[ad_1]

Many buyers are nonetheless studying concerning the varied metrics that may be helpful when analysing a inventory. This article is for individuals who wish to find out about Return On Equity (ROE). We’ll use ROE to look at Jianzhi Education Technology Group Company Limited (NASDAQ:JZ), by means of a labored instance.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. In less complicated phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

See our latest analysis for Jianzhi Education Technology Group

How Is ROE Calculated?

The system for return on fairness is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above system, the ROE for Jianzhi Education Technology Group is:

1.5% = CN¥6.2m ÷ CN¥417m (Based on the trailing twelve months to June 2022).

The ‘return’ is the yearly revenue. So, because of this for each $1 of its shareholder’s investments, the corporate generates a revenue of $0.01.

Does Jianzhi Education Technology Group Have A Good ROE?

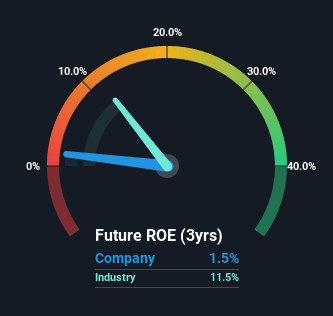

Arguably the simplest strategy to assess firm’s ROE is to check it with the typical in its business. The limitation of this method is that some corporations are fairly totally different from others, even inside the similar business classification. As proven within the graphic beneath, Jianzhi Education Technology Group has a decrease ROE than the typical (12%) within the Consumer Services industry classification.

That’s not what we prefer to see. That being mentioned, a low ROE just isn’t at all times a nasty factor, particularly if the corporate has low leverage as this nonetheless leaves room for enchancment if the corporate had been to tackle extra debt. An organization with excessive debt ranges and low ROE is a mix we prefer to keep away from given the danger concerned. You can see the 5 dangers we have now recognized for Jianzhi Education Technology Group by visiting our dangers dashboard free of charge on our platform here.

How Does Debt Impact ROE?

Companies often want to take a position cash to develop their earnings. That money can come from issuing shares, retained earnings, or debt. In the primary two circumstances, the ROE will seize this use of capital to develop. In the latter case, using debt will enhance the returns, however is not going to change the fairness. That will make the ROE look higher than if no debt was used.

Jianzhi Education Technology Group’s Debt And Its 1.5% ROE

Jianzhi Education Technology Group is freed from internet debt, which is a constructive for shareholders. Without a doubt it has a reasonably low ROE, however that is not so dangerous when you think about it has no debt. At the tip of the day, when an organization has zero debt, it’s in a greater place to take future progress alternatives.

Summary

Return on fairness is helpful for evaluating the standard of various companies. In our books, the best high quality corporations have excessive return on fairness, regardless of low debt. All else being equal, the next ROE is best.

Having mentioned that, whereas ROE is a helpful indicator of enterprise high quality, you may have to have a look at an entire vary of things to find out the fitting worth to purchase a inventory. The charge at which earnings are more likely to develop, relative to the expectations of revenue progress mirrored within the present worth, should be thought-about, too. Check the previous revenue progress by Jianzhi Education Technology Group by taking a look at this visualization of past earnings, revenue and cash flow.

Of course, you may discover a improbable funding by trying elsewhere. So take a peek at this free list of interesting companies.

What are the dangers and alternatives for Jianzhi Education Technology Group?

Jianzhi Education Technology Group Company Limited develops and offers academic content material merchandise and IT companies to greater training establishments in China.

Risks

-

Revenue has declined by 10.9% over the previous yr

-

Does not have a significant market cap ($48M)

-

Profit margins (1%) are decrease than final yr (17.5%)

-

Large one-off objects impacting monetary outcomes

-

Volatile share worth over the previous 3 months

Have suggestions on this text? Concerned concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to carry you long-term centered evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link