[ad_1]

Nailing know-how predictions in 2022 was tough enterprise, particularly for those who had been projecting the efficiency of markets, figuring out preliminary public providing prospects and making binary forecasts on knowledge, synthetic intelligence and the macro spending local weather — together with different associated matters in enterprise tech. 2022 was characterised by a seesaw economic system the place central banks had been restructuring their steadiness sheets, the battle in Ukraine fueled inflation, provide chains had been a multitude and the unintended penalties of digital acceleration are nonetheless being sorted.

In this Breaking Analysis, we proceed our annual custom of brazenly grading our earlier 12 months’s enterprise tech predictions. You might or might not agree with our self-grading system, however we provide the knowledge to attract your personal conclusions.

Prediction No. 1: Overall tech spending: C+

As we exited 2021, chief data officers had been optimistic about their digital transformation plans. They’d rushed to make adjustments to their companies and had been desperate to sharpen their focus and proceed to iterate on digital enterprise fashions. As such, we predicted an 8% rise in enterprise tech spending, which was wanting fairly good till Ukraine, and the Fed determined it needed to make up for misplaced time. We nailed the momentum within the vitality sector, however we are able to’t give ourselves an excessive amount of credit score for that layup.

As of October, Gartner had data know-how spending rising at simply over 5% this 12 months, so we’ll take the C+ and transfer on.

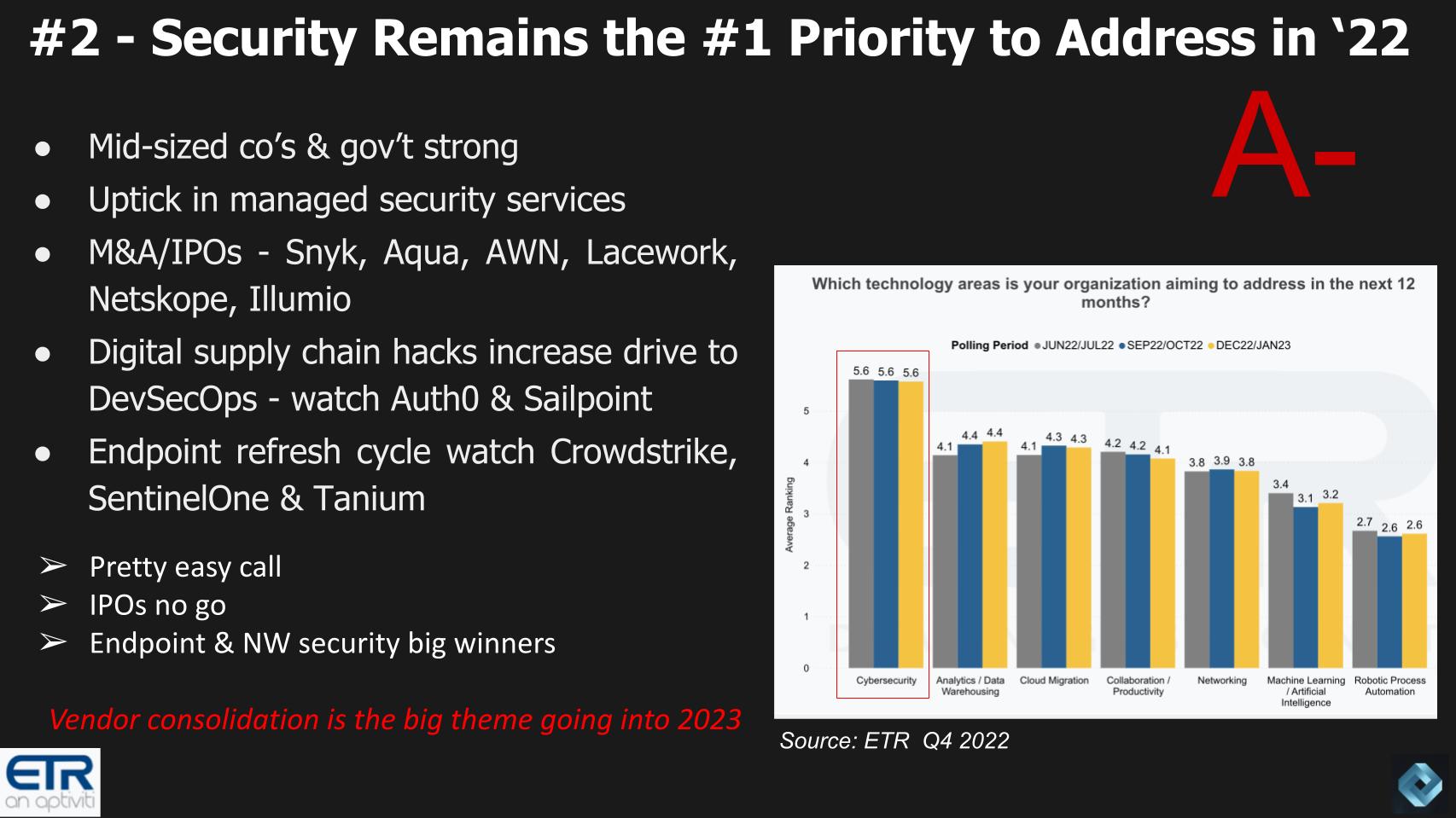

Prediction No. 2: IT priorities: A-

Our subsequent prediction was mainly a floor ball to second base, however we felt it was essential to focus on that safety would stay entrance and middle because the No. 1 precedence for organizations in 2022. But we threw in another predictions to make it more durable.

As is our custom, we attempt to up the diploma of issue by particularly figuring out firms that can profit from the traits. And we highlighted some attainable IPO candidates, which after all didn’t pan out. Snyk Ltd. was on our radar. The firm needed to do one other elevate lately and took a valuation hit, raising $196 million in a down round. Aqua Security Software Ltd.’s give attention to containers and cloud native was a classy name. We thought maybe an managed safety service supplier typically or Arctic Wolf Networks Inc. particularly would go public, however no approach that was occurring on this poor market. Nonetheless we expect these kind of firms are nonetheless faring properly because the expertise scarcity in safety stays acute.

