[ad_1]

The 2022 Trading Year mercifully pale into historical past, however the harm achieved to a big selection of shares in exchanges around the globe can be sluggish to erase.

Here in Australia, expertise shares adopted the lead from the US with crushing outcomes. High rates of interest aren’t variety to tech shares so the drastic drops ought to have come as no shock to most buyers.

Rising rates of interest are seen by central banks as the important thing to taming the second issue impacting the tech sector – inflation.

The third is the uncertainty surrounding the Chinese financial system within the gentle of that nation’s deeper plunge into COVID infections.

While inflation within the US has tamed a bit, buyers stay not sure of how a lot additional the US Federal Reserve Bank will go along with their aggressive fee mountain climbing. The US Department of Labor reported a decline within the annual inflation fee from November’s studying of seven.1% to six.5%. On a month-to-month foundation that represents a lower of 0.1%.

Economic measures within the US stay strong, regardless of a number of analysts and economists predicting a recession in 2023. Despite this, it seems the market neighborhood is betting on the US fee hike rampage to sluggish to a 0.25% improve in February with the ultimate improve coming in March.

History suggests to any investor prepared to pay attention that high quality corporations with services or products remaining in or returning to demand can recuperate over time. Doubting buyers have solely to analysis shares that collapsed within the GFC (Great Financial Crisis) and within the purported “death of the mining boom” right here in Australia.

Investing in tech shares proper now stays the province of threat tolerant buyers with the time and temperament to analysis shares and keep away from the stampeding herd.

On 12 December of 2022, the AFR (Australian Financial Review) reported the outcomes of a survey of 11 of Australia’s high expertise firm CEOs (Chief Executive Officer).

Most see slowing gross sales within the EU and the US impacting their operations, however they seem in settlement that enterprise to enterprise (B2B) corporations will fare higher than these serving client markets.

As far again as October of 2022, an analyst from Citi and others introduced what was on the time a reasonably contrarian view – tech shares would start to recuperate in 2023. In each Australia and the US, they’ve begun the yr in a modestly rising development.

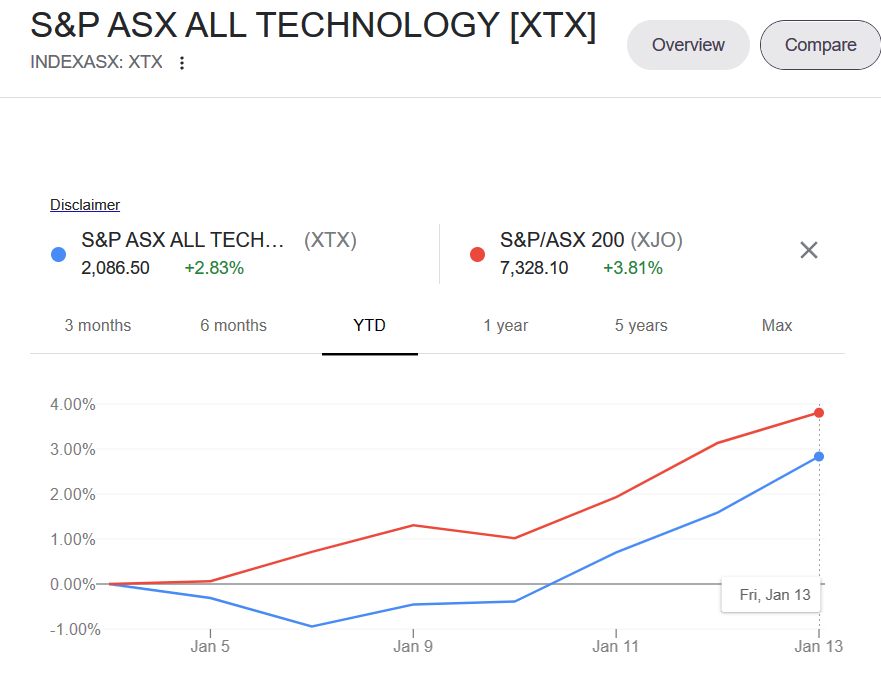

The US NASDAQ Index the place expertise shares commerce is up 5.6% whereas the S&P 500 Index is up 3.7%. The following graph from Google Finance compares the yr to this point efficiency of the ASX All Technology XTX index with the ASX 200.

For most buyers, the seek for potential bargains within the ASX expertise sector begins with two of probably the most battered shares within the as soon as favored group often known as the WAAAX stocks – Appen Limited (APX) and XERO Limited (XRO) – each B2B corporations.

Appen and XERO have been among the many worst performing ASX tech shares in 2022 , however Appen is at the moment rising in what could also be a growing optimistic upward tide of some tech shares – up 8.23% yr to this point, whereas XERO’s rise appears extra tentative – up 1.37% following a sooner or later uptick from a drop of 1.08%.

There are different badly overwhelmed down ASX expertise shares up greater than 5% yr to this point along with Appen, together with Megaport Limited (MP1) and FINEOS Corporation (FCL).

The following value efficiency graph from googlefinance.com tracks the share value efficiency of the three year-to-date:

FINEOS offers software program and providers to life, accident and well being insurers, and worker advantages insurers globally The majority of revenues coming from the US market – 79.4% in FY 2022

The firm is positioned in Dublin Ireland and trades on the ASX, debuting on 19 August of 2019. The FINEOS platform offers a complete set of instruments to a number of the largest insurers on the planet.

