[ad_1]

Investment thesis

Covid-19 has been compressing years of fundamental changes into months in many industries. Bilibili (BILI)’s hyper-growth is in the midst of this swift. The company has become a go-to-place for not just eSports, but also live-streaming, fashion, anime, and storytelling.

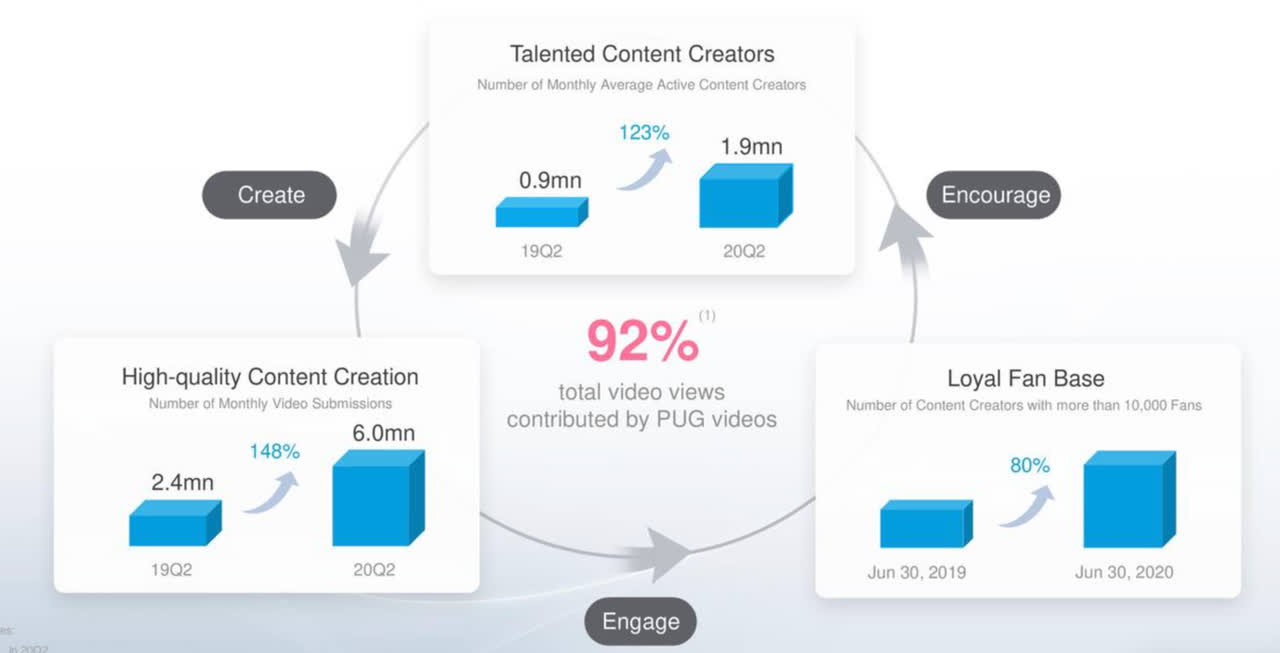

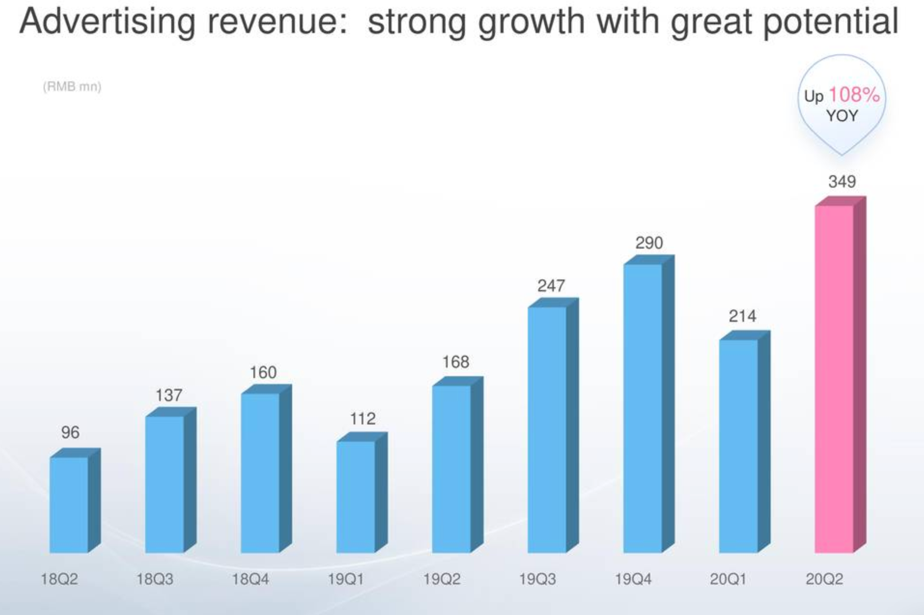

Source: Q2’2020 presentation

Not surprisingly, this hungry beast is also part of Tencent’s (OTCPK:TCEHY) 700 strategic investments. With the rapid transformation of the industry, Tencent is working on creating a ”Twitch” of Asia by combining Huya (HUYA) and DouYu (DOYU). As part of the giant’s portfolio, Bilibili could be one final piece of the jigsaw in online entertainment. However, that’s for later.

This analysis focuses on Bilibili as an investment v.s Huya and Douyu. We find that Bilibili is playing a risky game, paying a high price to attract content creators to the platform yet still has a high churn rate in users at 20% after 12 months, resulting in highly negative operating margin and a high level of cash burn.

On the other hand, Huya and DouYu are excellent investments. Albeit growing slower, both companies have been expanding quality gaming content, developing their streaming and cloud gaming platform, growing active users, and now reaching the stage of monetization, resulting in generating healthy cash levels.

The future is exceptionally bright for all players as the industry runway is long; investors with a long-term horizon would do very well with some exposure to all stocks. However, we would put Bilibili last on the list.

Q2 2020 summary – hyper-growth at a steep loss

For a quick review of the three companies’ Q2-2020 results, we compile the key stats below:

|

Q2 2020 numbers |

Bilibili |

DouYu |

Huya |

|

Revenue |

RMB 2,618 million |

RMB 2,510 million |

RMB 2,697 million |

|

Revenue growth |

