[ad_1]

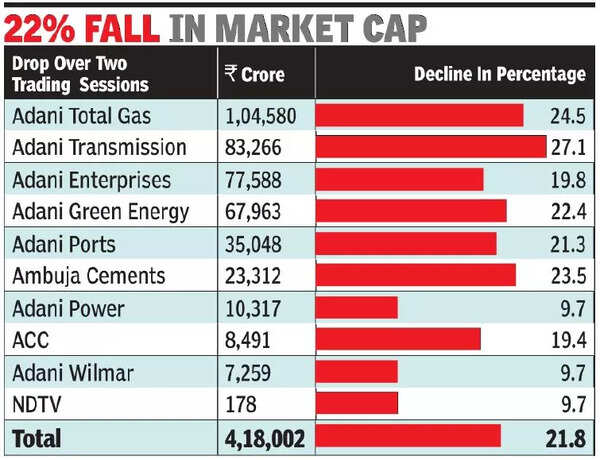

The two-day sell-off left the group’s shareholders poorer by $51.6 billion or about Rs 4.2 lakh crore, BSE information confirmed. It additionally wiped off over $25 billion of the non-public web value of Gautam Adani, the group’s chairman, to beneath $100 billion and relegated him to seventh richest on the earth, from third earlier this week, Forbes information confirmed. The group chairman’s web value is now at $96.6 billion (about Rs 7.9 lakh crore).

The sensex dropped 874 factors or 1.5%, its largest single-day loss in over a month, to settle at 59,331, its lowest shut since October 21. SBI was 5% decrease at Rs 540, whereas LIC misplaced 3.5% to Rs 666 on issues over publicity to the group.

According to some, one of many triggers for Friday’s selloff was a tweet by billionaire hedge fund supervisor Bill Ackman, who referred to as Hindenburg’s work on Adani Group “highly credible and well-researched”. Ackman is the founding father of Pershing Square, rated by Reuters as the most effective performing hedge funds on the earth. He is thought for betting towards common firms by going brief and later shopping for their shares when they aren’t trending.

“We are not invested long or short in any of the Adani companies…nor have we done our own independent research,” Ackman mentioned, becoming a member of the Hindenburg-Adani debate on Twitter on Friday.

The growth signifies that the Adani group has come below the scanner of world buyers. Late Tuesday, New York-based Hindenburg Research got here out with a report titled ‘Adani Group: How the world’s third richest man is pulling the biggest con in company historical past’.

The report alleged that the Adani Group was concerned “in a brazen stock manipulation and accounting fraud scheme over the course of decades.” Hindenburg additionally mentioned that it had taken a brief place in shares and bonds of Adani Group firms by way of offshore channels. The report talked about that the group’s key listed firms had taken on substantial debt, together with pledging shares of their inflated inventory for loans, “putting the entire group on precarious financial footing”.

Adani Group was fast to junk the report and referred to as it “a malicious combination of selective misinformation, stale and baseless allegations that have already been tested and rejected” by the SC. On Thursday, the group mentioned that it was mulling authorized recourse towards Hindenburg.

In response, Hindenburg tweeted that they might welcome such a transfer and dared Adani to sue them within the US, saying they might demand “a long list of documents” in a authorized discovery course of.

Friday’s selloff pulled down Adani Enterprises’ inventory worth by 18% to Rs 2,762. Along with it, Adani Transmission, Adani Green Energy and Adani Total Gas all closed on the 20% decrease circuit. Adani Power, Adani Wilmar and NDTV all closed on the 5% decrease circuit, whereas Adani Ports misplaced 16%. Ambuja Cements and subsidiary ACC recorded a 17.2% and 13.4% drop respectively.

As a results of this selloff in Adani shares, the group’s shareholders misplaced Rs 3.2 lakh crore. Together with the preliminary sell-off on Wednesday, the overall loss to buyers’ wealth is almost Rs 4.2 lakh crore in two days.

[adinserter block=”4″]

[ad_2]

Source link