[ad_1]

JHVEPhoto/iStock Editorial through Getty Images

Thesis Statement

DXC Technology (NYSE:DXC), a world tech companies firm, has lately displayed weakening financials that benefit a cautious method from potential traders. Despite seemingly strong income figures, declining traits in key monetary indicators, equivalent to income, revenue, and significantly free money circulate, function pink flags. Investors must method DXC with warning.

Company Overview

Founded as a pacesetter in tech companies, DXC Technology has cemented its place because the go-to answer for giant organizations seeking to handle and replace their laptop programs successfully. Its attain just isn’t restricted to non-public enterprises; even governments have been identified to belief DXC for his or her tech wants.

Client Trust Factor

DXC has garnered vital belief amongst Fortune 500 firms and public sector organizations. This belief relies on DXC’s observe report of delivering high-quality expertise companies that improve operational effectivity and buyer engagement.

Revenue Streams

DXC has a twin income stream, which includes Business Consulting and Global Infrastructure Services. The former helps organizations optimize their operations by way of expertise, whereas the latter focuses on the nuts and bolts—{hardware} and software program—guaranteeing easy system efficiency. Geographically, the corporate has a footprint in key markets, together with North America, Europe, Asia, and Australia, and immediately sells its companies by way of its world workplaces.

Takeaway

- Diverse Geographic Footprint: DXC’s world presence in North America, Europe, Asia, and Australia means it could leverage a number of markets for progress.

- Wide Range of Services: Their two-pronged method to service—Consulting and Global Infrastructure—permits them to serve a diversified clientele, together with personal and public sectors.

- Direct Sales Model: The firm’s direct-to-customer gross sales technique not solely permits for aggressive pricing but in addition fosters stronger consumer relationships—a big strategic benefit.

Key Metrics Overview

Revenue & Profit

DXC Technology reported a Q1 revenue of $3.4 billion, a 7% year-over-year lower. The decline is most noticeable in natural income, which dropped 3.6% in comparison with the identical quarter final 12 months.

Earnings Per Share

The firm’s EPS declined considerably to 17 cents in Q1 2024, down from 43 cents in the identical interval final 12 months.

Adjusted EPS

The adjusted earnings per share for the quarter was 63 cents, a 16% discount from 75 cents within the corresponding quarter of the earlier 12 months.

Cash Flow and Capital Expenditures

The firm made $127 million from its core enterprise however spent $202 million on capital expenditures, leading to damaging free money of $75 million.

Share Buyback

The firm utilized $280 million for share buybacks, usually a measure to reinforce shareholder worth.

Takeaway

- Declining Revenue and Profit: A 7% decline in income and a drop from 43 cents to 17 cents in EPS year-over-year may point out operational inefficiencies and market headwinds.

- Negative Free Cash: The damaging $75 million in free money after capital expenditures may point out short-term monetary struggles.

- Share Buyback: While share buybacks are sometimes a constructive sign, they elevate questions on this state of affairs, given the opposite damaging monetary indicators.

Revenues From Operations

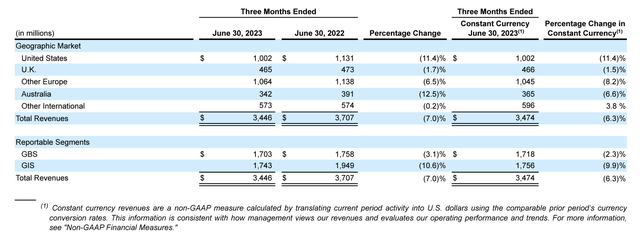

DXC 10-Q

Overview

In Q1 2024, the corporate reported complete revenues of $3.4 billion, $300 million lower than final 12 months’s interval. Various components contributed to this decline, starting from forex fluctuations to divestiture selections and “organic revenue” shifts.

Currency Fluctuations

Currency worth modifications had a marginal 0.7% affect on the income decline. Specifically, the U.S. greenback’s energy towards the Australian Dollar unfavourably affected the corporate’s earnings.

Business Divestitures

The firm offered or shut down particular enterprise segments, contributing to a 2.7% lower in income.

Organic Revenues

The largest contributor to the decline was a 3.6% drop in “organic revenue,” which comes from the corporate’s core operations.

The Revenue Playbook: GBS vs. GIS

Global Business Services

GBS generated $1.7 billion this quarter, $55 million lower than the earlier 12 months, marking a 3.1% decline. However, the division grew its core companies by 3.3%. GBS now constitutes 49.4% of the corporate’s complete income, an uptick of two% from final 12 months.

-

Foreign Currency Impact: A minor 0.8% loss was resulting from unfavourable overseas forex alternate charges.

-

Business Unit Changes: A 5.6% decline in income was as a result of enterprise tendencies.

