[ad_1]

Agarwal’s London-based Vedanta Resources is grappling with an enormous debt pile. It must pay about $3 billion over the following two years as some US forex bonds will mature. The firm closely relied on dividends from India-listed Vedanta Ltd. and Hindustan Zinc prior to now.

The junk-rated mining conglomerate has approached buyers to restructure a few of its bonds, and plans to separate its sprawling group to unlock higher worth for particular person companies.

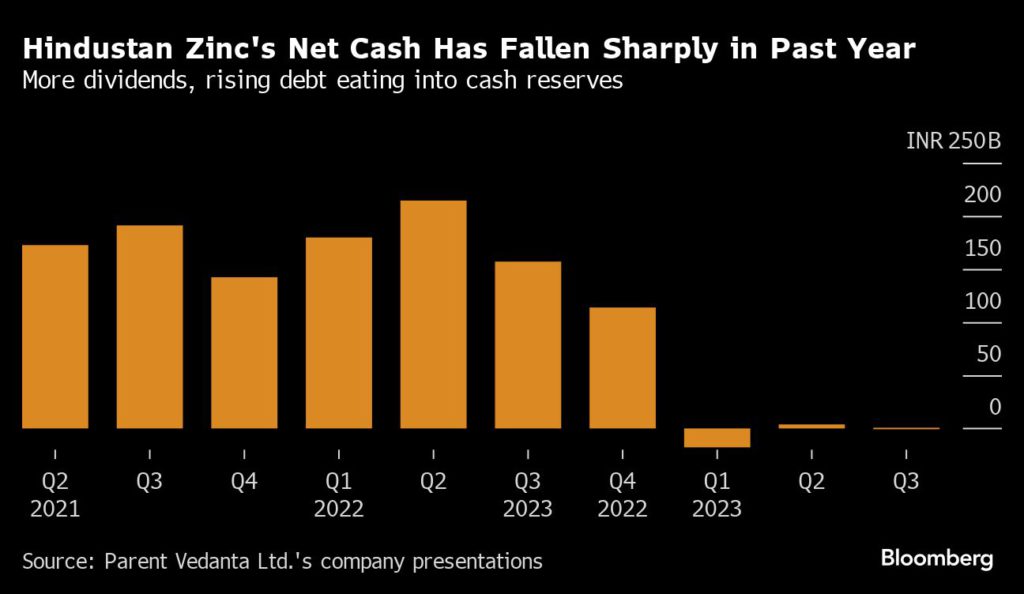

Hindustan Zinc has been doling out dividends regardless of a decent web money place. Its father or mother Vedanta Ltd. has solely paid one spherical of dividends this fiscal yr after an unprecedented 5 final yr.

The Indian authorities has a stake of about 30% within the Rajasthan-based miner.

Shares of Hindustan Zinc rose as a lot as 2.2% Wednesday, whereas Vedanta Ltd. superior 1.1%. The greenback bond of Vedanta Resources, due in January and August, gained forward of Hindustan Zinc’s board assembly.

(By Swansy Afonso)

[adinserter block=”4″]

[ad_2]

Source link