[ad_1]

The pleasure of investing in an organization that may reverse its fortunes is an enormous draw for some speculators, so even corporations that don’t have any income, no revenue, and a file of falling quick, can handle to seek out traders. Sometimes these tales can cloud the minds of traders, main them to speculate with their feelings fairly than on the benefit of fine firm fundamentals. A loss-making firm is but to show itself with revenue, and ultimately the influx of exterior capital could dry up.

In distinction to all that, many traders favor to give attention to corporations like L&T Technology Services (NSE:LTTS), which has not solely revenues, but in addition income. While revenue is not the only real metric that must be thought-about when investing, it is value recognising companies that may persistently produce it.

Check out the opportunities and risks within the IN Professional Services industry.

How Quickly Is L&T Technology Services Increasing Earnings Per Share?

Generally, corporations experiencing development in earnings per share (EPS) ought to see comparable tendencies in share worth. That makes EPS development a horny high quality for any firm. L&T Technology Services managed to develop EPS by 10% per yr, over three years. That’s a very good charge of development, if it may be sustained.

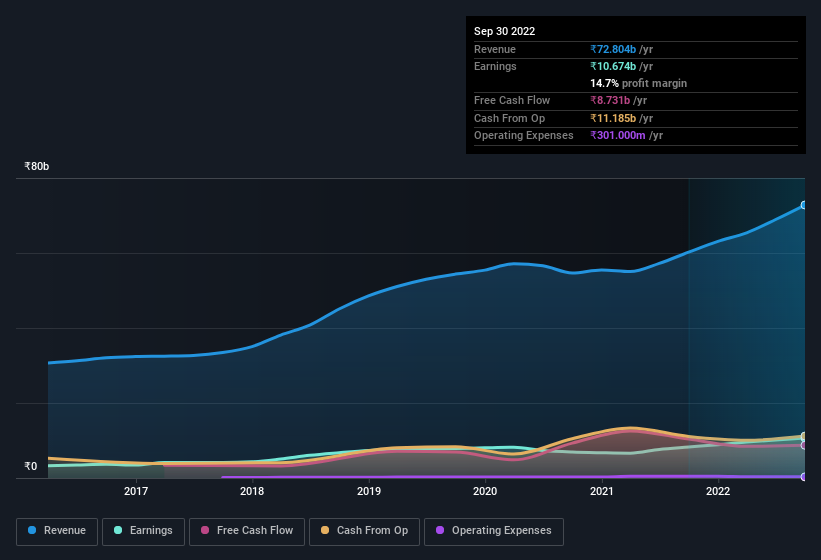

It’s usually useful to check out earnings earlier than curiosity and tax (EBIT) margins, in addition to income development, to get one other tackle the standard of the corporate’s development. While we notice L&T Technology Services achieved comparable EBIT margins to final yr, income grew by a stable 21% to ₹73b. That’s progress.

In the chart under, you’ll be able to see how the corporate has grown earnings and income, over time. To see the precise numbers, click on on the chart.

The trick, as an investor, is to seek out corporations which might be going to carry out nicely sooner or later, not simply previously. While crystal balls do not exist, you’ll be able to examine our visualization of consensus analyst forecasts for L&T Technology Services’ future EPS 100% free.

Are L&T Technology Services Insiders Aligned With All Shareholders?

It’s pleasing to see firm leaders with placing their cash on the road, so to talk, as a result of it will increase alignment of incentives between the individuals working the enterprise, and its true house owners. L&T Technology Services followers will discover consolation in realizing that insiders have a major quantity of capital that aligns their finest pursuits with the broader shareholder group. As a matter of reality, their holding is valued at ₹3.4b. That’s some huge cash, and no small incentive to work exhausting. Even although that is solely about 0.8% of the corporate, it is sufficient cash to point alignment between the leaders of the enterprise and peculiar shareholders.

Should You Add L&T Technology Services To Your Watchlist?

One necessary encouraging function of L&T Technology Services is that it’s rising income. For those that are searching for a little bit greater than this, the excessive stage of insider possession enhances our enthusiasm for this development. That mixture could be very interesting. So sure, we do assume the inventory is value maintaining a tally of. Still, you need to study concerning the 2 warning signs we’ve spotted with L&T Technology Services.

There’s at all times the potential of doing nicely shopping for shares that should not rising earnings and don’t have insiders shopping for shares. But for individuals who take into account these necessary metrics, we encourage you to take a look at corporations that do have these options. You can entry a free list of them here.

Please notice the insider transactions mentioned on this article seek advice from reportable transactions within the related jurisdiction.

Valuation is advanced, however we’re serving to make it easy.

Find out whether or not L&T Technology Services is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We purpose to carry you long-term targeted evaluation pushed by elementary information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link