Global Infrastructure Services

GIS additionally made $1.7 billion however took a more durable hit than GBS. The division misplaced $206 million in comparison with final 12 months, a ten.6% lower. GIS contributes 50.6% to the corporate’s complete earnings, 2% lower than final 12 months.

-

Core Business Woes: 9.9% of the loss is from their core enterprise actions not performing as anticipated.

-

Currency Fluctuations: A 0.7% loss was resulting from forex worth modifications, echoing the affect on GBS.

Takeaway

- Contrasting GBS and GIS: GBS has managed to develop its core enterprise, whereas GIS has faltered in its core actions.

-

Foreign Currency is a Factor: Currency modifications affected each segments however aren’t the principle story right here.

-

Revenue Share: GBS now makes up a much bigger slice of the pie, whereas GIS accounts for a bit lower than final 12 months.

-

Business Reorganization: Both divisions are impacted by reorganization, affecting income contributions.

Costs of Services

This quarter, DXC spent $2.7 billion, which is $211 million lower than they spent throughout the identical time final 12 months. So, how did they handle to spend much less?

-

A beneficial forex alternate fee contributed to a financial savings of $23 million.

-

Reduced hiring of exterior specialists and fewer gross sales additionally contributed to the decline in operational prices.

The “gross margin” remained practically static at 21.1%, solely a slight bump from final 12 months’s 21.0%.

Selling, General and Administrative Costs

SG&A prices for the quarter stood at $327 million, $22 million lower than final 12 months. However, SG&A prices as a share of earnings elevated barely to 9.5%, up by 0.1%.

Savings had been achieved by way of diminished spending on skilled companies and vendor prices. Conversely, worker salaries noticed a average enhance.

Merger Related Expenses

DXC put aside $11 million this 12 months for “indemnification,” a typical observe in mergers and acquisitions. This is marginally larger than the $10 million put aside final 12 months.

Depreciation and Amortization

The firm spent $113 million on depreciation and $231 million on amortization. This is a discount of $25 million and $20 million, respectively, in comparison with final 12 months. The firm completed some contracts with much less software program to amortize, so that they saved some cash right here.

Restructuring Costs

DXC spent $20 million on restructuring, $13 million lower than final 12 months. This 12 months, the sale of smaller enterprise segments resulted in a $5 million loss, contrasting with a $38 million achieve final 12 months.

Takeaway

-

Operational Efficiency: DXC has diminished operational and SG&A prices, exhibiting a dedication to bettering profitability.

-

Asset Management: Reducing depreciation and amortization bills suggests higher asset administration.

-

Strategic Decisions: Increased merger-related bills and diminished restructuring prices point out strategic focus, although the affect on the corporate’s future stays to be seen.

Earnings Per Share

DXC Technology reported a Q1 2024 EPS of 17 cents, a big drop from final 12 months’s 43 cents throughout the identical interval. The lower stems from a $66 million fall in complete revenue.

EPS Breakdown – Q1 2024

- 7 cents was spent on restructuring the corporate.

- 32 cents was used to account for the loss in worth of intangible property they’ve acquired, like software program.

- 2 cents was misplaced as a result of they offered off components of the enterprise (“divestments”).

- 3 cents went to writing off dangerous investments they made.

- 1 cent was used to regulate their taxes.

EPS Breakdown – Q1 2023

- 11 cents had been used for restructuring.

- 1 cent went to prices associated to offers and mergers.

- 34 cents had been for amortizing acquired intangible property.

- 16 cents had been positive factors they created from promoting off components of the enterprise.

- 3 cents had been put aside for prices associated to a merger (“indemnification”).

Takeaway

-

Increased Amortization Costs: The 32 cents allotted for amortization this quarter is not a sudden spike year-over-year however nonetheless represents an enormous chunk of the EPS.

-

Restructuring Focus: DXC used 7 cents for restructuring in 2024, in comparison with 11 cents final 12 months. The discount means that the corporate is presumably shifting previous its restructuring section, which might be constructive in the long term.

-

Lack of Divestment Gains: Last 12 months’s EPS bought a 16-cent enhance from divestments; this 12 months, it was a 2-cent loss, that means they did not get any one-off monetary windfalls this time.

-

Tax and Bad Investment Impact: Adjustments for taxes and writing off dangerous investments accounted for 4 cents, a comparatively minor however nonetheless notable a part of the EPS drop.

DXC Technology’s steep drop in EPS from 43 cents to 17 cents in Q1 2024 might initially seem regarding. However, a more in-depth look reveals that the corporate is present process restructuring and absorbing amortization prices, that are non-recurring bills. The absence of divestment positive factors, which boosted final 12 months’s EPS, additionally skewed this 12 months’s determine decrease.

The Liquidity Picture: What The Numbers Tell Us

As of at the moment, DXC Technology holds $1.6 billion in money, with round $800 million saved abroad. This marks a lower from March, once they had $1.9 billion in money, of which $700 million was exterior the U.S.

