[ad_1]

Reducing dependency on different international locations for importing elements will revolutionise electrical autos section within the nation; localisation must happen, exhibitors on the Auto Expo Components 2023 informed News18.

According to them, the dependency will likely be decreased solely when the Indian producers can produce precisely comparable high quality and technologically superior merchandise for EVs, whereas automakers will put their confidence in native distributors as an alternative of abroad suppliers.

The centre has urged home automakers to cut back imports of EV elements and different automotive elements from China and as an alternative set up manufacturing services in India. But, in response to the business, the nation’s reliance on Chinese imports is unlikely to be decreased anytime quickly, as it is going to take a number of extra years to ramp up EV part manufacturing in India.

Last 12 months, Union Commerce minister Piyush Goyal on the annual convention of the Automotive Component Manufacturers Association (ACMA) stated: “In case any of the auto companies is pressurising an auto component maker to import components instead of localising them here when you have the opportunity to localise and when you have the technology by which you can localise, I would urge you to please come straight to me and talk to me without hesitation.”

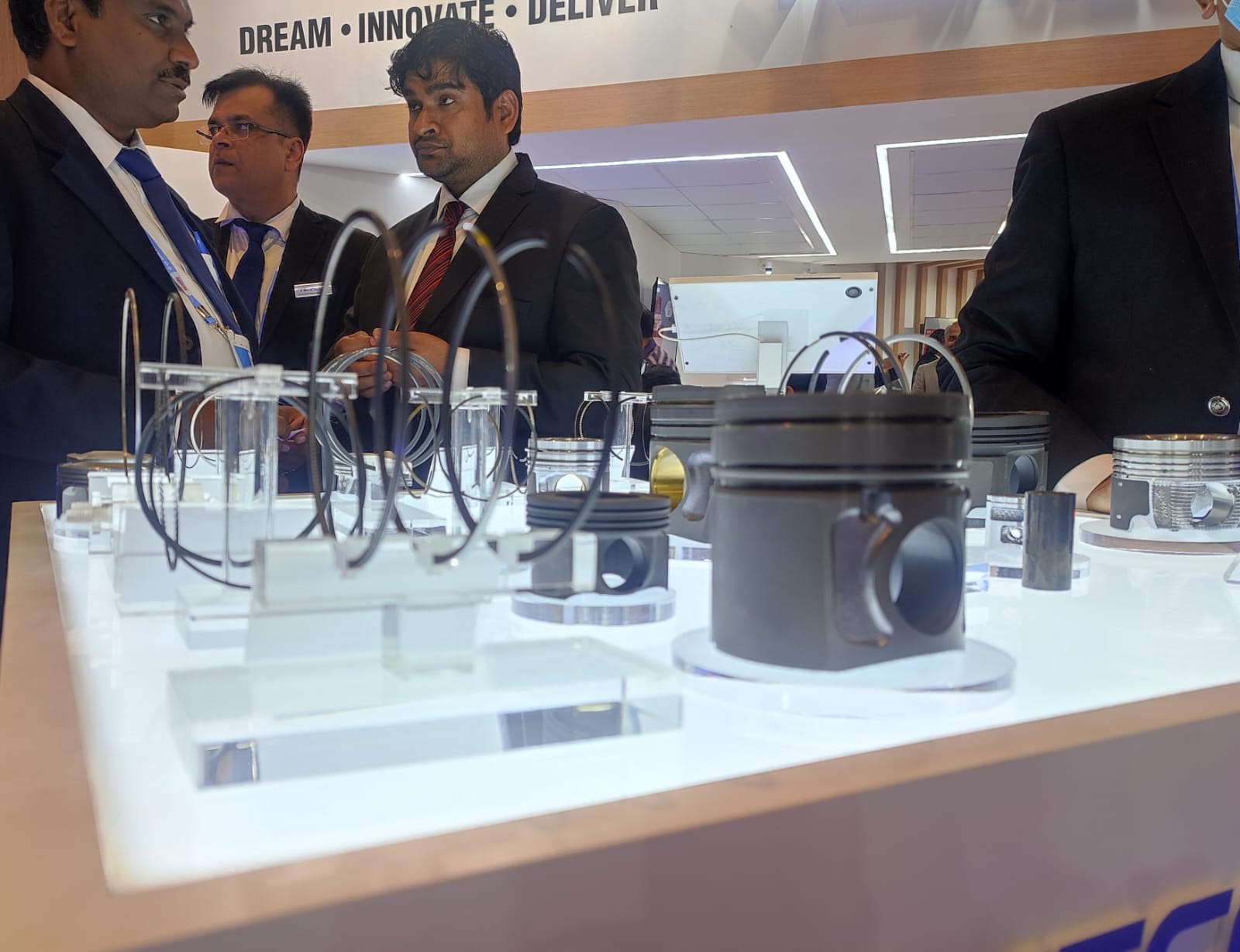

At the Pragati Maidan, the place the Component Expo is going down, there’s a lengthy record of part makers together with abroad firms who’re collaborating as exhibitors. There are a number of firms that are on the area with Made in India emblem. It highlighted the truth that India has homegrown part makers.

So, the query is why Indian EV gamers are nonetheless depending on abroad suppliers as an alternative of counting on native merchandise despite the fact that on the Auto Expo Motor Show it turned clear that automakers are investing in petrol-diesel options.

Tech Matters

At the Component Expo, Manav Kapur, Executive Director of Steelbird International, informed News18 that there’s a clear mandate from the federal government concerning localisation and it’s driving the demand however there are some points.

“As of now the technology is at a very nascent stage. So, when the technology becomes more mature, then people will like to stabilise the technology and have more local sources. I think there is definitely a direction towards the localisation and with time this will speed up,” he stated.

According to him, “When it comes to the mechanical parts, India is very strong. In the EV sector the majority of the local parts which are mechanical in nature are manufactured in the country. It is only the technologically driven parts which are not there in India and that is why we are looking outside the country to get better technology because we don’t have experience in that.”

“We must look at the countries where EVs have been there for a bit longer compared to India. So, you learn and inspire from them and that is how you bring the technology into India,” he added.

However, Kapur additionally believes that when international part makers would collaborate with native distributors, the producers in India will be taught and perceive the know-how extra precisely.

