[ad_1]

Hispanolistic/iStock by way of Getty Images

We current our notice on Flutter Entertainment (OTCPK:PDYPY) (OTCPK:PDYPF), a worldwide sports activities betting, gaming, and leisure firm, with a Buy ranking. We are drawn by Flutter’s power within the rising US on-line sports activities betting and that iGaming market, excessive earnings development pushed by US growth, strong fundamentals in mature markets, and enticing embedded returns. We will present a short overview of the corporate, briefly talk about its latest efficiency, analyze FanDuel’s enterprise mannequin and development trajectory, and lay out our funding case and valuation.

Introduction to Flutter Entertainment

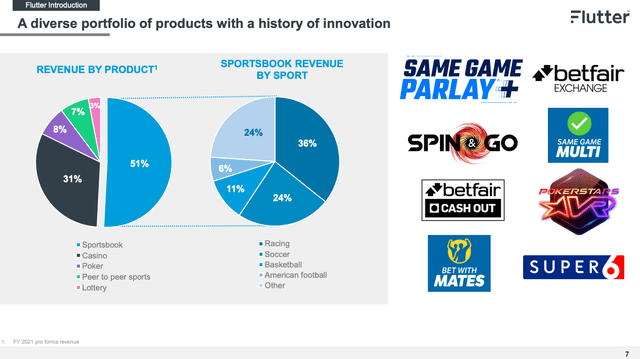

Flutter Entertainment is a world sports activities betting and playing firm, created in 2016 by means of the merger of Paddy Power and Betfair. The group operates in additional than 20 regulated markets and has a worldwide presence. The firm has 4 geographical divisions: US, UK&I, Australia, and International, representing respectively 34%, 28%, 16%, and 22% of the group’s web income in FY2022.

Its US division consists of FanDuel, TVG, FOX Bet, and so forth. It is necessary to notice that FanDuel is the main on-line sportsbook and on line casino operator within the US. Flutter’s UK & Ireland division consists of among the best-known manufacturers out there resembling Sky Betting & Gaming, Paddy Power, Betfair and Tombola. While the UK&I manufacturers function principally on-line, there are greater than 600 Paddy Power retail betting outlets. The firm’s Australian division consists of Sportsbet, the market chief in on-line betting throughout Australia. Flutter’s International division accommodates operations in additional than 100 international locations together with the most important on-line operator in Italy: Sisal, and the world’s largest poker web site: PokerStars.

Flutter is listed on the London Stock Exchange and has a present market capitalization of £25 billion. It is a FTSE100 index constituent. Underpinned by sturdy fundamentals, Flutter has had a sturdy monetary efficiency since 2017 with an EBITDA CAGR of twenty-two%.

FanDuel CMD

Multiyear Growth Pathway For FanDuel

We consider that probably the most vital value-creation driver for Flutter going ahead is FanDuel. After the repeal of PASPA by the US Supreme Court, in 2018, Flutter acquired a controlling stake in FanDuel to capitalize on the large US on-line sports activities betting and that iGaming alternative opening up. Flutter brings its tech stack and experience from the mature European markets by which it operates along with a multibillion capital dedication into the US. Founded as a fantasy sports activities supplier, FanDuel had an preliminary benefit due to model recognition and an intensive database. FanDuel is by far the market chief in on-line sports activities betting with an estimated market share of ~47% as per the most recent outcomes report, leaving DraftKings and BetMGM behind, and main in 15 out of 18 states. While it historically has not been a pacesetter in on-line on line casino gaming, FanDuel has impressively elevated its market share to 23% by the tip of Q2.

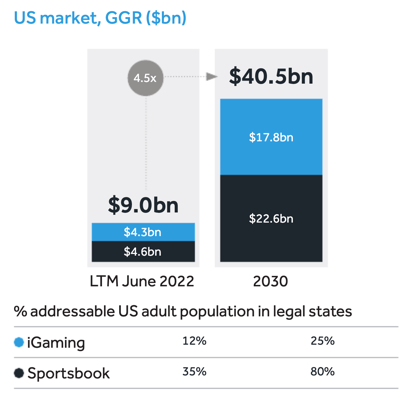

Flutter expects that the entire addressable market within the US will broaden to greater than $40 billion by 2030: or $22.6 billion in on-line sports activities betting pushed by growth to 80% of the inhabitants and penetration consistent with mature markets resembling Australia; and $17.8 billion in iGaming pushed by growth to 25% of the inhabitants and penetration ranges much like the sportsbook. As beforehand mentioned in our notice on Flutter’s competitor Entain, which owns a 50% stake in BetMGM, sell-side analyst estimates differ between $35-$45 billion, whereas BetMGM itself expects a TAM of $37 billion. Flutter expects a pathway for FanDuel income to 4.5-5x by 2030 vs. 2022 ranges and long-term EBITDA margins to be inside the vary of 25-30%.