FINEOS operates as a SaaS (software program as a service) with a core platform — the FINEOS AdminSuite. The platform can handle billing, funds, claims, coverage administration, underwriting, and new enterprise as a single suite platform or particular person platforms to satisfy particular wants.

Additional platforms embody FINEOS Engage, a machine-learning platform opening digital communication pathways throughout clients and companions; and a predictive analytics and reporting platform – FINEOS Insight.

In FY 2022 the corporate gained a number of awards, together with the Digital Project Technology of the Year Award and the Business and Finance Elevation Award. Full Year 2022 Financial Results dissatisfied buyers with a revenue loss rising 108% from FY 2021 – attributed to a one off goodwill write down on an acquisition. The the rest of the report was excellent, with revenues up throughout the board – whole revenues up 17.5%; subscription revenues up 34.2%, and providers revenues up 7.4%. Gross revenue rose 15.3% and EBITDA (earnings earlier than curiosity taxes depreciation and amortisation) up 28.8%.

The progress within the US market has risen from 45% of whole income in 2019 to the present 79.4%. The firm has maintained its monitor document of serious funding in analysis and growth (R&D) to drive income progress by increasing with current clients, including new clients, and getting into new markets.

On 25 July of 2022 FIENOS launched a case research — “New York Life Group Benefit Solutions: Core Administration System Total Digital Transformation,” highlighting the achievements NYL Benefits Solutions obtained with the FINEOS AdminSuite platform.

During 2022 the corporate finalised the acquisition of the Spraoi suite of machine studying and synthetic intelligence merchandise for the Group Life and Employee Benefits trade.

Of the three potential targets, FINEOS has gotten off to one of the best begin in 2023 and fell the least yr over yr.

Appen endured the worst beating of all ASX expertise shares in FY 2022, however in actuality the share value has been in free fall for a while. Over 5 years the Appen share value is down 69.2% whereas over the identical interval the Megaport share value is up 103.5%.

The firm is a frontrunner within the adoption of synthetic intelligence. Appen was an early entry within the area, utilizing synthetic intelligence in its strong language identification and translation software program for its consumer corporations. The firm is now a frontrunner in knowledge annotation for advancing synthetic intelligence powered purposes for expertise corporations, authorities businesses, and huge scale companies.

Organisations of every kind are shifting in the direction of synthetic intelligence techniques that may “learn” from knowledge collected by the organisation for analytic and predictive use. The knowledge should first be ready in a format recognisable by the machine. This is the method of knowledge annotation, the place a human annotator categorises and labels knowledge to be readable by machines.

Appen can present that contextual annotation to particular person photos, movies, audio recordings and indicators, textual content, in addition to multi-modal annotation. For some purchasers, the corporate affords pre-defined knowledge annotations.

The rush to undertake synthetic intelligence is pushed largely by the necessity for more and more focused advertising and promoting. The COVID 19 pandemic doused ice water on the promoting applications of a number of companies. Appen stays within the throes of “challenging external operating and macro conditions” in accordance with the corporate’s Half Year 2022 Financial Results. The firm closes its guide on the finish of December.

Management attributed the dismal outcomes to weaker promoting and decreased spending from main clients, and others. Revenue dropped 7% whereas EBITDA fell 24% . Earnings per share (EPS) dropped 130.2% as did underlying internet revenue. The firm outlook for the total yr was for extra of the identical.

The monetary efficiency coupled with the speedy withdrawal of a takeover bid from Canada-based expertise agency Telus International could have contributed closely to the resignation of the Appen CEO on 15 December.

Appen counts amongst its clients most of the world’s main expertise corporations, together with Microsoft, Google, Adobe, Amazon, and Salesforce.

Megaport has a software program platform that allows its clients to attach their very own inside networks to knowledge centres around the globe housing cloud and different digital providers suppliers. The firm operates as a Network as a Service (NaaS) supplier the place clients create a community to a lot of the world’s main cloud providers suppliers, together with Amazon Web Services; Google Cloud Platform; IBM Cloud; Microsoft Azure; Alibaba Cloud; and Salesforce.com.

The firm additionally operates the Megaport Marketplace, an internet hub the place service suppliers and enterprise clients can join.

The clients that make use of Megaport software program community providers are equally spectacular, from Adobe to FedEx to Tesla to BHP to ZOOM, and others.

Financial Results for the Full Year 2022 have been optimistic in each metric. The firm nonetheless posted a revenue loss however it was a 12% enchancment over the 2021 loss. Total revenues have been up 40%; whole clients have been up 16%; and whole providers rose 26%.

The following desk contains market cap, value actions, and buying and selling quantity for every of the three.

|

Company (CODE) |

Market Cap |

Share Price |

52 Week High |

52 Week Low |

90 Day Average Trading Volume |

|

Megaport Limited (MP!) |

$1.05B |

$6.84 |

$19.2 |

$4.7 |

1.2M |

|

FINEOS Corporation (FCL) |

$575M |

$1.85 |

$4.24 |

$1.20 |

279K |

|

Appen Limited (APX) |

$321M |

$2.63 |

$10.69 |

$2.20 |

967K Shares |

[adinserter block=”4″]

[ad_2]

Source link