[ad_1]

Boarding1Now/iStock Editorial by way of Getty Images

After failing to determine a plan on the best way to remarket the prevailing 737 MAXs to different clients from different international locations as a result of lack of ability to promote them in China, Boeing (NYSE:BA) is about to strike a take care of Air India, which has the intention to position an order for the numerous variety of new planes. The deal is probably going to assist Air India, which is in the midst of a significant transformation beneath new administration, to revive the previous glory of its model and make sure the world enlargement of the airline sooner or later.

As for Boeing, the upcoming order not solely would assist the corporate to ease the ache brought on principally by the geopolitical points that stop it to promote its newest planes to its Chinese clients, but in addition may encourage the administration to search for different alternatives inside the Indian market. With the worsening of Sino-American relations, pivoting to India might be the one possibility for the administration with a purpose to execute their transformation objectives as globalization, from which Boeing arguably benefited probably the most amongst its friends, unravels.

Forget About China

Earlier this month, I wrote an article on Boeing through which I highlighted how the corporate’s lack of ability to promote 138 737 MAXs which can be already in its stock to Chinese clients equivalent to China Southern as a result of geopolitical points are limiting the corporate’s means to develop its enterprise. At the identical time, as Beijing aims to grow to be extra self-reliant within the aviation trade within the foreseeable future whereas the nation’s state-owned producer COMAC not too long ago delivered the primary passenger jet for industrial use, it turns into apparent that Boeing not may depend on the Chinese market to generate a gentle revenue stream for years to return.

The excellent news although is that as Boeing was searching for the chance to remarket the planes that beforehand have been produced for its Chinese clients to different markets, it managed to discover a potential shopper from an sudden place.

Air India Is About To Save The Day

At the start of this 12 months, the federal government of India authorized the deal to promote the state-owned airline Air India to the well-known conglomerate Tata Group. The plan to promote the airline was on the checklist of issues that Indian Prime Minister Narendra Modi wished to do a very long time in the past as a result of the truth that Air India burned $2.6 million of Indian taxpayers’ cash every day and was staying afloat solely due to the federal government’s resolution to proceed to inject extra funds into it.

The deal not solely handed Air India into non-public fingers, nevertheless it additionally kicked off the most important consolidation of airliners in India’s historical past. The buy of the state-owned airline has allowed Tata Group to start a technique of merging its stakes in different airliners equivalent to AirAsia India and Vistara beneath a single model of Air India, which ultimately would grow to be one of many greatest Indian airliners. The merger is predicted to be accomplished in 2024, because the consolidation course of is about to get began.

As a part of the consolidation and enlargement plan, Air India’s CEO final month stated the will to purchase new planes from Boeing and Airbus (OTCPK:EADSY). Then at the start of final week, information come out that Air India is interested in considerably increasing its fleet by ordering as much as 500 new industrial jets. All of this was concluded final Friday when Bloomberg reported that Boeing and Air India are able to signal the deal till the tip of this month to buy as much as 200 737 MAXs, out of which 40 to 50 planes might be people who have been anticipated to be delivered to Chinese clients however are at the moment caught in Boeing’s stock.

This deal unquestionably is nice information for Boeing, which has been struggling to discover a footing after the grounding of 737 MAXs three years in the past as a result of questions of safety. At the identical time, it will assist it to mitigate a number of the downsides brought on by the geopolitical points that blocked the recertification of the corporate’s newest planes in China.

Considering that a number of the estimates earlier this 12 months suggested that near $5 billion are tied to 737 MAXs that Boeing isn’t capable of ship to China, the flexibility to remarket round one-third of them to Air India already would have the ability to enhance the corporate’s monetary efficiency within the coming years. Thanks to this, the road already positively reacted to the upcoming take care of Air India.

