[ad_1]

In the center of Gautam Adani’s infrastructure empire, engineers slot metal items collectively to make wind generators. Nearby, staff function machines in a manufacturing unit spitting out photo voltaic panels, overshadowed by 4 candy-striped cooling towers of India’s largest non-public coal-fired energy station.

The three amenities are a part of the 37,000-acre Mundra port and particular financial zone, the showpiece of Adani’s sprawling conglomerate and the vacation spot for billions of {dollars} in new investments, from a copper smelter to a coal-to-plastic manufacturing unit.

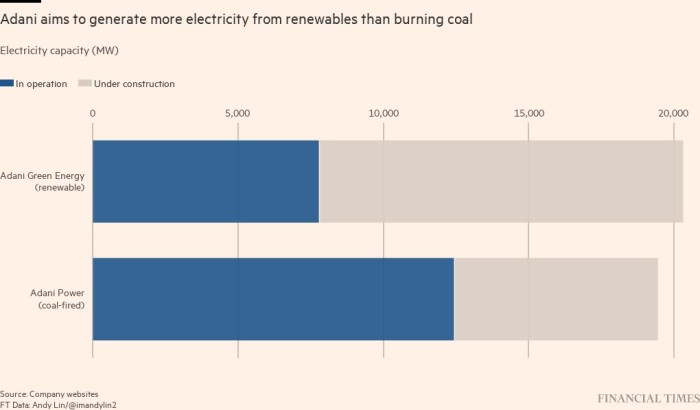

Asia’s richest man is embarking on a fundraising effort to handle his debt and proceed his fast enlargement, as he confronts questions in regards to the firm’s leverage and investor strain to maneuver away from fossil fuels. The 60-year-old first-generation entrepreneur has pledged to speculate $70bn in inexperienced power know-how by 2030, at the same time as he continues to develop a multinational coal enterprise.

Adani, who raised $2bn from Abu Dhabi fund International Holding Company this 12 months, stated he anticipated additional funding from “many sovereigns”. He added: “We want our investors to be as long as the Adani family.”

Adani’s fundraising ambitions echo that of fellow tycoon Mukesh Ambani, whose Reliance Industries tapped world buyers together with Facebook, KKR and Mubadala for $20bn in 2020 because it sought to chop down money owed.

Adani’s renewables unit raised $750mn in inexperienced bonds this 12 months, and in December introduced a $200mn yen-denominated refinancing facility with MUFG Bank and Sumitomo Mitsui Banking Corporation appearing as principal lenders. Adani Enterprises, one other listed entity, is looking for to boost round $2.5bn from issuing new shares to retail and institutional buyers.

Investors “are notably polarised” over Adani Enterprises’ fundraising as a result of the listed entity has very high valuations, stated Praveen Jagwani, chief government of UTI International, an Indian asset supervisor in Singapore. Jagwani added that Adani was elevating funds largely to “reduce the interest burden. Equity is way cheaper than debt”.

During an interview at his places of work in Gujarat’s enterprise capital Ahmedabad, Adani stated he was assured about securing financing for renewable companies based mostly on the pressing have to decarbonise.

“Every [multilateral] agency has obligations to finance. Every banking system, every hedge fund, every private equity fund, every investor . . . is under the pressure of not investing in fossil fuels and investing into the energy transition,” Adani stated.

Adani insisted that his group can be the primary port of name for worldwide buyers betting on India. “We are the largest group in India, followed by Tata, followed by Reliance,” he stated, referring to 2 conglomerates which might be additionally investing closely in renewables. “So when someone wants to invest into India, where will they go first?”

Adani, a university dropout and erstwhile diamond service provider, is pushing into new markets at a breakneck tempo. This 12 months, the group acquired Holcim’s Indian cement enterprise in a $10bn deal financed by international banks to grow to be the nation’s second-largest cement participant in a single day. The group additionally raised $760mn from seven state-owned banks to construct a copper-smelting plant and introduced $7bn in alumina and iron ore tasks.

Adani’s debt-fuelled progress has raised considerations about its borrowing, with CreditSights, a part of Fitch, warning that the group was “deeply overleveraged”. Adani Group stated its firms had mixed money owed of Rs1.95tn ($24bn), nearly seven instances mixed earnings earlier than curiosity, tax, depreciation and amortisation of Rs296bn.

Adani argued that some analysts “have not understood [his businesses] in real terms”.

“Who understands are my lenders, my banks, my global investors. Every time Adani comes into the market, they love to invest. And that’s how we are continuously growing.”

Critics stated Adani’s renewables push helped him increase cash whereas his polluting companies continued rising. Adani has been “phenomenally successful to date at convincing the western market that the right hand is different to the left hand, and if you fund Adani Green you are not funding Adani Power or Adani Enterprises,” stated Tim Buckley, director of Climate Energy Finance, an Australian think-tank.

Adani stated that “not more than 10 per cent” of the Group’s income got here from coal, whereas contending that it was unfair to demonise India for utilizing its ample coal reserves.

The billionaire businessman stated that he benefited from aligning his renewables push with India’s pursuits and New Delhi’s decarbonisation objectives. “We aligned our business and business ambition in line with government wishes. And because of that we always got tailwind.”

But a stronger pivot away from coal is critical, stated consultants. Adani’s “investment into fossil fuels is likely to get stranded in the next few years,” stated Vibhuti Garg, south Asia director on the Institute for Energy Economics and Financial Analysis.

Adani is about to construct his first “green ammonia” facility lower than 100km from Mundra, a part of a $50bn, 10-year dedication with French power group TotalEnergies, which owns a 20 per cent stake in Adani’s listed renewable power firm.

Still, environmental activists have criticised Adani for ramping up mining. As a contractor, Adani Enterprises mined 27.7mn metric tonnes of coal throughout the monetary 12 months ending in 2022, a 58 per cent leap on the earlier 12 months. Adani can be establishing coal-fired energy stations below commitments made a number of years in the past.

Adani admitted that “the electricity coming out of renewables is cheaper” however insisted fossil fuels had been wanted as a result of photo voltaic and wind energy “is not 24/7”. He declined to decide to targets on phasing out coal.

“Why do we have to go and make a commitment to the world which two years down the line you have to reverse?” Adani stated, declaring that western nations backed away from coal commitments on account of power market turbulence attributable to Russia’s invasion of Ukraine.

“Self-reliance . . . energy transition, climate change, these are big, huge business opportunities,” stated Adani. “You are helping the planet, you are helping the country, but at the same time, as a corporate, these are huge business opportunities.”

[adinserter block=”4″]

[ad_2]

Source link