[ad_1]

Last week, you might need seen that Carpenter Technology Corporation (NYSE:CRS) launched its quarterly outcome to the market. The early response was not constructive, with shares down 4.5% to US$63.41 prior to now week. Results look blended – whereas income fell marginally wanting analyst estimates at US$624m, statutory earnings had been in step with expectations, at US$0.85 per share. Following the outcome, the analysts have up to date their earnings mannequin, and it could be good to know whether or not they suppose there’s been a robust change within the firm’s prospects, or if it is enterprise as ordinary. We thought readers would discover it fascinating to see the analysts newest (statutory) post-earnings forecasts for subsequent 12 months.

See our latest analysis for Carpenter Technology

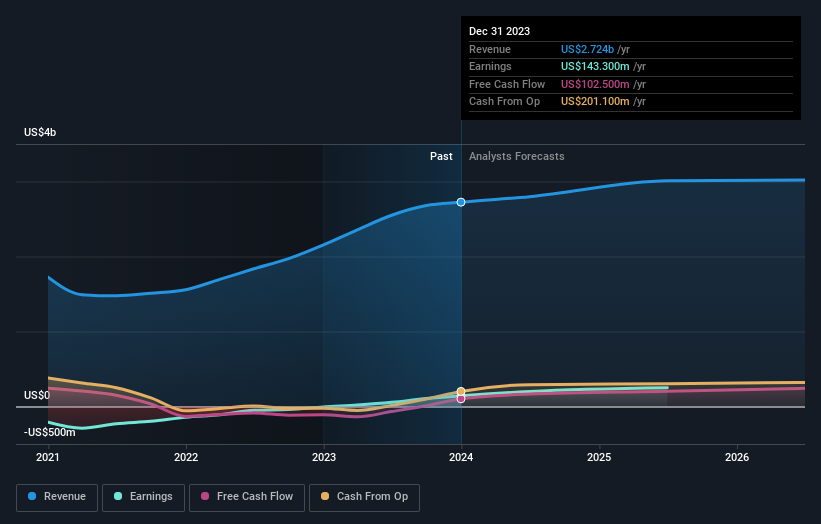

After the most recent outcomes, the 4 analysts overlaying Carpenter Technology are actually predicting revenues of US$2.80b in 2024. If met, this might replicate an inexpensive 2.7% enchancment in income in comparison with the final 12 months. Per-share earnings are anticipated to leap 38% to US$4.00. In the lead-up to this report, the analysts had been modelling revenues of US$2.84b and earnings per share (EPS) of US$4.02 in 2024. So it is fairly clear that, though the analysts have up to date their estimates, there’s been no main change in expectations for the enterprise following the most recent outcomes.

The analysts reconfirmed their worth goal of US$86.00, displaying that the enterprise is executing effectively and in step with expectations. There’s one other method to consider worth targets although, and that is to have a look at the vary of worth targets put ahead by analysts, as a result of a variety of estimates may counsel a various view on attainable outcomes for the enterprise. The most optimistic Carpenter Technology analyst has a worth goal of US$100.00 per share, whereas essentially the most pessimistic values it at US$75.00. With such a slim vary of valuations, the analysts apparently share related views on what they suppose the enterprise is value.

One technique to get extra context on these forecasts is to have a look at how they evaluate to each previous efficiency, and the way different corporations in the identical industry are performing. It’s clear from the most recent estimates that Carpenter Technology’s fee of progress is predicted to speed up meaningfully, with the forecast 5.5% annualised income progress to the top of 2024 noticeably sooner than its historic progress of 0.5% p.a. over the previous 5 years. By distinction, our information means that different corporations (with analyst protection) in the same trade are forecast to develop their income at 4.1% per 12 months. Factoring within the forecast acceleration in income, it is fairly clear that Carpenter Technology is predicted to develop a lot sooner than its trade.

The Bottom Line

The most vital factor to remove is that there is been no main change in sentiment, with the analysts reconfirming that the enterprise is performing in step with their earlier earnings per share estimates. Happily, there have been no main adjustments to income forecasts, with the enterprise nonetheless anticipated to develop sooner than the broader trade. The consensus worth goal held regular at US$86.00, with the most recent estimates not sufficient to have an effect on their worth targets.

With that stated, the long-term trajectory of the corporate’s earnings is much more vital than subsequent 12 months. At Simply Wall St, we’ve a full vary of analyst estimates for Carpenter Technology going out to 2026, and you’ll see them free on our platform here..

And what about dangers? Every firm has them, and we have noticed 1 warning sign for Carpenter Technology you need to learn about.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link