Lacework Inc. laid off 20% of its workforce in 2022 and co-Chief Executive Dave Hatfield left the corporate. Meanwhile, Netskope Inc. stays sturdy within the ETR Emerging Technologies Survey, with Ilumio Inc. holding its personal.

We by no means appreciated the $7 billion price ticket that Okta Inc. paid for Auth0 Inc., however we cherished the whole out there market enlargement technique to focus on builders. But we have now to take some factors off for the failure to this point of Okta to actually nail the mixing of Auth0 into the corporate.

The give attention to endpoint safety was a winner in 2022 as CrowdStrike Holdings Inc. led that cost, with others holding their very own… not the least of which was Palo Alto Networks Inc., because it continued to broaden past community safety, and CyberArk Software Ltd.

Overall we’ll give ourselves an A- for this name. We’re carefully watching the seller consolidation pattern in 2023. According to a current Palo Alto Networks survey of 1,300 SecOps professionals, on common, organizations have greater than 30 instruments to handle, and lowering these is a logical solution to optimize prices.

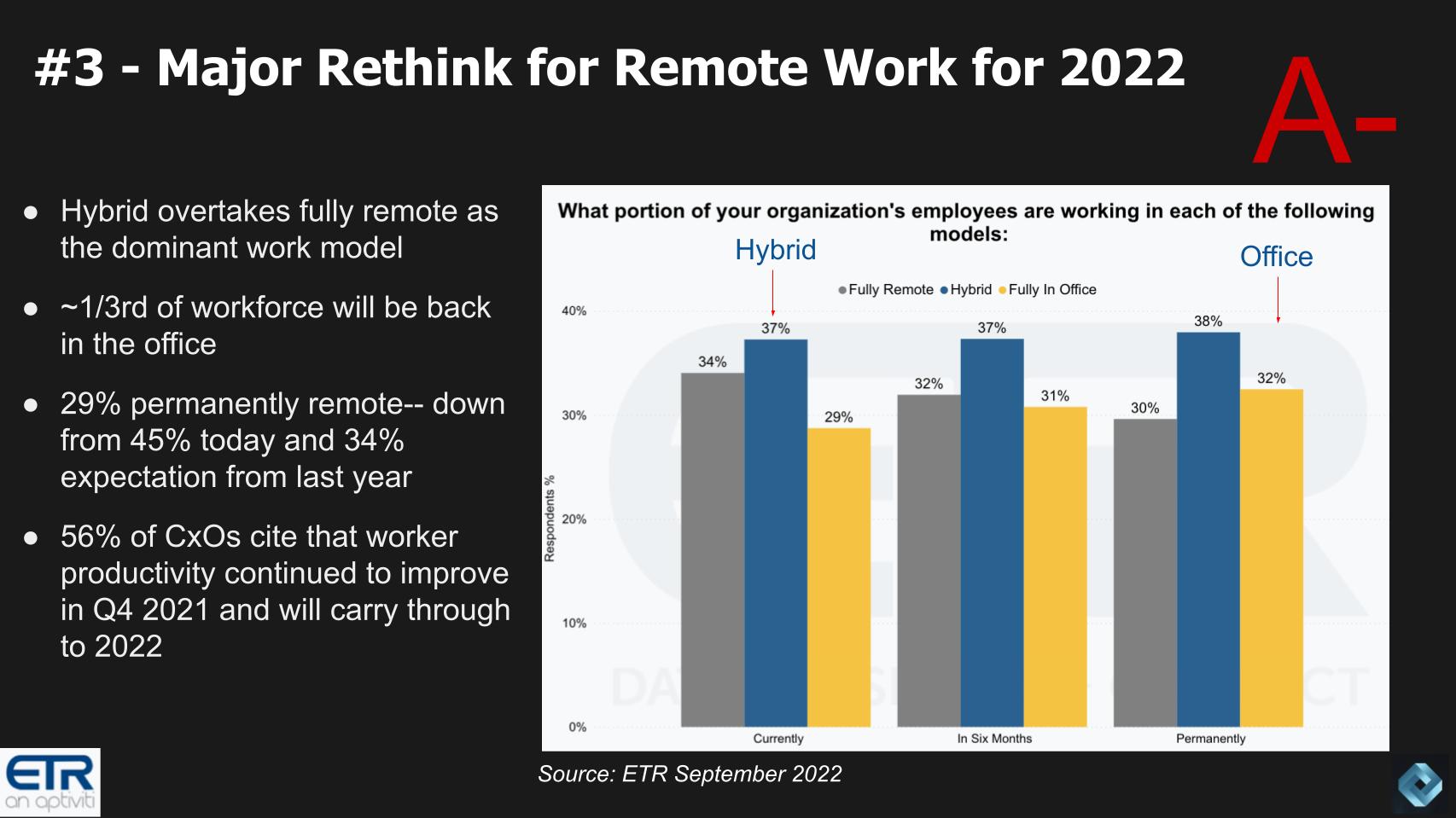

Prediction No. 3: Hybrid work: A-

The large theme of 2020 and 2021 was distant work, hybrid work, new methods to work with an eye fixed towards what the return to work would seem like.

We predicted that in 2022, hybrid work fashions would develop into the dominant protocol, which clearly is the case. We predicted that about 33% of the workforce would come again to the workplace in 2022. In September, the Enterprise Technology Research knowledge confirmed that determine was at 29% however organizations anticipated that 32% could be again to the workplace by year-end. That hasn’t fairly occurred but, however we had been fairly shut with these projections. So we’ll take an A minus on this one.

