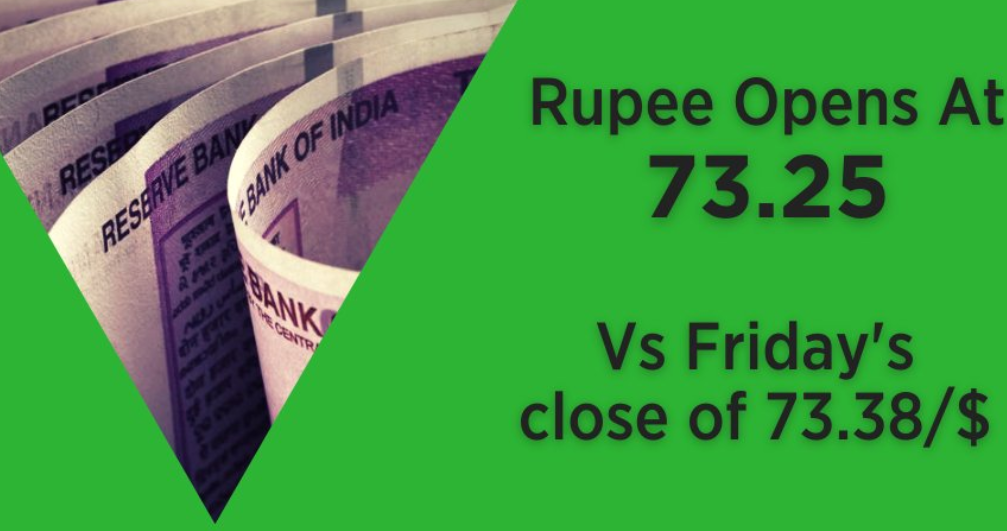

Rupee continues to move higher against the US dollar

Pharma sector needs global collaboration: Industry leaders, govt officials

The need of global collaboration in the pharma sector from research and development to drug manufacturing has never been as great as it is now amid the deadly COVID pandemic, industry leaders and officials from India and the United States said Sunday. Ahead of the 14th edition of the annual BioPharma and Healthcare Summit, that bring stakeholders from India and the United States on one platform, officials and industry leaders said the global health crisis requires a global solution, which can be achieved through global collaboration. India and the United States can play a lead role in this, they said. More here

