[ad_1]

Oscar Wong/Moment by way of Getty Images

Intro

We wrote about Kforce (Staffing Services Outfit) (NASDAQ:KFRC) in April 2022 after we assessed whether or not the multi-year bull run within the staffing & employment firm may certainly proceed. Shares on the time have been buying and selling simply beneath the $72 mark. Despite the inventory’s sturdy dividend progress charges on the time, shares regarded overbought on the technical chart. We, due to this fact, urged buyers to stay cautious (citing a ‘Hold’ score) till the inventory confirmed its near-term route.

As we see beneath, our considerations relating to the overbought nature of Kforce on the time got here to go as shares started a sample of decrease highs & decrease lows from that time earlier than bottoming out in December of that yr at simply above $52 a share. Since then, we’ve got seen a stable restoration, though shares at their present $68+ stay nicely beneath their late 2021 highs of roughly $79 a share.

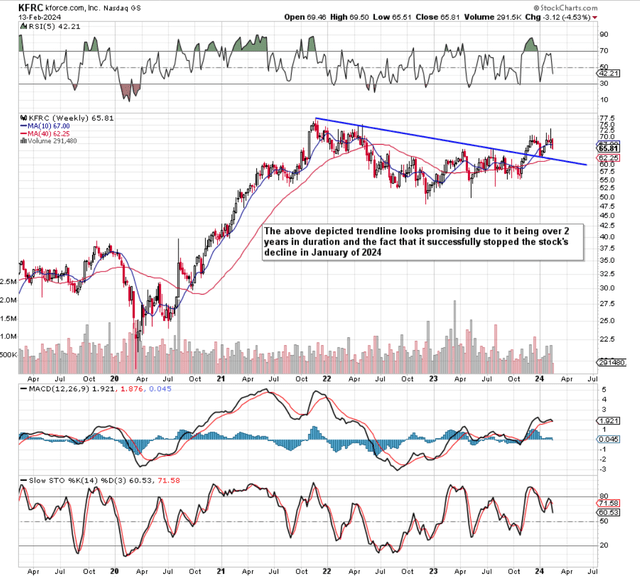

Technically, nonetheless, we do see energy at this second in time as a result of breaking out of the inventory above its multi-year trendline depicted beneath. This trendline appears to have benefit, as shares dropped down and efficiently examined this degree in early January of this yr. The preliminary upside trendline break was instigated by the corporate’s convincing earnings beat in Q3 of fiscal 2023 which in flip led to a powerful up transfer within the inventory in November of final yr. Kforce adopted on that earnings beat with a subsequent bottom-line beat in This autumn, which was simply introduced earlier this month. Therefore, let’s delve by way of that report and related traits to see if shares at the moment are primed to go on a sustained bullish run.

KFRC Technical Chart (Stockcharts.com)

This autumn Trends

Kforce reported earnings of $0.82 per share and revenues of $363.45 million within the latest fourth quarter, the place each numbers, as talked about, beat consensus projections. This meant that top-line revenues declined by roughly 10% in comparison with fiscal 2022 with GAAP earnings falling by roughly 15%. Although it’s obvious that margins contracted in fiscal 2023, Kforce stays a extremely worthwhile firm, as we are able to see from the inventory’s trailing returns on its fairness (35%+). If we have been to multiply this quantity by Kforce’s GAAP retention ratio (54%), the ensuing quantity (19%+) demonstrates how a lot administration in idea may carry on rising the annual dividend cost over time, all issues remaining equal. Suffice it to say, the latest 5.6% improve within the quarterly dividend stays nicely coated and supplies loads of left-over funding capital to maintain on constructing the enterprise in addition to aggressively purchase again firm inventory.

Sequential Improvements

To this level regarding forward-looking funding, buyers would do nicely in what’s coming down the observe right here as a substitute of specializing in the contraction in gross sales and earnings in fiscal 2023. For one, the know-how enterprise inched up in This autumn together with the FA phase the place the stabilizing of invoice pay spreads was encouraging. Therefore, if the macro image can proceed stabilizing, we imagine Kforce’s determination to focus its efforts in the suitable areas (back-office transformation, productiveness features, managed groups & mission options, and so on) ought to proceed to bear fruit in a world with growing AI know-how impression. Consensus is already pricing in these features as we see beneath with a return to twenty% bottom-line progress in fiscal 2025 after an anticipated 12%+ drop in earnings in fiscal 2024.

