[ad_1]

Predictions about enterprise tech have by no means been extra unsure. They develop into much more difficult once you attempt to make forecasts which can be measurable. Generally, our perception is we should always be capable to look again a 12 months later and say with a point of certainty whether or not the prediction got here true – ideally with some quantifiable proof to again that up.

In this Breaking Analysis and for the third 12 months in a row, we collaborate with Erik Bradley of Enterprise Technology Research and to share our annual enterprise expertise predictions.

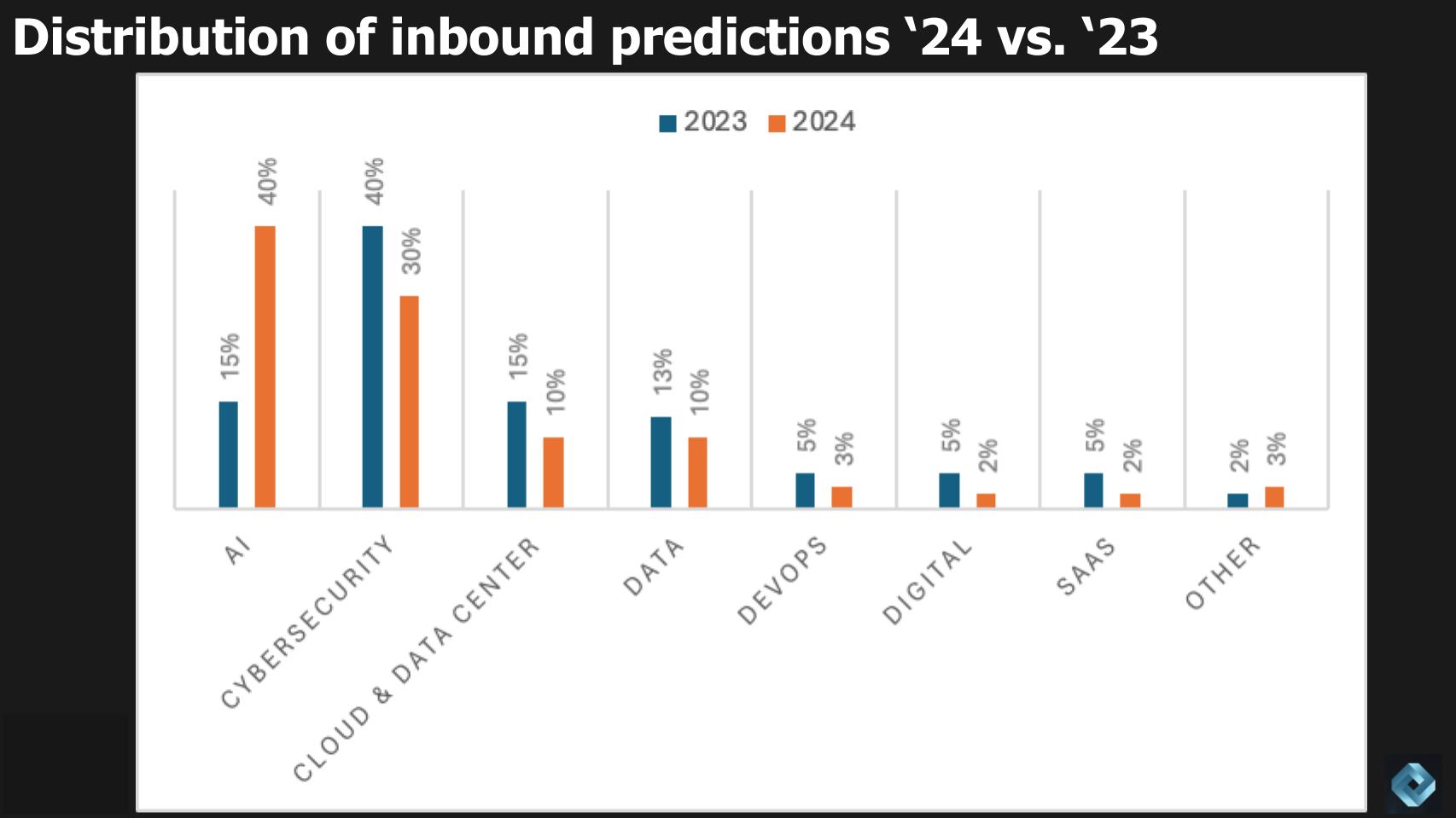

Over 1,000 inbound predictions

Since we began this custom, public relations of us have kindly offered their purchasers’ views on the developments to look at within the coming 12 months. The graphic above reveals the change within the lead categorical matters from these outreaches relative to final 12 months.

It’s no shock to see an enormous soar in synthetic intelligence predictions, that are partially understated as a result of nearly all these classes included some AI content material. Cybersecurity is down however nonetheless distinguished adopted by cloud, information heart and information/analytics. Then a smattering of DevOps, digital, software program as a service and another tidbits.

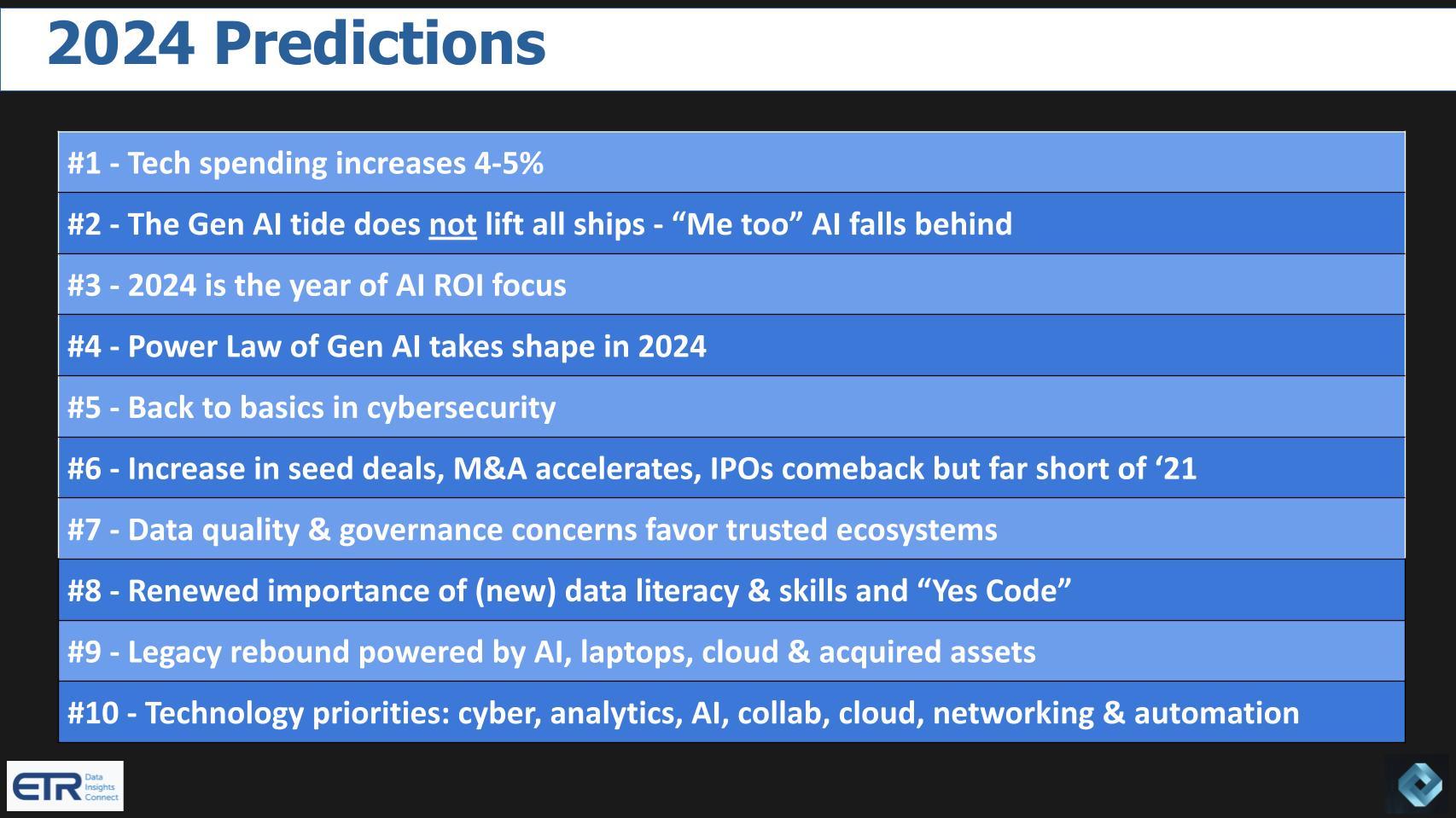

A snapshot of our 2024 predictions

Here are two different sources you could be all for reviewing:

- Our look again on 2023. Grading last year’s predictions.

- Predictions from our collaboration with members of theCUBE Collective and the “Data Gang” focused on data.

Below is a fast scan and rundown of this 12 months’s predictions the place we cowl the macro info expertise spending atmosphere, the state of generative AI, AI return on funding, cybersecurity, mergers and acquisitions, information high quality, governance, abilities, momentum for legacy gamers, and 2024 expertise priorities.

OK, let’s get began.