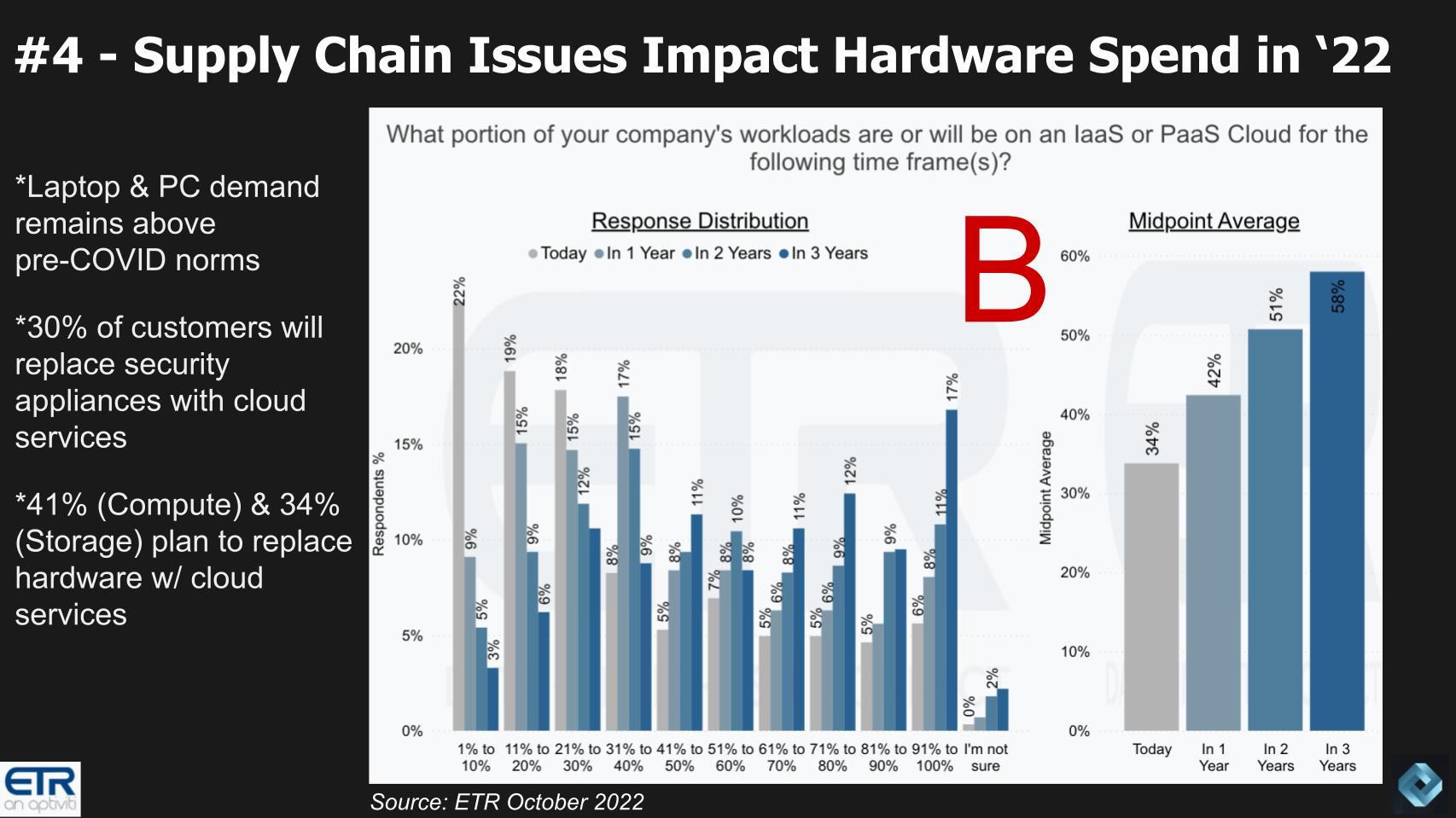

Prediction #4: Supply chain impacts on spending: B

Supply chain disruption was one other large theme we felt would carry via to 2022. Sure, that feels like one other simple one, however as is our sample, we attempt to put some binary metrics round particular predictions to place some measurability on the pattern.

We mentioned PC/laptop computer demand would stay above pre-COVID ranges, reversing a decade of year-on-year declines. Although demand is down this 12 months relative to 2021, IDC has worldwide unit shipments for PCs at simply over 300 million for 2022. Go again to 2019 and also you had been taking a look at round 260 million items or so.

Why solely a B you ask? Well we projected that 30% of consumers would change safety home equipment with cloud-based companies and that greater than a 3rd would change their inside knowledge middle server and storage {hardware} with cloud companies.

We don’t have express survey knowledge on precisely these metrics, however anecdotally we see this occurring in earnest. And we do have some knowledge that we present above on cloud adoption from ETR’s October 2022 survey, the place the midpoint of workloads operating within the cloud is 34% and forecast to develop steadily over the following three years.

While not a one-to-one correlation with our prediction, it’s a reasonably good guess that we had been proper. But we’ll take some factors off for lack of unequivocal proof. We all the time try to make our predictions in ways in which they are often measured as correct or not. And we attempt to present knowledge as proof. In this case it’s a bit fuzzy though we’re fairly comfy the prediction was correct.

