[ad_1]

With its inventory down 23% over the previous three months, it’s simple to ignore Selan Exploration Technology (NSE:SELAN). We, nevertheless determined to check the corporate’s financials to find out if they’ve something to do with the worth decline. Stock costs are normally pushed by an organization’s monetary efficiency over the long run, and subsequently we determined to pay extra consideration to the corporate’s monetary efficiency. Particularly, we might be taking note of Selan Exploration Technology’s ROE immediately.

Return on Equity or ROE is a check of how successfully an organization is rising its worth and managing buyers’ cash. In brief, ROE exhibits the revenue every greenback generates with respect to its shareholder investments.

See our latest analysis for Selan Exploration Technology

How To Calculate Return On Equity?

The system for return on fairness is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, based mostly on the above system, the ROE for Selan Exploration Technology is:

6.9% = ₹240m ÷ ₹3.5b (Based on the trailing twelve months to September 2022).

The ‘return’ is the revenue over the past twelve months. One approach to conceptualize that is that for every ₹1 of shareholders’ capital it has, the corporate made ₹0.07 in revenue.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an environment friendly profit-generating gauge for an organization’s future earnings. Depending on how a lot of those earnings the corporate reinvests or “retains”, and the way successfully it does so, we’re then in a position to assess an organization’s earnings progress potential. Assuming every thing else stays unchanged, the upper the ROE and revenue retention, the upper the expansion price of an organization in comparison with firms that do not essentially bear these traits.

A Side By Side comparability of Selan Exploration Technology’s Earnings Growth And 6.9% ROE

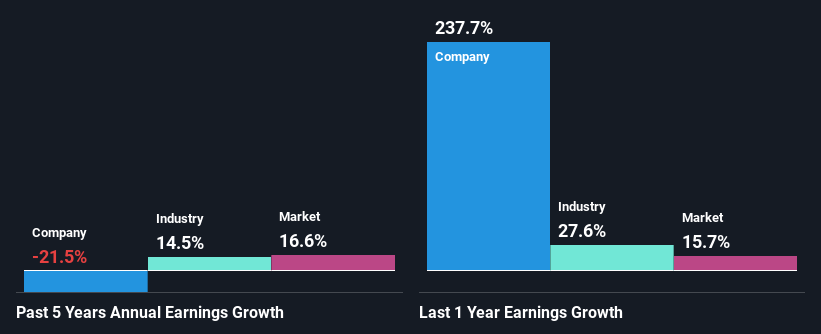

It is kind of clear that Selan Exploration Technology’s ROE is relatively low. Even when in comparison with the trade common of 13%, the ROE determine is fairly disappointing. Therefore, it may not be mistaken to say that the 5 yr web revenue decline of 21% seen by Selan Exploration Technology was presumably a results of it having a decrease ROE. However, there may be different components inflicting the earnings to say no. For occasion, the corporate has a really excessive payout ratio, or is confronted with aggressive pressures.

However, after we in contrast Selan Exploration Technology’s progress with the trade we discovered that whereas the corporate’s earnings have been shrinking, the trade has seen an earnings progress of 15% in the identical interval. This is kind of worrisome.

The foundation for attaching worth to an organization is, to an incredible extent, tied to its earnings progress. It’s vital for an investor to know whether or not the market has priced within the firm’s anticipated earnings progress (or decline). Doing so will assist them set up if the inventory’s future seems to be promising or ominous. If you are questioning about Selan Exploration Technology’s’s valuation, take a look at this gauge of its price-to-earnings ratio, as in comparison with its trade.

Is Selan Exploration Technology Efficiently Re-investing Its Profits?

Selan Exploration Technology’s low three-year median payout ratio of 21% (implying that it retains the remaining 79% of its earnings) comes as a shock once you pair it with the shrinking earnings. This usually should not be the case when an organization is retaining most of its earnings. So there could possibly be another explanations in that regard. For instance, the corporate’s enterprise could also be deteriorating.

Additionally, Selan Exploration Technology has paid dividends over a interval of a minimum of ten years, which signifies that the corporate’s administration is set to pay dividends even when it means little to no earnings progress.

Conclusion

On the entire, we really feel that the efficiency proven by Selan Exploration Technology might be open to many interpretations. While the corporate does have a excessive price of revenue retention, its low price of return might be hampering its earnings progress. Wrapping up, we’d proceed with warning with this firm and a method of doing that will be to take a look at the chance profile of the enterprise. To know the 4 dangers we now have recognized for Selan Exploration Technology go to our risks dashboard for free.

Valuation is complicated, however we’re serving to make it easy.

Find out whether or not Selan Exploration Technology is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link