However, he additionally stated: “Considering the kind of commitment companies are putting in, such as setting up manufacturing and R&D capabilities, I think we will be far ahead of other countries. At this moment the market is very small, but when the market starts to grow more towards electric, capabilities will build accordingly.”

However, it is not only Kapur who pointed out why the dependency still exists. Some other exhibitors at the Component expo also believe that the automakers are still reliant on overseas suppliers, specifically China because they have the technology and they mastered it.

For example, one of the industry experts told News18 that in Shanghai, people could see EVs on road in the early 2000s, while India is talking about electrifying the roads in recent years. So, when it comes to China and the imports of components, it is mainly because they understand the technology completely, there is a massive product demand and the manufacturing ecosystem. It is believed that because of all these reasons it is easy to get the required components easily.

China Advantage

Sanjay Chadda, Managing Director of Stanadyne, which sells fuel injection systems (responsible for injecting the right amount of fuel into the engine) to several companies including Chinese manufacturers, told News18 that Chinese, as well as European companies probably got the first advantage of working on the EVs but eventually Indian manufacturers will be able to catch up and start making components for alternative solutions.

According to Chadda, cheap cost and the support from the Chinese govt are some factors playing important roles in this case but another major fact is that Chinese manufacturers do set up large manufacturing capacities in advance because they know about the requirements very well.

“Indian manufacturers are a little bit lacking in that because they first want the market to mature and then invest. So this is also probably one of the reasons why countries like China have an advantage over India,” he added.

Time Factor

A spokesperson from JK Fenner, one of the market leaders in the component section that began developing EV solutions almost five years ago, told News18 that 100% localisation has been the focus of the company so that the dependency on Chinese or European suppliers can be reduced.

He said in the Indian market, EV players are asking for immediate supply. When it comes to Chinese players, according to the spokesperson, they are giving materials at a cheap cost, though the life of these products is becoming less.

“In terms of technology, we are trying to use the expertise of retired IIT professors and doing all the analysis to produce a quality product step by step. But EV players are asking for the supply urgently and we are unable to meet a such short deadline. All we are asking is to give us time to provide cost-effective quality EV products,” he added.

However, there are other component makers who are either not interested or not willing to get into the EV sector at this moment. One of those big companies that provide components for major automakers in India told News18 that they are not planning to make EV components and seeing the size of the market, they are still waiting for the right time and want to overserve the EV market growth for a few more years.

Read all of the Latest Auto News right here

[adinserter block=”4″]

[ad_2]

Source link