68% |

33.9% |

34.2% |

|

Q3 Revenue growth est. |

Up 64% |

Up 42% |

– |

|

Gross Margin |

23% |

20.8% |

21.3% |

|

Net Margin |

-23% |

12.7% |

7.5% |

|

Average MAU (mobile) |

172 million, up 55% YoY (153 million, up 53% YoY) |

Est. 158 million (58.4 million, up 15% YoY) |

168.5 million (75.6 million, up 35%) |

|

ARPPU |

– |

RMB300.06, up 19.7% |

– |

|

Number of paying users |

12.9 million, up 105% YoY |

7.6 million, up 13.4% YoY |

6.2 million |

|

Cash (net debts) |

$2300 million |

$1176 million |

$1520 million |

|

Market cap |

$16.4B |

$4.5B |

$5.2B |

Source: BiliBili’s Q2 2020 results, Huya’s Q2 2020 results, DouYu’s Q2 2020 results

Bilibili is head and shoulders above Huya and Douyu in terms of growth, Q3’s growth is estimated to be elevated at 64% too.

However, due to the massive increase in SG&A spending (up 181% YoY), Bilibili is suffering deep losses, -23% operating margin vs. positive 12.7%, and 7.5% compared to Huya and Douyu.

The trend is unlikely to stop in the short term, as Bilibili is mighty confident and focused in its growth initiative as Sam Fan reiterates during the conference call, investing more than half of sales, RMB 1.5B, on CAPEX in the last 12 months.

We remain committed to our user growth-focused strategy. After 11 years of cultivation, we believe our content pool is deep and diverse enough to accommodate a much larger user base, and our community is friendly and robust enough to retain those newcomers. Hence, we have made more proactive user growth plans.

If you believe that the growth investment will bring economies of scale and sustainability in the future, then Bilibili is the winner. Indeed, there are signs that their strategy is working.

Engagement is strong but high churn rate

Bilibili’s primary areas of focus are on creating additional brand awareness and targeted channel acquisition. The results are impressive.