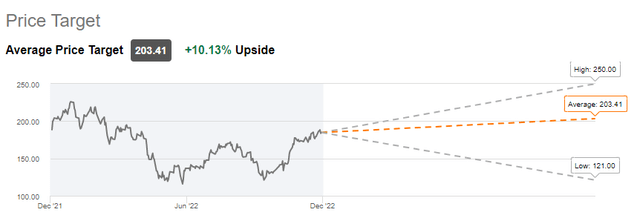

Let’s not neglect that at the start of this month, when there have been questions on whether or not Boeing would have the ability to remarket any of its planes, the consensus on the road was that the corporate’s upside can be minimal, and its consensus value goal was $192.25 per share. When the potential of a take care of Air India exponentially elevated within the final week, the road up to date its fashions to replicate a brand new actuality and already offers Boeing’s inventory a consensus value goal of $203.41 per share, which represents ~10% upside from the present market ranges. If in some way Boeing managed to promote two-thirds of the remaining 737 MAXs which can be caught in storage, then it will be protected to imagine that the upside then might be better than it’s right now.

Boeing’s Consensus Price Target (Seeking Alpha)

The Bigger Picture

It’s protected to say that Boeing was one of many greatest beneficiaries of globalization in current many years. As new markets opened, the corporate managed to shortly develop to different areas and strengthen its industrial enterprise there, as a result of truth that there have been no native alternate options to Boeing and Airbus industrial jets. With China going all-in on supporting its personal passenger jet producer, whereas Russia is being lower off from the worldwide aviation market, Boeing urgently must search for new markets to safe further revenue streams that may assist its progress story. India may grow to be that market.

To counter China’s affect within the Southeast Asian area and the Indian Ocean, the Biden administration has been engaged on strengthening the bilateral ties with India by executing numerous widespread initiatives and initiatives. At the identical time, the passage of the National Defense Authorization Act final week gives the Department of Defense and State Department further funds to assist India lower its reliance on unreliable Russian weapons and navy tools. This also needs to assist Washington to enhance its relations with New Delhi over the long run.

India, however, can’t absolutely depend on Russia or China on the subject of ordering new industrial jets. Let’s not neglect that Russia didn’t safe its personal provide chains earlier than the invasion of Ukraine and consequently, it’s now required to use second-hand engines for its flagship passenger jet that doesn’t have an excellent security report. At the identical time, exposing itself to China can also be not an possibility as a result of distinction on numerous main points such because the demarcation of the border with one another, which consistently leads to confrontation between their troopers. That’s why it seems that counting on the U.S. producers equivalent to Boeing is the one viable possibility for India if it needs to securely develop its aviation market. As a consequence, the upcoming deal between Boeing and Air India might be solely the start of a long-term partnership.

Another factor that’s vital to say is that India can also be expected to develop its financial system within the following years at a better price than China and considerably above the worldwide common price. At the identical time, its inhabitants is forecasted to proceed to develop at a good price for years to return at a time when China has already reached its peak final 12 months and is about to lose greater than half of its present inhabitants by the tip of the century.

Considering this, it’s protected to imagine that India’s aviation market is greater than more likely to proceed to develop at an aggressive price within the following many years. The newest estimates suggest that the nation’s annual passenger visitors can be 520 million by 2037, up from 158 million in 2017. Boeing can also be optimistic about the way forward for India, because it expects the nation to have the fastest-growing aviation market on this planet, with a mean annual progress price of 6.9% by 2040. Thanks to this, it’s possible that we’ll see Boeing searching for further alternatives there, as geopolitics is greater than more likely to proceed to restrict its progress in China.

The Bottom Line

Even although it’s too quickly to speak a few full pivot to India, the nation itself may grow to be a profitable marketplace for Boeing. At the identical time, as India makes an attempt to grow to be a world superpower of its personal, it must proceed to develop its aviation market and develop its transportation infrastructure. By not having its personal profitable industrial jet producer, Boeing may play an important function in serving to the nation together with its airliners equivalent to Air India to develop their horizons and on the similar time lower its personal Chinese-related dangers in the long term.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[adinserter block=”4″]

[ad_2]

Source link