[ad_1]

-

Annual Revenue: Increased to $11.5 billion from $10.8 billion within the earlier yr.

-

Net Income: A notable shift from a web lack of $899 million to a web revenue of $786 million year-over-year.

-

Adjusted EBITDA: Same-store Adjusted EBITDA rose to $3.9 billion for the total yr, up from $3.2 billion.

-

Caesars Digital: Adjusted EBITDA turned optimistic at $38 million, a big enchancment from a $(666) million loss.

-

Debt Reduction: Over $3.0 billion in debt completely repaid because the 2020 merger, with plans for continued discount in 2024.

-

Leverage: Total web leverage beneath the financial institution credit score facility lowered to three.9x as of December 31, 2023.

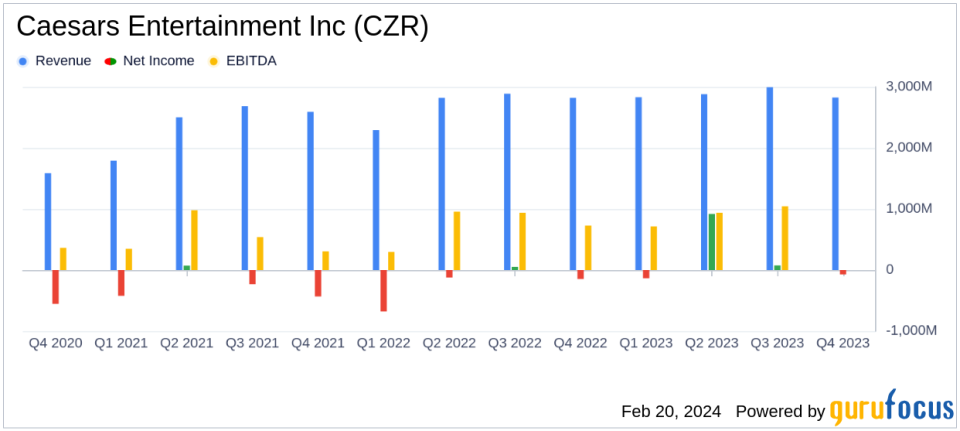

On February 20, 2024, Caesars Entertainment Inc (NASDAQ:CZR) launched its 8-K filing, detailing its monetary efficiency for the fourth quarter and full yr ended December 31, 2023. The firm, which operates roughly 50 home gaming properties and owns the U.S. portion of William Hill, a digital sports activities betting platform, reported a slight improve in GAAP web revenues for This fall, reaching $2.83 billion in comparison with $2.82 billion within the prior-year interval. The web loss was considerably lowered to $72 million from $148 million year-over-year.

For the total yr, Caesars Entertainment Inc (NASDAQ:CZR) noticed a 6.5% improve in GAAP web revenues, rising to $11.5 billion from $10.8 billion. The firm achieved a outstanding turnaround with a GAAP web revenue of $786 million, in comparison with a web lack of $899 million within the earlier yr. Same-store Adjusted EBITDA for the total yr was $3.9 billion, up from $3.2 billion, indicating a strong operational efficiency.

Financial Highlights and Challenges

The firm’s Caesars Digital phase confirmed a marked enchancment, with Adjusted EBITDA of $38 million for the yr, a stark distinction to the $(666) million loss within the prior yr. This development is critical because it displays the corporate’s strategic give attention to increasing its digital and on-line gaming presence, which is more and more essential within the aggressive Travel & Leisure trade.

However, the corporate nonetheless faces challenges, together with a slight lower in Same-store Adjusted EBITDA for This fall, all the way down to $930 million from $949 million within the comparable prior-year interval. This might sign potential points in sustaining development momentum within the extremely aggressive gaming and leisure market.

Debt Management and Liquidity

Caesars Entertainment Inc (NASDAQ:CZR) reported a powerful stability sheet with $12.4 billion in combination principal quantity of debt excellent and $1.0 billion in money and money equivalents, excluding restricted money of $138 million. The firm’s proactive debt administration was highlighted by CFO Bret Yunker’s commentary:

Our fourth quarter working outcomes demonstrated consolidated web income development, lowered web loss and steady consolidated Adjusted EBITDA yr over yr. Results had been pushed by a 28% year-over-year improve in Caesars Digital web income that generated a ten% Adjusted EBITDA margin within the quarter. Full yr outcomes benefited from a 78% improve in Caesars Digital web revenues to roughly $1.0 billion, and an over $700 million enchancment on this segments Adjusted EBITDA.

The firm’s dedication to debt discount is clear, with over $3.0 billion in debt completely repaid because the 2020 merger, and a give attention to additional debt discount in 2024. The refinancing accomplished on February sixth allowed the corporate to repay all excellent 2025 debt, extending its nearest maturity to July of 2027 and lowering whole web leverage to three.9x as of December 31, 2023.

Looking Forward

Caesars Entertainment Inc (NASDAQ:CZR) stays centered on constructing worth for its visitors by a mix of service, operational excellence, and expertise management. With a powerful emphasis on its Caesars Rewards loyalty program and a dedication to company social accountability, the corporate is poised to proceed its trajectory of development and debt discount within the coming yr.

Investors and events had been invited to affix the corporate’s convention name on February 20, 2024, to debate the ends in additional element, with entry offered by the Investor Relations part of Caesars Entertainment’s web site.

For a complete understanding of Caesars Entertainment Inc (NASDAQ:CZR)’s monetary efficiency, together with detailed monetary tables and reconciliation of GAAP measures to non-GAAP measures, readers are inspired to view the total 8-K filing.

Explore the whole 8-Okay earnings launch (here) from Caesars Entertainment Inc for additional particulars.

This article first appeared on GuruFocus.

[adinserter block=”4″]

[ad_2]

Source link