[ad_1]

An evaluation of the DRAM and flash market confirms costs in each commodities are rising sharply and will proceed to take action for the rest of 2024. This implies that costs of reminiscence modules and SSDs may very well be on the rise, too.

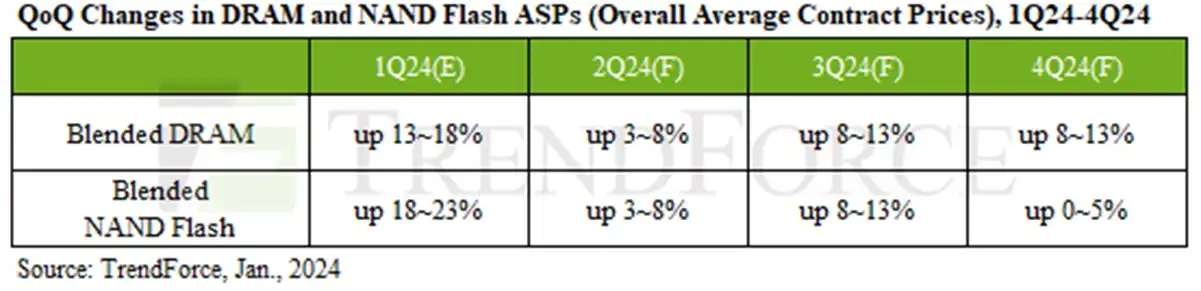

TrendForce started noticing the increases in the spot market for DRAM and flash on the finish of final yr. Prices had fallen for 2 straight years because the finish of 2021. Now, the corporate is predicting value will increase within the contract marketplace for DRAM of between 13 to 18 p.c within the first quarter alone as nicely value hikes for NAND flash of between 18 to 23 p.c.

The new report is a way more concrete main indicator that costs in each DRAM and SSDs are on the rise. Think of the spot market (talked about within the older TrendForce report) as a “grocery store” of digital parts: memory-module makers will put in massive orders for DRAM to make modules out of. If they’re off by a bit, they’ll purchase or promote the rest on the spot market.

It’s these massive bulk orders, nonetheless, the place a module maker or an SSD maker will point out what they consider to be the “true” value of the commodity. These are the contract costs, the place nearly all of the DRAM and flash are bought. And patrons are locking in larger costs.

TrendForce believes that the NAND flash patrons will end up restocking their very own inventories by the primary quarter, in order that flash contract costs will drop from a pointy bounce of between an estimated 18 to 23 p.c within the first quarter to extra modest value will increase all year long. TrendForce measures quarter-over-quarter value adjustments, so a 3 to eight p.c improve within the second quarter represents that value improve from the quarter earlier than.) Naturally, these are forecasts.

TrendForce

DRAM costs are anticipated to point out smaller, however steadier good points over your complete yr. In half, that’s as a result of the elevated share of DDR5 reminiscence will push up the general common value, TrendForce mentioned.

As has been the case for many years, nonetheless, there’s a wrinkle: greed. In some ways, reminiscence and flash function in the identical approach as oil cartels. If everybody cuts manufacturing, quantity stays low and costs stay excessive. But reminiscence manufacturing capability nonetheless stays beneath 100% utilization, TrendForce famous. If reminiscence makers get too aggressive in growing manufacturing, then provide will as soon as once more outpace demand — and costs will fall. That’s not anticipated to occur…however it might.

[adinserter block=”4″]

[ad_2]

Source link