Therefore the important thing query is whether or not Kforce’s present valuation justifies the present unfavorable progress curve anticipated to push into fiscal 2024. Before delving into some valuation metrics, it is very important notice (even in unfavorable progress environments) that so long as Kforce can report sufficient gross sales to generate significant quantities of free money circulation, then this exact same money circulation can be utilized to construct the enterprise over time, subsequently returning the corporate to progress.

Strong Return On Capital Record

To this level, whereas top-line gross sales when ironed out over a 5-year foundation have solely elevated by roughly 5% on common per yr, the dividend has elevated by 16% on common yearly with the debt-to-equity ratio having fallen to 0.28 (nicely down from its 5-year common of 0.47). Furthermore, from a shareholder’s standpoint, the variety of shares excellent has fallen from 24.7 million on the finish of fiscal 2018 to 19.5 million on the finish of fiscal 2023 (21% decline) aiding Kforce inventory to virtually double in worth over this timeframe.

These bullish traits (within the absence of searing top-line progress) reveal Kforce’s sturdy return on capital which got here in at 25.15% on the finish of fiscal 2023. ROC can also be a powerful valuation driver that is available in nicely forward of Kforce’s 5-year common (21.51%) as we see beneath. The firm’s gross sales, earnings, and property could also be a tad dear in comparison with historic multiples however we advocate buyers deal with the next when valuing this inventory.

| Metric | Trailing 12-Month | 5-Year Average |

| P/E GAAP | 21.34 | 17.62 |

| Price / Sales | 0.85 | 0.73 |

| Price / Book | 8.06 | 5.83 |

| Price / Cash Flow | 15.44 | 12.72 |

| Return on Total Capital | 25.15% | 21.51% |

| Total Debt/Equity | 0.28 | 0.48 |

Technology Spending To Continue to Rise

Firstly, the corporate’s determination to focus extra on its know-how providing submit the nice recession of 2008 has arrange Kforce for sustained progress going ahead. Why do we are saying this? Well with common charged invoice charges of roughly $90 an hour, Kforce is in a powerful place to maintain benefitting from elevated demand. Strong digitization & cloud tailwinds just about be sure that Kforce’s money circulation will stay sturdy as its blue-chip prospects proceed to avail from in-demand technologists over time.

Therefore, as know-how spending continues to extend, buyers shouldn’t underestimate the long-standing relationships that Kforce has garnered over time with its prospects on this area. The profit of those relationships is two-fold in that aside from holding a stronger place in comparison with opponents, Kforce also can cost extra per hour in comparison with its conventional staffing phase.

Downside Risks

From a technical standpoint, the 40-week transferring common of $62+ per share supplies stable draw back help contemplating the inventory is buying and selling as talked about simply north of $68 per share at current. Furthermore, Kforce’s market cap of $1.3 billion and respectable buying and selling quantity give the above-mentioned multi-year supporting pattern line extra benefit over a micro-cap play for instance.

From a macro perspective, forward-looking staffing demand will definitely play a task in Kforce’s in regards to the US labor market could also be thought of ‘mute’ at current. Furthermore, bears could state that since 100% of the corporate’s revenues are derived from the US, this additional brings jurisdiction danger regarding Kforce’s localized revenues.

Nevertheless, buyers must separate company ‘elective’ spending versus what will likely be wanted over the upcoming years. Suffice it to say, that even when the unemployment price inches up in 2024 within the US, Kforce’s appreciable multi-national prospects know that sustained digitization must happen internally to stay aggressive in a worldwide panorama. Suffice it to say, that know-how spending (as programs & processes slowly part out labor over time) going ahead will most probably happen alongside rising unemployment. The key’s to find out the place staffing ranges are being downsized as we imagine it is not going to be going down within the know-how area.

Conclusion

Therefore, to sum up, we’re bullish on Kforce attributable to its encouraging technicals, and sequential monetary enhancements in addition to the corporate’s lengthy runway for progress within the know-how area. Therefore, regardless of the corporate’s above-average valuation multiples right now, Kforce’s rising ROC and decreasing debt factors to secure money flows will solely develop going ahead. An preliminary lengthy place appears pertinent at current adopted by a bigger place when it’s clear that the inventory has damaged above its all-time highs ($78+) We sit up for continued protection.

[adinserter block=”4″]

[ad_2]

Source link