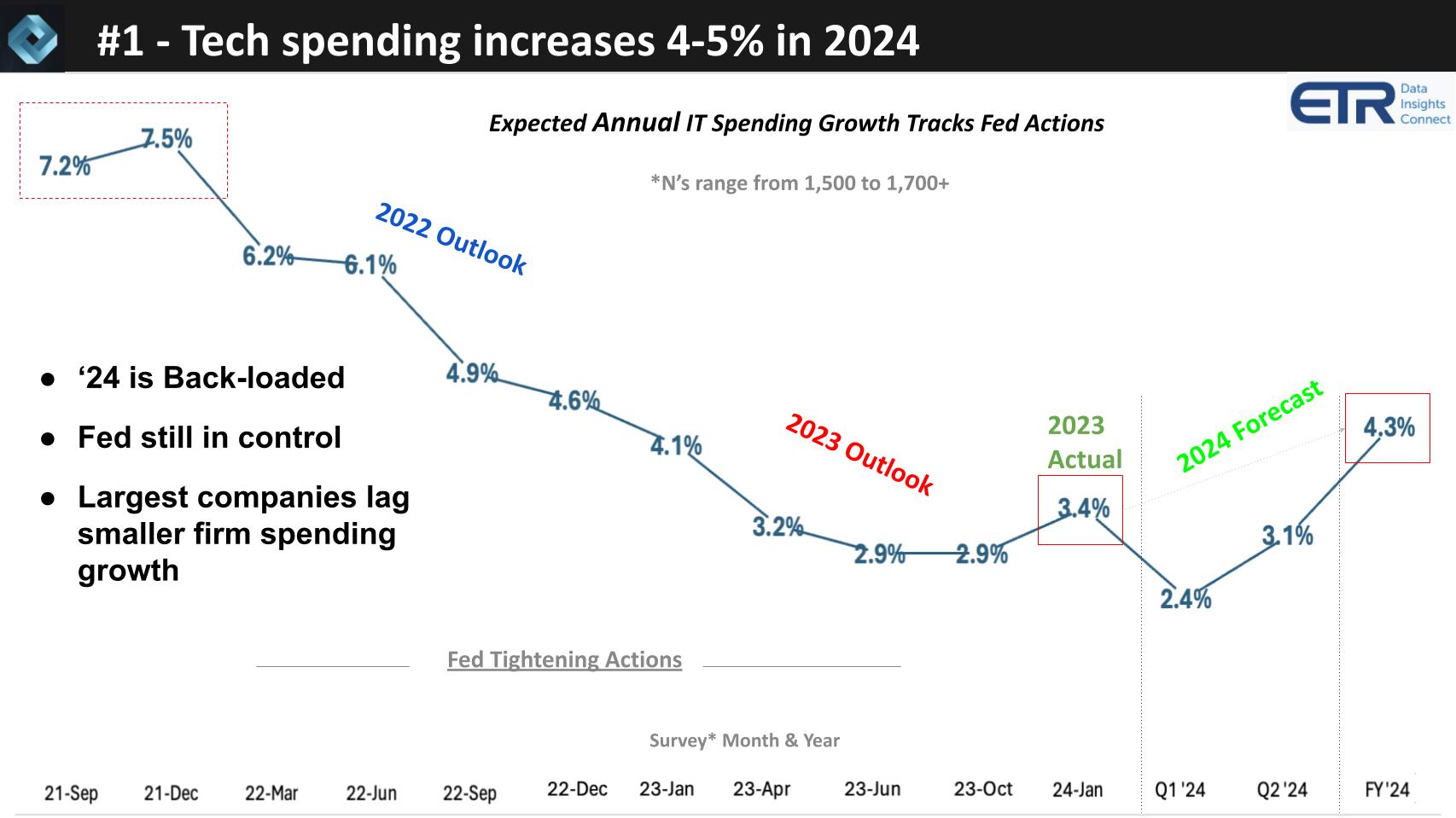

No. 1: Tech spending will increase 4% to five% in 2024

The graphic beneath reveals the annual tech spending progress expectations from greater than 1,500 IT resolution makers, or ITDMs, at totally different closing dates.

ITDMs exited the isolation economic system very enthusiastic, with execs anticipating their tech budgets have been going to extend 7.5%. We know what occurred. Ukraine, Fed tightening and all by way of 2022, we noticed these expectations for the 12 months go down. After the Fed stopped tightening, we noticed a flattening out of anticipated annual progress at 2.9%.

ITDMs on common mentioned that in 2023, their spending ended up rising at 3.4%. You can see the forecast for 2024 is 4.3%, however it’s back-loaded with Q1 and Q2 2024 anticipated to develop at 2.4% and three.1%, respectively.

The following extra factors summarize our analysis and predictions. Our evaluation signifies a cautiously optimistic outlook for spending developments within the IT sector. Key observations from this dialogue are as follows:

- There has been a notable improve in spending after a big decline over the previous six quarters. This development reversal is especially evident in giant firms, with Fortune 500 corporations rising their spending budgets from 1% to three% since July.

- Small corporations, nonetheless, proceed to guide by way of spending progress, presently at about 6.5%, in contrast with the bigger corporations.

- Despite the rise, there’s a notable disparity in spending between small and medium-sized companies and bigger Global 2000 corporations, with SMBs nearly doubling the spending price.

- The broader market stays cautious because of uncertainties, with organizations adopting a quarter-by-quarter method, largely influenced by earnings estimates and total financial circumstances.

- The Federal Reserve’s insurance policies and actions proceed to play a big position in shaping market expectations and spending behaviors.

- Positive indicators within the IT sector embrace the conclusion of rigorous cloud audits and an increase in new IT initiatives. Additionally, there’s a rise in Net Score spending in IT consulting and providers, historically seen as a number one indicator of broader spending developments. Note: Net Score is ETR’s proprietary methodology to measure spending momentum.

In abstract, our opinion on the macro is that these developments, notably the elevated engagement of enormous organizations in spending and the constructive indicators within the IT sector, paint a cautiously optimistic image for the continuation of this spending development all year long. However, the continued warning because of macroeconomic uncertainties, the backloaded nature of the forecasts and the numerous position of the Federal Reserve’s insurance policies can’t be missed.

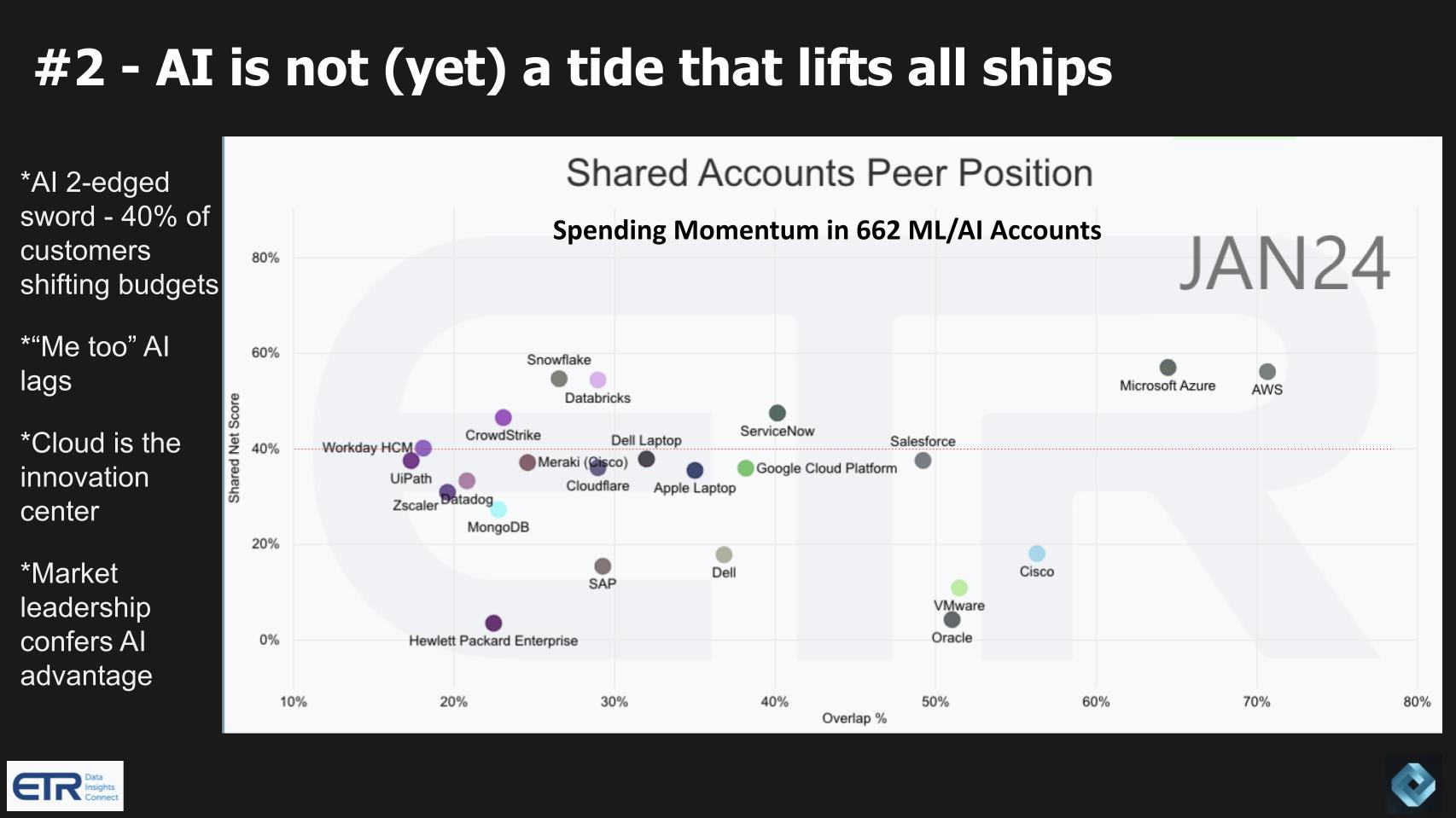

No. 2: AI is not (but) a tide that’s lifting all ships

The graphic beneath reveals information that measures spending momentum or Net Score on the vertical axis and the presence of an organization or platform inside the survey set of greater than 1,700 respondents on the horizontal axis. This lower isolates these 1,700 right down to 662 machine studying/AI accounts. So it’s a measure of the prominence of varied corporations, platforms and merchandise inside these 662 ML/AI-heavy accounts. The crimson line at 40% signifies a extremely elevated spending velocity.

