[ad_1]

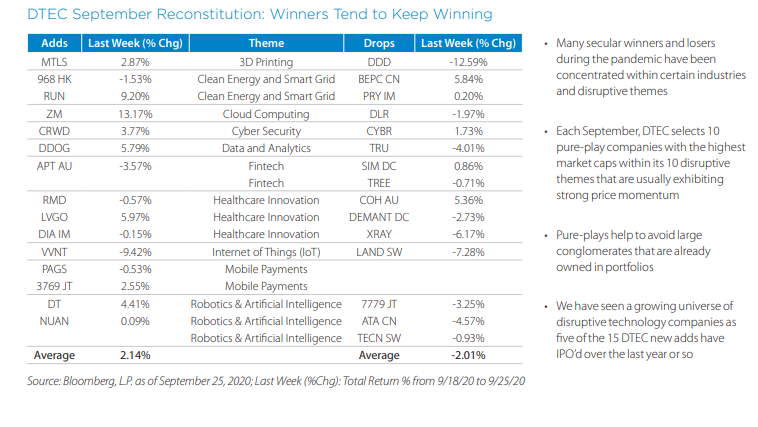

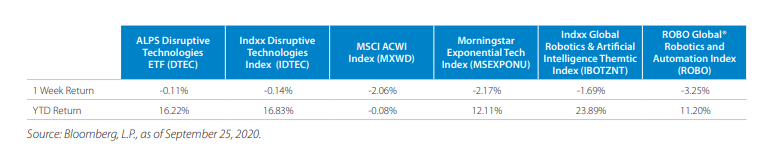

The ALPS Disruptive Technologies ETF (DTEC) outpaced the broader equity markets last week amid volatility, driven by its Cloud Computing and Cyber Security themes. With its September reconstitution in the books, 15 new pure-play disruptive technology companies were added to DTEC while 15 were removed. Some notable additions include:

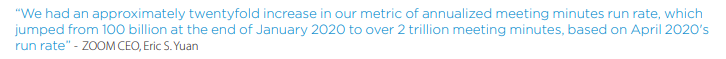

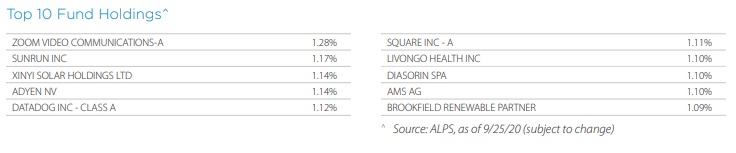

- Zoom Video Communications (ZM, 1.28% weight*), which has been a powerhouse amid the shift to work-from-home (WFH), was added to DTEC’s Cloud Computing theme. The cloud-based video conferencing provider is up over 600% in 2020 and was up 13% last week amid resurging COVID-19 cases that may result in new lockdowns.

- The Clean Energy & Smart Grid theme in DTEC has been gaining steam amid the pandemic. New add, Sunrun Inc. (RUN, 1.17% weight*), has gained close to 400% in 2020 and was up over 9% last week after inking a deal with California to build solar projects on the state’s low-income housing that will save on energy costs for residents.

- Livongo Health Inc (LVGO, 1.10% weight*), part of DTEC’s Healthcare Innovation theme, is up nearly 460% in 2020 and rose 6% last week on optimism over its merger with Teledoc Health Inc (TDOC; not in DTEC*) that is expected to close in Q4. Utilization rates for telehealth solutions are skyrocketing under the global pandemic.

- Within the Data & Analytics theme in DTEC, Datadog Inc (DDOG, 1.12% weight*), is up almost 140% in 2020 and rallied over 5.5% last week after an Investor’s Business Daily (IBD) article cited the company’s disruptive software monitoring & analytics platform in IBD’s highest-possible (99) composite rating for growth companies.

Performance data quoted represent past performance. Past performance is no guarantee of future results so that shares, when redeemed may be worth more or less than their original cost. The investment return and principal value will fluctuate. Current performance may be higher or lower than the performance quoted. For the most current month end performance data please call 844.234.5852. Performance includes reinvested distributions and capital gains.

For standardized performance of the fund please click here.

* weights in DTEC as of 9/25/20

Important Disclosure & Definitions

An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing. ALPS Disruptive Technologies ETF Shares are not individually redeemable. Investors buy and sell shares of the ALPS Disruptive Technologies ETF on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares. There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus. The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector. Diversification does not eliminate the risk of experiencing investment losses. An investor cannot invest directly in an index. A basis point is one hundredth of one percent. An investment in the Fund is subject to investment risk including the possible loss of the entire principal amount that you invest. Companies that the Index Provider believes are developing disruptive technologies may not in fact do so or may not be able to capitalize on those technologies. Companies that develop disruptive technologies may face political, legal or regulatory challenges. Such companies may also be exposed to risks applicable to industries or sectors other than the disruptive technology Theme for which they are chosen and may underperform relative to other companies that are also focused on a particular Theme. Smaller and mid-size companies often have narrower markets, more limited managerial and financial resources and a less diversified product offering than larger, more established companies. As a result, their performance can be more volatile, which may increase the volatility of the Fund’s portfolio. The large capitalization companies in which the Fund invests may underperform other segments of the equity market or the equity market as a whole. The Fund’s investments in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers, including, among others, less liquidity generally, greater market volatility than U.S. securities and less complete financial information than for U.S. issuers. In addition, adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Finally, the value of the currency of the country in which the Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors. Index Disruptive Technologies Index is based around companies that enter traditional markets with new digital forms of production and distribution, are likely to disrupt an existing market and value network, displace established market leading firms, products and alliances and increasingly gain market share. One may not invest directly in the index. The MSCI ACWI Indexes offer a modern, seamless, and fully integrated approach to measuring the full equity opportunity set with no gaps or overlaps. MSCI ACWI represents the Modern Index Strategy and captures all sources of equity returns in 23 developed and 24 emerging markets. The Morningstar Exponential Technologies Net Total Return Index is composed of developed and emerging market companies that create or use exponential technologies. The index uses a unique evaluation process to identify companies developing and/or leveraging promising technologies. The ROBO Global® Robotics & Automation Index has the objective of providing investors with a comprehensive, transparent, and diversified benchmark that represents the global value chain of robotics, automation, and enabling technologies. The Indxx Global Robotics & Artificial Intelligence Thematic Index is designed to track the performance of companies listed in developed markets that are expected to benefit from the increased adoption and utilization of robotics and Artificial Intelligence (“AI”), including companies involved in Industrial Robotics and Automation, Non-Industrial Robots, Artificial Intelligence and Unmanned Vehicles. The Fund employs a “passive management”- or indexing- investment approached and seeks to track the investment results of an index composed of global companies that enter traditional markets with new digital forms of production and distribution, and are likely to disrupt an existing market or value network. Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble unless that security is removed from the Index Disruptive Technologies Index. Similarly, the Fund does not buy a security because the security is deemed attractive unless that security is added to the Index Disruptive Technologies Index. ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS Disruptive Technologies ETF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

[ad_2]

Source link