[ad_1]

Tex Cycle Technology (M) Berhad (KLSE:TEXCYCL) has had a terrific run on the share market with its fill up by a major 100% over the past month. However, we determined to concentrate to the corporate’s fundamentals which do not seem to provide a transparent signal concerning the firm’s monetary well being. In this text, we determined to give attention to Tex Cycle Technology (M) Berhad’s ROE.

Return on Equity or ROE is a check of how successfully an organization is rising its worth and managing buyers’ cash. In quick, ROE exhibits the revenue every greenback generates with respect to its shareholder investments.

View our latest analysis for Tex Cycle Technology (M) Berhad

How Is ROE Calculated?

The formulation for return on fairness is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above formulation, the ROE for Tex Cycle Technology (M) Berhad is:

6.0% = RM7.3m ÷ RM122m (Based on the trailing twelve months to September 2022).

The ‘return’ is the revenue over the past twelve months. That signifies that for each MYR1 price of shareholders’ fairness, the corporate generated MYR0.06 in revenue.

What Has ROE Got To Do With Earnings Growth?

So far, we have discovered that ROE is a measure of an organization’s profitability. We now want to judge how a lot revenue the corporate reinvests or “retains” for future progress which then offers us an concept concerning the progress potential of the corporate. Generally talking, different issues being equal, corporations with a excessive return on fairness and revenue retention, have a better progress fee than corporations that don’t share these attributes.

A Side By Side comparability of Tex Cycle Technology (M) Berhad’s Earnings Growth And 6.0% ROE

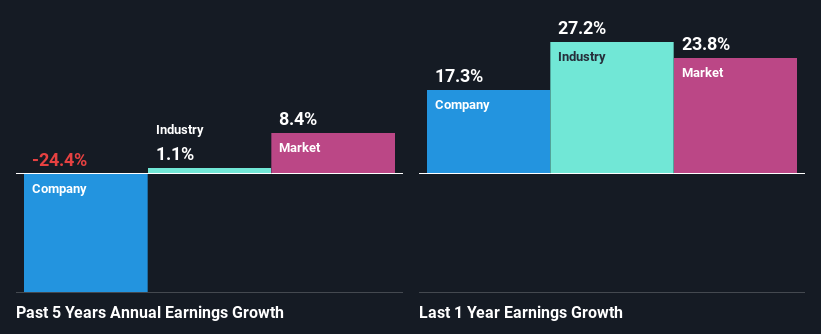

When you first take a look at it, Tex Cycle Technology (M) Berhad’s ROE would not look that enticing. A fast additional research exhibits that the corporate’s ROE would not examine favorably to the trade common of 10% both. Therefore, it won’t be mistaken to say that the 5 12 months web earnings decline of 24% seen by Tex Cycle Technology (M) Berhad was most likely the results of it having a decrease ROE. We consider that there additionally is likely to be different elements which can be negatively influencing the corporate’s earnings prospects. For occasion, the corporate has a really excessive payout ratio, or is confronted with aggressive pressures.

So, as a subsequent step, we in contrast Tex Cycle Technology (M) Berhad’s efficiency in opposition to the trade and have been upset to find that whereas the corporate has been shrinking its earnings, the trade has been rising its earnings at a fee of 1.1% in the identical interval.

Earnings progress is a big think about inventory valuation. It’s necessary for an investor to know whether or not the market has priced within the firm’s anticipated earnings progress (or decline). By doing so, they may have an concept if the inventory is headed into clear blue waters or if swampy waters await. Is Tex Cycle Technology (M) Berhad pretty valued in comparison with different corporations? These 3 valuation measures may make it easier to resolve.

Is Tex Cycle Technology (M) Berhad Efficiently Re-investing Its Profits?

Tex Cycle Technology (M) Berhad’s low three-year median payout ratio of 24% (or a retention ratio of 76%) over the past three years ought to imply that the corporate is retaining most of its earnings to gasoline its progress however the firm’s earnings have really shrunk. This sometimes should not be the case when an organization is retaining most of its earnings. It seems to be like there is likely to be another causes to clarify the dearth in that respect. For instance, the enterprise could possibly be in decline.

Moreover, Tex Cycle Technology (M) Berhad has been paying dividends for at the very least ten years or extra suggesting that administration will need to have perceived that the shareholders desire dividends over earnings progress.

Summary

On the entire, we really feel that the efficiency proven by Tex Cycle Technology (M) Berhad might be open to many interpretations. Even although it seems to be retaining most of its earnings, given the low ROE, buyers is probably not benefitting from all that reinvestment in spite of everything. The low earnings progress suggests our concept right. Wrapping up, we’d proceed with warning with this firm and a technique of doing that might be to take a look at the danger profile of the enterprise. You can see the three dangers we’ve got recognized for Tex Cycle Technology (M) Berhad by visiting our dangers dashboard without spending a dime on our platform here.

Valuation is advanced, however we’re serving to make it easy.

Find out whether or not Tex Cycle Technology (M) Berhad is probably over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to convey you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link