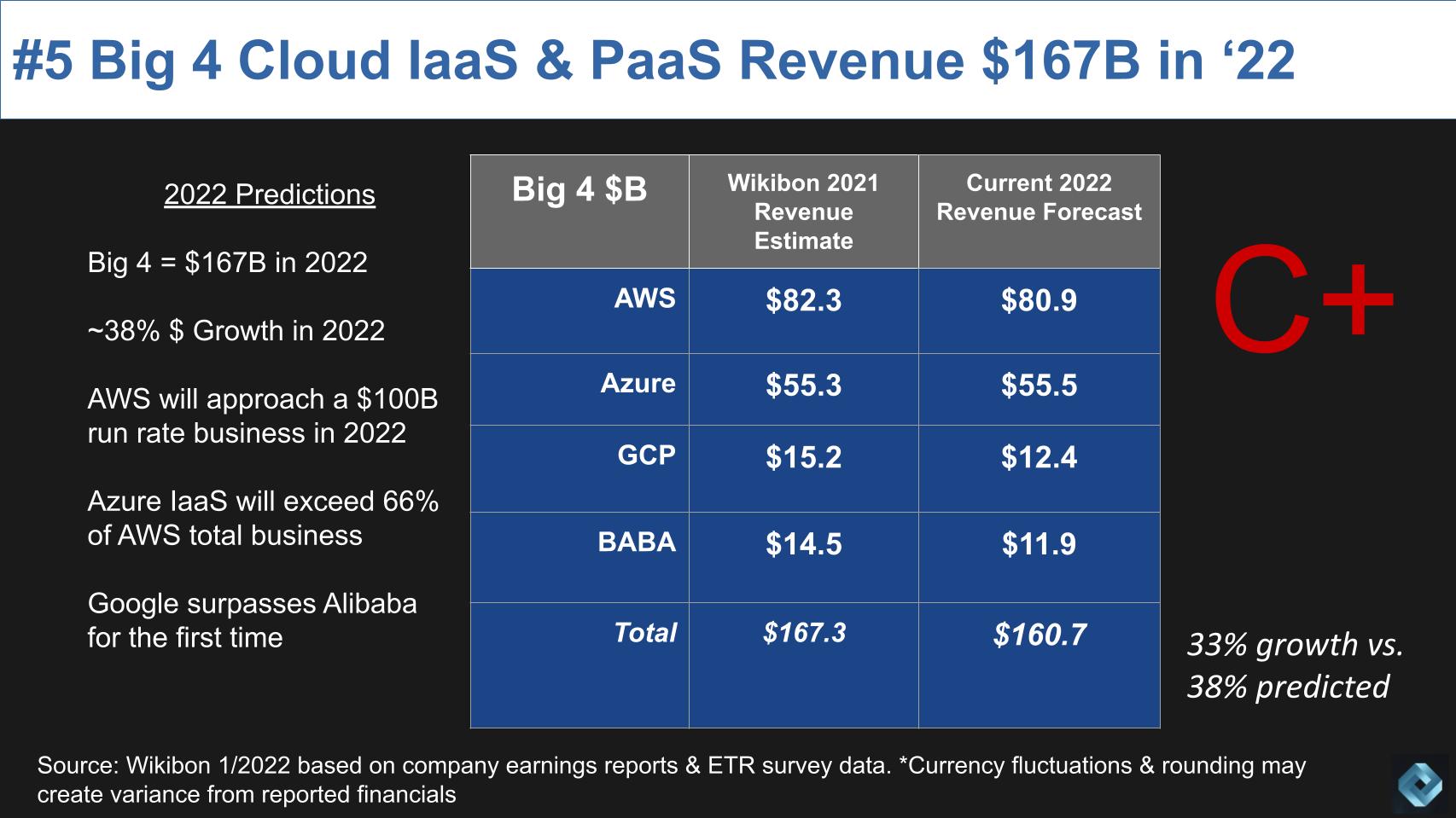

Prediction No. 5: Hyperscale cloud spend: C+

We mentioned that in 2022, the Big Four cloud gamers would generate $167 billion in instrastructure-as-a-service and platform-as-a-service income, combining for a 38% market development. Our present forecasts are proven right here with a comparability to our January 2022 figures and we count on now about $162 billion and a 33% development charge. Still very wholesome, however not on the mark.

We assume Amazon Web Services Inc. will miss our predictions by about $1 billion. As properly, it gained’t hit our overly aggressive expectation of exiting 2022 at practically $25 billion per quarter. We just about nailed Microsoft Azure. But despite the fact that our prediction was right that Google Cloud Platform would surpass Alibaba Cloud, we overestimated the efficiency of each firms.

We’ll give ourselves a C+ right here. Maybe that’s a bit harsh, we might argue for a B-, however the misses on GCP and Alibaba warrant a penalty.

