[ad_1]

Investment thesis

As COVID-19 is changing how people work and entertain, trends have emerged to be permanent.

One of which is online entertainment. JOYY (YY) offers short-form video entertainment through multiple apps on PC and mobile, including YY Live, Bigo Live, and Likee, and it also provides eSports entertainment through Huya (HUYA) and Hago (casual games).

Both categories are still is in their early innings of growth. However, they are proving to be very popular among generation Z and particularly sticky during times like this.

It’s easy to see why. Users in all of JOYY’s apps are spending more hours per day on these apps, then on Huya’s eSports streaming platform. 90% of users are also gamers, thus, users are both consumers of the app and also content creators.

The low valuation is what first brought us to JOYY. Further analysis shows us that JOYY has an incredibly resilient platform of video-based entertainment and that the industry setup is favorable in the long-run. As a bonus, we get exposure to Asia, where COVID-19 is better controlled.

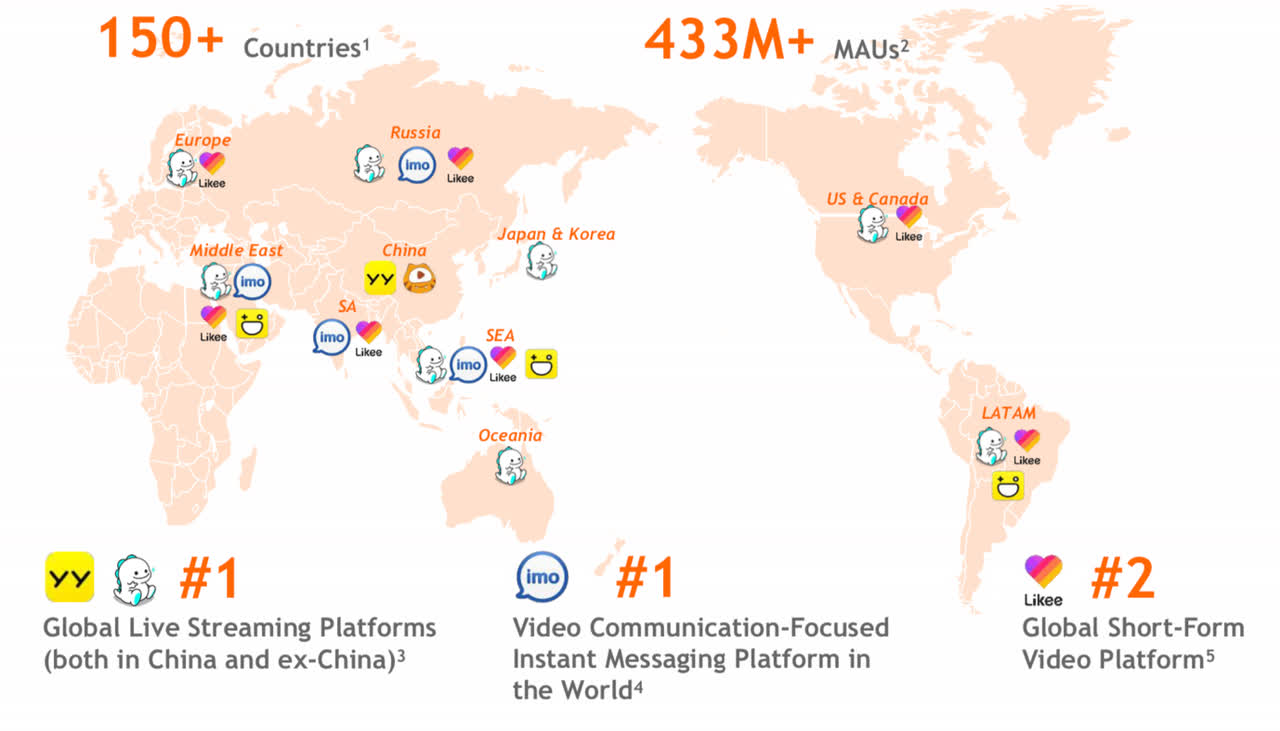

Massive user base and Bigo effect

Source: Total MAU user is 457M as at Q2 2020

Q2 2020 key stats

- Net revenues increased by 36.3% to RMB 5,840.1 million.

- Net income from continuing operations increased by 38.3% to RMB 493.6 million, driven by growing economies of scale in Bigo. Net margin was 10.6%.

- Global average mobile MAUs increased by 21.0% to 457.1 million, among that 91.0% were from markets outside of China.

- Average mobile MAUs of video communication service was 204.4 million.