The engagement has exploded as content creators, quality content, and loyal fan base all multiplied at near triple digits.

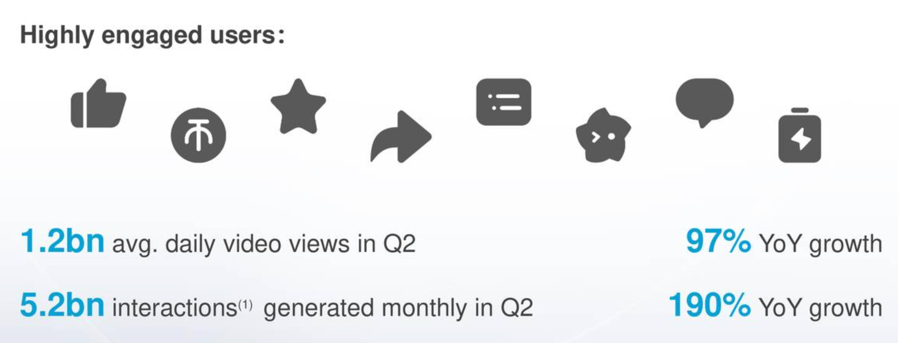

Next, users are highly engaged as they spent more minutes each day on the platform. In the second half, users spent an average of 79 minutes per day on the Bilibili app, making them one of the most popular platforms in Asia. The second quarter also showed record highs across all of the primary engagement metrics.

The daily video views reached 1.2 billion, up 97% year-over-year. Users generated nearly 5.2 billion monthly interactions through bullet chats, comments, likes, and Bilibili moment posts, almost three times the amount from the same period in 2019.

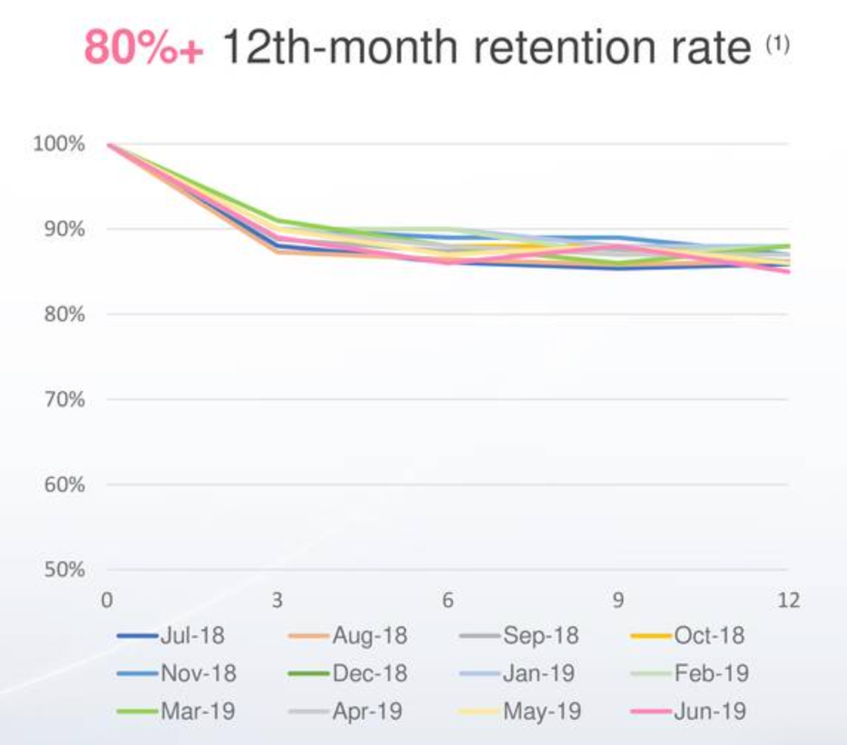

However, an 85% retention rate means a 15% churn rate, and the following chart shows many users leave after just three months on the platform.

