[ad_1]

Elevator Pitch

I maintain a Neutral rating on Hong Kong-listed Macau gaming operator Galaxy Entertainment Group Limited (OTCPK:GXYEF) (OTCPK:GXYEY) (OTCPK:GXYYY) [27:HK].

This is an update of my prior initiation article on Galaxy Entertainment published on August 29, 2019. Galaxy Entertainment’s share price has increased by +17% from HK$49.75 as of August 28, 2019 to HK$58.35 as of September 7, 2020 since my initiation. During the same period, the Hong Kong benchmark Hang Seng Index was down approximately -4%. In other words, Galaxy Entertainment has significantly out-performed the Hong Kong benchmark Hang Seng Index in the past year, which suggests that positives for the stock have been priced into a large extent. Galaxy Entertainment trades at consensus forward FY 2021 P/E and EV/EBITDA multiples of 23.3 times and 15.6 times, respectively. It also offers a consensus forward FY 2021 dividend yield of 1.2%.

Galaxy Entertainment was loss-making at the EBITDA level in 2Q 2020; the better-than-expected performance of the construction materials business and the lower-than-expected operating expense burn were bright spots. There has been an easing of travel restrictions for Mainland China visitors, which brings hopes of an earnings recovery for Galaxy Entertainment in 2H 2020.

Nevertheless, given Galaxy Entertainment’s share price out-performance as highlighted above, I see positives for the stock as priced in and retain my Neutral rating on Galaxy Entertainment.

Readers have the option of trading in Galaxy Entertainment shares listed either on the Over-The-Counter Bulletin Board/OTCBB as ADRs with the tickers GXYEF, GXYEY and GXYYY, or on the Hong Kong Stock Exchange with the ticker 27:HK. For those shares listed as ADRs on the OTCBB, note that liquidity is low and bid/ask spreads are wide.

For those shares listed in Hong Kong, there are limited risks associated with buying or selling the shares in terms of trade execution, given that the Hong Kong Stock Exchange is one of the major stock exchanges that is internationally recognized, and there is sufficient trading liquidity. Average daily trading value for the past three months exceeds $100 million, and market capitalization is above $32 billion, which is comparable to the majority of stocks traded on the US stock exchanges.

Institutional investors which own Galaxy Entertainment shares listed in Hong Kong include Capital Research Global Investors, The Vanguard Group, BlackRock, and Norges Bank Investment Management, among others. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage such as Interactive Brokers or Fidelity, or international brokers with Asian coverage like Hong Kong’s Monex Boom Securities and Singapore’s OCBC Securities.

Poor 2Q 2020 Financial Results

Galaxy Entertainment reported 2Q 2020 financial results on August 13, 2020, and the company’s financial performance was poor as expected with the Macau gaming industry being negatively impacted by Covid-19.

The company went from positive EBITDA of HK$4,332 million and HK$283 million in 2Q 2019 and 1Q 2020 to an operating loss of -HK$1,370 million in 2Q 2020. Galaxy Entertainment registered a net revenue of HK$1,153 million in 2Q 2020, which represented a QoQ decline of -77% and a YoY drop of -91%.

There were two bright spots amidst the gloom.

Galaxy Entertainment’s non-core construction materials business performed well in 2Q 2020. Net revenue for the construction materials business grew by +4% YoY and +57% QoQ to HK$747 million in the second quarter of the year. The construction materials business derived an EBITDA of HK$390 million in the most recent quarter, which was equivalent to growth rates of +7% YoY and +228% QoQ. In the company’s 2Q 2020 results announcement, Galaxy Entertainment attributed the construction materials business’s strong performance in 2Q 2020 to “pent-up demand for construction materials” in China with the easing of lock-down measures and increased “demand for cement in Yunnan driven by government infrastructure projects.”

Galaxy Entertainment also continued to reduce the company’s operating costs, which should help the company to tide through this difficult period in the Macau gaming industry period. At the company’s 2Q 2020 results briefing on August 13, 2020, Galaxy Entertainment disclosed that its “Macau OpEx (operating expense) burn” declined from $2.8 million per day in 1Q 2020 to $2.5 million per day in 2Q 2020. Notably, the company’s Macau operating expense burn was approximately $3.4 million per day pre-Covid-19.

Share Price Rallied On Relaxation Of Travel Restrictions

Galaxy Entertainment’s share price has rallied by +51% from its year-to-date low of HK$38.60 as of March 19, 2020 to HK$58.35 as of September 7, 2020. The relaxation of travel restrictions with respect to people from Mainland China visiting Macau has been the key factor that drove the company’s strong share price performance in the past few months.

A mandatory 14-day quarantine for visitors traveling from the Guangdong province to Macau was lifted starting July 15, 2020, three and a half months after this was implemented on March 27, 2020. In mid-August, it was announced that the Individual Visit Scheme or IVS will resume on August 26, 2020 and September 23, 2020, for the Guangdong province and the whole of Mainland China, respectively, after the IVS was suspended in late-January 2020 following the outbreak of Covid-19. Based on the Hong Kong’s Tourism Commission website, the Individual Visit Scheme or IVS is referred to as a “tourism liberalization measure” that enables residents of over 40 Mainland China cities to visit Macau and Hong Kong for up to seven days on tourist visas.