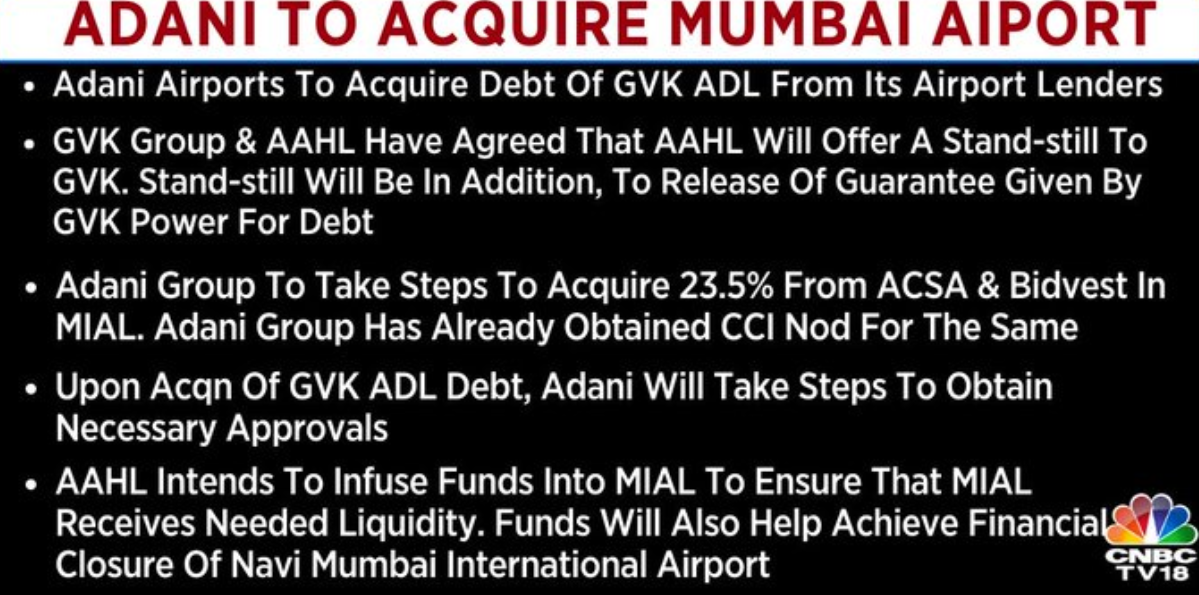

Adani Airports Will acquire the controlling interest in Mumbai Airport from GVK

Sovereign gold bonds open for subscription today

The last installment (series VI) of the Sovereign Gold Bond (SGB) scheme for 2020-21 opened for subscription on Monday. The issue price for the same has been fixed at Rs 5,117 per gram of the yellow metal. Online subscribers can however secure these bonds at a discount of Rs 50 per gram. This subscription of bonds will close on September 4, according to Reserve Bank of India (RBI). More here

Reliance Industries jump over 2.5% post acquisiton of Future Group’s businesses

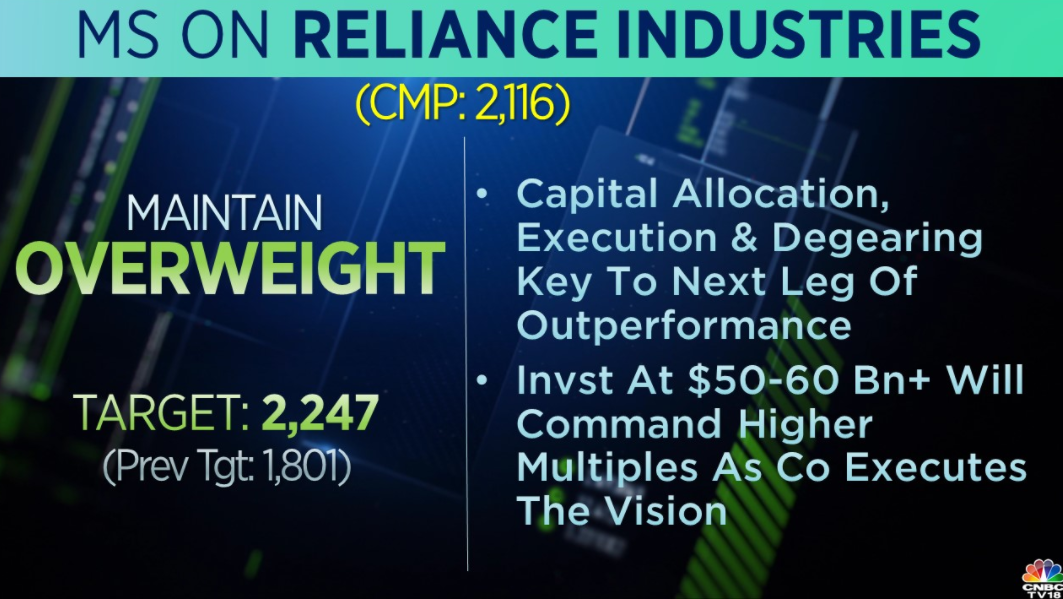

Shares of Reliance Industries (RIL) surged over 2.5 percent on Monday after it announced its acquisition of the Kishore Biyani-promoted Future Group’s retail, wholesale, logistics, and warehousing businesses. The company will acquire the businesses on a slump sale basis for Rs 24,713 crore. Brokerages are also very bullish on the stock post the acquisition. Global brokerage house Morgan Stanley raised RIL’s target price to Rs 2,247 from Rs 1,801 per share earlier post the announcement. It maintains an ‘overweight’ rating on the stock. Meanwhile, CLSA also had an ‘outperform’ call on the stock with a target at Rs 2,250 per share. It said that the acquisition of Future Group business is value accretive with big market share gains.