Long-term tailwinds

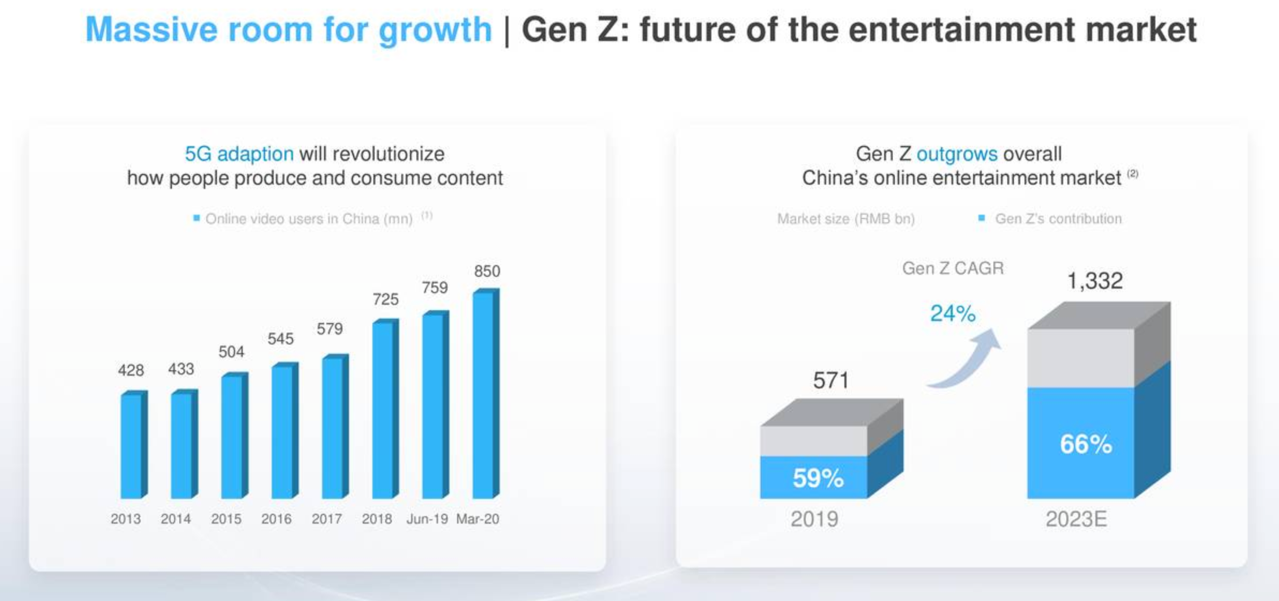

Followers of eSports have seen the recent rise in popularity as a form of entertainment. Tencent’s strategic moves have provided a snippet of the future in eSports in Asia. eSport has the potential to become the primary sport, and the runway for growth is enormous.

The average fan base age for eSports is about 30 – primarily Generation Z, vs. the average fan base age for traditional sports. For example, Major League Baseball’s average fan base age is 57! The age gap implies very long-term tailwind in terms of time and disposable income growth. The CAGR is estimated to be 24% until 2023.

Revenue per gamer is only $3, vs. $40 in sports. Again, there is a vast gap to grow into the future. As gaming becomes more engaging and immersive (in-game), a further avenue for monetization will grow, such as placement advertising, which Bilibili is successfully monetizing.

Finally, video is rapidly becoming the most interactive and influential method to convey information. Building on a decade of experience and leadership in the video community, Bilibili is well-positioned to capture the growth opportunity.

Valuation and risks

Bilibili is growing the fastest, has strong execution in diverse segments of online entertainment. However, investors are asked to pay up 12.6x EV/Sales, triple the multiple of Huya and DouYu, at 3.7x and 3.2x, respectively. Both of the latter are growing slower at 30%+ but are already profitable and cash generative.

In terms of potential, Bilibili is taking over the show with much more substantial user growth and engagement. However, like other Chinese stocks, apart from execution risks, all are exposed to headline risks in regards to US-China politics, the odd of being delisted from the US stock exchange, among others.

Summary

Bilibili’s impressive growth is worth a deep dive. It has become the leader in eSports and other online entertainment in China within a short period.

Like Huya and Douyu, it also has the backing of Tencent and benefits from long-term secular tailwinds of the industry. We are witnessing a massive transformation of Esports in the East. Investors should do quite well in all three, but for us, Bilibili is the least favorite.

Disclosure: I am/we are long HUYA, TCEHY, DOYU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link