[ad_1]

Marvell Technology Inc. (NASDAQ:MRVL) has skilled vital volatility within the inventory market. Over the previous three years, its share worth has fluctuated extensively, starting from $36 to $89. Recently, it plunged practically 11.40% following the announcement of first-quarter steerage that fell in need of expectations. Despite this current drop, I imagine Marvell stays considerably overvalued.

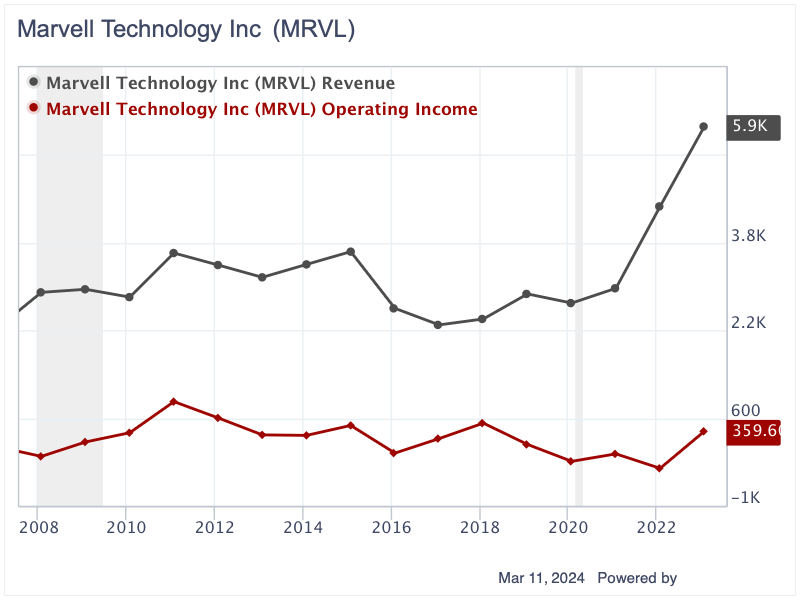

Growing income, however fluctuating working earnings

A number one supplier of semiconductor options for knowledge infrastructure, Marvell serves 5 major finish markets: Data Center, Enterprise Networking, Carrier Infrastructure, Consumer and Automotive/Industrial. The Data Center market is the corporate’s largest income supply, contributing $2.40 billion or 41% of its whole income in fiscal 2023. Enterprise Networking ranked second, accounting for 23% of whole gross sales. Carrier Infrastructure and Consumer markets made up 18% and 12% of the entire yr income. The firm has some buyer focus dangers, with its high 10 prospects producing 63% of its income. Notably, one distributor alone comprised 20% of the entire gross sales in 2023.

From 2008 to 2021, Marvell Technology’s income fluctuated between $2.30 billion and $3.64 billion. In the following two subsequent years, its income soared to $5.92 billion in 2023, pushed by increased product gross sales, elevated costs and the acquisition of Inphi, a high-speed semiconductor specialist. Despite this surge, 2024 noticed a 7.60% drop to $5.50 billion. In 2024, solely the Data Center market grew by 54%, whereas different 4 markets confronted double-digit declines.

Marvell’s working earnings has additionally skilled extensive fluctuations, transferring from a $315 million loss to a $901.2 million revenue between 2018 and 2023. In 2024, the corporate produced losses of $567.70 million. The 2024 losses have been brought on by falling income, rising analysis and growth bills and excessive restructuring-related costs.

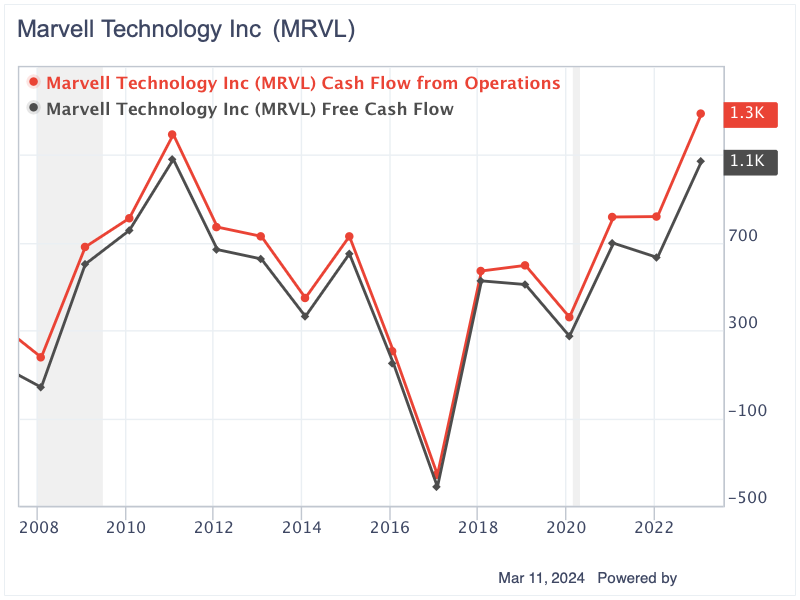

Consistent money move era

Despite the unstable working earnings, Marvell has constantly generated optimistic working money move and free money move in 15 out of the previous 16 years. The solely exception was in 2017 when the corporate produced detrimental working money move and free money move, primarily because of a $736 million litigation settlement with Carnegie Mellon University. The settlement was associated to read-channel built-in circuit gadgets and the arduous drives incorporating such gadgets.