There’s a preferred narrative that AI is benefiting all people. We don’t assume that is the case and we imagine it’ll develop into extra evident in 2024. Specifically we see a market of AI haves and have-nots.

AI in our view is a two-edged sword. In some circumstances it may be a tailwind. Pure-play AI corporations resembling OpenAI, Anthropic PBC, Hugging Face Inc. and a few others are clearly benefitting from the development. Notably, the general public cloud distributors and even the specialised AI clouds resembling CoreWeave Inc., Core42, Lambda Inc. and Genesis Cloud GmbH are definitely benefitting from the elevation in mindshare. However, 40% of consumers say that their AI funds are coming from different budgets.

AI is lifting market leaders executing on a cogent AI technique

Our prediction is that in 2024 we’ll see a divergence between these corporations delivering significant AI worth and people delivering “me-too AI” will lag. In the January information above, you may see the platforms which have AI affinity. Microsoft Corp. with Azure has its OpenAI partnership. Amazon Web Services Inc. is distinguished as effectively. They’re each above that 40% line. Notably, Google LLC is much beneath these two regardless of its AI investments and capabilities.

ServiceNow Inc.’s recent quarterly results point out AI is a tailwind. Databricks Inc. and Snowflake Inc. have excessive AI alignment, as do CrowdStrike Holdings Inc. and Zscaler Inc. Salesforce Inc. is pounding its AI messaging in tv and digital adverts, and Workday Inc. is constructing AI into its SaaS merchandise, as is Oracle Corp.

Interestingly we additionally see laptops from Dell Technologies Inc. and Apple Inc. as distinguished. Apple has for years shipped merchandise with various silicon from its Arm-based inner growth efforts, together with not solely central processing unit however graphics processing unit and neural processing unit capabilities.

Others resembling MongoDB Inc. are including vector embeddings, which have been effectively accepted and assist the creation of retrieval-augmented technology or RAG capabilities. Others resembling Cisco Systems Inc., which isn’t seen as an apparent AI firm, are benefitting from acquisitions resembling Meraki. Hewlett Packard Enterprise Co.’s acquisition of Juniper Networks Inc. was largely about bolstering its AI capabilities.

Although corporations are making strikes, not all might be profitable by way of producing income and shareholder worth and we predict that can develop into extra apparent in 2024 with a bifurcated market.

Me-too AI distributors will sink – Mike Finley, CTO of AnswerRocket

The following extra factors summarize our analysis and predictions:

- Hyperscalers are presently reaping essentially the most advantages available in the market. As effectively, corporations resembling Snowflake and Databricks, identified for his or her subtle information administration capabilities, have gotten more and more vital within the AI journey.

- Cisco Meraki stands out as a brilliant spot in Cisco’s latest quarterly report, excelling in networking and unified endpoint administration. This success story underscores the various influence of technological developments throughout totally different sectors.

- Generative AI shouldn’t be uniformly boosting all segments of the tech trade. The most intriguing battleground seems to be within the robotic course of automation sector, the place gen AI may probably revolutionize and even marginalize conventional RPA options.

- There’s an attention-grabbing dynamic within the RPA market, notably with main gamers resembling Microsoft’s Power Automate, UiPath Inc. and Automation Anywhere Inc. displaying robust alignment with OpenAI adoption. This alignment appears to be creating spending momentum within the sector for these leaders however not so for others with out that alignment.

- Our analysis means that market leaders who successfully combine and execute AI methods, avoiding superficial purposes, that’s “AI washing,” are prone to emerge as leaders within the AI area. This contains partnerships throughout the ecosystem and real purposes of AI applied sciences.

In abstract, our view is that the expertise sector is experiencing a transformative part, with hyperscalers and complex information corporations main the way in which in AI purposes. The RPA sector, specifically, presents an intriguing space of growth, the place the mixing of gen AI may redefine market dynamics. The success of corporations on this evolving panorama seems to hinge on their skill to genuinely embed and execute AI methods, slightly than merely market superficial purposes.

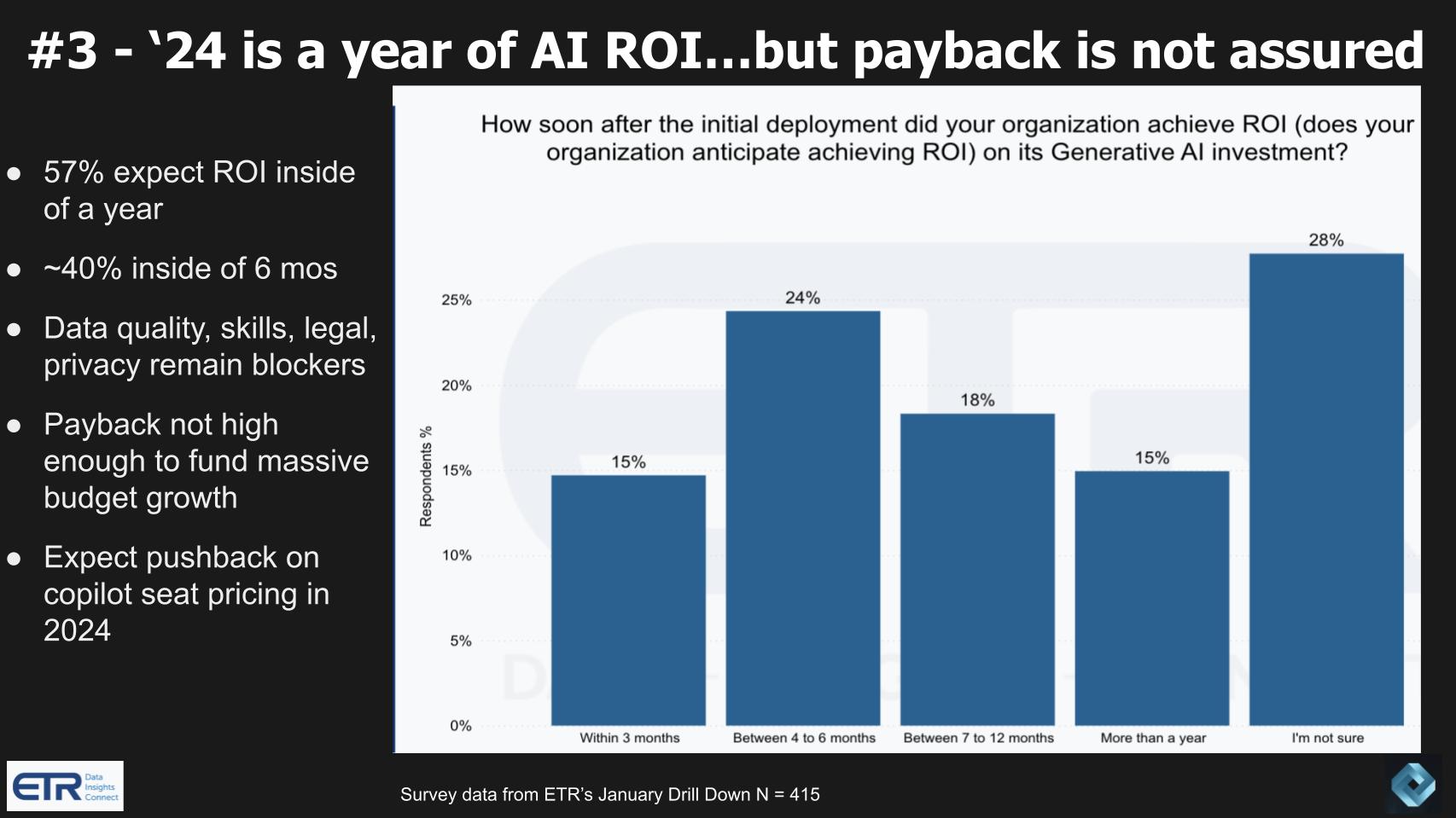

No. 3: 2024 is a 12 months of AI ROI… however payback shouldn’t be assured

The graphic beneath is from an ETR drill-down survey exploring the ROI of AI. It shouldn’t be exact in that it permits the respondent to interpret the query as both breakeven (time to constructive worth) or hitting ROI targets.

Our evaluation covers a number of key factors:

- A big majority (57%) of organizations count on to realize ROI from gen AI inside a 12 months, with 40% anticipating this inside six months. This suggests a excessive degree of confidence within the effectivity and effectiveness of gen AI applied sciences.

- Despite the optimism, challenges resembling information high quality, talent set necessities, authorized and privateness considerations stay vital headwinds.

- There’s a notable concern that AI budgets are affecting different areas, resulting in finances compression in some sectors. This underscores the prioritization of AI initiatives over different investments.

- The value of implementing gen AI, notably by way of per-seat licensing charges, is a rising concern. Organizations are cautious in regards to the scalability of those prices, particularly when contemplating enterprise-wide deployment.

- Currently, the market is in a testing part with gen AI, the place pricing pushback is minimal. However, this might change as full-scale implementations progress.

- ETR survey information signifies that 25% of ITDMs say their organizations usually are not actively evaluating gen AI. Although this highlights a preponderance of adoption, it’s a warning to see that it’s not almost 100%, as these corporations not fascinated about making use of gen AI to their enterprise will fall behind.