For the needs of our valuation train, we’ll use Flutter’s TAM estimates that are largely consistent with consensus. However, as referenced in our Entain notice, we consider the market could also be underestimating iGaming TAM in the long term. Our variant view on iGaming upside isn’t a driver of our funding thesis both for Entain or for Flutter, however we consider it stays a invaluable choice.

We want to level out the market construction of the playing trade which tends to have a winner takes most dynamic, whereby the market chief constantly strengthens its moat. The dominant market participant, with larger advertising spend, tends to have higher model recognition and more practical promoting leading to decrease buyer acquisition prices. In addition, larger tech spending leads to a technological benefit main to higher UX, liquidity, and selection. In flip, margins and consumer retention are pushed up. This creates a flywheel impact that compounds Flutter’s power within the US. The dynamic ought to result in above-market development and better earnings high quality and therefore a valuation premium for the “winner”.

FanDuel had an EBITDA of $100 million in H1, and the corporate can now offset new buyer acquisition by means of the earnings coming from present clients. This earnings inflection is a crucial catalyst for Flutter.

Flutter Annual Report

Solid Performance In Mature & Other Markets

Flutter’s ex-US enterprise, representing 64% of FY2022 income is well-positioned in lots of interesting markets and continues to drive development and generate money that’s invested into FanDuel, in inorganic development by means of M&A, or returned to shareholders. The enterprise is well-diversified and advantages from economies of scale. The firm expects a top-line development vary of 5-10% for its ex-US companies and better EBITDA margins. The ex-US world betting and gaming market is estimated to be price £263 billion in 2022, with 30% on-line. A CAGR of 9% is estimated within the on-line market within the subsequent 5 years.

The UK&I division is in a strong place and outperforming its friends when it comes to development on account of product enhancements and earlier self-imposed implementation of safer playing measures. The publication of the DCMS playing reform white paper after a protracted ready interval removes a regulatory overhang and represents one other key catalyst for Flutter. The Australian division has been a bit softer with development barely under expectations in H1, however the long-term alternative stays enticing and Flutter continues to speculate whereas rivals pull again. Moreover, the International division has a big runway for development that might be achieved inorganically by means of M&A.

Investment Case And Valuation

We use a Sum of the Parts evaluation to worth Flutter. We consider that is probably the most applicable methodology given the profiles of the divisions. We worth UK&I, Australia, and International at 9x EV/EBITDA with 6x for UK&I retail, and we worth FanDuel on 2030 mature estimates discounted again to the current. We forecast a £1.7 billion EBITDA FY24e for the ex-US division (excluding UK retail), arriving at an EV of £15.3 billion. We forecast an EBITDA of £45 million for UK retail, arriving at an EV of £270 million. We forecast £120 million of central value, to which we apply a a number of of 9x as nicely, leading to a detrimental EV of £1.1 billion.

We assume a US TAM of $40 billion, a market share of 40%, and a bonus charge of 30%, therefore a 70% conversion of gross to web gaming income. We arrive at a 2030 NGR of $11.2 billion. We assume a 30% EBITDA margin consistent with the higher finish of its vary, arriving at a 2030 EBITDA of $3.4 billion. We apply a a number of of 12x EBITDA arriving at an EV of $40.3 billion and low cost again utilizing an 8% value of fairness. We arrive at a gift worth of $25.4 billion for FanDuel or £20.1 billion.

The whole EV we get is £34.6 billion. After eradicating web debt and making different EV changes we arrive at an fairness worth of £30 billion, implying 19% upside and a share value of 17020p per share or $215 per share for PDYPF. We consider the secondary itemizing within the US, in addition to continued earnings development, are the primary catalysts for the inventory.

Risks

Risks embody however are usually not restricted to deteriorating macroeconomic situations resulting in a decline in enterprise exercise, decrease on-line sports activities betting and playing adoption within the US, larger than anticipated competitors within the US resulting in a decline in market share or a decline in profitability, surprising regulatory restrictions, and worth damaging M&A exercise in worldwide markets.

Conclusion

Given the excessive earnings development and fairly enticing valuation, we advocate constructing a protracted place in Flutter shares.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.

[adinserter block=”4″]

[ad_2]

Source link