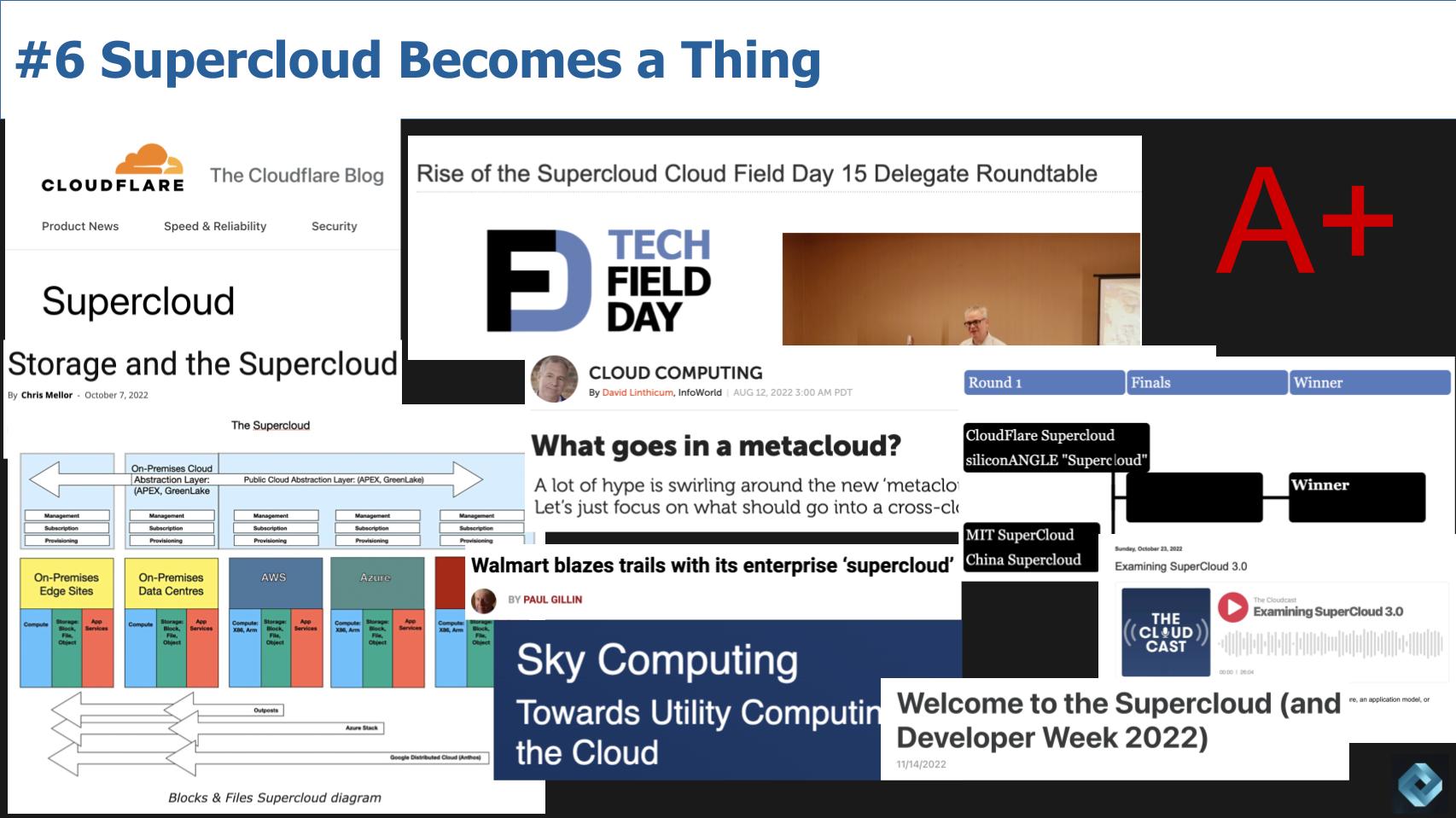

Prediction No. 6: Supercloud: A

Next we transfer on to our prediction about supercloud. We mentioned it turns into a factor in 2022 and it has. Despite the naysayers, we’re seeing clear proof that the idea of a layer of worth add that sits above and throughout clouds is taking form. On the slide under we present simply a few of the pickup within the trade.

One of essentially the most attention-grabbing is Cloudflare Inc.. The greatest supercloud antagonist, Charles Fitzgerald, as soon as predicted no vendor would ever use the time period in its advertising and marketing. Cloudflare has and it launched its model of supercloud at its Developer Week.

Chris Mellor of The Register put out a supercloud block diagram. David Linthicum makes use of the time period metacloud and supercloud virtually interchangeably to explain the pattern. Brian Gracely has coated the idea on the favored Cloudcast podcast. The University of California at Berkeley launched the Sky Computing initiative with many ideas highlighted within the supercloud 3.0 community definition. Walmart Inc. launched a platform with most of the supercloud’s salient attributes — as did Goldman Sachs Group Inc., Capital One Financial Corp. and Nasdaq Inc.

You can hate the time period, however very clearly the proof is gathering.

We’ll take an A on this one… sorry, haters.