- The supply of funding for gen AI initiatives is cut up, with nearly half the organizations utilizing new funds and the opposite half reallocating budgets from different areas, together with non-IT departments and productiveness purposes.

- In sure industries resembling monetary providers and manufacturing, there’s a notable development of reallocating budgets from RPA to gen AI, elevating considerations in regards to the influence on current automation investments.

- Anecdotal proof means that the perceived advantages of gen AI, resembling vital labor value financial savings, would possibly outweigh considerations about licensing prices if the expertise delivers on its promise.

In abstract, our evaluation means that whereas there’s a excessive expectation of reaching ROI from gen AI inside a brief interval, there are additionally vital challenges and considerations, notably concerning finances allocation and pricing fashions. The reallocation of funds from different areas, together with RPA budgets, signifies a strategic shift towards gen AI. However, the final word success and acceptance of gen AI available in the market will rely upon its skill to ship tangible advantages and justify its implementation prices.

The backside line on this prediction is there are two attainable outcomes we’re predicting: 1) AI ROI is clear and fuels a rise in total tech spending; or 2) AI fails to ship on its expectations for 2024 and tech spending stays tepid. Our base case is AI ROI won’t throw off sufficient free money circulation in 2024 to supply “gainshare” funding that will increase total IT spending past the anticipated common.

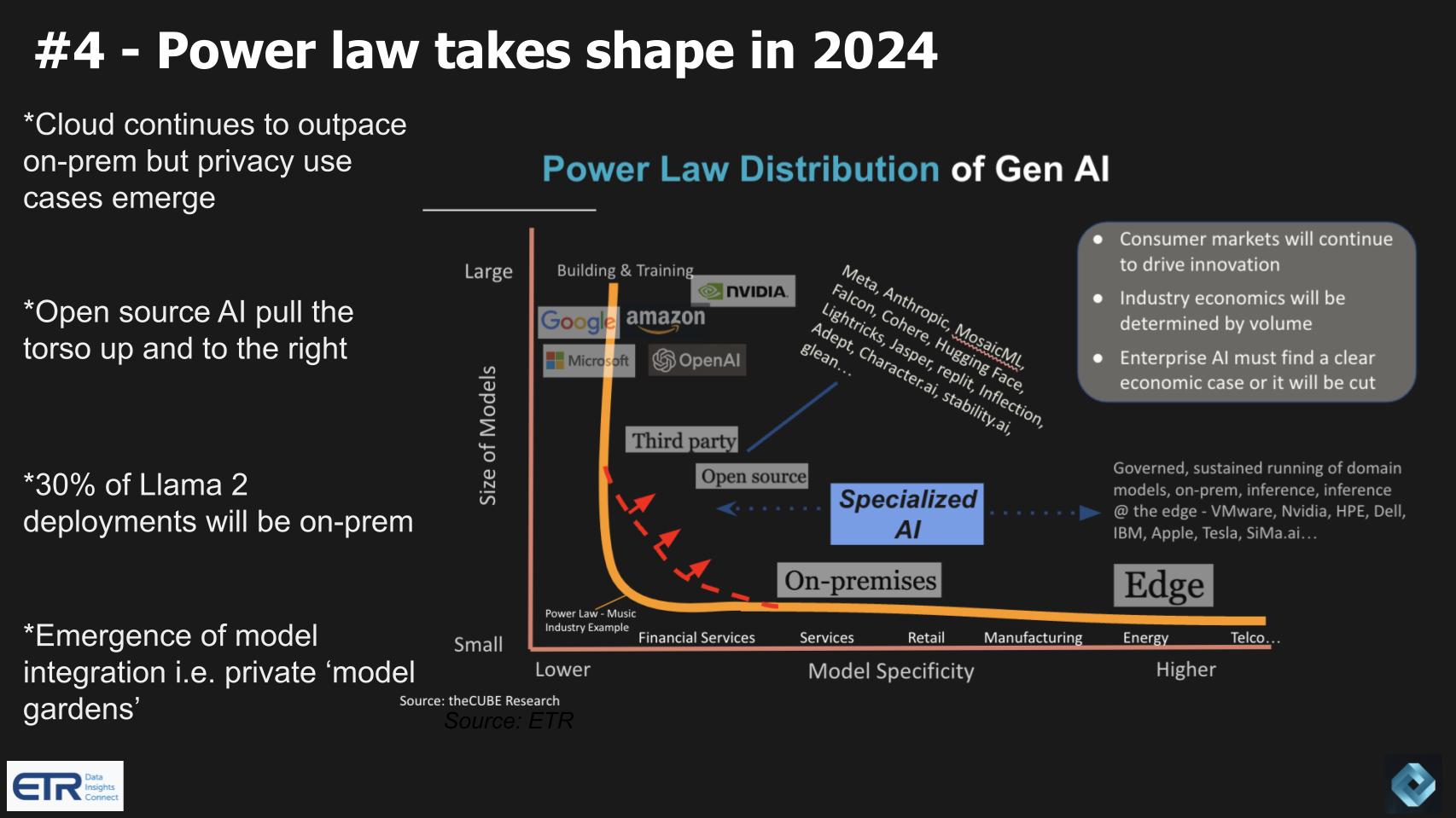

No. 4: The gen AI energy legislation begins to take form in 2024

The gen AI energy legislation developed final 12 months by theCUBE Research staff makes an attempt to articulate how we see generative AI and huge language fashions evolving. Unlike some industries — for instance, the music trade of yesterday, the place just a few dominant gamers ‘own’ the market and there’s a protracted tail of super-small gamers — we see gen AI as considerably totally different.

Although the hyperscalers are dominating the marketplace for giant fashions (measurement of mannequin on the vertical axis), we see an rising marketplace for specialised fashions with area data which can be smaller (horizontal axis). The lengthy tail is analogous, however the torso is pulled up and to the fitting by open supply and unbiased firm fashions.

Additional key factors on this prediction embrace:

- While the cloud giants are presently main with giant fashions, there’s a notable affect of open-source initiatives (resembling Llama 2) and unbiased gamers, shaping the trade’s trajectory.

- Despite cloud dominance, we predict a extra balanced development beginning in 2024 towards on-premise deployments, pushed by privateness and information sovereignty considerations. Our analysis signifies about 30% of Llama 2 deployments are estimated to be on-premises, with some analysts believing it may very well be as excessive as 50%.

- There’s a resurgence in hybrid cloud fashions, with a robust choice for personal cloud options. We attribute this to considerations round information management and regulatory points in Gen AI.

- Companies with delicate aggressive information are notably cautious about cloud deployments, choosing non-public clouds to take care of management over their information.

- The trade continues to be in an early part, and it’s too early for corporations to place full belief in cloud-based options with their delicate information.

- A latest ETR AI examine reveals a cut up of 50-50 between individuals saying that they’re going to develop their very own AI options utilizing open supply, whether or not it’s Anthropic or OpenAI and the like, and the opposite 50% are nonetheless hoping that it’ll develop into embedded of their already trusted distributors. Those distributors have window, however it’s not that enormous a window. They want to start out rolling out their capabilities and speaking their AI roadmaps if we’re going to see that development take form.

In abstract, our evaluation means that whereas the cloud giants presently dominate the Gen AI area, there’s a big need from many public corporations in the direction of on-premise and personal cloud deployments because of information privateness and regulatory considerations. We predict in 2024, the trade will see the early phases of the ability legislation taking form, with a protracted tail of specialised AI and a rising emphasis on information sovereignty. This development is anticipated to develop into extra pronounced over time underscoring a various and evolving Gen AI panorama.

Here are some inbound 2024 predictions from the neighborhood associated to this matter:

The gen AI dialogue goes to maneuver from idea to follow and goes to focus extra on inference – John Roese, CTO of Dell Technologies

Specialized AI will take form and open supply fashions will emerge – Quentin Clark, General Catalyst

Hypermodal AI, which mixes totally different AIs with different information sources will emerge – Bernd Greifeneder, CTO, Dynatrace

Gen AI must be seen as a characteristic of trade options, not an answer in and of itself – Bryan Harris, CTO, SAS Institute

We’re headed extra towards a gen AI monopoly – Patrick McFadin, DataStax

We agree that these domain-specific AIs are going to see a protracted tail start to emerge in 2024. Regarding Patrick McFadin’s prediction, we hope not. We agree that hyperscalers proper now are within the leaders with the necessity to construct and ideal giant fashions. This has to occur earlier than higher-quality, high-volume inference begins to dominate. But if he’s appropriate, this prediction will fail in the long run.

Of be aware, McFadin predicted again in November that regulators are going to return raining down on these massive cloud corporations. That prediction has already come true with FTC Chair Lina Khan’s actions this week.

