[ad_1]

Key Insights

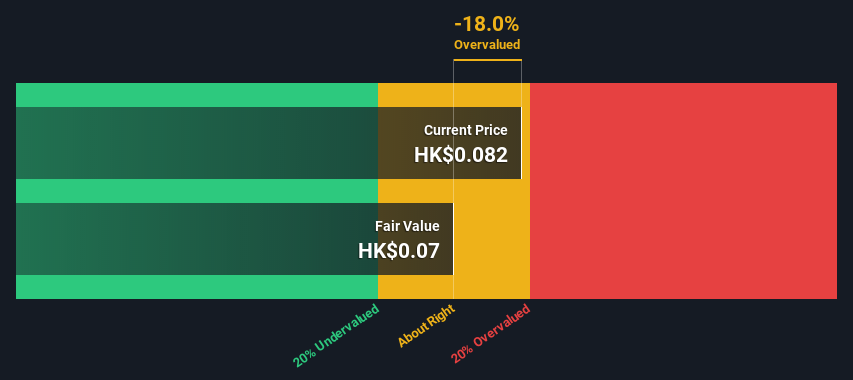

- Dafeng Port Heshun Technology’s estimated truthful worth is HK$0.07 primarily based on 2 Stage Free Cash Flow to Equity

- Current share worth of HK$0.08 suggests Dafeng Port Heshun Technology is buying and selling near its truthful worth

- Industry average of 532% suggests Dafeng Port Heshun Technology’s friends are at the moment buying and selling at a better premium

How far off is Dafeng Port Heshun Technology Company Limited (HKG:8310) from its intrinsic worth? Using the newest monetary information, we’ll check out whether or not the inventory is pretty priced by estimating the corporate’s future money flows and discounting them to their current worth. Our evaluation will make use of the Discounted Cash Flow (DCF) mannequin. There’s actually not all that a lot to it, though it would seem fairly complicated.

Companies could be valued in plenty of methods, so we’d level out {that a} DCF will not be excellent for each scenario. For those that are eager learners of fairness evaluation, the Simply Wall St analysis model here could also be one thing of curiosity to you.

Check out our latest analysis for Dafeng Port Heshun Technology

The Model

We’re utilizing the 2-stage progress mannequin, which merely means we absorb account two levels of firm’s progress. In the preliminary interval the corporate could have a better progress price and the second stage is often assumed to have a steady progress price. To begin off with, we have to estimate the subsequent ten years of money flows. Seeing as no analyst estimates of free money circulation can be found to us, now we have extrapolate the earlier free money circulation (FCF) from the corporate’s final reported worth. We assume firms with shrinking free money circulation will sluggish their price of shrinkage, and that firms with rising free money circulation will see their progress price sluggish, over this era. We do that to mirror that progress tends to sluggish extra within the early years than it does in later years.

A DCF is all about the concept a greenback sooner or later is much less priceless than a greenback at this time, so we have to low cost the sum of those future money flows to reach at a gift worth estimate:

10-year free money circulation (FCF) estimate

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF (HK$, Millions) | HK$9.45m | HK$10.7m | HK$11.8m | HK$12.6m | HK$13.4m | HK$14.0m | HK$14.5m | HK$14.9m | HK$15.3m | HK$15.6m |

| Growth Rate Estimate Source | Est @ 18.47% | Est @ 13.42% | Est @ 9.88% | Est @ 7.40% | Est @ 5.67% | Est @ 4.45% | Est @ 3.60% | Est @ 3.01% | Est @ 2.59% | Est @ 2.30% |

| Present Value (HK$, Millions) Discounted @ 15% | HK$8.2 | HK$8.1 | HK$7.7 | HK$7.1 | HK$6.6 | HK$5.9 | HK$5.3 | HK$4.8 | HK$4.2 | HK$3.8 |

(“Est” = FCF progress price estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = HK$62m

The second stage is also referred to as Terminal Value, that is the enterprise’s money circulation after the primary stage. For various causes a really conservative progress price is used that can’t exceed that of a rustic’s GDP progress. In this case now we have used the 5-year common of the 10-year authorities bond yield (1.6%) to estimate future progress. In the identical manner as with the 10-year ‘progress’ interval, we low cost future money flows to at this time’s worth, utilizing a price of fairness of 15%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = HK$16m× (1 + 1.6%) ÷ (15%– 1.6%) = HK$116m

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= HK$116m÷ ( 1 + 15%)10= HK$28m

The whole worth is the sum of money flows for the subsequent ten years plus the discounted terminal worth, which ends up in the Total Equity Value, which on this case is HK$90m. The final step is to then divide the fairness worth by the variety of shares excellent. Compared to the present share worth of HK$0.08, the corporate seems round truthful worth on the time of writing. The assumptions in any calculation have a big effect on the valuation, so it’s higher to view this as a tough estimate, not exact all the way down to the final cent.

The Assumptions

Now an important inputs to a reduced money circulation are the low cost price, and naturally, the precise money flows. You do not must agree with these inputs, I like to recommend redoing the calculations your self and enjoying with them. The DCF additionally doesn’t take into account the attainable cyclicality of an business, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Given that we’re taking a look at Dafeng Port Heshun Technology as potential shareholders, the price of fairness is used because the low cost price, relatively than the price of capital (or weighted common value of capital, WACC) which accounts for debt. In this calculation we have used 15%, which relies on a levered beta of two.000. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the business common beta of worldwide comparable firms, with an imposed restrict between 0.8 and a couple of.0, which is an affordable vary for a steady enterprise.

SWOT Analysis for Dafeng Port Heshun Technology

- No main strengths recognized for 8310.

- Current share worth is above our estimate of truthful worth.

- Has ample money runway for greater than 3 years primarily based on present free money flows.

- Lack of analyst protection makes it tough to find out 8310’s earnings prospects.

- Debt will not be effectively lined by working money circulation.

- Total liabilities exceed whole belongings, which raises the danger of economic misery.

Looking Ahead:

Whilst necessary, the DCF calculation should not be the one metric you have a look at when researching an organization. The DCF mannequin will not be an ideal inventory valuation device. Instead one of the best use for a DCF mannequin is to check sure assumptions and theories to see if they’d result in the corporate being undervalued or overvalued. For occasion, if the terminal worth progress price is adjusted barely, it may possibly dramatically alter the general end result. For Dafeng Port Heshun Technology, we have put collectively three important features it is best to assess:

- Risks: Take dangers, for instance – Dafeng Port Heshun Technology has 4 warning signs (and 2 which are a bit unpleasant) we predict it is best to find out about.

- Other High Quality Alternatives: Do you want all-rounder? Explore our interactive list of high quality stocks to get an thought of what else is on the market it’s possible you’ll be lacking!

- Other Top Analyst Picks: Interested to see what the analysts are considering? Take a have a look at our interactive list of analysts’ top stock picks to search out out what they really feel might need a gorgeous future outlook!

PS. The Simply Wall St app conducts a reduced money circulation valuation for each inventory on the SEHK every single day. If you need to discover the calculation for different shares simply search here.

Valuation is complicated, however we’re serving to make it easy.

Find out whether or not Dafeng Port Heshun Technology is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by elementary information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link