[ad_1]

Key Insights

-

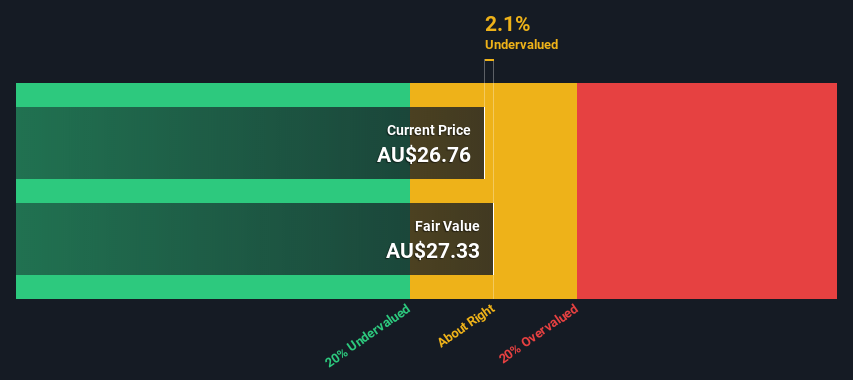

The projected honest worth for Ansell is AU$27.33 based mostly on 2 Stage Free Cash Flow to Equity

-

With AU$26.76 share worth, Ansell seems to be buying and selling near its estimated honest worth

-

Analyst price target for ANN is US$27.26 which is analogous to our honest worth estimate

Today we’ll do a easy run by way of of a valuation technique used to estimate the attractiveness of Ansell Limited (ASX:ANN) as an funding alternative by taking the anticipated future money flows and discounting them to in the present day’s worth. This shall be carried out utilizing the Discounted Cash Flow (DCF) mannequin. It might sound sophisticated, however really it’s fairly easy!

Companies might be valued in a number of methods, so we might level out {that a} DCF just isn’t good for each state of affairs. If you need to be taught extra about discounted money circulate, the rationale behind this calculation might be learn intimately within the Simply Wall St analysis model.

View our latest analysis for Ansell

Step By Step Through The Calculation

We are going to make use of a two-stage DCF mannequin, which, because the title states, takes under consideration two levels of development. The first stage is mostly the next development interval which ranges off heading in direction of the terminal worth, captured within the second ‘regular development’ interval. To begin off with, we have to estimate the following ten years of money flows. Where doable we use analyst estimates, however when these aren’t accessible we extrapolate the earlier free money circulate (FCF) from the final estimate or reported worth. We assume corporations with shrinking free money circulate will sluggish their charge of shrinkage, and that corporations with rising free money circulate will see their development charge sluggish, over this era. We do that to replicate that development tends to sluggish extra within the early years than it does in later years.

A DCF is all about the concept a greenback sooner or later is much less precious than a greenback in the present day, so we have to low cost the sum of those future money flows to reach at a gift worth estimate:

10-year free money circulate (FCF) estimate

|

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

|

|

Levered FCF ($, Millions) |

US$112.9m |

US$125.0m |

US$143.7m |

US$136.3m |

US$141.2m |

US$145.0m |

US$148.6m |

US$152.0m |

US$155.3m |

US$158.6m |

|

Growth Rate Estimate Source |

Analyst x3 |

Analyst x3 |

Analyst x3 |

Analyst x1 |

Analyst x1 |

Est @ 2.69% |

Est @ 2.46% |

Est @ 2.30% |

Est @ 2.19% |

Est @ 2.11% |

|

Present Value ($, Millions) Discounted @ 7.7% |

US$105 |

US$108 |

US$115 |

US$101 |

US$97.5 |

US$92.9 |

US$88.4 |

US$84.0 |

US$79.7 |

US$75.6 |

(“Est” = FCF development charge estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$947m

After calculating the current worth of future money flows within the preliminary 10-year interval, we have to calculate the Terminal Value, which accounts for all future money flows past the primary stage. The Gordon Growth system is used to calculate Terminal Value at a future annual development charge equal to the 5-year common of the 10-year authorities bond yield of 1.9%. We low cost the terminal money flows to in the present day’s worth at a price of fairness of seven.7%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$159m× (1 + 1.9%) ÷ (7.7%– 1.9%) = US$2.8b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$2.8b÷ ( 1 + 7.7%)10= US$1.3b

The whole worth is the sum of money flows for the following ten years plus the discounted terminal worth, which ends up in the Total Equity Value, which on this case is US$2.3b. In the ultimate step we divide the fairness worth by the variety of shares excellent. Compared to the present share worth of AU$26.8, the corporate seems about honest worth at a 2.1% low cost to the place the inventory worth trades at present. Valuations are imprecise devices although, moderately like a telescope – transfer a number of levels and find yourself in a unique galaxy. Do preserve this in thoughts.

Important Assumptions

The calculation above may be very depending on two assumptions. The first is the low cost charge and the opposite is the money flows. Part of investing is developing with your personal analysis of an organization’s future efficiency, so strive the calculation your self and verify your personal assumptions. The DCF additionally doesn’t take into account the doable cyclicality of an trade, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Given that we’re Ansell as potential shareholders, the price of fairness is used because the low cost charge, moderately than the price of capital (or weighted common price of capital, WACC) which accounts for debt. In this calculation we have used 7.7%, which is predicated on a levered beta of 0.970. Beta is a measure of a inventory’s volatility, in comparison with the market as a complete. We get our beta from the trade common beta of worldwide comparable corporations, with an imposed restrict between 0.8 and a pair of.0, which is an inexpensive vary for a steady enterprise.

SWOT Analysis for Ansell

Strength

Weakness

Opportunity

Threat

Next Steps:

Although the valuation of an organization is vital, it’s only one in all many elements that you have to assess for an organization. DCF fashions will not be the be-all and end-all of funding valuation. Preferably you’d apply completely different circumstances and assumptions and see how they might impression the corporate’s valuation. For occasion, if the terminal worth development charge is adjusted barely, it could actually dramatically alter the general outcome. For Ansell, we have compiled three related gadgets it is best to have a look at:

-

Risks: We really feel that it is best to assess the 1 warning sign for Ansell we have flagged earlier than investing within the firm.

-

Management:Have insiders been ramping up their shares to make the most of the market’s sentiment for ANN’s future outlook? Check out our management and board analysis with insights on CEO compensation and governance elements.

-

Other Solid Businesses: Low debt, excessive returns on fairness and good previous efficiency are elementary to a powerful enterprise. Why not discover our interactive list of stocks with solid business fundamentals to see if there are different corporations you could not have thought-about!

PS. The Simply Wall St app conducts a reduced money circulate valuation for each inventory on the ASX daily. If you need to discover the calculation for different shares simply search here.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to carry you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link