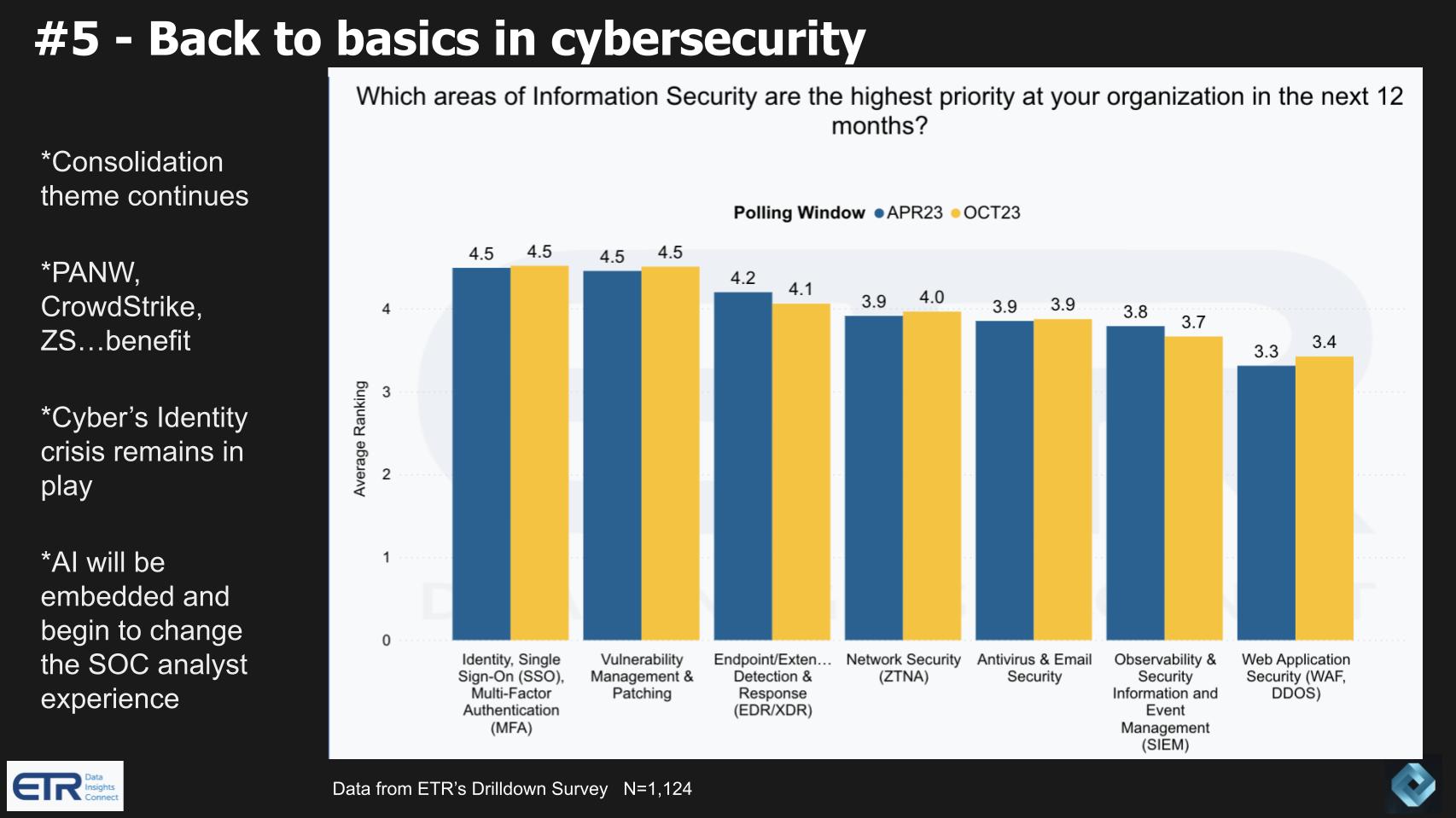

No. 5: 2024 sees back-to-basics in cybersecurity

The chart beneath drills into ITDMs’ safety priorities within the coming 12 months.

Our evaluation of this information and predictions name for a notable shift in the direction of basic safety measures, coupled with the continued evolution and integration of AI applied sciences. Key factors from our analysis supporting our predictions are as follows:

- We imagine that AI, regardless of its prominence in headlines, will develop into more and more embedded in cybersecurity, notably supporting areas resembling identification and single sign-on, vulnerability administration, endpoint and community safety.

- Our analysis reveals that these facets of knowledge safety are presently the very best precedence in organizations, emphasizing a back-to-basics method.

- We predict that the consolidation development inside cybersecurity will persist, favoring main consolidators resembling Palo Alto Networks Inc., CrowdStrike and Zscaler. This development is noteworthy, particularly contemplating the decline in vendor consolidation as a cost-reduction technique relative to final 12 months. We predict that cybersecurity might be much less inclined to this development than different sectors of the market.

- Despite this consolidation, we imagine that the crowded nature of the cybersecurity market will proceed to current vital challenges to the trade, as highlighted by the continued identification disaster the trade is going through (pun supposed).

- We be aware the rising position of AI in altering the Security Operations Center analyst expertise, exemplified by developments resembling CrowdStrike’s announcement of its LLM, Charlotte.

- Our evaluation additionally signifies a big willingness amongst chief info safety officers to discover cybersecurity options from startups, suggesting an openness to innovation and cutting-edge applied sciences on this sector, which is able to additional compound the crowding impact on this market.

- That mentioned, our prediction and recommendation is there might be a noticeable shift in focus amongst safety specialists to keep away from instruments creep towards prioritizing fundamental safety hygiene practices like worker coaching, penetration testing, asset administration and vulnerability patching.

In abstract, our prediction for the cybersecurity sector within the coming 12 months is a twin emphasis on foundational safety practices and the strategic integration of AI. This method, together with continued market consolidation and openness to innovation from startups, indicators a dynamic and evolving panorama in cybersecurity that can stay problematic. Leading practitioners will take a back-to-basics method as the best technique of stopping breaches.

Here are some inbound 2024 predictions from the neighborhood associated to this matter:

65% of organizations usually are not assured that their, not very assured their organizations may absolutely get better from an information loss incident –Dell Technologies Global Data Protection Index

52% of manufacturing information is backed up on tape nonetheless. So all people says tape is useless, no, it’s not. And 61% of manufacturing information can be backed up within the cloud – Veeam’s Data Protection Trend Report

Voice goes to develop into the brand new fingerprint – Aron England, chief product officer and CTO of Rev

Overhyped instruments drive the necessity for safety operations – Nick Schneider, CEO, Arctic Wolf

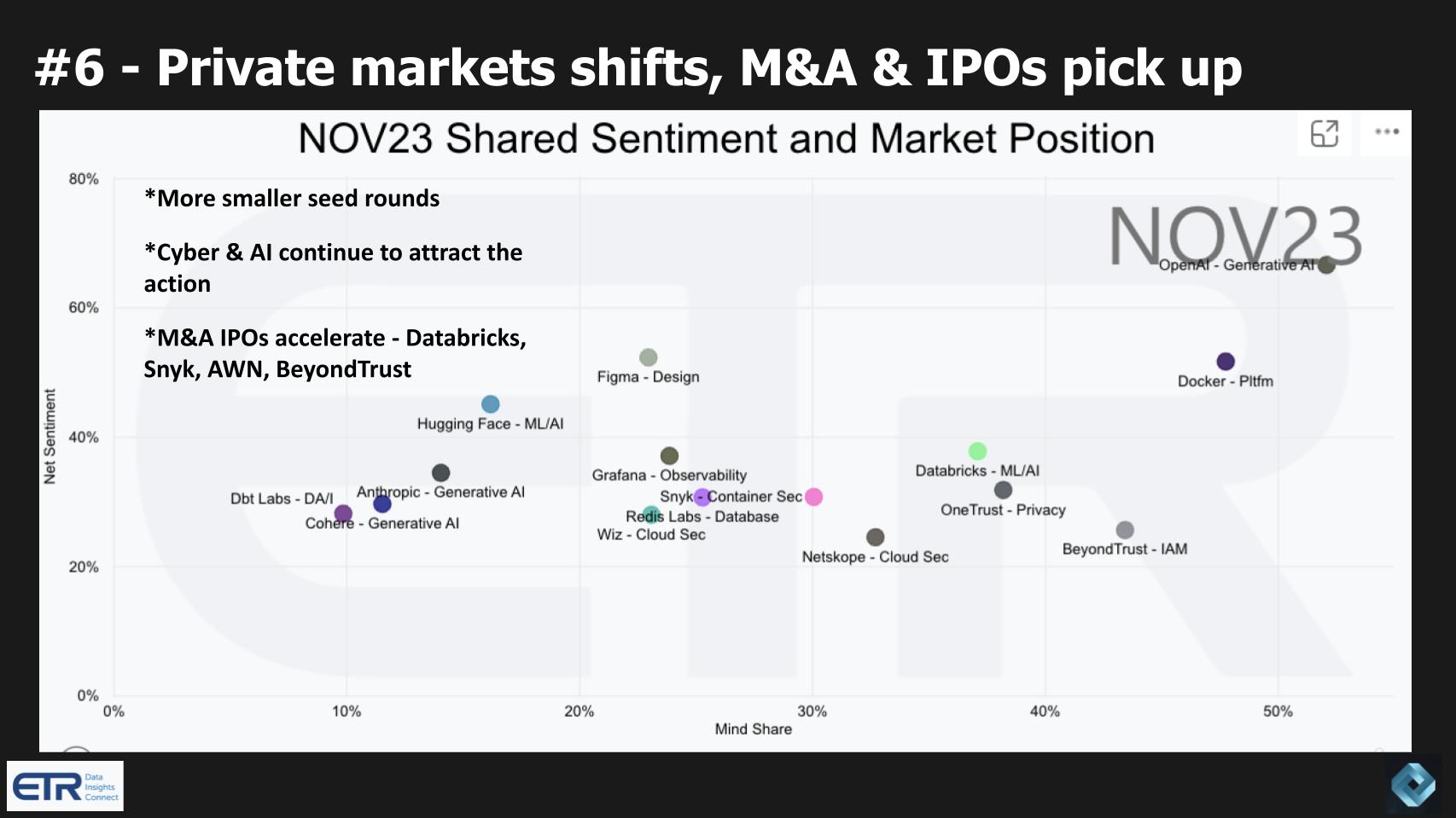

No. 6: Private market shifts, M&A and IPOs choose up

In cybersecurity, 2023 noticed 437 funding rounds and M&A transactions with $8.6 billion raised over 346 rounds and 91 whole acquisitions final 12 months – Mark Sasson, Pinpoint Search Group

Our evaluation of the non-public market M&A and preliminary public choices within the expertise sector reveals a number of key developments and predictions:

- We count on a big shift within the non-public market, with a specific concentrate on earlier stage rising expertise corporations with smaller investments. This is evidenced by robust spending momentum and elevated intent to interact with these corporations.

