[ad_1]

While SkyCity Entertainment Group Limited (NZSE:SKC) won’t have the most important market cap round , it noticed a good share worth progress of 16% on the NZSE over the previous few months. Shareholders could admire the latest worth leap, however the firm nonetheless has a option to go earlier than reaching its yearly highs once more. With many analysts overlaying the inventory, we could anticipate any price-sensitive bulletins have already been factored into the inventory’s share worth. However, might the inventory nonetheless be buying and selling at a comparatively low cost worth? Let’s study SkyCity Entertainment Group’s valuation and outlook in additional element to find out if there’s nonetheless a discount alternative.

View our latest analysis for SkyCity Entertainment Group

Is SkyCity Entertainment Group Still Cheap?

Great information for traders – SkyCity Entertainment Group continues to be buying and selling at a reasonably low cost worth. According to our valuation, the intrinsic worth for the inventory is NZ$2.91, however it’s presently buying and selling at NZ$2.06 on the share market, which means that there’s nonetheless a possibility to purchase now. Another factor to remember is that SkyCity Entertainment Group’s share worth could also be fairly steady relative to the remainder of the market, as indicated by its low beta. This signifies that for those who imagine the present share worth ought to transfer in the direction of its intrinsic worth over time, a low beta might recommend it’s not prone to attain that stage anytime quickly, and as soon as it’s there, it might be onerous to fall again down into a beautiful shopping for vary once more.

What does the way forward for SkyCity Entertainment Group appear like?

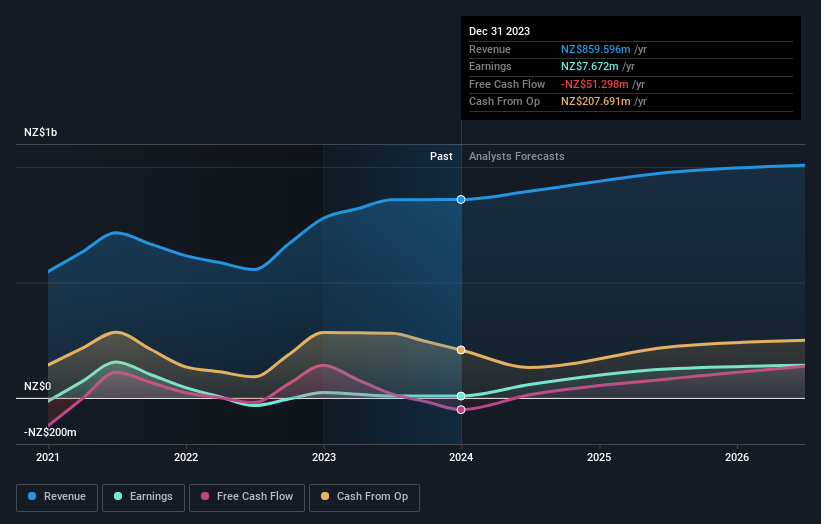

Investors searching for progress of their portfolio could wish to think about the prospects of an organization earlier than shopping for its shares. Buying an excellent firm with a sturdy outlook at an affordable worth is at all times funding, so let’s additionally check out the corporate’s future expectations. SkyCity Entertainment Group’s earnings over the subsequent few years are anticipated to double, indicating a really optimistic future forward. This ought to result in stronger money flows, feeding into a better share worth.

What This Means For You

Are you a shareholder? Since SKC is presently undervalued, it might be a good time to extend your holdings within the inventory. With a optimistic outlook on the horizon, it looks like this progress has not but been totally factored into the share worth. However, there are additionally different components similar to monetary well being to think about, which might clarify the present undervaluation.

Are you a possible investor? If you’ve been keeping track of SKC for some time, now may be the time to enter the inventory. Its affluent future outlook isn’t totally mirrored within the present share worth but, which implies it’s not too late to purchase SKC. But earlier than you make any funding selections, think about different components such because the power of its steadiness sheet, with a purpose to make a well-informed purchase.

In gentle of this, if you would like to do extra evaluation on the corporate, it is important to be told of the dangers concerned. Our evaluation reveals 3 warning signs for SkyCity Entertainment Group (1 is a bit disagreeable!) and we strongly suggest you take a look at them earlier than investing.

If you’re not inquisitive about SkyCity Entertainment Group, you should use our free platform to see our checklist of over 50 other stocks with a high growth potential.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link