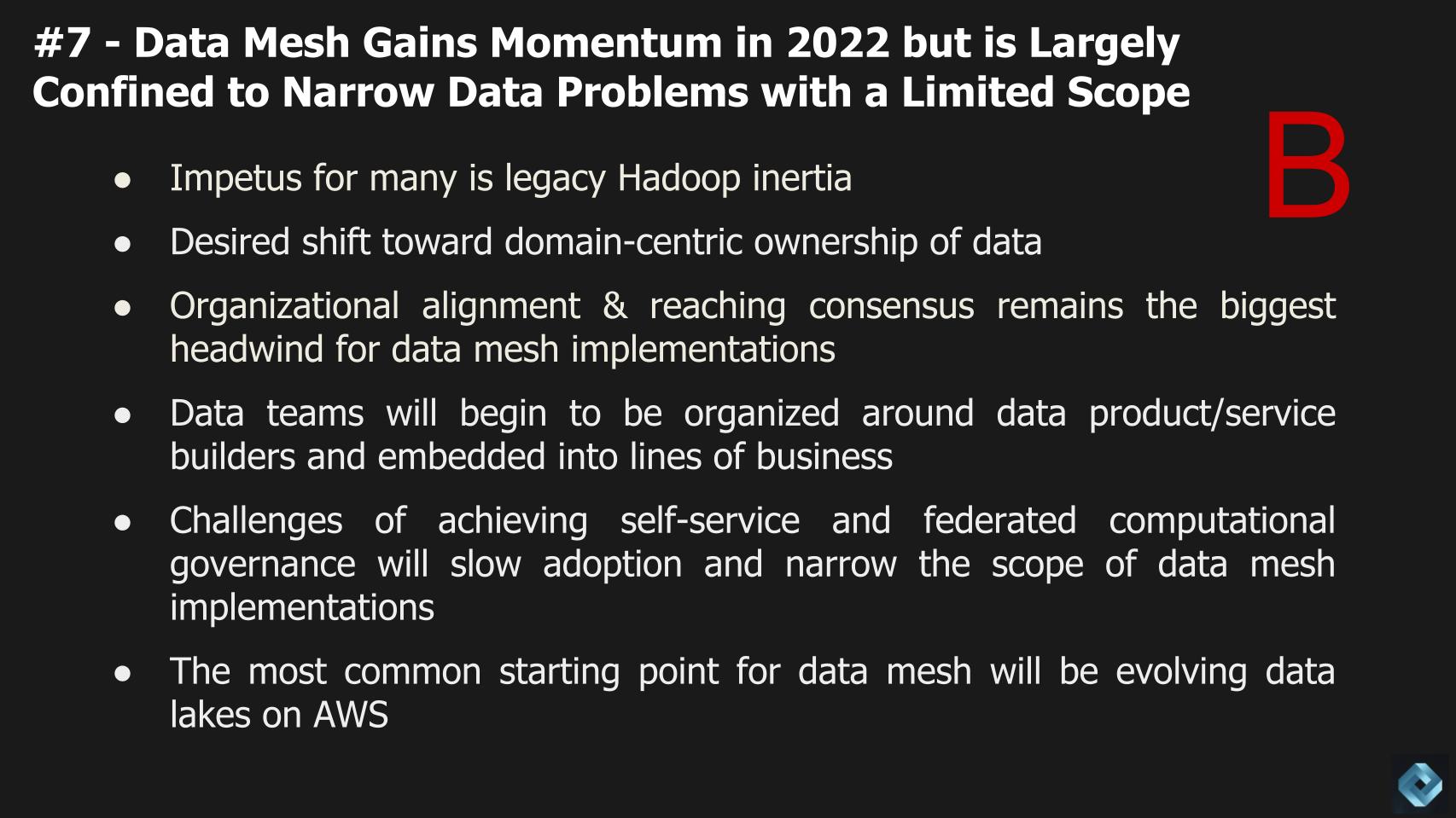

Prediction No. 7: Data mesh: B

Let’s discuss knowledge mesh. In our 2021 predictions submit we mentioned that within the 2020s, 75% of enormous organizations will re-architect their large knowledge platforms. And as a result of it was a longer-term prediction we took an incomplete for a grade.

There’s a lot dialogue within the knowledge group about knowledge mesh. And though there are an rising variety of examples – JP Morgan Chase & Co., Intuit Inc., HSBC Holdings PLC, HelloFresh SE and others, fully re-architecting knowledge platforms is nontrivial. There are organizational challenges, knowledge possession debates and technical concerns. In specific, two of the 4 basic knowledge mesh ideas describe self-service infrastructure and federated computational governance capabilities.

Democratizing knowledge and facilitating knowledge sharing creates conflicts with regulatory necessities round knowledge privateness. As such, many organizations are being selective with their knowledge mesh implementations and therefore our prediction of narrowing the scope of information mesh initiatives.

JP Morgan Chase is an efficient instance of this, the place a single group is narrowly implementing the info mesh structure in AWS utilizing knowledge lakes, Amazon Glue and a wide range of different strategies to satisfy its aims. Many different firms are dealing with limitations with their Hadoop knowledge platforms and want new considering. HelloFresh is an efficient instance of this.

The backside line is that organizations wish to get extra worth from knowledge and having centralized, super-specialized groups that personal the info drawback has been a barrier to success. Data mesh begins with organizational concerns as described by Ash Naseer of Warner Bros. Discovery Inc. Here’s how he describes it:

When individuals consider Warner Bros., you all the time consider the film studio, however we’re greater than that. I imply, you consider HBO, you consider TNT, you consider CNN, we have now 30-plus manufacturers in our portfolio and every has their very own wants. So the thought of an information mesh actually helps us as a result of what we are able to do is we are able to federate entry throughout the corporate in order that CNN can work at their very own tempo when there’s election season, they will ingest their very own knowledge they usually don’t must bump up towards for instance, HBO, if “Game of Thrones” is happening.

It usually is the case that knowledge mesh is within the eyes of the implementer. Although an organization’s implementation might not strictly adhere to Zhamak Dehghani’s vision of a data mesh, that’s OK. The purpose is to make use of knowledge extra successfully and, regardless of Gartner’s makes an attempt to deposition knowledge mesh in favor of the considerably complicated knowledge cloth idea that it stole from NetApp Inc., knowledge mesh is taking maintain in organizations globally.

So we’ll take a B on this one. The prediction is shaping up the best way we’ve envisioned, however as we’ve beforehand reported it’s going to take time – the higher a part of a decade, in our view. New requirements should emerge to make this imaginative and prescient come true and they’ll come within the type of each open and de facto approaches.