- Total number of paying users of YY decreased by 2.2% to 4.1 million (excl. Huya).

|

Q2 2020 |

MAU (M) |

Growth YoY |

Revenue |

Growth YoY |

Category |

|

YY Live + IMO 1 |

41.2 |

+6% |

RMB2.7B |

(10%) |

Live stream, short-form video, and communication |

|

Bigo Live 2 |

29.4 |

+41% |

RMB3B |

148%+ |

Live-streaming, casual game, dating |

|

Likee |

150.3 |

+86% |

– |

– |

Short-form video |

|

Hago |

31.7 |

+25% |

– |

– |

eSports, casual games |

|

Huya |

168.5 |

+35% |

– |

– |

eSports |

Source: Press release

1 – YY segment includes YY Live, IMO, Likee, Hago

2 – Bigo segment includes Bigo Live

Bigo is worth at least $5B

The most impressive part of the quarter was the 148% YoY growth in Bigo. The live-streaming platform was only acquired in 2019. Today, its revenue surpasses the legacy YY segment.

Intriguingly, Bigo generates RMB 877 million gross profit in Q2, RMB 300M more than Huya, which is valued at $5.4B. If Bigo was a separate entity today, we believe it should be valued at least Huya’s current market cap, if not more, as it has a 5x stronger growth profile and is much earlier in its path to monetization.

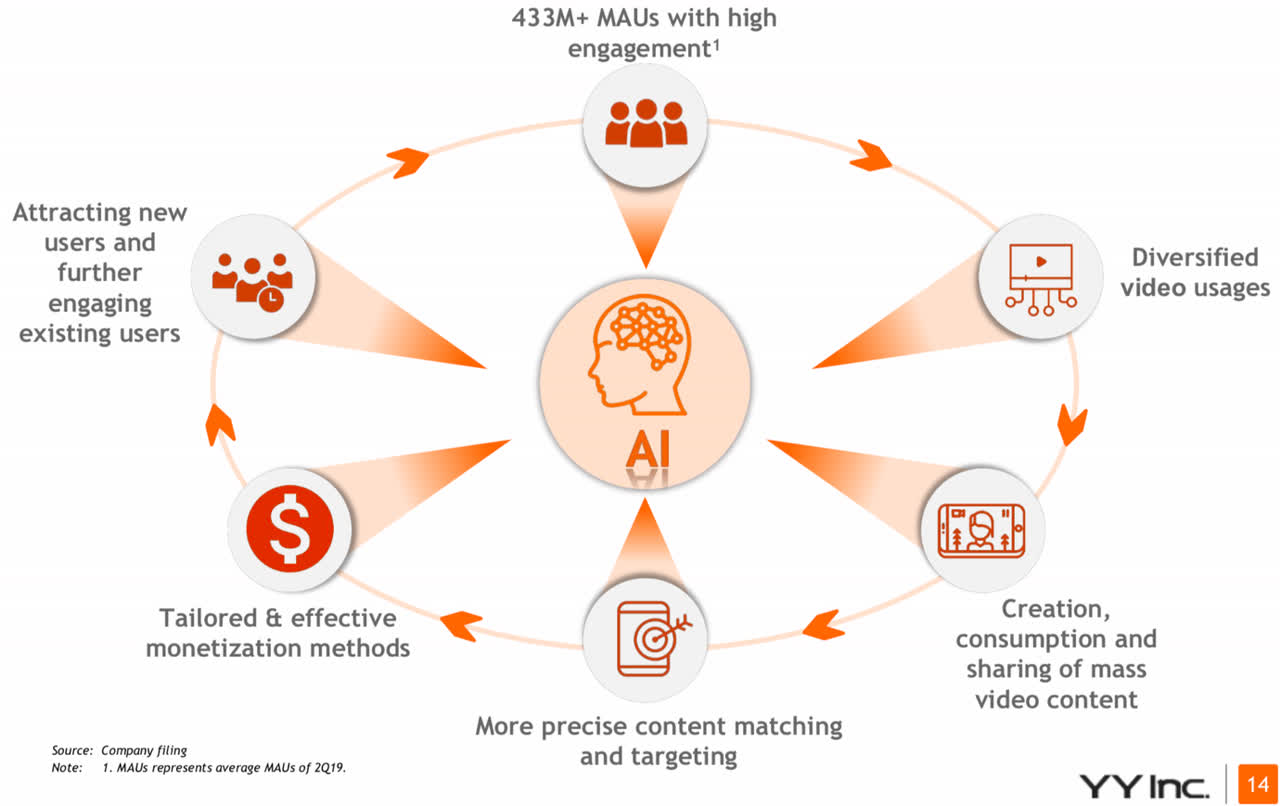

But, JOYY isn’t just about Bigo. The following three slides taken from JOYY’s corporate presentation demonstrate the strength of the company’s ecosystem and the explosive growth in the industry that JOYY is likely to benefit.

JOYY’s growing platform and explosive market size

JOYY’s massive user base will continue to grow due to a very tight ecosystem that exhibits that elusive network effect. As the user base grows, the content grows, which drives more users’ growth — the flywheel repeats, resulting in a bigger community and higher user engagement.