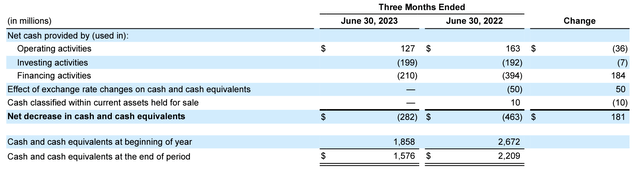

DXC 10-Q

Cash From Operations

DXC Technology generated $127 million in money from operations this 12 months, a $36 million drop from final 12 months’s $163 million. Notably, earnings fell by $109 million, even after changes, which explains a lot of this lower.

Working Capital

On a brighter observe, working capital confirmed a sturdy enchancment of $73 million. A big enhance could be attributed to extra environment friendly accounts receivable collections.

Cash Conversion Cycle

Additionally, the money conversion cycle tightened from 22 days to twenty days. This exhibits that DXC is changing its expenditures into money extra swiftly than earlier than.

Investment Activities

DXC Technology amped its investments to $199 million this 12 months, marking a rise of $7 million from final 12 months. The modifications break down as follows:

- Business Dispositions: $29 million much less spent this 12 months.

- Long-Term Investments: An extra $27 million, largely funneled into software program.

- Miscellaneous Activities: A cutback of $9 million in comparison with final 12 months.

Financing Activities

Financing took a pointy dive to $210 million this 12 months from $394 million final 12 months, translating right into a whopping $184 million lower. Key strikes embrace:

- Leasing and Loan Repayments: A discount of $28 million, signalling a extra frugal method.

- Short-term Loans: DXC padded their funds with an additional $188 million, even after paying off older money owed.

- Share Buybacks and Tax Handling: An enhance of $35 million in expenditure.

Takeaway

- Earnings and Cash Flow: While the corporate generated much less money this 12 months, it is important to notice that earnings took a large hit. This immediately affected the money from operations, which is a pink flag.

- Cash Position: Despite a noticeable decline in money reserves, DXC Technology can repatriate $800 million again to the U.S. with out extra taxation. This may considerably fortify its home money pool.

-

Working Capital and Cash Conversion: The enhance in working capital, significantly the proficiency in accounts receivable, is a constructive signal that their each day operational money wants are bettering. This might be a sign of higher monetary administration. A diminished money conversion cycle is at all times excellent news. It means the corporate is extra environment friendly at turning its spending into money. This might be an indicator of elevated operational effectivity.

-

Investment Activities: A $7 million uptick in total investments is noteworthy. The $27 million allotted to long-term software program investments is much more compelling, signalling a calculated pivot in the direction of technological development and future progress.

-

Financing Activities: The firm has notably reduce on financing actions. Specifically, it saved $28 million on lease and mortgage repayments, indicating a cautious method in the direction of debt administration.

DXC Technology presents a combined bag with regards to liquidity. On the one hand, it has demonstrated working capital and money conversion efficiencies. Conversely, there is a lower in money generated from operations and complete money reserves. However, strategic long-term investments and prudent monetary administration trace at a cautiously optimistic outlook for the corporate.

Valuation

Financial Model

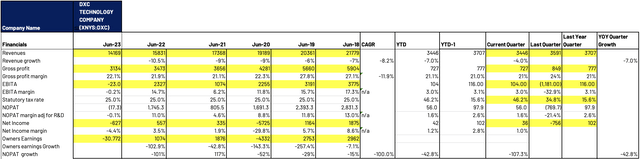

Revenue Decline

DXC Technology has considerably eroded its income base over 5 years. 2018, the corporate reported a formidable income determine of $21.7 billion. However, by 2023, this had sharply declined to $14.1 billion, registering a mean annual contraction of 8.2%.

Margin Contraction

Equally alarming is the corporate’s gross margin compression, which has diminished from 27.1% in 2018 to 22.1% in 2023. Furthermore, the Earnings Before Interest, Taxes, and Amortization margin has swung from a sturdy 17.2% in 2018 to a damaging 0.2% in 2023.

Underlying Factors

The erosion in gross margin factors in the direction of rising manufacturing prices, operational inefficiencies, or pricing pressures that DXC Technology has been unable to mitigate successfully. The downturn in EBITA margin is much more regarding, with the corporate’s core enterprise additionally underperforming alongside divestitures contributing to this damaging pattern.

