[ad_1]

Stay knowledgeable with free updates

Simply signal as much as the Indian enterprise & finance myFT Digest — delivered on to your inbox.

India’s surging inventory market is fuelling a rush of preliminary public choices, however some traders have gotten apprehensive concerning the poor efficiency of a lot of Mumbai’s listings.

Investors and analysts mentioned the upbeat outlook for India’s economic growth, improved company earnings and robust demand from international traders are offering a tailwind for offers, with Dealogic knowledge displaying 21 IPOs raised about $678mn in January, in contrast with $17mn a 12 months in the past.

More listings are anticipated: a complete of 66 firms have filed itemizing paperwork with Indian regulators, in response to brokerage IIFL.

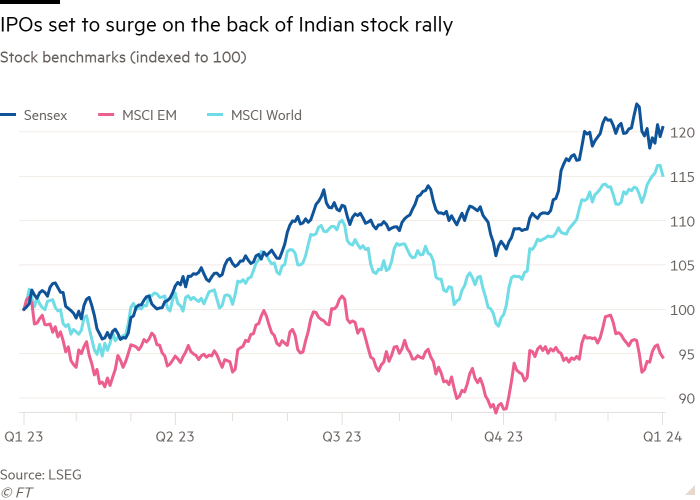

But analysts warn {that a} 20 per cent rise in India’s benchmark Sensex inventory index over the previous 12 months has pushed valuations for the nation’s equities to traditionally elevated ranges.

“In the near term, strong IPO flows look set to continue in India,” mentioned Kunal Vora, head of India fairness analysis at BNP Paribas, pointing to robust fundamentals and development estimates for the approaching 12 months. “The only concern that remains is that of valuation.”

The slate of anticipated offers consists of Ola Electric — anticipated to be among the many largest Indian IPOs of the previous two years — in addition to fintech group MobiKwik.

India’s IPO market picked up final 12 months as shares, which had made little progress since late 2021, rallied on the again of robust company earnings and rising enthusiasm from each home and worldwide traders. Many of the international traders had been looking for enticing development alternatives after fleeing China’s tumbling markets.

That renewed enthusiasm helped push the full market capitalisation of shares listed in India to roughly $4tn, overtaking Hong Kong to change into the world’s seventh-largest market. Last 12 months, Indian IPOs raised nearly $8bn.

“The potential for Indian companies to go public and raise capital is huge and still under-tapped,” mentioned Nirmal Jain, IIFL’s founder. While “the older generation [of company founders] was very conservative and wanted to keep information private . . . a new generation has come”.

India has change into one of many fastest-growing economies on this planet, with an growth of seven per cent anticipated this 12 months.

It has been a number one beneficiary of unease over China’s economy and geopolitical tensions with the west, with international traders pouring greater than $20bn into Indian shares in contrast with $8bn into Chinese equities in 2023, in response to Société Générale.

The nation’s giant listed firms have benefited from Prime Minister Narendra Modi’s emphasis on infrastructure and digitisation, with the federal government on Thursday asserting a rise in public spending in a finances forward of elections this 12 months.

The digitisation drive has helped entice tens of millions of recent retail traders to India, with the full variety of buying and selling accounts within the nation rising to a document of almost 140mn by the top of 2023.

SocGen’s analysts warned, nevertheless, that with Indian equities much more richly valued than their Chinese counterparts, the “relative strength argument is somewhat weakening”.

An evaluation of returns on debut share gross sales in Mumbai throughout current years additionally highlights the poor efficiency of many Indian IPOs, which may imply that home and international traders ultimately lose their urge for food for such listings.

Demand for IPO shares in firms which have listed in India because the begin of 2021 has outstripped accessible provide by 44 instances on common, with these shares occurring to leap a few quarter on the primary day of buying and selling, in response to a current report by funding agency YK2 Partners.

But two-thirds of these listings went on to lag behind the broader market, in response to the agency, which mentioned Indian IPOs “might make sense for investors looking for an IPO pop but not for long-term investors”.

Among probably the most outstanding examples is Paytm — one of many first of a era of know-how start-ups to go public in 2021, which is now buying and selling at Rs609 a share, about 70 per cent under its IPO worth.

Paytm’s shares fell sharply on Thursday after the Reserve Bank of India ordered its funds financial institution to cease taking deposits and providing banking companies, slicing off an important development space for the fintech group. The RBI cited “persistent non-compliances and . . . supervisory concerns”. The firm has mentioned it’s complying with the order.

Concerns about IPO efficiency have prompted some institutional traders in India to query the knowledge of collaborating in new listings. Raamdeo Agrawal, chair of Indian monetary group Motilal Oswal, mentioned his mutual funds would largely eschew IPOs this 12 months, preferring capital raises from firms already buying and selling on public markets as a result of better transparency round their funds.

“IPOs, for serious buying, are avoidable,” he mentioned. “People apply into an IPO and hope for a big pop . . . We’re in the game of investing, we’re not in the game of speculating.”

[adinserter block=”4″]

[ad_2]

Source link