[ad_1]

Summary

- Technology and e-commerce sectors witnessed a boom amid the COVID-19 pandemic, with people experiencing a drastic change in their lifestyle like the way they work, shop or perform other day-to-day activities.

- Stocks like ALU and TPW have experienced strong growth in customer base and announced solid financial results.

- Electronic design software company, Altium achieved a solid result exceeding 50k subscriber base and delivering 10% revenue growth in FY20.

- Temple & Webster, the leading online retailer for furniture & homewares, experienced record level of customer satisfaction, 74 per cent revenue and 77 per cent active customer base growth, and cash flow positive FY20.

With the onset of COVID-19 pandemic, physical distancing and other measures are being practised, making all dependent on digital technologies and e-commerce like never before. Digital technologies enabled several companies to manage work from home, educational institutions to provide continuous education, people to shop from the comfort of their homes and governments to deliver public services, while also playing an indispensable role in sustaining social activities.

Good Read: Technology family: Shedding light upon Fintech, Regtech, Medtech, Proptech

The pandemic-driven situations have forced many businesses to implement technologies much more quickly than otherwise planned. As a result, digital technologies’ usage has spiked, with the related-space players witnessing an unprecedented boom. Retailers that quickly invested in digital transformation, in addition to those that are already offering digital services to their customer base, experienced a massive surge in sales through their digital platforms.

Several businesses from the technology and e-commerce sectors emerged as winners during the prolonged virus crisis.

Altium Reports Solid Revenue Growth, Subscribers Exceed 50K Mark

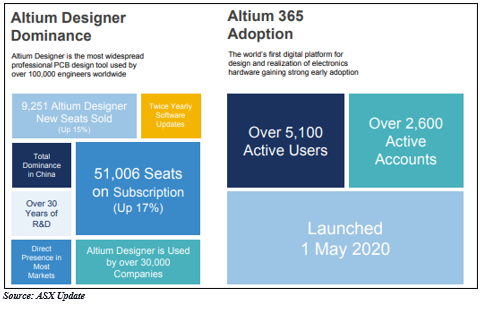

On 17 August 2020, electronic design software company Altium Limited (ASX:ALU) announced full-year results for the period ended 30 June 2020. The company’s revenue grew by 10 per cent to USD 189 million, on the back of excellent performances in all core business units and key regions.

Furthermore, profit before tax went up by 12 per cent to USD 65 million and EBITDA margin stood at 40.0 per cent for FY20. The subscription base grew by 17 per cent to 51,006 subscribers.

Related: Shedding light on 7 ASX Tech Titans that have rebooted Growth Investment Style

Other significant highlights included:

- ALU successfully launched Altium 365, its new cloud platform, which is gaining strong early adoption.

- Altium Designer seats sales were 9,251, up by 15 per cent.

- At end-June 2020, cash balance was USD 93 million, representing an increase of 16 per cent on the PCP.

- Final dividend stood at AU19 cents, up by 15 per cent on a yearly basis, taking the full-year dividend to AU39 cents for the year.

Altium CEO Aram Mirkazemi highlighted that despite robust performance in FY20, the company could not achieve its long-held aspirational goal of USD 200 million in revenue, owing to the pandemic. The strong performance reflects the company’s strength, business model flexibility and versatility to perform across multiple fronts and in different conditions, Mr Mirkazemi added.

During the last quarter of 2020, as the company realised that some customers prefer monthly payment terms due to the pandemic situation, Altium, which doesn’t have any long-term plan to offer in this regard, started to promote term-based pricing for Altium Designer.

The move is expected to boost recurring revenue more than the current rate of 60 per cent in time, while also complementing the high-end products that are sold only on a term-basis.

ALU remains committed to its long-term goals and is on track to achieve 100K subscribers by 2025. However, due to COVID-19 situation, the company might take an additional 6-12 months to achieve the goal of USD 500 million in revenue, according to Mr Mirkazemi.

Stock Information – On 20 August 2020, ALU closed the day’s trade at AUD 35.770, down by 3.167 per cent. The company has a market cap of AUD 4.84 billion and its stock has delivered a return of more than 12 per cent in the last one-month period.

Good Read: Technology Space in the face of COVID-19; Investment Tips for Tech Stocks

Temple & Webster’s FY20 Revenue Up by 74 Per Cent Year on Year

Australia’s online market leader in furniture & homewares, Temple & Webster (ASX:TPW) registered a great set of numbers for FY20 despite very tough retail conditions, owing to the pandemic.

Key highlights for FY20 included

- Revenue grew by 74 per cent year on year to AUD 176.3 million with Q4 revenue up by 130 per cent and H2 revenue up by 96 per cent.

- EBITDA stood at AUD 8.5 million, compared with AUD 1.5 million in the same period a year ago.

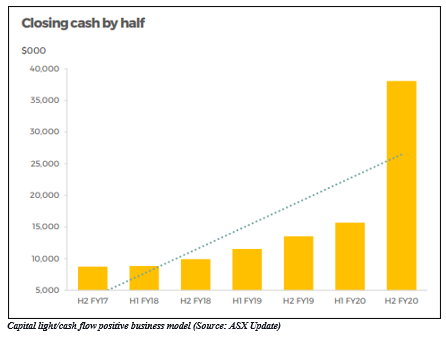

- Positive cash flow with ending cash of AUD 38.1 million and no debt, excluding proceeds from recent placement worth AUD 40 million.

- Active customer base grew by 77 per cent year on year

- Trade and Commercial division up by 68 per cent YoY

- Successful completion of capital raising worth AUD 40 million, boosting the balance sheet

- Customer satisfaction reached record levels in Q4 (NPS up 65 per cent)

Good Read: 10 Consumer Discretionary Stocks in ASX Bull Run

The year FY21 initiated on a very positive note with robust July revenue growth. The company plans to take advantage of the structural shift towards online platform, while capitalising on both organic and inorganic opportunities. Meanwhile, as part of its high growth strategy, the company would keep assessing the competitive and macroeconomic environment.

Stock Information – On 20 August 2020, TPW closed the day’s trade at AUD 8.110, up by 3.841 per cent. The company has a market cap of AUD 940.74 million and its stock has delivered a return of more than 7 per cent and 104 per cent in the last one month and six months, respectively.

Must Read: E-commerce Emerges as Winner from COVID-19 Turmoil

[ad_2]

Source link