[ad_1]

Photographer: Dhiraj Singh/Bloomberg

Photographer: Dhiraj Singh/Bloomberg

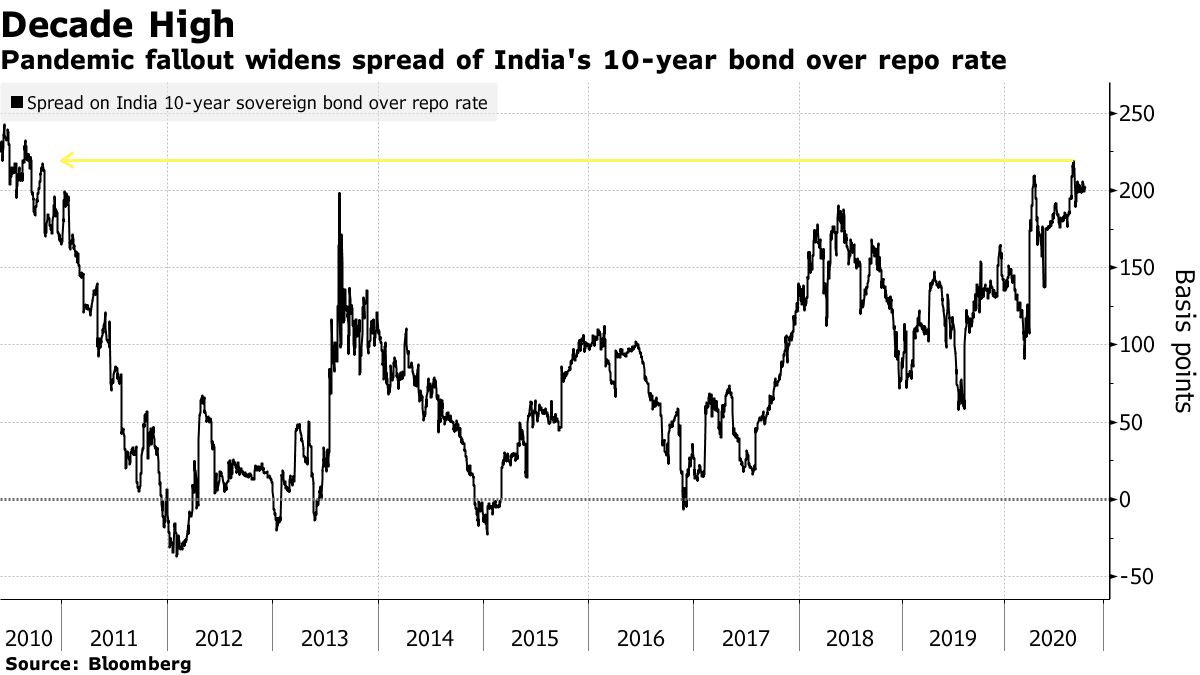

A relentless increase in bond issuance by Indian states means the federal government will likely have to pay a higher price for Prime Minister Narendra Modi’s record borrowing plans.

“Spreads over government bonds will widen,” said Pankaj Pathak, a fixed income fund manager at Quantum Asset Management Ltd. in Mumbai. “For some investors, state bonds are a substitute and they may be lured by the higher spread, which will in turn steepen the longer end of the government bond curve.”

Strains for the federal government are already showing, with underwriters rescuing four of its last seven debt auctions as investors demanded higher yields. It’s in the middle of a 12 trillion rupees ($163 billion) borrowing spree this fiscal year ending March and states typically lump their debt issuance toward the end of the period.

The states have boosted issuance by 55% so far this fiscal year, compared to the same period in 2019, according to Care Ratings, as the coronavirus pandemic depresses their tax revenues and the federal government fails to meet its funding commitments to them.

They face a 2.35 trillion rupees shortfall in their share of revenue from the national goods and services tax and this is likely to spark a further “scramble for funds,” particularly in the fiscal fourth quarter, said Madhavi Arora, an economist at Edelweiss Securities Ltd.

The states will seek to raise 2.02 trillion rupees in the current quarter, meaning weekly supply that is almost 60% more than the level seen in the first half.

Below are the latest signs of stress identified by Care Ratings:

- Borrowing costs for states continued to rise on Tuesday with the weighted average yield of state debt at 6.80%, 23 basis points higher than a week ago, and 31 basis points higher than the first week of September.

- The weighted average yield of 10-year state bonds auctioned Tuesday was 6.89%, 2 basis points higher than a week ago; nearly 40% of state debt issuance is via 10-year bonds.

- Maharashtra, Andhra Pradesh, and Karnataka states have seen their borrowing costs rise by an average 53 basis points over the past one month.

- The spread between 10-year state debt and government bonds has widened to a four-month high of 88 basis points.

[ad_2]

Source link