[ad_1]

VIKRAM SHROFF, one of the two sons of Rajju (Rajnikant) Shroff, the founder of the Rs 38,694-crore global pesticide producer UPL (earlier United Phosphorus Ltd), acquired companies in the British Virgin Islands to hold a yacht and along with elder brother Jaidev, set up a four-layered subsidiary structure to own real estate in Dubai, records in the Pandora Papers investigated by The Indian Express reveal.

The records show that Vikram Shroff, a British citizen, had in June 2011, set up a company called Spider Investments Ltd in the Cayman Island, to hold a Euro 3.65 million motor yacht named Robusto for personal use and chartering. Spider Investments was incorporated through Trident Trust Company (BVI) Ltd, a corporate services provider firm.

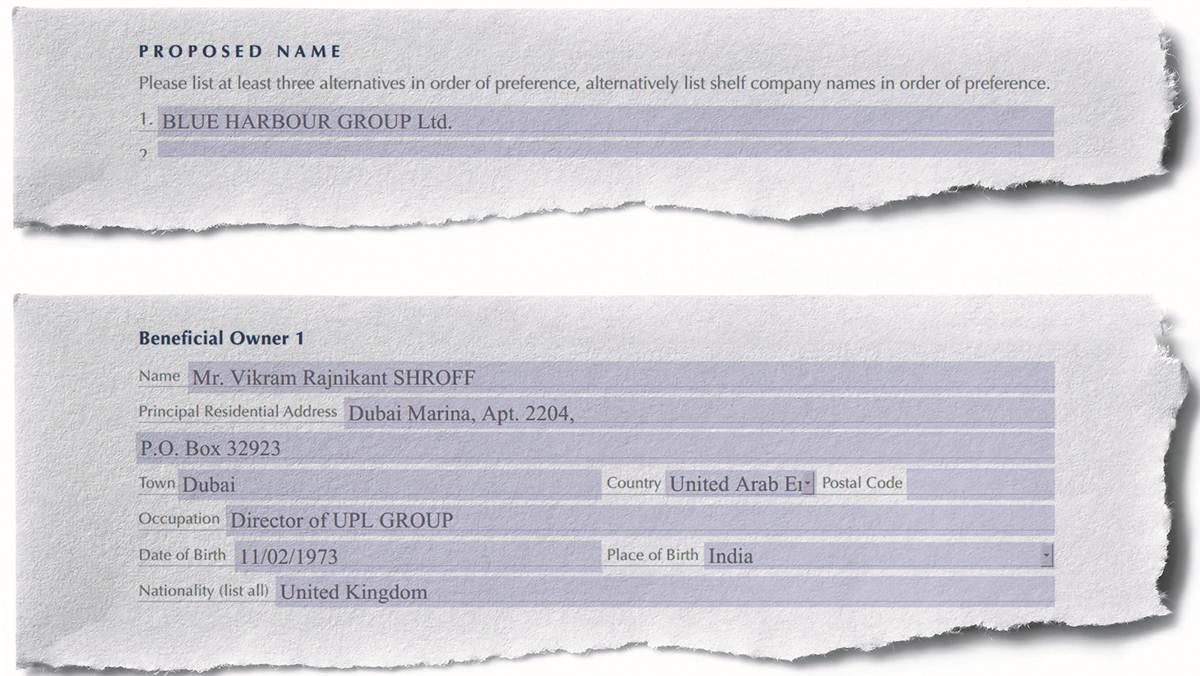

In July 2016, Trident Trust set up another company called Blue Harbor Group Ltd in BVI with Vikram Shroff as the beneficial owner, and Trident Trust subsidiary Harris Trustees Limited, registered in St Kitts and Nevis, as its shareholder.

According to the incorporation form of Blue Harbor, the company was set up solely to hold a Euro 3.5 million yacht, to be later exported to BVI for “tax purposes”. The Blue Harbor records are maintained at Trident Trust’s office in Cyprus. Vikram’s annual income is stated to be $1.5 million and approximate overall wealth to be $40 million in the incorporation form.

🗞️ Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

Jaidev and Vikram are also owners of BVI firms Gem Consulting Ltd and Legacy Investing SA, respectively. Both these firms were incorporated in January 2013. While Jaidev’s Gem Consulting owns JS Investments Ltd in Jebel Ali Free Zone (Jafza) in UAE, Vikram solely owns VS Investments Ltd in Jafza.

JS Investments and VJ Investments, in turn, hold 50 per cent each in another Jafza-based entity VJS Investments Ltd (now Vesper Investments Ltd). VJS Investments Ltd is the owner of Dubai-based Prasadah Trading DMCC, which records in Pandora Papers reveal, was set up to own properties in Dubai. All these firms were set up in 2014 between February and September.

Trident Trust documents show Vikram Shroff as the Beneficial Owner of BVI entity Blue Harbour Group Ltd.

Trident Trust documents show Vikram Shroff as the Beneficial Owner of BVI entity Blue Harbour Group Ltd.

Records also show that Vikram Shroff is the beneficial owner of another BVI firm Lorena Asset Holdings Ltd set up in 2011 to hold bankable assets and investments. It was also set up to own a bank account and Vikram’s investment portfolio at Bank Julius Baer in Zurich. The sole shareholder of Lorena is another BVI entity, Louksor Limited, the records show.

Jaidev Shroff is the beneficial owner of Trenkore Investments Limited, an entity in Cyprus which was re-domiciled in the BVI in 2011. Shroff controls this company through Seychelles-based Vector Projects Ltd, records show.

Responding to a list of questions, Mishcon de Reya LLP, the law firm representing the Shroff brothers Jaidev said, “Jaidev and Vikram Shroff have worked exceptionally hard building one of the world’s largest corporations which has created jobs and prosperity in India and across the world. The Shroffs own a yacht, which is only ever used by the family in a private capacity. It has never generated any income, is not used for chartering and there are no taxation implications.”

It further said: “To ensure their private assets and liabilities are recorded and tracked, Jaidev and Vikram set up companies for each of their investments well in advance of any deal. If that deal is not concluded, the company has no further use and lies dormant or is wound up. If it goes ahead, Jaidev and Vikram proudly comply with the global Common Reporting Standard developed by the OECD in 2014. They send information to the relevant tax authorities and keep their tax filings up to date. The brothers are not resident in India but wherever Indian-sourced income is generated they readily pay all taxes due.”

On January 22, 2020, the Income Tax authorities had searched UPL premises after complaints of alleged tax evasion. In its annual report of FY 2021, the company said the I-T department served notices asking it to file revised tax returns for past years.

“Company has filed its return of income. Further, the income tax department has issued notices to the company calling for certain preliminary information. The company is in the process of responding to the above notices and does not expect any significant financial or reporting implications to emerge out of this matter,” said UPL in the annual report.

UPL was also mired in a controversy after a whistle-blower alleged siphoning of funds by promoters as the company paid crores of rupees in rent to shell companies for properties earlier owned by UPL’s global head Jaidev Shroff. He denied any wrongdoing and said the UPL’s audit committee examined the whistle-blower’s complaint in 2017 and did not find merit in the allegations.

(With inputs from Jayprakash Naidu in Mumbai)

[ad_2]

Source link