[ad_1]

If we wish to discover a potential multi-bagger, typically there are underlying tendencies that may present clues. Firstly, we might wish to determine a rising return on capital employed (ROCE) after which alongside that, an ever-increasing base of capital employed. If you see this, it sometimes means it is an organization with an incredible enterprise mannequin and loads of worthwhile reinvestment alternatives. So once we checked out Elevance Health (NYSE:ELV) and its development of ROCE, we actually appreciated what we noticed.

Return On Capital Employed (ROCE): What Is It?

For those that do not know, ROCE is a measure of an organization’s yearly pre-tax revenue (its return), relative to the capital employed within the enterprise. The formulation for this calculation on Elevance Health is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.15 = US$9.9b ÷ (US$109b – US$42b) (Based on the trailing twelve months to December 2023).

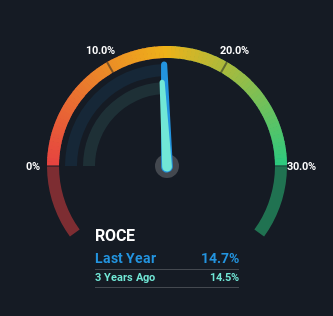

Therefore, Elevance Health has an ROCE of 15%. In absolute phrases, that is a passable return, however in comparison with the Healthcare trade common of 11% it is significantly better.

Check out our latest analysis for Elevance Health

In the above chart we now have measured Elevance Health’s prior ROCE in opposition to its prior efficiency, however the future is arguably extra necessary. If you want, you may check out the forecasts from the analysts covering Elevance Health for free.

What Does the ROCE Trend For Elevance Health Tell Us?

We just like the tendencies that we’re seeing from Elevance Health. Over the final 5 years, returns on capital employed have risen considerably to fifteen%. The firm is successfully making more cash per greenback of capital used, and it is value noting that the quantity of capital has elevated too, by 35%. The rising returns on a rising quantity of capital is widespread amongst multi-baggers and that is why we’re impressed.

In Conclusion…

An organization that’s rising its returns on capital and might constantly reinvest in itself is a extremely wanted trait, and that is what Elevance Health has. Since the inventory has returned a stable 88% to shareholders during the last 5 years, it is truthful to say traders are starting to acknowledge these adjustments. With that being stated, we nonetheless assume the promising fundamentals imply the corporate deserves some additional due diligence.

On a last notice, we have discovered 1 warning sign for Elevance Health that we expect you have to be conscious of.

For those that wish to put money into stable corporations, try this free list of companies with solid balance sheets and high returns on equity.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We intention to deliver you long-term targeted evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link