- Companies resembling OpenAI, Docker Inc., Databricks, OneBelief LLC, BeyondTrust Inc., Netskope Inc., Grafana Labs and Snyk Ltd. are notable for his or her excessive thoughts share and intent to interact, as per the Emerging Technology Survey.

- We predict an acceleration in M&A actions and IPOs within the expertise sector. Companies resembling Databricks, Snyk, Arctic Wolf and BeyondTrust are probably candidates for IPOs, following a downturn within the variety of IPOs final 12 months.

- Despite an anticipated improve, we don’t anticipate a return to the IPO ranges seen in 2021. This suggests a extra cautious and selective method within the present market atmosphere.

- We additionally foresee an uptick in smaller seed rounds and startups, particularly within the realms of AI and cybersecurity. This development is pushed by the effectivity and potential of AI applied sciences, making it an opportune time for brand new firm formations.

- On the non-public fairness aspect, there’s an expectation of elevated exercise because of beforehand accrued funds and a warming funding atmosphere.

- We determine particular corporations, resembling Cohere Inc., Hugging Face, Wiz Inc. and Snyk, as prime candidates for acquisition, given their robust efficiency and rising mindshare within the sector.

In conclusion, our prediction is that the expertise sector, notably in AI and cybersecurity, will expertise a resurgence in M&A and IPO actions to ranges above these seen final 12 months however lower than half of these from 2021. This development is underpinned by the tech sector’s bettering efficiency, robust stability sheets, AI crucial and the excessive potential of rising applied sciences. The improve in smaller seed funding rounds additionally signifies a vibrant and evolving startup ecosystem, notably within the AI and cybersecurity domains.

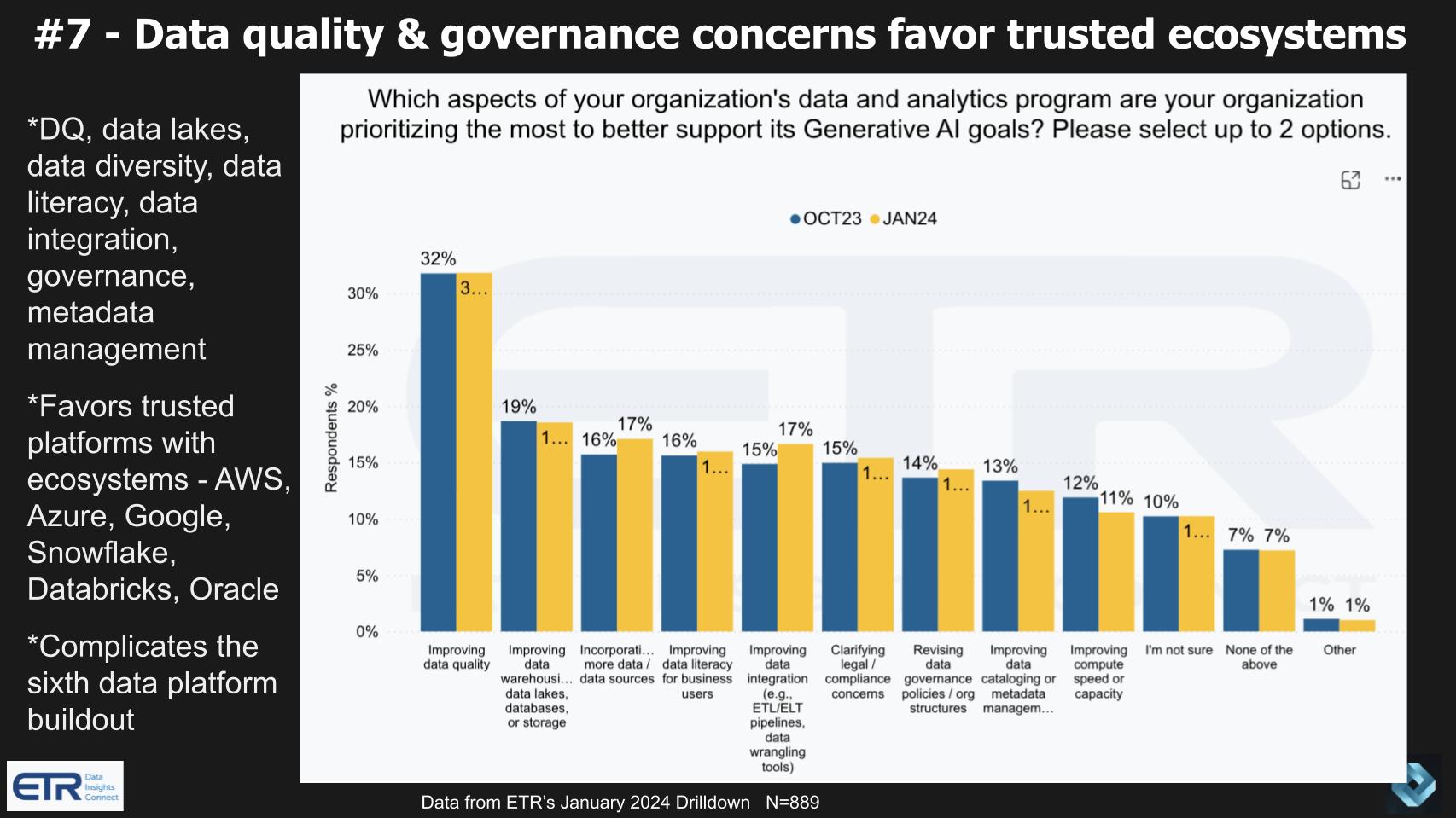

No. 7: Data high quality and governance considerations favor trusted ecosystems

Our evaluation predicts a big shift towards prioritizing information high quality and governance, which in flip favors established and trusted expertise ecosystems. This shift is pushed by the necessity to assist Gen AI targets successfully. Key information factors from an ETR drill-down survey are proven within the graphic beneath and spotlight the info challenges confronted by practitioners.

Relevant factors on this prediction embrace:

- The prioritization of information high quality, information lakes, range, literacy, integrations and governance is essential for organizations aiming to harness gen AI’s full potential.

- We imagine this development distinctly advantages trusted platforms with strong ecosystems, resembling AWS, Azure, Google Cloud, Snowflake, Databricks and established information gamers resembling Oracle. These platforms are acknowledged for his or her skill to handle advanced information wants. Snowflake and Databricks specifically are infusing AI into immediately’s fashionable information stack and profitable available in the market with continued momentum in spending velocity and share features.

- AWS and Azure are main on this space, however Google Cloud additionally performs a big position in each AI and information innovation. Oracle, with its transactional information capabilities, and IBM Corp. are notable for his or her potential in managing various information varieties. IBM with Watson 2.0 seems to be heading in the right direction and Oracle’s full-stack AI choices from infrastructure to apps are a profitable system, in our view.

- The concentrate on information high quality is paramount. The precept of “garbage in, garbage out” emphasizes the significance of high-quality information for profitable AI purposes.

- The concentrate on ecosystems, together with efficient extract/rework/load processes and information pipelines, is essential for translating information into actionable insights for enterprise customers.

- Our analysis signifies that information high quality is a main concern, outweighing different facets in information and analytics packages as per present survey information.

In abstract, for 2024 our prediction is that the demand for top information high quality and strong governance will more and more favor established expertise platforms with complete ecosystems. These platforms are prone to develop into much more pivotal in supporting organizations’ gen AI initiatives because of their superior capabilities in dealing with advanced information varieties and guaranteeing information integrity.

Followers of Breaking Analysis have seen our work on the sixth information platform. Although we imagine the way forward for information platforms will shift emphasis to real-time, unified information sources, the challenges cited above, particularly associated to governance, will push its emergence to the second half of this decade.

