[ad_1]

Top fintech leaders in the country remain cautiously optimistic about the industry’s growth prospects despite the devastating impact of the Covid-19 pandemic on the country’s economy, says a survey by venture capital firm Matrix Partners and consultancy McKinsey & Company.

The survey of 70 founders and top executives of fintech firms, including PhonePe chief executive Sameer Nigam, Razorpay CEO Harshil Mathur, ZestMoney CEO Lizzie Chapman and Jupiter CEO Jitendra Gupta, showed that they are more bullish on some segments than others.

The survey was conducted in two parts – by recording responses through a questionnaire and then through fireside sessions – to capture the overarching trends that are shaping the sector in the post-pandemic world.

The results of the survey, shared with ET, shows industry confidence as an index on short term and long-term growth prospects.

Respondents believe that lending is most severely impacted with a negative confidence score, while insurance and wealth management businesses are expected to see some tailwinds.

Majority of fintech companies expect volume recovery in 3-6 months with less than 30% respondents expecting the industry’s time-to-profitability extended by more than six months.

“The broad consensus among the respondents was that fintech will become a pull service rather than a push product,” said Vikram Vaidyanathan, managing director of Matrix India. “The overarching theme is that because of the digital transformations, customer acquisition costs have reduced while the market base has increased.”

Most respondents said they were witnessing a second spurt in growth after demonetisation, driven by digitisation of traditionally offline channels such as FMCG, govt payments and growth of new online segments such as gaming, edtech and OTT. While the short-term confidence in payments is neutral, 100% of respondents are bullish about long-term outlook

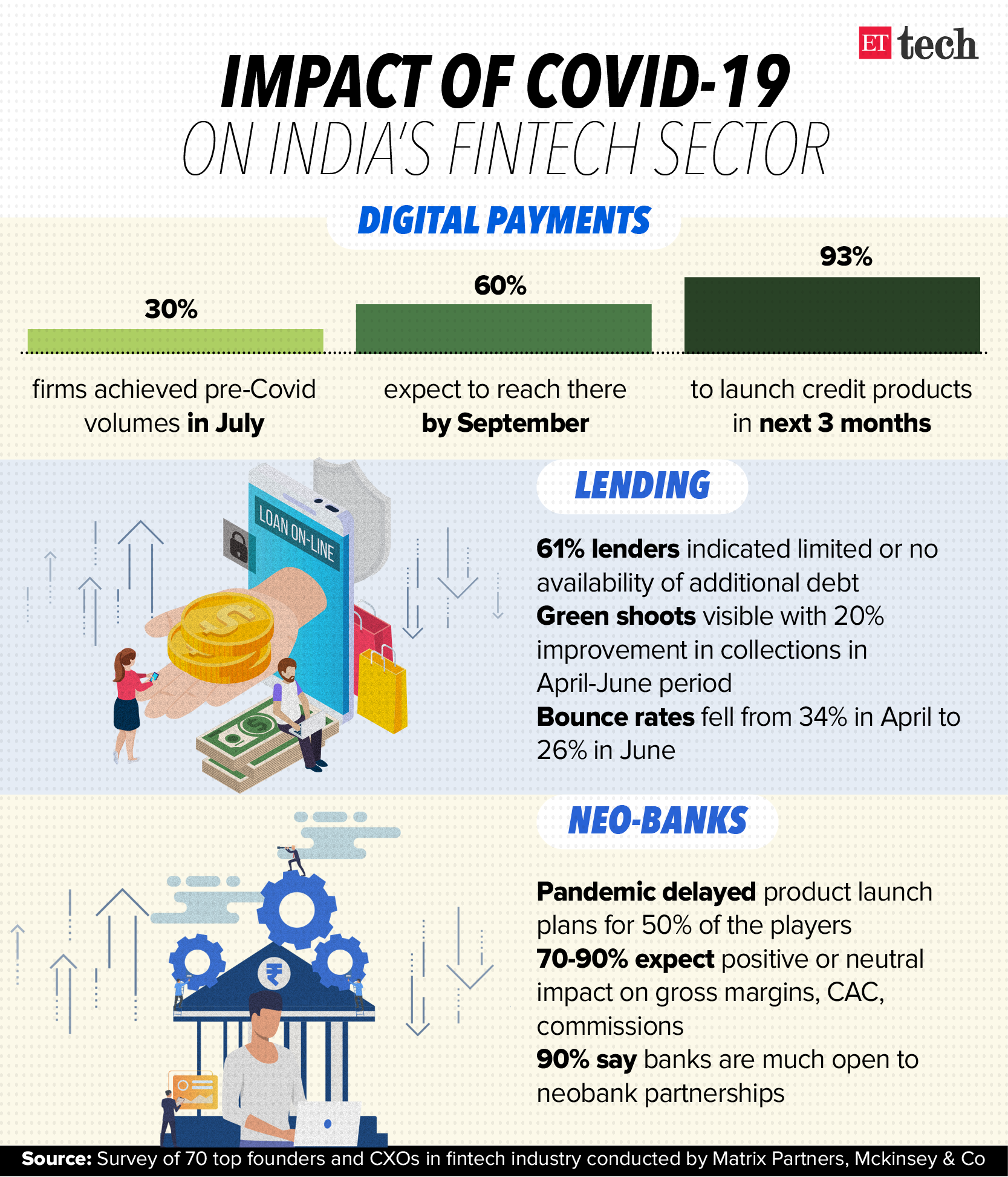

- 30% of respondents had achieved pre-Covid volumes by July.

- 60% expect to reach those by September.

- 93% of the respondents said they will launch credit products in the next three months as scale, path to sustainable and profitability are uncertain.

Digital Lending

Lending is perhaps the worst-impacted sub-category in the fintech ecosystem with short-term confidence index of -25 (Range of -100 to 100). However, most respondents remain bullish in their long-term outlook with a confidence index score of 65.

- As of June, disbursal volumes were down by ~80% versus pre-Covid levels with ~50% lenders stopping disbursals altogether, according to respondents.

- Short-term profit expectations subdued with ~60% higher credit losses. Further, 61% of lenders indicated that limited or no availability of additional debt.

- Signs of green shoots are visible with a ~20% improvement in collections efficiency in the April to June period.

- Bounce rates have also decreased from 34% in April to 26% in June.

Neobanks

While pandemic has accelerated Indian customers’ adoption of digital financial products (new account openings for neobanks are already above pre-Covid levels). Clarity on bank-fintech partnerships is much needed, stakeholders said.

- The pandemic has delayed product launch plans for 50% players.

- 70-90% respondents believe pandemic would have a positive or neutral impact on gross margins, CAC and commissions.

- 90% of respondents feel that banks are much open to neobank partnerships.

[ad_2]

Source link