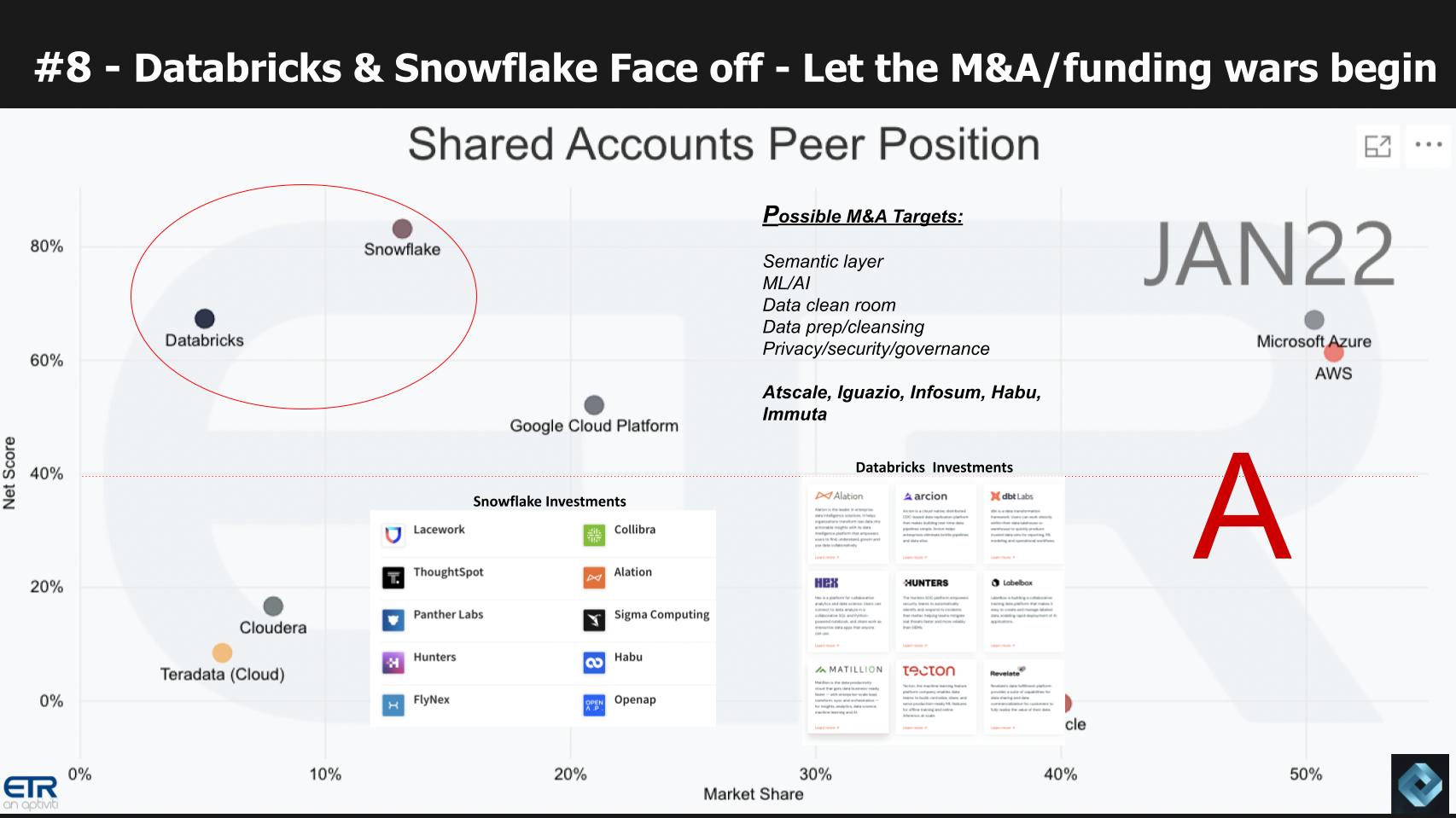

Prediction No. 8: Snowflake versus Databricks: A

Our eighth prediction final 12 months targeted on the face off between Snowflake Inc. and Databricks Inc. We notice it’s a preferred subject and perhaps one which’s getting overplayed, however these are two firms that originally had been shaping up as companions. They nonetheless are partnering within the area. The thought of utilizing AWS infrastructure, Databricks machine intelligence know-how and Snowflake as a facile knowledge warehouse remains to be viable. But each of those firms have bigger ambitions, large whole markets to chase and enormous valuations to justify.

As we’ve beforehand reported, every of those firms is shifting towards the opposite agency’s area. And they’re every constructing out an ecosystem that can be important to their futures. As a part of that effort, we mentioned, every goes to develop into aggressive traders in and acquirers of firms. And on this chart produced final 12 months, we cited some firms that had been targets and we’ve now added the current investments of Snowflake and Databricks that you could see above.

Both firms have invested in Alation Inc.. Snowflake has put cash into Lacework, the safety agency, along with ThoughtSpot Inc, which is attempting to democratize knowledge with AI, and Collibra NV as a governance platform. You can see Databricks investments in knowledge transformation with dbtLabs Inc. Matillion Ltd. doing simplified business intelligence, Cyber Hunters Ltd. in safety and so forth.

Other than our thought that we’d see Databricks go public, this prediction has been spot on and we’ll give this one an A.