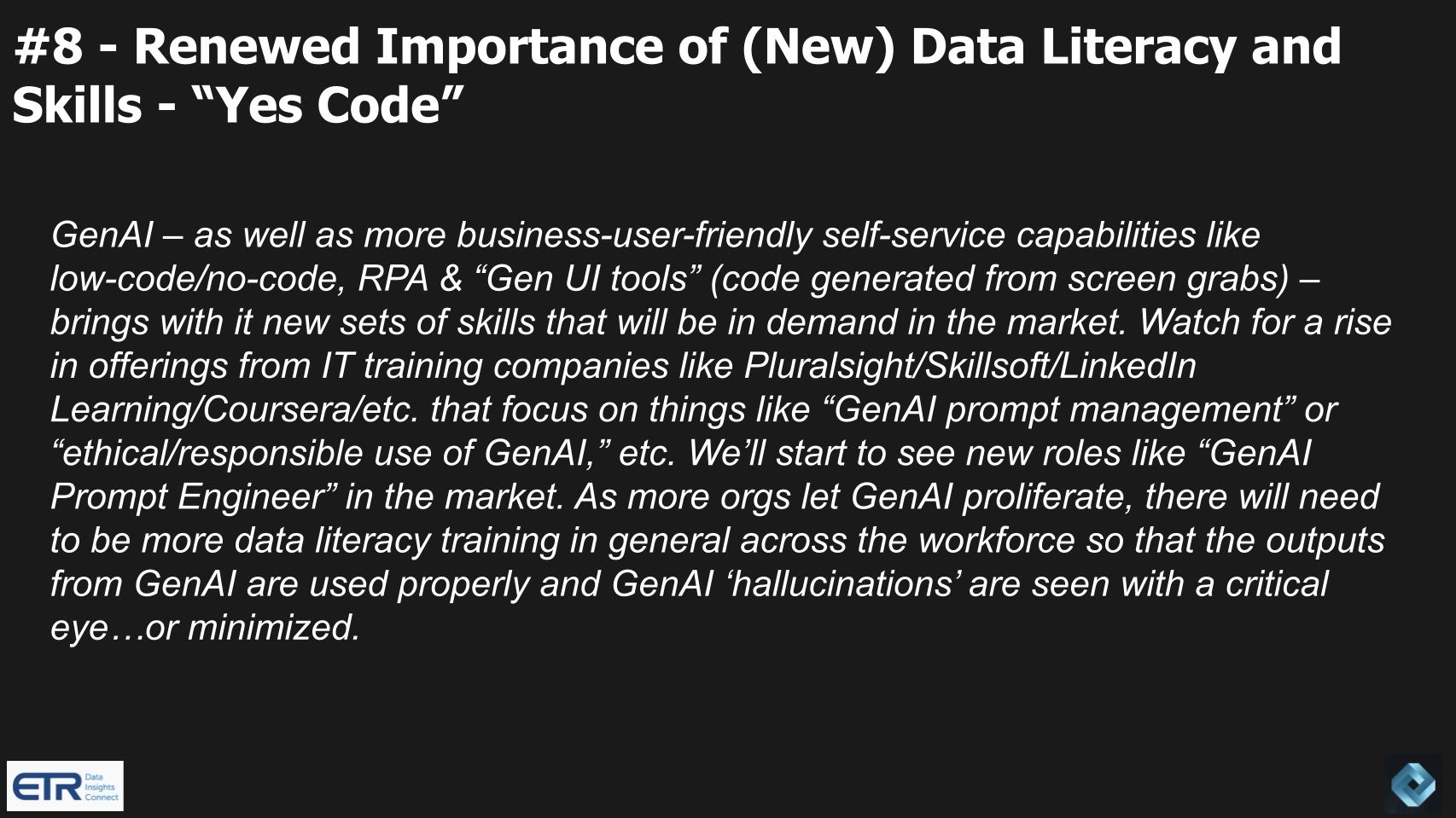

No. 8: Renewed significance of (new) information literacy and abilities – ‘yes code’

Our evaluation highlights the rising significance of recent information literacy and abilities within the continued software of gen AI and business-user-friendly applied sciences like low-code/no-code purposes, RPA and generative UI instruments. The survey outcomes and our key factors beneath underscore the info challenges organizations face in reaching their gen AI targets.

Note: ETR’s Daren Brabham offered this prediction.

Gen AI – in addition to extra business-user-friendly self-service capabilities like low-code/no-code, RPA and “gen UI tools” (code generated from display screen grabs) – brings with it new units of abilities that might be in demand available in the market. Watch for an increase in choices from IT coaching corporations resembling Pluralsight, Skillsoft,LinkedIn Learning, Coursera and others that concentrate on issues like gen AI immediate administration” or “ethical/responsible use of gen AI.” We’ll begin to see new roles resembling “gen AI prompt engineer” available in the market. As extra orgs let gen AI proliferate, there’ll must be extra information literacy coaching generally throughout the workforce in order that the outputs from gen AI are used correctly and gen AI “hallucinations” are seen with a essential eye… or minimized.

Key components of our analysis and predictions

- The rise of gen AI and user-friendly instruments like low-code/no-code purposes is creating a requirement for brand new talent units available in the market. This contains proficiency in immediate administration, moral use of gen AI, and understanding generative consumer interface ideas.

- We anticipate a surge in instructional choices from IT coaching corporations resembling Pluralsight, Skillsoft, LinkedIn Learning and Coursera. These choices will probably concentrate on areas pertinent to gen AI, together with immediate engineering and accountable AI utilization.

- We predict the emergence of recent roles resembling “gen AI prompt engineers,” reflecting the rising want for specialised abilities in optimizing gen AI outputs.

- There might be an elevated want for common information literacy coaching throughout the workforce. This coaching is essential to make sure that gen AI outputs are utilized successfully and to attenuate the chance of gen AI hallucinations or deceptive outputs.

- The idea of “yes code,” which mixes gen AI with front-end instruments to create generative UI, is gaining traction. This method underscores the evolving relationship between AI and consumer interface design.

- We are already observing gen AI prompts being listed as a skillset in job descriptions and resumes, indicating a swift adaptation to those new applied sciences within the job market.

- Nontechnical enterprise customers are more and more required to develop into information literate to stay related of their roles, no matter age or prior expertise.

- The majority of AI budgets are actually originating from enterprise departments, not conventional IT sectors, signifying a broader shift in how AI is built-in and utilized throughout varied enterprise features.

In conclusion, our prediction is that the demand for brand new information literacy and abilities associated to gen AI and related applied sciences will proceed to develop. This development will probably result in an enlargement of instructional choices, the emergence of recent job roles, and a higher emphasis on information literacy throughout all ranges of the workforce. As AI turns into extra embedded in enterprise processes, staying abreast of those evolving skillsets might be essential for professionals throughout varied industries.

Yes Code: Generative AI + Frontend = Generative UI. [In 2024], we’ll see extra “generative UI” instruments that allow prompt creation of UI code from screenshots, drawing, voice, or prompts. Critically, the instruments that embrace established trade instruments (like React) for his or her outputs, will decrease the barrier for delivery generated code in actual product use circumstances – Lee Robinson, vie president of product, Vercel

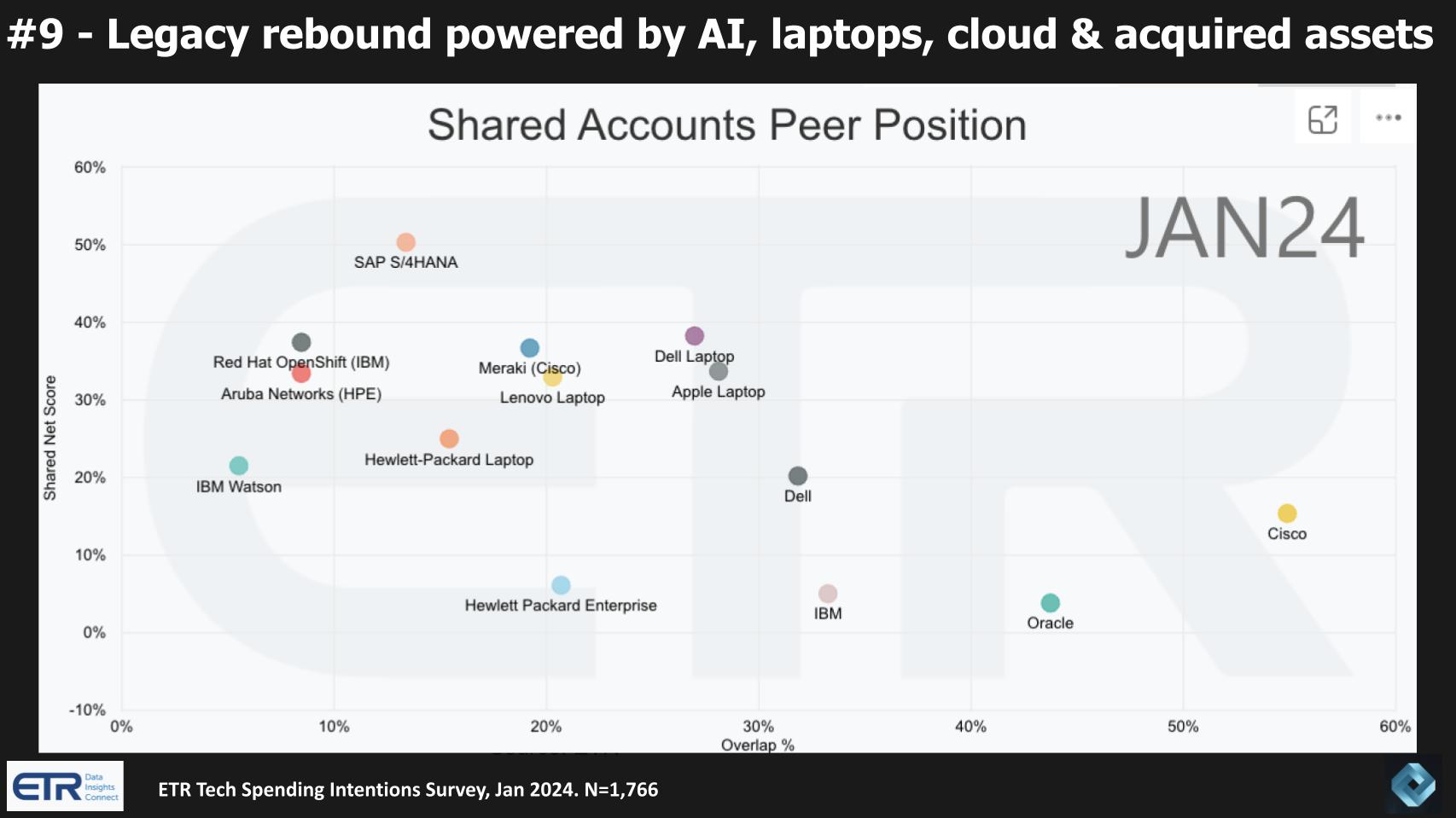

No. 9: Legacy rebound powered by AI, laptops, cloud and bought belongings

We’re seeing a resurgence of legacy tech corporations, powered by a refresh cycle that can assist on-prem AI workloads. As effectively, cloud developments and strategic acquisitions have enabled these corporations to supply “good enough” working experiences which have stopped the large bleeding off of workloads to the general public cloud. This development, as mirrored in latest information, suggests a number of key developments that we’ll spotlight beneath. Notably, not all corporations are ready to make the most of these developments and we imagine the leaders in key sectors will profit to a higher diploma.