Nevertheless, the actual resumption of the IVS will still be dependent on how the Covid-19 situation evolves in Mainland China and Macau. Galaxy Entertainment cautioned at its 2Q 2020 earnings call on August 13, 2020 that “these (easing of travel restrictions) are gradual steps” and “it will take some time to ramp that (IVS) up.” Furthermore, there is natural cap on gaming revenues, as social distancing measures, which limit gaming tables to half of their capacity, remain in place.

Hopes Of Earnings Recovery In 2H 2020

Market consensus expects Galaxy Entertainment to register a positive EBITDA of HK$1,227 million for full-year FY 2020 as compared to an EBITDA loss of -HK$1,174 million in 1H 2020, which implies a strong earnings recovery in the second half of the year.

More importantly, Galaxy Entertainment guided at the company’s recent 1H 2020 earnings call that it can achieve positive EBITDA if gaming revenue is restored to the “low 30s” percentage of pre-Covid-19 levels. Notably, the company also added that the Macau gaming operators on average require gaming revenue to reach around 40% of pre-Covid-19 levels to be profitable at the EBITDA level.

There are two key reasons why Galaxy Entertainment could possibly achieve earnings recovery at a faster pace compared to its Macau gaming operator peers.

Firstly, Galaxy Entertainment is the market leader in the VIP segment of the Macau gaming industry, and it is expected that the VIP segment will recover faster than the mass segment. At the company’s 2Q 2020 results briefing, Galaxy Entertainment highlighted that it thinks “higher-spend customers” and “the premium segment will lead the recovery.”

Secondly, Galaxy Entertainment has been managing its costs well. As highlighted above, the company’s Macau daily operating expense burn has been reduced from $3.4 million last year to $2.8 million and $2.5 million for 1Q 2020 and 2Q 2020, respectively.

Financial Strength And Capacity Expansion Plans Are Positive Factors

As of June 30, 2020, Galaxy Entertainment has net cash of HK$43.6 million on its books. The company is the only Macau gaming operator with a net cash balance sheet which means it has the best chances of survival among its peers if Covid-19 fails to be contained for a longer-than-expected period of time.

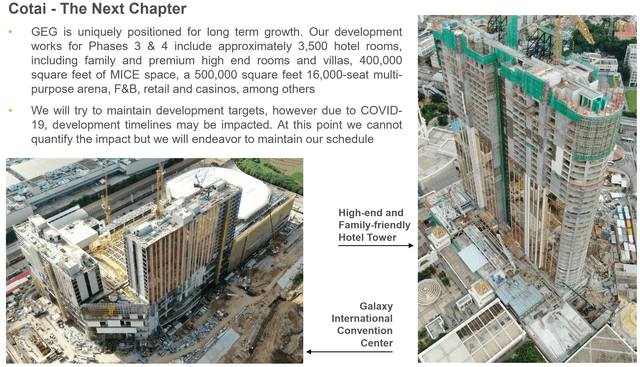

Galaxy Entertainment’s strong financial position also supports the company’s future capacity growth plans. In my initiation article on Galaxy Entertainment published on August 29, 2019, I noted that the company has “the largest undeveloped land bank” of the six Macau gaming operators and its major capacity expansion plans to “double its Cotai footprint and the gross floor area of Galaxy Macau” are underway.

Despite Covid-19 disruptions, Galaxy Entertainment expects Phase 3 of the company’s capacity expansion plans for its Galaxy Macau property to be completed by the middle of 2021, as per earlier plans. This could be perfectly timed with a recovery of the Macau gaming sector driven by pent-up demand, assuming Covid-19 is contained by then.

Phase 3 And 4 Of Galaxy Entertainment’s Capacity Expansion Plans For The Galaxy Macau Property In Cotai, Macau

Source: Galaxy Entertainment’s 2Q 2020 Results Presentation Slides

Source: Galaxy Entertainment’s 2Q 2020 Results Presentation Slides

Valuation And Dividends

Galaxy Entertainment trades at consensus forward FY 2021 P/E and EV/EBITDA multiples of 23.3 times and 15.6 times, respectively based on its share price of HK$58.35 as of September 7, 2020. As a comparison, the stock’s 10-year mean consensus forward next twelve months’ P/E and EV/EBITDA multiples were 20.9 times and 20.3 times, respectively.

Galaxy Entertainment chose to suspend its interim dividend for 1H 2020, which is no different from what other Macau gaming operators and other companies affected by Covid-19 have done. At the company’s 2Q 2020 earnings call on August 13, 2020, Galaxy Entertainment noted that it “decided to pursue a more conservative direction” considering the “prevailing market conditions.” The company did not provide guidance on future dividends, only highlighting at the recent results briefing that it “will continue to evaluate our approach to dividends on a case-by-case basis.”

Sell-side analysts expect Galaxy Entertainment to declare dividends of HK$0.126 and HK$0.718 for FY 2020 and FY 2021 which imply dividend yields of 0.2% and 1.2%, respectively.

Risk Factors

The key risk factors for Galaxy Entertainment are a delay in the easing of travel restrictions for visitors from Mainland China, disruption to the company’s medium-term capacity expansion plans due to Covid-19, and lower-than-expected dividends going forward.

Note that readers who choose to trade in Galaxy Entertainment shares listed as ADRs on the OTCBB (rather than shares listed in Hong Kong) could potentially suffer from lower liquidity and wider bid/ask spreads.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link