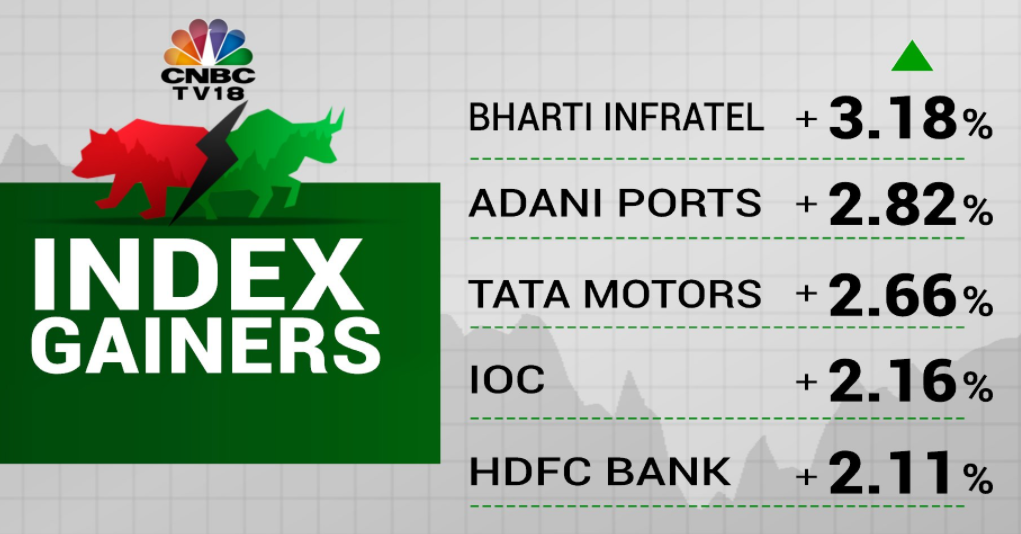

Bharti Infratel, Adani Ports top Index gainers

Opening Bell: Sensex, Nifty open over 1 percent higher; RIL, banks gain

Indian shares opened over 1 percent higher on Monday following Asian peers, which notched a fresh two-year high. Domestic indices were mainly led by index heavyweight Reliance Industries and financial stocks like HDFC Bank, ICICI Bank, and IndusInd Bank. At 9:18 am, the Sensex was up 519 points at 39,986 while the Nifty rose 130 points to 11,777. Broader markets also rose with the midcap and smallcap indices up 0.6 percent and 0.8 percent, respectively. The banking index surged over 2 percent at opening while fin services index rose 1.5 percent. Nifty Auto and Nifty Realty added 0.7 percent each. All other sectors, except Nifty Media, were also in the green.

Warren Buffett looks to Japan, takes 5% stakes in five biggest trading firms

Berkshire Hathaway Inc said it has acquired slightly more than 5 percent of the shares in five large Japanese companies, marking a departure for Chairman Warren Buffett as he looks outside the United States to bolster his conglomerate. In a statement on Sunday, Buffett’s 90th birthday, Berkshire said it acquired its stakes in Itochu Corp, Marubeni Corp, Mitsubishi Corp, Mitsui & Co Ltd and Sumitomo Corp over approximately 12 months. Berkshire said it intends to hold the investments for the long term, and may boost its stakes to 9.9 percent. A Berkshire insurance business, National Indemnity Co, is holding the shares. More here

Suzlon Energy loss widens to nearly Rs 399 crore in June quarter

Suzlon Energy on Saturday reported widening of its consolidated net loss to Rs 398.86 crore in the April-June quarter compared to the year-ago period mainly due to lower revenues. The consolidated net loss of the company was Rs 336.88 crore in the quarter ended on June 30, 2019, a BSE filing said. Total consolidated income of the company declined to Rs 528.22 crore in the quarter under review from Rs 851.09 crore in the same period last year. About the COVID-19 situation in the country, the company stated that the group’s ability to generate sufficient cash flows to meet its financial obligations in the foreseeable future could be impacted by the undetermined circumstances arising from the pandemic. More here

Gold hits near two-week high on weaker dollar, dovish Fed signals

Gold prices rose on Monday to their highest level in nearly two weeks, as demand was boosted by a weaker dollar and the US Federal Reserve’s new policy framework suggested that interest rates would remain low for some time. Spot gold was up 0.4 percent at USD 1,971.68 per ounce by 0043 GMT, after hitting its highest since Aug. 19 at USD 1,976 in early Asian trade. However, gold is down nearly 0.2 percent so far this month. US gold futures rose 0.4 percent to USD 1,982.50. More here

