[ad_1]

, Shyamlal Yadav

, Jay Mazoomdaar

, Sandeep Singh

, Khushboo Narayan

| Mumbai, New Delhi |

Updated: September 21, 2020 6:03:38 am

In a majority of cases, domestic branches of Indian banks have been utilised to receive or remit the funds; in some cases, bank accounts with foreign branches of Indian banks, too, have been used to carry out these transactions.

In a majority of cases, domestic branches of Indian banks have been utilised to receive or remit the funds; in some cases, bank accounts with foreign branches of Indian banks, too, have been used to carry out these transactions.

Layer by layer, the secrecy that shrouds international money flows involving Indians has been unpeeled — beginning with the Offshore Leaks in 2013, Swiss Leaks in 2015, Panama Papers in 2016, and Paradise Papers in 2017, in a series of investigations by The Indian Express. Now comes the FinCEN Files.

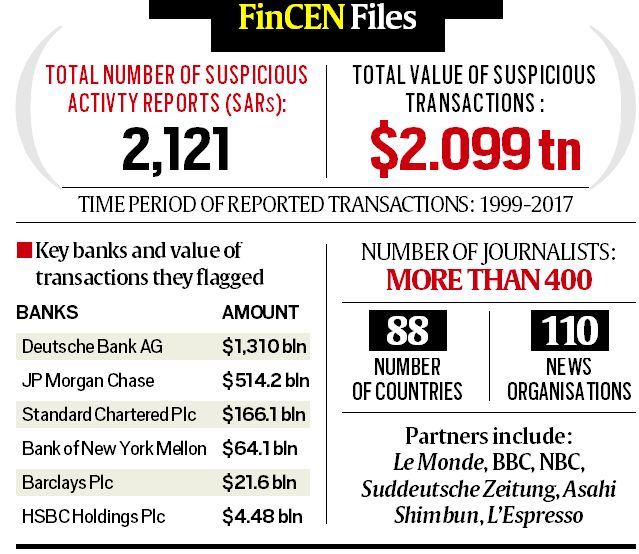

The newspaper’s latest, beginning today, examines Indian connections in a cache of over 2000 secret documents — so secret banks aren’t even allowed to confirm they exist — which have been red-flagged to the top US financial watchdog, the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) for suspected money laundering, terrorism, drug dealing or financial fraud.

These documents, called Suspicious Activity Reports or SARs, which constitute the FinCEN Files, are not evidence of illegality. They reflect views by watchdogs within banks, known as compliance officers, reporting past transactions that bore hallmarks of financial crime, or that involved clients with high-risk pofiles or past run-ins with the law.

In effect, they are crucial red flags raised by banks that point law-enforcement agencies to further investigation. (See explained). Indeed, the Department of Justice in the US has launched investigations and secured convictions in cases that are related to SARs.

Headquarters of FinCEN, the top US financial watchdog, in Virginia. (Source: Scilla Alecci/ICIJ)

Headquarters of FinCEN, the top US financial watchdog, in Virginia. (Source: Scilla Alecci/ICIJ)

The Indian Express, along with 109 media organisations in 88 countries, including Le Monde(France), Asahi Shimbun(Japan), Suddeutsche Zeitung(Germany), Aftenposten(Norway), NBC (US), BBC, and the Australian Broadcasting Corporation, teamed up with the International Consortium of Investigative Journalists (ICIJ) and BuzzFeed News to trace the Indian entities and banks named in these SARs filed with FinCEN between 1999 and 2017.

More than eight of every ten of these SARs were filed by: Deutsche Bank, Bank of New York Mellon (BNYM); Standard Chartered Bank, Citibank and JP Morgan Chase. The total value of transactions covered in these SARs: $ 2 trillion.

Read | On US radar: Dawood Ibrahim’s financier, his laundering, funding of Lashkar, Jaish

The SARs provide a rare peek into how businessmen, politicians and their companies utilise banking channels around the world to move their wealth across borders or to tax havens to avoid taxation or detection.

Over three months, The Indian Express investigated all the SARs with an India trail, further looking into those already under scrutiny in India for alleged financial irregularities. Indeed, a key finding is that in many cases the very fact that individuals and companies are being probed by Indian agencies is part of the SAR flagged to FinCEN.

Thus, transactions of Indian entities named in scams such as the 2G scam; the Augusta Westland scandal; the Rolls Royce bribery case and the Aircel-Maxis case besides those involved in other corruption and duty-evasion cases have all been hot-listed with the FinCEN.

Significantly, these cases are also being investigated by agencies like the Central Bureau of Investigation; the Enforcement Directorate and the Directorate of Revenue Intelligence.

Read | Bank reported fraud, UK link of an IPL team sponsor

The Indian Express investigation has revealed transactions of a range of individuals and companies: a jailed art and antique smuggler; a global diamond firm owned by Indian-born citizens named in several offshore leaks; a premier healthcare and hospitality group; a bankrupt steel firm; a luxury car dealer who allegedly duped several high net worth individuals; a multinational Indian conglomerate; a sponsor of the Indian Premier League (IPL) team; an alleged hawala dealer who became the reason for a massive fight within the Enforcement Directorate (ED) and a key financier of an Indian underworld don, among others.

Read | Revealed: how Jindal Steel sent funds abroad, and got them in same period

In a majority of cases, domestic branches of Indian banks have been utilised to receive or remit the funds; in some cases, bank accounts with foreign branches of Indian banks, too, have been used to carry out these transactions.

As many as 44 Indian banks figure in the FinCEN Files primarily because they are “correspondent banks” to the foreign banks which have filed these SARs. Key in this list are Punjab National Bank, Kotak Mahindra, HDFC Bank, Canara Bank, IndusInd Bank and Bank of Baroda, among others.

There are a total of 3,201 transactions which have been listed as ‘’suspicious’’ in nature and these add to $1.53 billion – but this is only those where complete Indian addresses linked to different entities (senders, banks, beneficiaries) are available. These are attached as spreadsheets in each SAR.

Over and above, are thousands of other transactions, also linked to Indian entities where senders or beneficiaries have addresses in foreign jurisdictions. These are contained in the SARs themselves.

Among the major global revelations, the investigation traced a Rhode Island drug dealer’s dollars to a chemist’s lab in Wuhan, China; explored scandals that crippled economies in Africa and Eastern Europe; tracked tomb raiders who looted ancient Buddhist artefacts that were sold to New York galleries; surveyed Venezuelan tycoons who siphoned money from public housing and hospitals; and scrutinized the Middle East’s largest gold refinery, the subject of a sprawling, never-revealed, US money-laundering probe.

Dozens of political figures who feature in the documents include Paul Manafort, the former Donald Trump campaign manager who was convicted of fraud and tax evasion.

JPMorgan processed more than $50 million over a decade between Manafort and his associates’ shell companies — at least $6.5 million of that over 14 months after he resigned from the campaign amid charges of money laundering spawning from his ties to Russian-connected Ukrainian officials.

Earlier this month, anticipating this investigative series, FinCEN issued a statement in New York that “the unauthorized disclosure of SARs is a crime that can impact the national security of the United States, compromise law enforcement investigations, and threaten the safety and security of the institutions and individuals who file such reports.” FinCEN said it had referred this to the US Department of Justice and the US Department of the Treasury’s Office of Inspector General.

Responding to this, ICIJ said the reporting for the FinCEN Files is lawful and appropriate. “Our reporting exposes how banks and regulators have failed the public by allowing the flow of dirty money to go unchecked despite a system that is supposed to prevent it.”

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Express Exclusive News, download Indian Express App.

[ad_2]

Source link