[ad_1]

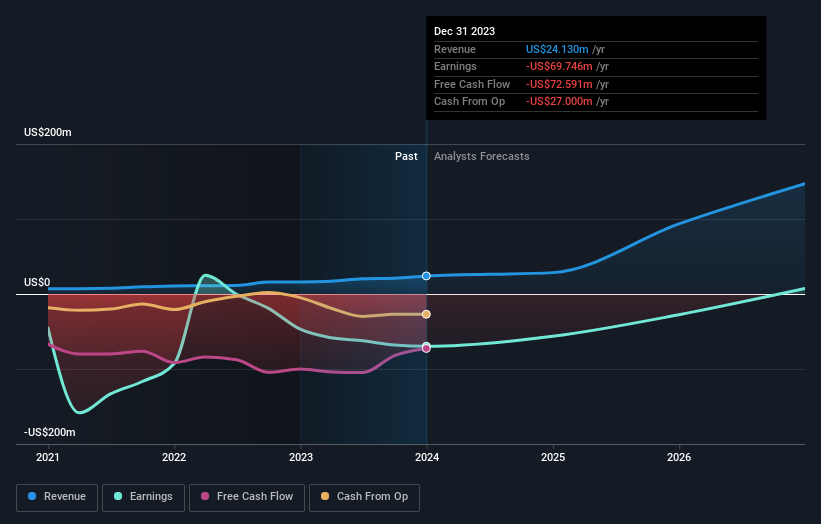

Shareholders may need seen that Hall of Fame Resort & Entertainment Company (NASDAQ:HOFV) filed its yearly consequence this time final week. The early response was not optimistic, with shares down 5.5% to US$3.46 up to now week. Hall of Fame Resort & Entertainment reported revenues of US$24m, according to expectations, but it surely sadly additionally reported (statutory) losses of US$11.97 per share, which have been barely bigger than anticipated. This is a vital time for traders, as they’ll monitor an organization’s efficiency in its report, take a look at what professional is forecasting for subsequent 12 months, and see if there was any change to expectations for the enterprise. So we gathered the most recent post-earnings forecasts to see what estimate suggests is in retailer for subsequent 12 months.

Check out our latest analysis for Hall of Fame Resort & Entertainment

Taking under consideration the most recent outcomes, the present consensus from Hall of Fame Resort & Entertainment’s solitary analyst is for revenues of US$28.5m in 2024. This would replicate a stable 18% improve on its income over the previous 12 months. Losses are supposed to say no, shrinking 19% from final 12 months to US$8.82. Before this newest report, the consensus had been anticipating revenues of US$40.0m and US$8.70 per share in losses. So there’s been fairly a change-up of views after the current consensus updates, withthe analyst making a critical minimize to their income forecasts whereas additionally making no actual change to the loss per share numbers.

The analyst has minimize their worth goal 33% to US$8.00per share, signalling that the declining income and ongoing losses are contributing to the decrease valuation.

One option to get extra context on these forecasts is to have a look at how they evaluate to each previous efficiency, and the way different corporations in the identical industry are performing. It’s fairly clear that there’s an expectation that Hall of Fame Resort & Entertainment’s income progress will decelerate considerably, with revenues to the top of 2024 anticipated to show 18% progress on an annualised foundation. This is in comparison with a historic progress fee of 28% over the previous 5 years. By manner of comparability, the opposite corporations on this business with analyst protection are forecast to develop their income at 9.8% yearly. Even after the forecast slowdown in progress, it appears apparent that Hall of Fame Resort & Entertainment can be anticipated to develop sooner than the broader business.

The Bottom Line

The most necessary factor to remove is that the analyst reconfirmed their loss per share estimates for subsequent 12 months. Regrettably, additionally they downgraded their income estimates, however the newest forecasts nonetheless suggest the enterprise will develop sooner than the broader business. Furthermore, the analyst additionally minimize their worth targets, suggesting that the most recent information has led to better pessimism concerning the intrinsic worth of the enterprise.

With that in thoughts, we would not be too fast to return to a conclusion on Hall of Fame Resort & Entertainment. Long-term earnings energy is far more necessary than subsequent 12 months’s income. At least one analyst has supplied forecasts out to 2026, which could be seen free of charge on our platform here.

It can be value noting that we have now discovered 3 warning signs for Hall of Fame Resort & Entertainment (1 does not sit too nicely with us!) that it’s good to consider.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We goal to convey you long-term targeted evaluation pushed by basic information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link