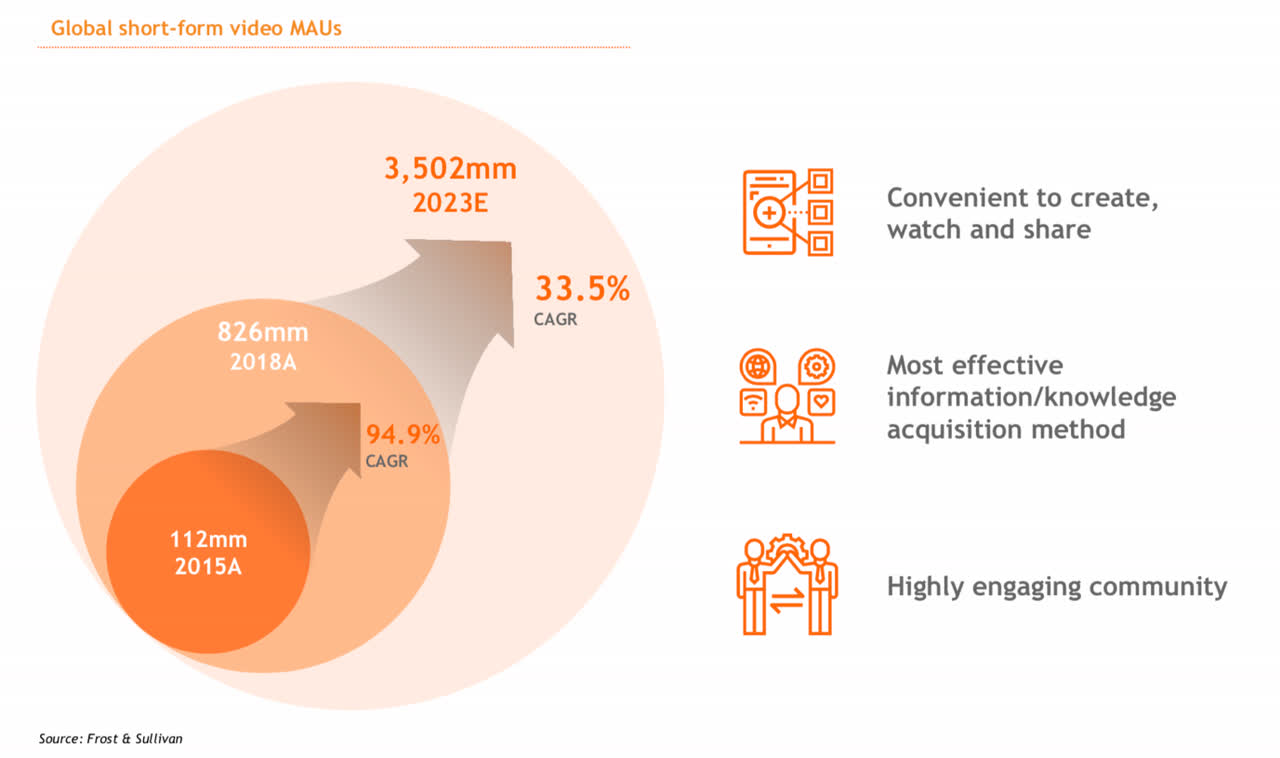

JOYY has benefited from the growing popularity of online entertainment consumption. We first heard of this explosion in video content when Mark Zuckerberg made a comment hinting his intention to invest in videos for the newsfeed on Facebook (FB) back in 2017.

