[ad_1]

Rasi Bhadramani

Since January, China’s financial hunch has led traders to show away from investments with excessive exposures to Chinese financial development, in favor of belongings which may present a hedge to China’s disappointments.

India’s home coverage developments and distant financial ties imply that Indian equities are proving to be a stable diversifier within the EM Asia area.

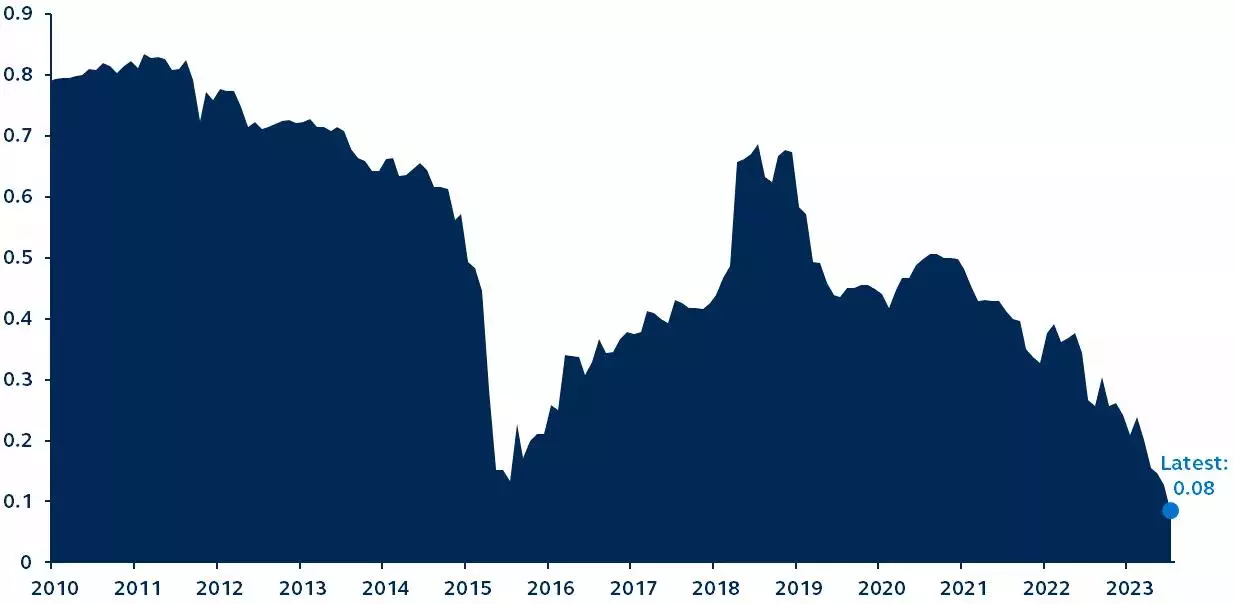

MSCI China and MSCI India correlation

Rolling 36-month return correlation, 2010–current

Source: Bloomberg, Principal Asset Management. Data as of July 31, 2023.

China’s financial momentum has quickly light. Although authorities have launched new stimulus, it has been inadequate to stabilize development and confidence.

For traders specializing in EM Asia, that is significantly troublesome given most international locations within the area have robust ties with China. India, nonetheless, has emerged as a significant outlier inside Asia for its minimal attachment to China’s downward pull.

China is the highest buying and selling companion for a lot of Asian international locations, and (together with Hong Kong) accounts for 11% of growing Asia’s complete exports. By distinction, it accounted for simply 5.5% of India’s complete exports in 2022, having fallen from 12.1% in 2010.

More importantly for traders, whereas the businesses included within the MSCI Asia Pacific ex-Japan Index generate 32% of their income from China, firms within the MSCI India Index generate solely 2% from China – a transparent reflection of the Indian market’s minimal publicity to China’s financial hunch.

In addition, the 2 economies’ contrasting strategy to COVID reopening illustrates their often-different home insurance policies, additional driving diverging financial performances.

In truth, because the starting of 2023, MSCI China has fallen -2.8%, considerably underperforming MSCI India’s 5.8% acquire.1

For traders, the low correlation between the 2 economies signifies that exploring the diversification advantages between India and China is usually a good supply of alpha technology.

1Return information as of August 14, 2023.

Editor’s Note: The abstract bullets for this text had been chosen by Seeking Alpha editors.

[adinserter block=”4″]

[ad_2]

Source link