[ad_1]

A Wood Mackenzie report forecasts China will dominate photo voltaic manufacturing by means of 2026, holding greater than 80% of poly, wafer, cell and module manufacturing capability for the following three years.

A Wood Mac report forecasts that India will overtake Southeast Asia because the second-largest module manufacturing area by 2025. The nation is experiencing a robust construct out in photo voltaic manufacturing, due to sturdy authorities coverage within the type of PLI incentives.

The report, “How will China’s expansion affect global solar module supply chains?,” finds that China’s coverage help for and funding in manufacturing throughout the photo voltaic provide chain will hold the nation on prime by way of capability by means of 2026.

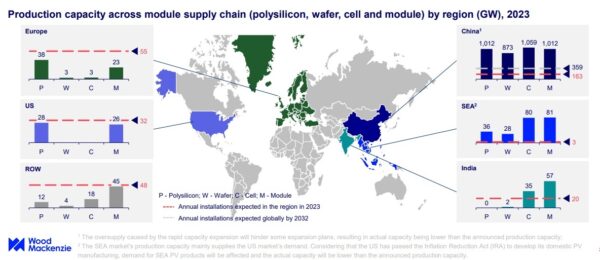

China has invested an estimated $130 billion into its photo voltaic trade this 12 months, in keeping with the Wood Mackenzie report. With greater than 1 TW of wafer, cell and module forecast to return on-line within the subsequent 12 months, China could have sufficient capability to satisfy international demand by means of 2032, the report says.

“China’s solar manufacturing expansion has been driven by high margins for polysilicon, technology upgrades and policy support,” mentioned Huaiyan Sun, senior advisor at Wood Mackenzie, and writer of the report. “And despite strong government initiatives for developing local manufacturing in overseas markets, China will still dominate the global solar supply chain and continue to widen the technology and cost gap with competitors.”

The report forecasts that China will maintain greater than 80% of the world’s polysilicon, wafer, cell, and module manufacturing capability from 2023 to 2026. In addition, not solely will the nation dominate in capability, its product will come at a decrease price. For instance, the report says {that a} module made in China is half the worth of that made in Europe and 65% lower than that made within the U.S.

This comes as no shock as a result of, as famous on the current pv journal Roundtables US 2023, constructing a provide chain takes time. It has been simply over a 12 months because the passage of the Inflation Reduction Act (IRA) within the U.S., which incorporates $370 billion to help renewable power construct out. Expert panelists famous that they count on the U.S. to be heavy with downstream photo voltaic manufacturing, and “we’ll have to continue to rely on imports from foreign partners for polysilicon, ingots and wafers to the U.S.,” mentioned MJ Shiao, vice chairman of provide chain and manufacturing for the American Clean Power Association. Shiao estimated that it could possibly take from three to 5 years to construct new polysilicon manufacturing.

The buildout of U.S. photo voltaic manufacturing will start with modules, which Shiao mentioned is the good method to go to make sure that we meet the downstream demand, then begin to search for extra of the upstream a part of the provision chain to satisfy home demand. But upstream manufacturing takes time, the panelists agreed.

“Despite considerable module expansion plans, overseas markets still cannot eliminate their dependence on China for wafers and cells in the next three years,” Sun mentioned.

The U.S. isn’t the one area in search of wafer and cell capability. As seen within the chart under, Europe and the U.S. each have polysilicon and module capability, however fall far quick in wafers and cell. Southeast Asia, however, has practically matched capability for cells and modules, with India not far behind.

As different areas are slower to ramp up cell manufacturing, China will proceed to be the chief in capability, holding an estimated 17 instances extra cell capability than the remainder of the world.

However, it’s not with out its challenges. The report notes that China has lately introduced the termination of greater than 70 GW in capability on account of oversupply and competitors. This primarily considerations previous manufacturing traces that produce decrease effectivity p-type and M6 cells. Wood Mac analysts count on p-type cells to say no to only 17% of provide by 2026.

This content material is protected by copyright and might not be reused. If you need to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.

[adinserter block=”4″]

[ad_2]

Source link