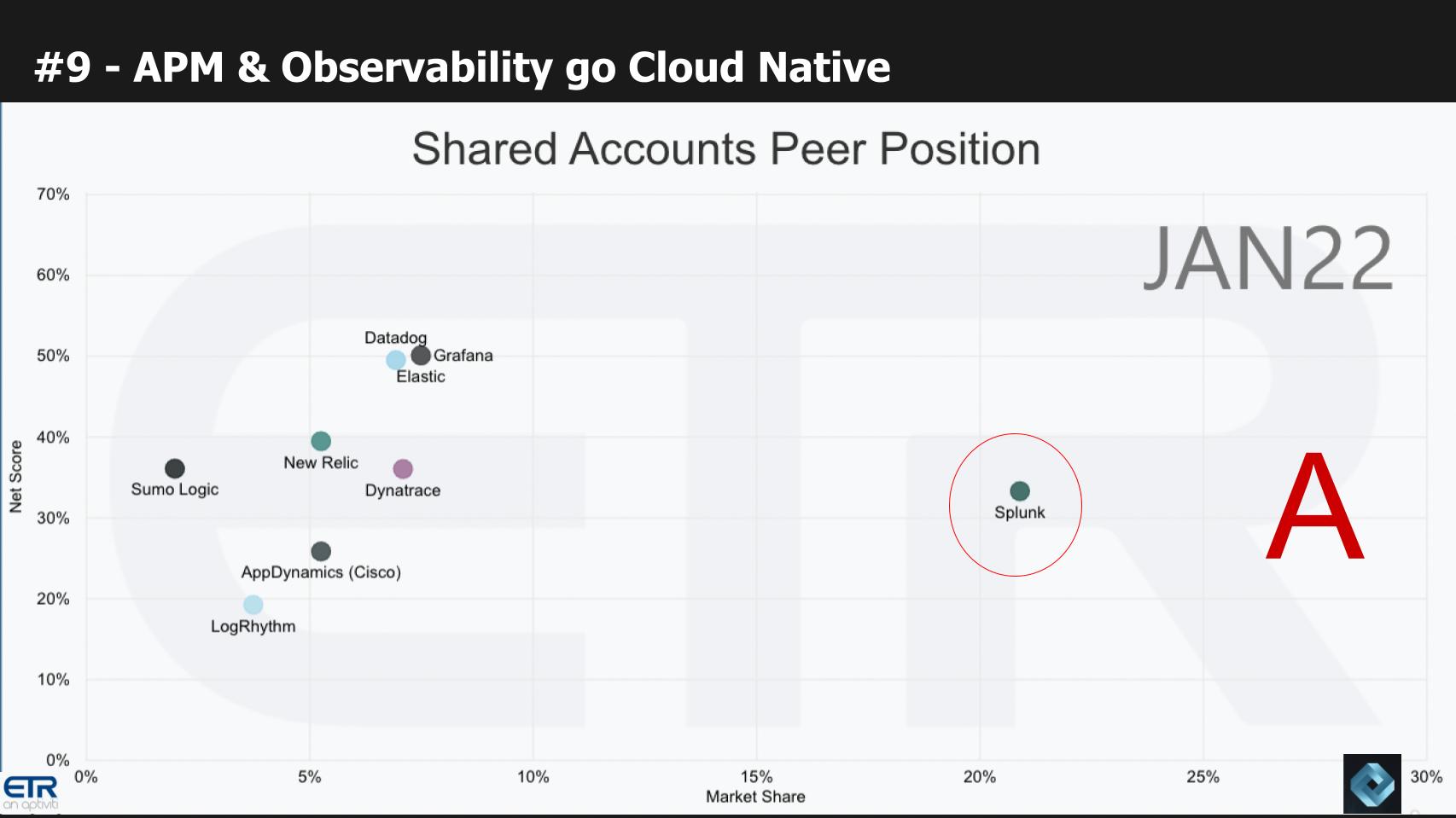

Prediction No. 9: Observability and the cloud: A

Application efficiency administration is evolving towards observability, which has been a sizzling subject we’ve been masking for some time with our good friend Erik Bradley over at ETR. Our No. 9 prediction final 12 months was mainly for those who’re not cloud-native on this market, you’re going to be in bother.

And that has clearly been the case. Splunk Inc., the large participant available in the market, has been transitioning to the cloud. Datadog Inc. has actual momentum, the Elastic and the Elk Stack with its open-source cloud mannequin… new entrants that we cited comparable to Observe Inc., Honeycomb.io, ChaosSearch Inc. and others we’ve reported on are all born within the cloud. So we’ll take one other A on this one. Admittedly a reasonably simple name, however you want a couple of of these within the combine.

Prediction No. 10: Hybrid occasions: B+

The final prediction was round occasions… one thing theCUBE is aware of a bit about. We mentioned the brand new class of occasions could be hybrid and for essentially the most half that has occurred. But there are nonetheless challenges and extra learnings to use.

The narrative behind that is virtual-only occasions are good for fast hits however awful replacements for in-person reveals. That mentioned, organizations of all styles and sizes realized easy methods to create higher digital content material to serve distant audiences.

We mentioned pure play digital offers solution to hybrid, that the bodily defines the expertise and there could be VIP occasions that create concern of lacking out and a digital part that serves an viewers 10 occasions the dimensions of bodily. Even examples of our prediction of metaverse-like immersion have popped up and lots of firms are again to doing regional roadshows.

In reviewing this prediction, the grade we gave ourselves might be a bit unfair – it may very well be larger. But organizations nonetheless haven’t figured it out. They have hybrid experiences however they typically do a poor job of leveraging the afterglow of an occasion. It nonetheless tends to be “one and done,” then let’s transfer onto the following occasion or the following metropolis and let the gross sales groups decide up the items.

So due to that, we’re solely taking a B+ on this one.

Summarizing the evaluate of our 2022 predictions: B+

Overall, for those who common out the grades on the ten predictions, they arrive out to a B+. We can’t appear to get that elusive A, however we’re going to attempt. Our mates at ETR and we’re beginning to take a look at the info for 2023 and put collectively our predictions. We’ve had a whole bunch of inbounds from PR professionals pitching us. We have this big thick folder that we’ve began to evaluate with our yellow highlighter.

Our plan is to evaluate the info this month. The ETR January survey is within the area and as soon as we’ve digested that, we’ll come again and publish our predictions for 2023 in January.

So keep tuned for that. And if in case you have concepts or predictions of your personal be at liberty to share with us. If we reference them, after all, we’ll provide you with attribution.

Keep in contact

Many due to Stu Miniman and David Floyer for his or her enter to as we speak’s episode. And after all to John Furrier for extracting the sign from the noise in his sitdown with Adam Selipsky. Kudos to Alex Myerson and Ken Shiffman on manufacturing, podcasts and media workflows for Breaking Analysis. Special due to Kristen Martin and Cheryl Knight who assist us preserve our group knowledgeable and get the phrase out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish every week on Wikibon and SiliconANGLE. These episodes are all out there as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and touch upon our LinkedIn posts.

Also, take a look at this ETR Tutorial we created, which explains the spending methodology in additional element. Note: ETR is a separate firm from Wikibon and SiliconANGLE. If you wish to cite or republish any of the corporate’s knowledge, or inquire about its companies, please contact ETR at authorized@etr.ai.

Here’s the total video evaluation:

All statements made concerning firms or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, different company on theCUBE and visitor writers. Such statements will not be suggestions by these people to purchase, promote or maintain any safety. The content material offered doesn’t represent funding recommendation and shouldn’t be used as the idea for any funding resolution. You and solely you’re chargeable for your funding selections.

Disclosure: Many of the businesses cited in Breaking Analysis are sponsors of theCUBE and/or purchasers of Wikibon. None of those corporations or different firms have any editorial management over or superior viewing of what’s printed in Breaking Analysis.

Image: Matthew Benoit

Show your assist for our mission by becoming a member of our Cube Club and Cube Event Community of specialists. Join the group that features Amazon Web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and lots of extra luminaries and specialists.

[adinserter block=”4″]

[ad_2]

Source link