[ad_1]

While Ainsworth Game Technology Limited (ASX:AGI) won’t be probably the most extensively identified inventory in the meanwhile, it acquired a number of consideration from a considerable worth motion on the ASX over the previous couple of months, growing to AU$1.10 at one level, and dropping to the lows of AU$0.95. Some share worth actions can provide traders a greater alternative to enter into the inventory, and probably purchase at a lower cost. A query to reply is whether or not Ainsworth Game Technology’s present buying and selling worth of AU$1.00 reflective of the particular worth of the small-cap? Or is it at the moment undervalued, offering us with the chance to purchase? Let’s check out Ainsworth Game Technology’s outlook and worth primarily based on the latest monetary information to see if there are any catalysts for a worth change.

View our latest analysis for Ainsworth Game Technology

What Is Ainsworth Game Technology Worth?

Ainsworth Game Technology is at the moment costly primarily based on my worth a number of mannequin, the place I have a look at the corporate’s price-to-earnings ratio compared to the business common. In this occasion, I’ve used the price-to-earnings (PE) ratio given that there’s not sufficient info to reliably forecast the inventory’s money flows. I discover that Ainsworth Game Technology’s ratio of 39.25x is above its peer common of 33.03x, which suggests the inventory is buying and selling at a better worth in comparison with the Hospitality business. If you just like the inventory, you could need to maintain a watch out for a possible worth decline sooner or later. Given that Ainsworth Game Technology’s share is pretty unstable (i.e. its worth actions are magnified relative to the remainder of the market) this might imply the value can sink decrease, giving us one other probability to purchase sooner or later. This is predicated on its excessive beta, which is an efficient indicator for share worth volatility.

Can we count on progress from Ainsworth Game Technology?

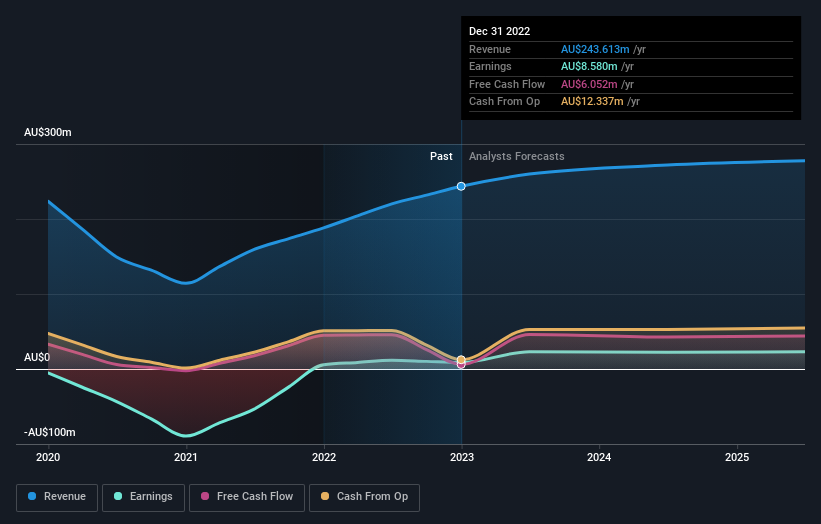

Investors in search of progress of their portfolio might need to take into account the prospects of an organization earlier than shopping for its shares. Although worth traders would argue that it’s the intrinsic worth relative to the value that matter probably the most, a extra compelling funding thesis could be excessive progress potential at an affordable worth. With revenue anticipated to greater than double over the subsequent couple of years, the longer term appears shiny for Ainsworth Game Technology. It seems to be like greater money movement is on the playing cards for the inventory, which ought to feed into a better share valuation.

What This Means For You

Are you a shareholder? AGI’s optimistic future progress seems to have been factored into the present share worth, with shares buying and selling above business worth multiples. However, this brings up one other query – is now the proper time to promote? If you consider AGI ought to commerce beneath its present worth, promoting excessive and shopping for it again up once more when its worth falls in the direction of the business PE ratio could be worthwhile. But earlier than you make this determination, check out whether or not its fundamentals have modified.

Are you a possible investor? If you’ve been holding tabs on AGI for a while, now might not be the perfect time to enter into the inventory. The worth has surpassed its business friends, which implies it’s possible that there is no such thing as a extra upside from mispricing. However, the optimistic outlook is encouraging for AGI, which implies it’s price diving deeper into different elements with a purpose to reap the benefits of the subsequent worth drop.

With this in thoughts, we would not take into account investing in a inventory except we had a radical understanding of the dangers. You’d have an interest to know, that we discovered 1 warning sign for Ainsworth Game Technology and you will need to find out about it.

If you’re not all for Ainsworth Game Technology, you need to use our free platform to see our record of over 50 other stocks with a high growth potential.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to carry you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Join A Paid User Research Session

You’ll obtain a US$30 Amazon Gift card for 1 hour of your time whereas serving to us construct higher investing instruments for the person traders like your self. Sign up here

[adinserter block=”4″]

[ad_2]

Source link