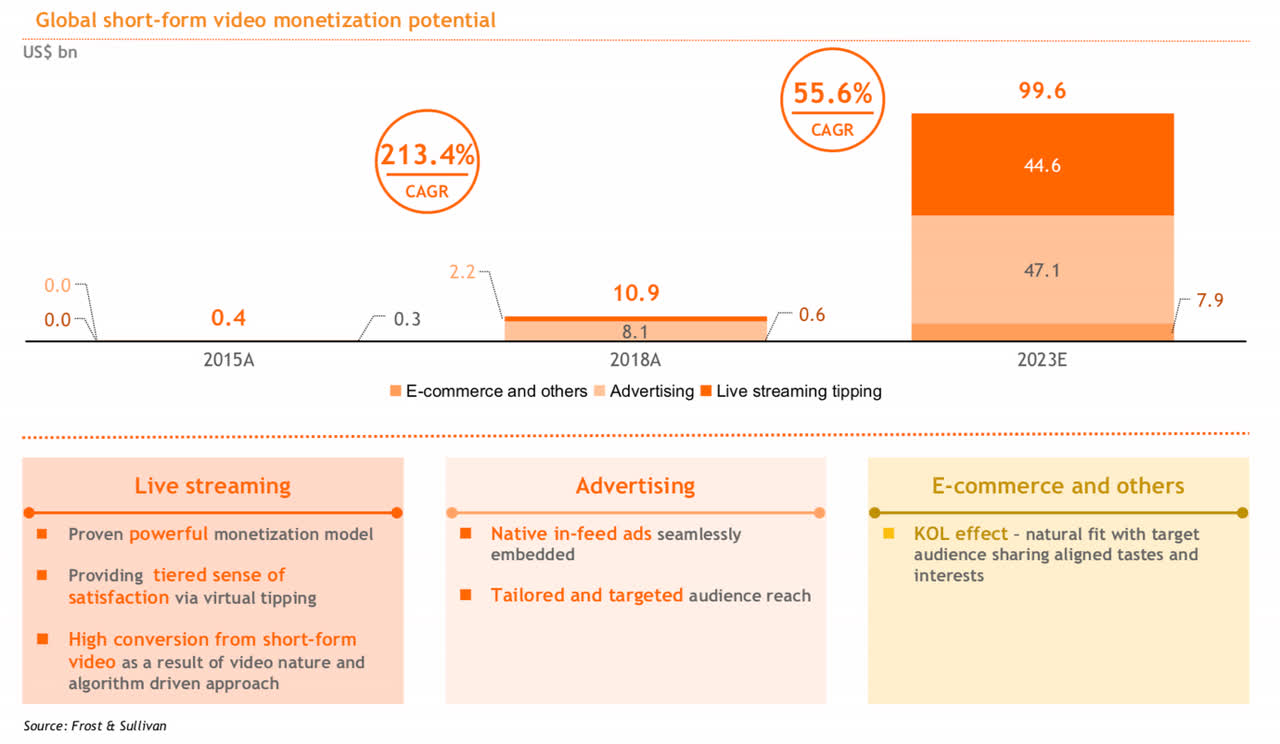

Today, JOYY has proven the trend is not hyped as it amasses 457 million users on its platform. The number is projected to grow as the industry is growing rapidly. By 2023, the short-form video industry is forecasted to attract 3.5 billion users, implying a 33.5% CAGR, in line with JOYY’s forward growth rate.

As JOYY’s platform becomes more fluid, engaging, and improves content quality, JOYY could unlock more avenues to monetize, such as placement advertising and e-commerce. Investors could wait until this happens or take a leap of faith and invest today.

Financial scorecard

For Q3 2020, the company expects to grow its revenue by 28% at the midpoint (excluding Huya). The rate of growth is still impressive, given the uncertainties.

Gross and net margins have been trending down since the acquisition of Bigo. However, we are not concerned by the apparent decline in profitability since JOYY’s cash generation is still very impressive, and let’s not forget the company has $2B of cash.

Source: Stockrow, JOYY’s gross and net margin

Source: Stockrow, JOYY’s gross and net margin

When comparing to Huya and DouYu (DOYU), JOYY is generating a higher gross margin (31% vs. 20%) and incurs less SG&A (10% vs. 20%). Thus, the potential for higher profitability is on the card. With almost half a billion users, we expect as the company turns its focus from user growth to profitability, as such, margins will improve.

Overall, we see a company that is gaining strength, already profitable, and generating cash. And they still have multiple avenues to monetize in the future.

Valuation is out of whack!

JOYY is currently trading at 1x EV/Sales and 9x EV/FCF. That is absurdly cheap compared to the sum of parts valuation of the underlying business.

If we take out the $2B cash and roughly $2B stake in Huya, the rest of JOYY carries a market value at $2.6B. There is no way to justify how any private equity wouldn’t snap this business out of the market today if it weren’t for a fact that the company still requires expert execution to grow the business fully. Bigo on its own should be valued at $5B given the hyper-growth rate and high gross margin business.

The current valuation of JOYY should be:

$2B cash +$2B Huya +5B Bigo + X in others = $9B + X

JOYY is at the very least undervalued by $2.5B, or a 35% upside at today’s prices.

Nonetheless, we do recognize that JOYY is ‘attached’ to geopolitical risks. However, we are not too concerned as the user base of JOYY’s app is very diverse and the data it collects doesn’t pose much national security risks.

Summary

We have demonstrated that JOYY is an incredible steal at $6.6B. Looking under the hood, we discover a very resilient platform of online entertainment apps that is likely to grow at 30%+ in the coming years.

Next, we know that two-third of JOYY has a marketable value of $4B. Effectively, the remaining $2.6B is what the market is currently willing to pay up to own Bigo. This part is what excites us about investing in JOYY.

This segment alone already contributes more than half of JOYY’s total revenue and forward growth trending to be at least above 100%. It also generates a higher gross profit than Huya, and we are not even scratching the surface in terms of monetization. The future is very bright for JOYY.

Disclosure: I am/we are long YY, HUYA, DOYU, MOMO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link