[ad_1]

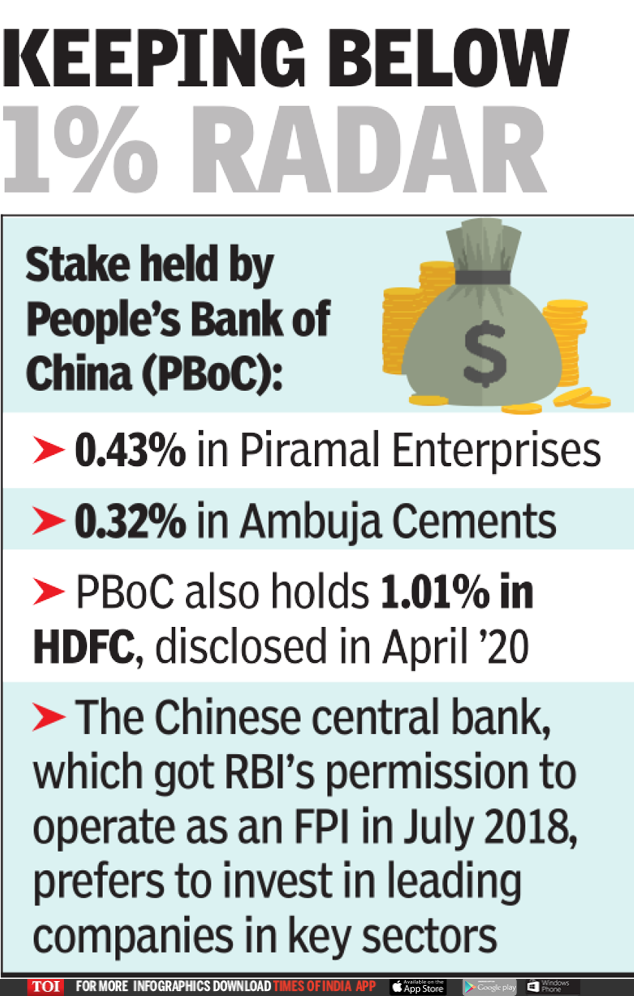

PBoC’s holding in HDFC is currently worth about Rs 3,100 crore, while in Piramal Enterprises around Rs 137 crore, and in Ambuja Cement about Rs 122 crore. Exactly two years ago, the Chinese central bank had received RBI permission to set shop here. Two recent reports on Chinese investments in India have warned that several funds and investment companies, directly controlled or indirectly influenced by its government, have been eyeing stakes in companies that are strategically important to the economy.

India-China stand-off: Complete coverage

Till 2019, PBoC also had a small stake in a company that’s a major player in the game of chances, but the bank exited that company some months ago. Market sources said the Chinese central bank also has stakes in several other companies, including in the Indian arm of a German manufacturing major and another domestic fertilisers major. But these are not disclosed publicly since they all are below the 1% limit.

Ambuja Cement’s annual report for 2019 showed PBoC held nearly 63 lakh shares in the cement major. Of these, the bank acquired about 16 lakh shares by buying small chunks through 2019. In Piramal Enterprises, PBoC increased its stake early this year to 0.43% when the company went for a rights offer. “This marginal increase in their holding (in terms of number of shares) is largely on account of PBoC’s participation in our rights issue,” a spokesperson for the group said.

After PBoC’s stake acquisition in HDFC came to light on April 12, the government, through a press note on April 17, amended foreign investment rules into India. The addition was that any investment from an entity from a country that shares “a land border with India” will require government’s approval. Earlier, such restrictions were applicable to investments from Bangladesh and Pakistan, and the April 17 note included investments from China as well.

In the recent past, some developed jurisdictions have amended foreign investment policies to weed out opportunistic takeovers of strategically important and other domestic companies when valuations are low, as Covid-19-related issues are weighing on stock prices. India has not gone as far as these countries, but China-watchers say it should be on guard. According to a leading Sinologist, there is an old Chinese tactic called “loot a burning house”. “The government policymakers should remember this while formulating the FDI policies.”

A recent Brookings Institute report also put out caveats along similar lines for Indian policymakers, especially regulators for investments into India. The March 2020 report said that the growth of Chinese investments into India since 2014 has changed the nature of what has been a largely transactional trade relationship.

“Chinese companies are emerging as prominent players and investors, in areas ranging from infrastructure and energy to newer sectors of interest such as technology startups and real estate,” Ananth Krishnan, the author of the report, said. Drawing on several sources within India and from China, the report said that the aggregate Chinese investment in India was a staggering $26 billion with a pledge to invest another $15 billion in major infrastructure projects. However, these figures are likely an underestimation since there are several limitations to exactly map Chinese investments in India, especially given the reluctance of the Chinese government to share the data.

Another report by Gateway House, a foreign relations think tank, pointed out how Chinese companies were using the startup route to invest in leading players in several sectors in India. The list includes investments by Alibaba in Paytm group, Zomato and others and by Tencent in Byju’s, Ola, Flipkart and others.

[ad_2]

Source link