MS has an Overweight Rating on Reliance Ind with target being raised to Rs 2,247/Share

GDP numbers, auto sales data fresh triggers for stock market this week: Analysts

Domestic equity bourses in the coming week will be guided by Q1 GDP print, infrastructure output data for July and monthly auto sales numbers, which together will give an indication about the health of the economy, analysts said. During this data-heavy week, the investor focus will also remain on global market trends and COVID-19 updates like the number of infection cases and news related to the progress of vaccines. “This week, participants will be closely eyeing auto sales number and GDP data for cues on how the economy is progressing. Besides, monsoon progress and news updates related to COVID-19 would also be on their radar,” said Ajit Mishra, VP-Research, Religare Broking Ltd. More here

Reliance Industries arm to acquire Future Group’s retail, wholesale, logistics, warehousing biz for Rs 24,713 crore

Reliance Retail Ventures (RRVL), a subsidiary of Reliance Industries, today announced that it is acquiring the Kishore Biyani-promoted Future Group’s retail, wholesale, logistics, and warehousing businesses on a slump sale basis for Rs 24,713 crore. A slump sale is when a business is sold for a lump sum consideration without values being assigned to the individual assets and liabilities. The deal value is subject to adjustments set out in the composite scheme of arrangement. Under the scheme, Future Group will merge certain companies carrying on the abovementioned businesses into Future Enterprises Limited (FEL). More here

Here are some other global cues for today

ESAF Small Finance Bank to take call on Rs 976-crore IPO after September

Kerala-based ESAF Small Finance Bank has said it will take a call on Rs 976-crore initial public offering (IPO) after September. As part of its commitment for going public by listing its stock in line with requisite guidelines, the bank had filed draft red herring prospectus (DRHP) in January and subsequently got approval from the market regulator Sebi in the last week of March. However, the bank could not go to market due to lockdown imposed in the wake of COVID-19 outbreak.

Six of top 10 most valued firms together add over Rs 1 lakh crore in m-cap

The market valuation of six of the top 10 most valued firms zoomed by Rs 1,06,523.84 crore last week, with ICICI Bank and Kotak Mahindra Bank leading the pack. During the last week, the BSE benchmark Sensex had gained 1,032.59 points or 2.68 percent. Of these 10 most valued companies in terms of market capitalisation (m-cap), Reliance Industries Ltd (RIL), HDFC Bank, HDFC, Kotak Mahindra Bank, Bharti Airtel and ICICI Bank emerged as gainers. On the other hand, four firms Tata Consultancy Services (TCS), Hindustan Unilever Ltd (HUL), Infosys and ITC ended the week with losses. Read More

Asian stocks hit two-year top, Nikkei bounces as Berkshire buys in

Asian shares notched a fresh two-year high on Monday as investors wagered monetary and fiscal policies globally would stay super stimulatory for a protracted period, keeping the safe-haven dollar on the defensive. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.2 percent to reach its highest since June 2018, extending a 2.8 percent rise last week. Tokyo’s Nikkei rallied 1.4 percent aided by news Warren Buffett’s Berkshire Hathaway had bought more than 5 percent stakes in each of the five leading Japanese trading companies. The Nikkei had dipped on Friday after Prime Minister Shinzo Abe’s resignation stirred doubts about future fiscal and monetary stimulus policies. More here

First up, here is quick catchup of what happened in the markets on Friday

Indian indices ended higher for the sixth consecutive session on Friday lifted by gains in financial stocks. Heavyweights ICICI Bank, Axis Bank, Kotak Bank, IndusInd Bank, SBI, and HDFC contributed the most to the benchmarks. The Sensex ended 354 points higher at 39,467 while the Nifty rose 88 points to end at 11,647. For the week, the indices rose around 2.5 percent. The benchmark indices have climbed close to 5 percent this month on signs that business activity is picking up and global optimism around potential coronavirus vaccines.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link