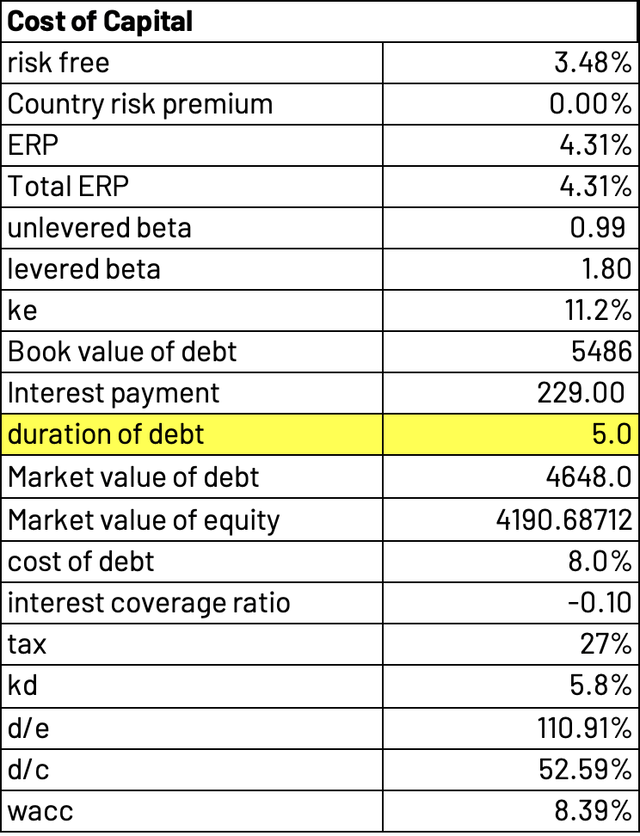

WACC

DXC Technology is grappling with an onerous debt load totalling $5.4 billion. The firm should make annual curiosity funds of $229 million, a burden changing into more and more problematic given its underperforming core enterprise.

On a constructive observe, DXC Technology holds a Baa2 credit standing, contributing to a average value of debt at 8%. When contemplating tax shields, the after-tax value of this debt is diminished to five.8%. While the Baa2 ranking does supply some consolation, it would not fully alleviate the dangers signalled by different monetary indicators.

Upon inspecting the corporate’s capital construction, it’s revealed that 52.5% of its capital is debt-financed. This ratio results in an total weighted common value of capital of 8.39%.

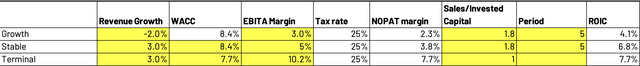

DCF Inputs

Downward Trajectory

DXC Technology is projected to expertise a contraction of roughly 2% yearly for the following 5 years. This pattern is attributed to the continued divestitures and operational restructuring. Over the final 5 years, the corporate’s revenues have declined by an annual fee of 8.2%, largely resulting from asset gross sales. While the speed of divestitures is predicted to decelerate, the financial headwinds within the IT companies sector may perpetuate this shrinking pattern.

Margin Analysis

Contrary to the income decline, DXC Technology has efficiently upheld its gross margin between 21-22%. Strategic cost-cutting measures, significantly in Selling, General and administrative bills, are anticipated to raise the corporate’s EBITA margin from 3% subsequent 12 months to probably 5% within the terminal 12 months.

Capital Turnover

As the corporate continues its divestiture technique, its stability sheet turns into much less encumbered. The capital turnover ratio is anticipated to stay at 1.8 over the following decade, in step with final 12 months’s efficiency. This implies a return of $1.80 for each greenback invested.

Valuation Metrics

Utilizing the Discounted Cash Flow mannequin and assuming a tax fee of 25%, the estimated intrinsic worth of DXC Technology stands at roughly $24.10 per share, a premium to its present buying and selling worth of $20.43.

Uncertainties Ahead

It needs to be famous that these projections are fraught with uncertainties, hinging on the belief that DXC Technology will resume progress in roughly 5 years. Failure in restructuring initiatives may jeopardize these forecasts. Moreover, the corporate’s inventory repurchase program suggests a self-perceived undervaluation, signalling a possible entry level for risk-tolerant traders.

Conclusion

DXC Technology’s latest monetary stories reveal a regarding pattern: declining revenues throughout its most important enterprise segments. Despite makes an attempt to streamline operations and enhance liquidity, the corporate hasn’t been capable of reverse these damaging trajectories. An extra concern is the corporate’s appreciable debt burden, which poses a critical threat for short-term and long-term stability.

Recommendation

For these comfy with threat, cautiously buying a small place in DXC Technology could also be price contemplating. The potential for a turnaround exists, however it’s not assured.

For traders prioritising security over excessive returns, holding DXC Technology in your watchlist and observing its efficiency over the following quarter could be prudent. This offers you a greater image of whether or not or not the corporate is popping issues round.

If you are already invested in DXC Technology, sustaining your present stake might be an affordable method. There’s nonetheless the possibility that the corporate’s future progress initiatives might repay, resulting in an affordable ROI.

Investment Rating: Hold (High Risk)

[adinserter block=”4″]

[ad_2]

Source link