[ad_1]

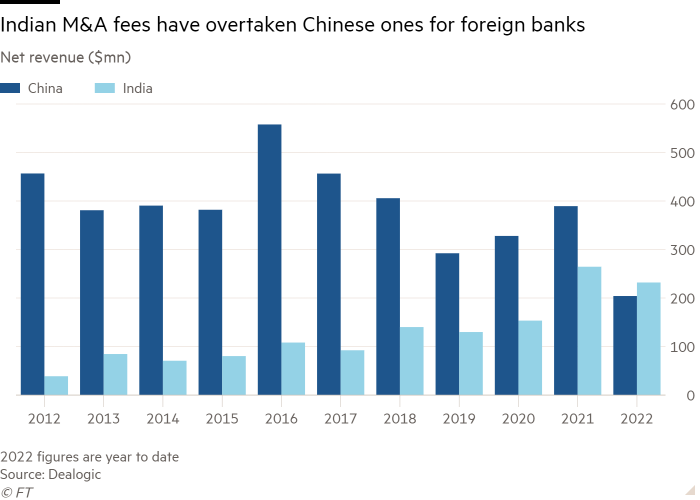

The world’s largest funding banks will earn extra dealmaking charges in India this 12 months than in China, a primary that financiers describe as a historic reorientation as they diversify away from a decoupling Chinese financial system.

Foreign banks have pulled in $231mn in mergers and acquisitions charges from India thus far this 12 months, based on Dealogic, beating the $204mn earned in China over the identical interval.

JPMorgan is amongst these that can earn extra from M&A in India than in China this 12 months for the primary time, based on two individuals with information of the financial institution’s place. JPMorgan declined to remark.

Revenue from Chinese fairness and bond markets, lengthy one of many largest sources of charges for US and European finance homes in Asia, has fallen in 2022 as mainland China sealed itself off through the pandemic and more and more favoured native banks.

Although deal exercise is predicted to develop as China now reopens, Wall Street bankers have warned that the lengthy interval of closure had made extra Chinese firms flip to home banks for advisory work sooner or later.

Foreign funding banks’ core income — together with fairness and debt capital markets in addition to mergers and acquisitions — has dropped 70 per cent to $602mn over the 12 months to this point in contrast with 2021, based on information from Dealogic. That follows a drop of 15 per cent the earlier 12 months.

The development reinforces how the decoupling in trade, investment and technology between the US and China is affecting capital markets. While India stays a fraction of the income China traditionally brings in for world funding banks, the numbers are indicative of a broader shift by western finance to seek out alternatives and progress in different markets.

Jan Metzger, head of banking, capital markets and advisory for Citi in Asia, mentioned “the evolution of the banking wallet there with the growth in tech, alongside the established Indian corporate titans being more active” had made India a “leading investment banking market for Citi in 2022”.

He added: “We expect that to continue in the years ahead with the pipeline [in India], one of the largest we have.”

The Singapore-based Asian funding banking head of 1 US financial institution described it as a “fundamental and I think permanent repositioning by Wall Street. If you believe Xi Jinping is intent on building his own sphere of economic influence, while the US shows no sign of stopping its crackdown on China, where else do you go in the region?”

India has been a worldwide outlier for M&A exercise this 12 months, at the same time as inflation and recession fears pressured a few of the largest declines in dealmaking in different areas because the monetary disaster. M&A exercise in India surged 58 per cent 12 months on 12 months to an all-time excessive of $148bn within the first 9 months of 2022, based on a report by Refinitiv, a knowledge supplier. A big chunk of that got here from the $40bn merger between HDFC Bank, India’s third-biggest listed firm by market capitalisation, and mum or dad Housing Development Finance Corporation, the main mortgage supplier.

Bankers additionally mentioned {that a} shift in the kind of Indian firms partaking them for preliminary public providing and fairness issuance work had been pivotal. When a lot of India’s largest listings had been privatisations of state-owned belongings, the charges had been comparatively low. Now that the stability has shifted to non-public firms, the work is considerably extra worthwhile.

The banking business’s shift follows a similar dynamic at play in India’s tech sector last year, when many funding {dollars} had been diverted from China to India. For each greenback invested in Chinese tech, $1.50 went into India in 2021, based on Asian Venture Capital Journal, although slower progress and rising rates of interest this 12 months helped scale back inflated valuations and a few of the market frenzy.

“India can be unpredictable and certainly foreign businesses have been burnt [there] before. But you can no longer have all your eggs in one basket like China, especially as supply chains and economies decouple,” mentioned one asset supervisor rising their India workplace, who didn’t wish to be named as a result of they nonetheless had shoppers and enterprise in mainland China.

Additional reporting by Chloe Cornish in Mumbai

[adinserter block=”4″]

[ad_2]

Source link