[ad_1]

With its inventory down 35% over the previous three months, it’s straightforward to ignore UET United Electronic Technology (ETR:CFC). However, inventory costs are often pushed by an organization’s financials over the long run, which on this case look fairly respectable. Specifically, we determined to review UET United Electronic Technology’s ROE on this article.

ROE or return on fairness is a great tool to evaluate how successfully an organization can generate returns on the funding it acquired from its shareholders. In different phrases, it’s a profitability ratio which measures the speed of return on the capital offered by the corporate’s shareholders.

See our latest analysis for UET United Electronic Technology

How To Calculate Return On Equity?

The system for return on fairness is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above system, the ROE for UET United Electronic Technology is:

76% = €3.8m ÷ €5.0m (Based on the trailing twelve months to June 2023).

The ‘return’ is the yearly revenue. One method to conceptualize that is that for every €1 of shareholders’ capital it has, the corporate made €0.76 in revenue.

Why Is ROE Important For Earnings Growth?

Thus far, now we have realized that ROE measures how effectively an organization is producing its income. Based on how a lot of its income the corporate chooses to reinvest or “retain”, we’re then in a position to consider an organization’s future potential to generate income. Assuming every part else stays unchanged, the upper the ROE and revenue retention, the upper the expansion fee of an organization in comparison with corporations that do not essentially bear these traits.

UET United Electronic Technology’s Earnings Growth And 76% ROE

Firstly, we acknowledge that UET United Electronic Technology has a considerably excessive ROE. Second, a comparability with the common ROE reported by the trade of 11% additionally does not go unnoticed by us. As you may anticipate, the 30% web earnings decline reported by UET United Electronic Technology does not bode properly with us. So, there may be another features that would clarify this. For instance, it may very well be that the corporate has a excessive payout ratio or the enterprise has allotted capital poorly, as an illustration.

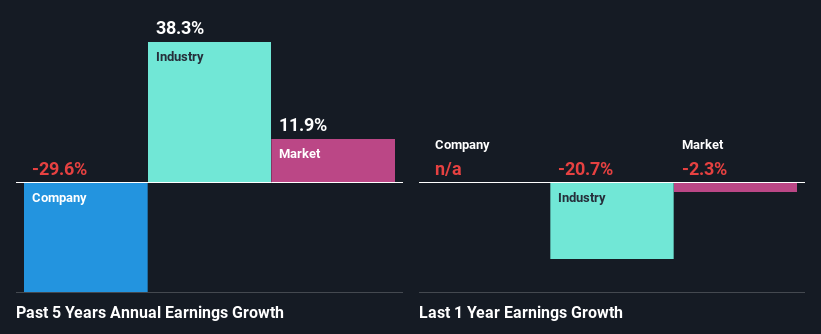

So, as a subsequent step, we in contrast UET United Electronic Technology’s efficiency in opposition to the trade and have been dissatisfied to find that whereas the corporate has been shrinking its earnings, the trade has been rising its earnings at a fee of 38% over the previous few years.

Earnings progress is a big consider inventory valuation. The investor ought to attempt to set up if the anticipated progress or decline in earnings, whichever the case could also be, is priced in. Doing so will assist them set up if the inventory’s future seems promising or ominous. If you are questioning about UET United Electronic Technology’s’s valuation, take a look at this gauge of its price-to-earnings ratio, as in comparison with its trade.

Is UET United Electronic Technology Making Efficient Use Of Its Profits?

Because UET United Electronic Technology does not pay any common dividends, we infer that it’s retaining all of its income, which is slightly perplexing when you think about the truth that there isn’t any earnings progress to indicate for it. So there may be different elements at play right here which may doubtlessly be hampering progress. For instance, the enterprise has confronted some headwinds.

Summary

On the entire, we do really feel that UET United Electronic Technology has some optimistic attributes. Although, we’re dissatisfied to see a scarcity of progress in earnings even despite a excessive ROE and and a excessive reinvestment fee. We imagine that there may be some outdoors elements that may very well be having a unfavorable impression on the enterprise. While we can’t utterly dismiss the corporate, what we might do, is attempt to confirm how dangerous the enterprise is to make a extra knowledgeable determination across the firm. To know the 4 dangers now we have recognized for UET United Electronic Technology go to our risks dashboard for free.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by elementary information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link