The discrepancy between working earnings and working money move could be attributed to substantial quantities of depreciation, amortization of acquired intangible property and non-cash stock-based compensation to staff. In 2024, Marvell reported an working money move of $1.37 billion and free money move of $1.10 billion, with non-cash stock-based compensation amounting to just about $610 million. The vital stock-based compensation has led to a rise within the whole variety of shares excellent. Since 2008, the entire share depend has risen by 46.50%, from 590.30 million to 864.50 million shares.

High however manageable leverage

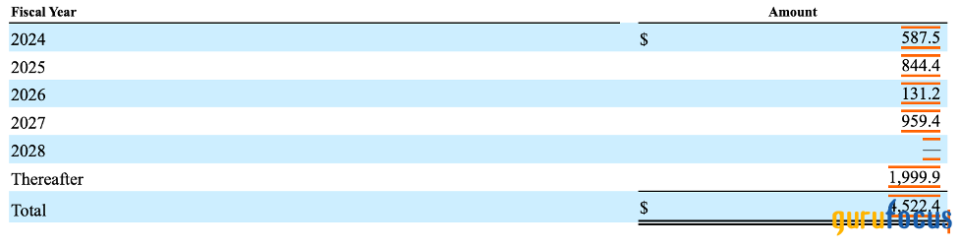

Many buyers would possibly fear about Marvell’s excessive leverage stage. As of February, Marvell reported $14.83 billion in shareholders’ fairness, together with $950.80 million in money and money equivalents. The interest-bearing debt reached $4.17 billion. In the following 5 years, the principal debt due per yr ranged from $131.20 million to just about $960 million. With an working money move of $1.37 billion and a stable money place, the corporate is in an excellent place to settle its debt obligations comfortably.

Source: Marvell’s 10-Okay

On the asset aspect, a good portion of the corporate’s property include goodwill, amounting to $11.59 billion, and purchased intangible property valued at $4 billion. Goodwill represents the surplus fee revamped the online asset worth for acquisitions, whereas intangible property embrace patents, manufacturers, emblems and copyrights. Holding a excessive stage of goodwill and intangible property poses the chance of potential write-downs or impairments if the efficiency of the acquired corporations or the worth of intangible property falls in need of expectations. Such monetary changes may considerably cut back reported earnings and adversely have an effect on the corporate’s inventory worth.

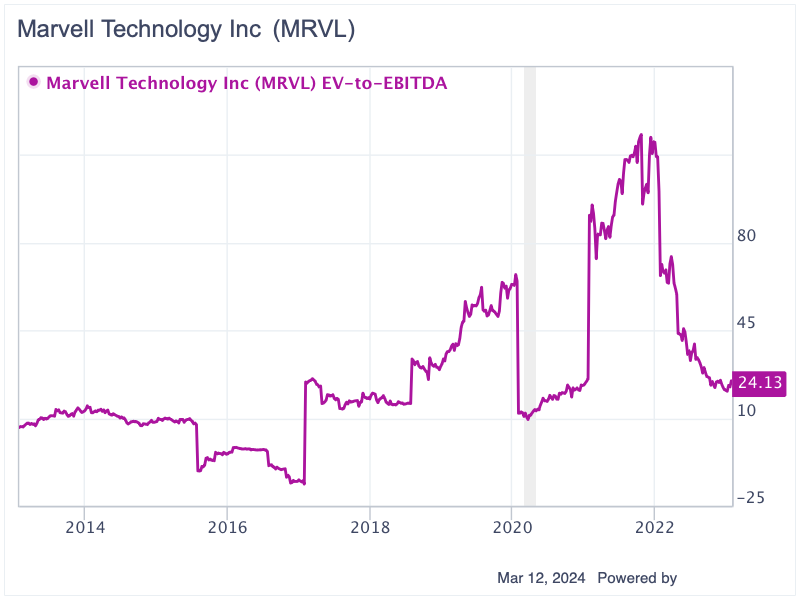

Significantly overvalued

By 2026, Marvell is anticipated to generate income of roughly $7 billion. Assuming an Ebitda margin of round 25%, which is analogous to the 2023 margin, Marvell’s Ebitda is estimated to be $1.75 billion.

Over the previous decade, Marvell’s Ebitda multiples have exhibited vital volatility, starting from a low of -16.30 to a excessive of 123.15. The common a number of over the previous 10 years stands at 27, barely increased than the corporate’s present Ebitda a number of of 24.13.

If we apply the 10-year common Ebitda a number of of 27, Marvell’s enterprise worth could be estimated at $47.25 billion. After adjusting for web debt of $3.22 billion, the fairness worth is calculated to be $44 billion. Assuming a 20% improve in whole share depend because of stock-based compensation, the variety of excellent shares would rise to 1.04 billion. Consequently, Marvell’s intrinsic worth per share is estimated to be $42.30, solely 56% of the present buying and selling worth.

Conclusion

Despite Marvell’s robust place throughout the semiconductor business and constant money move era, the volatility in working earnings, coupled with the current income drop and the excessive ranges of goodwill and intangible property, alerts potential dangers for buyers. These property, whereas useful, carry the specter of impairments that would considerably impression monetary outcomes. Furthermore, primarily based on my estimation, Marvell’s present share worth seems considerably overvalued. As a end result, buyers ought to anticipate a greater worth earlier than initiating a protracted place.

This article first appeared on GuruFocus.

[adinserter block=”4″]

[ad_2]

Source link