The following key factors are related:

- We count on a “legacy rebound” in corporations resembling Cisco, Oracle, IBM, Dell and HPE, pushed by revolutionary makes use of of AI and cloud applied sciences. In the case of Dell, a PC rebound might be incrementally helpful as effectively.

- Notably, IBM, with watsonx and its Red Hat acquisition, and Oracle, with its cloud and different vital R&D investments, are poised to profit from the legacy tech refresh.

- The development is additional supported by a renewed concentrate on laptops, with a refresh cycle anticipated, particularly for corporations resembling Apple and Dell. This aligns with Intel Corp.’s projections for progress in PC gross sales, regardless of that firm’s troubles stemming from its money must battle a multifront conflict.

- We imagine that these legacy corporations usually are not solely reclaiming their place available in the market but in addition actively investing in and adapting to present technological developments, not like predecessors of the Eighties and ’90s that did not adapt.

- The ETR survey information signifies a broad enchancment in spending trajectories for these legacy corporations, spanning cloud, information and {hardware} sectors.

- We predict that the financial downturn and finances constraints have inadvertently given these corporations a “second life,” permitting them time to boost their choices and shut the expertise hole with cloud suppliers.

- The idea of hybrid cloud is gaining traction, with corporations like IBM specifically but in addition HPE, Dell and VMware Inc. asserting their presence on this area.

- In addition, we count on a complete {hardware} refresh cycle throughout servers, storage and networks, indicating a strong interval for {hardware} renewals.

In abstract, our evaluation means that legacy corporations are experiencing a big comeback, fueled by AI, cloud improvements and a concentrate on {hardware}. This resurgence shouldn’t be merely a return to kind however an evolution, with these corporations actively embracing new applied sciences and market dynamics. As a outcome, they’re well-positioned to compete within the present expertise panorama, making them higher positioned this decade to compete with the dominance of cloud-native gamers.

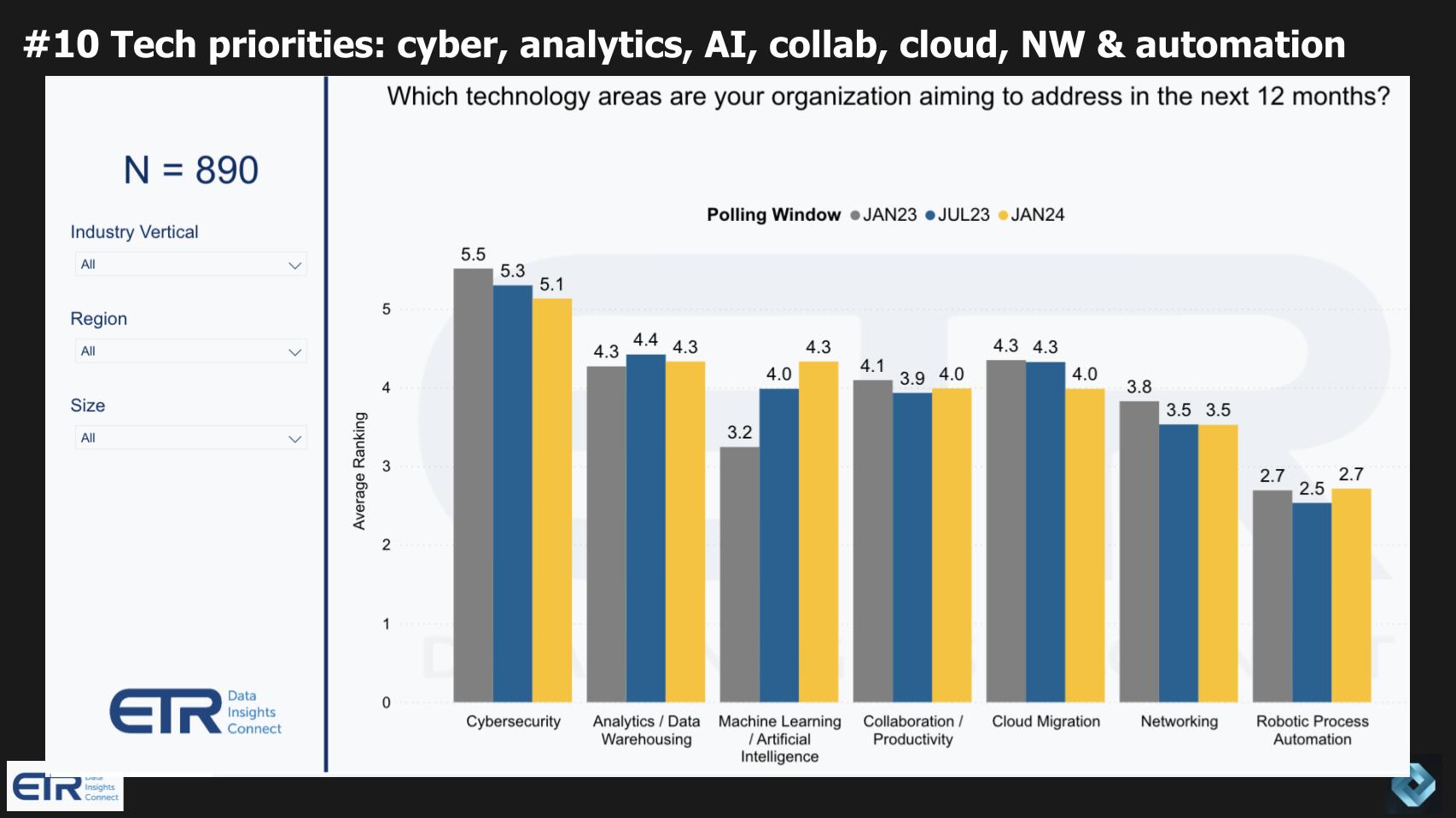

No. 10: Tech priorities: cyber, analytics, AI, collaboration and cloud, networking and automation

This latest evaluation proven beneath of expertise priorities highlights that cybersecurity, analytics, AI, collaboration, cloud, networking and automation stay on the forefront of tech funding and innovation.

Key observations from the info and our predictions embrace:

- Cybersecurity persistently ranks as the highest precedence throughout industries and geographies. Despite a slight lower, it stays the highest focus space.

- The significance of analytics and information warehousing is distinguished, emphasizing that efficient information administration is foundational to leveraging AI applied sciences.

- Collaboration instruments, which gained prominence throughout the pandemic, proceed to be important for organizational operations to assist hybrid work, which has develop into the dominant mannequin for organizations.

- Though cloud adoption has seen slowing progress post-pandemic, cloud-based innovation stays a big driver of technological development. The versatility and wealthy ecosystems provided by cloud suppliers proceed to energy new worth.

- Networking is gaining significance in AI environments, evolving as a brand new bottleneck to deal with.

- RPA is sustaining its relevance and displaying indicators of elevated adoption and is reforming as an end-to-end enterprise functionality usually described as “intelligent automation.”

- A notable shift in cloud methods is anticipated, with a lower within the urgency of cloud migration. Many organizations are shifting towards a hybrid mannequin, combining non-public cloud belongings with public cloud providers.

- The information suggests a slowdown within the anticipated tempo of cloud workload migration. The expectation of reaching 60% to 70% cloud workloads is progressing extra slowly than initially thought.

- That mentioned, the cloud continues to be the epicenter for innovation and new workload creation, notably pushed by generative AI applied sciences.

- The digital transformation journey is much from over, indicating a long-term, sustained funding in cloud applied sciences and digital initiatives.

In abstract, our prediction means that cybersecurity, analytics, AI and cloud will stay prime tech priorities. However, the character of cloud adoption is evolving. The focus is shifting from mere migration — carry and shift — to innovation and new workload creation within the cloud, influenced considerably by developments in generative AI. This development indicators a maturing market the place established applied sciences are being leveraged for brand new, revolutionary purposes.

How do you see 2024 shaping up?

What’s your outlook for tech spending and which applied sciences will present the best alternatives and disruptive threats?

Let us know.

Keep in contact

Thanks to Alex Myerson and Ken Shifman on manufacturing, podcasts and media workflows for Breaking Analysis. Special because of Kristen Martin and Cheryl Knight, who assist us maintain our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish every week on Wikibon and SiliconANGLE. These episodes are all obtainable as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and touch upon our LinkedIn posts.

Also, try this ETR Tutorial we created, which explains the spending methodology in additional element. Note: ETR is a separate firm from theCUBE Research and SiliconANGLE. If you wish to cite or republish any of the corporate’s information, or inquire about its providers, please contact ETR at authorized@etr.ai or analysis@siliconangle.com.

Here’s the total video evaluation:

All statements made concerning corporations or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, different friends on theCUBE and visitor writers. Such statements usually are not suggestions by these people to purchase, promote or maintain any safety. The content material offered doesn’t represent funding recommendation and shouldn’t be used as the premise for any funding resolution. You and solely you’re chargeable for your funding choices.

Disclosure: Many of the businesses cited in Breaking Analysis are sponsors of theCUBE and/or purchasers of Wikibon. None of those companies or different corporations have any editorial management over or superior viewing of what’s revealed in Breaking Analysis.

Image: ProstoSvet/Adobe Stock

Your vote of assist is vital to us and it helps us maintain the content material FREE.

One click on beneath helps our mission to supply free, deep, and related content material.

Join our community on YouTube

Join the neighborhood that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and plenty of extra luminaries and specialists.

THANK YOU

[adinserter block=”4″]

[ad_2]

Source link