[ad_1]

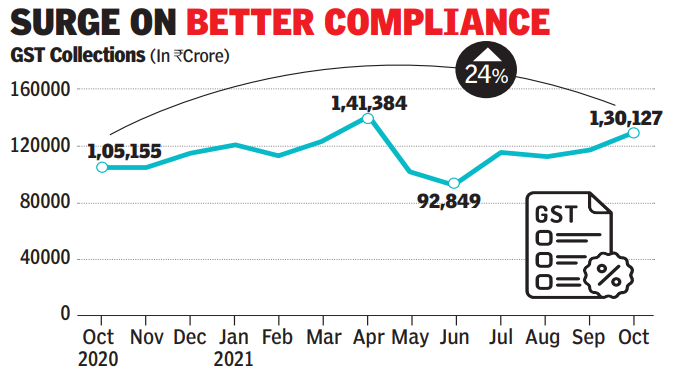

Data released by the finance ministry on Monday showed GST receipts in October were 24% higher than the revenues in the same month last year, and 36% over 2019-20. Revenues from import of goods was 39% higher, and revenues from domestic transactions (including import of services) were 19% more than the revenues from these sources during October 2020, the finance ministry said in a statement. This is the fourth straight month of receipts crossing Rs 1 lakh crore. The highest collection so far was in April this year.

“This is very much in line with the trend in economic recovery. This is also evident from the trend in the e-way bills generated every month since the second wave,” the finance ministry said. “The revenues would have still been higher if the sales of cars and other products had not been affected on account of disruption in supply of semiconductors.”

Since the lifting of curbs after the second Covid-19 wave, revenues have been robust, thanks to the economic rebound. The ministry said the mop-up has also been aided by the efforts of the state and central tax administration, resulting in increased compliance over previous months.

It said that in addition to action against individual tax evaders, this has been a result of the multipronged approach followed by the GST Council. Measures taken to ease compliance include nil filing through text messages, enabling the quarterly return monthly payment (QRMP) system and auto-population of returns. “Overall, the impact of these efforts has ensured increased compliance and higher revenues… more steps to restrict fake ITC (input tax credit) are under consideration of the GST Council,” the ministry’s statement said.

In the past year, GSTN — the IT backbone — has augmented the system capacity considerably to improve user experience. The council has also taken various steps to discourage non-compliant behaviour, like blocking of e-way bills for non-filing of returns, system-based suspension of registration of taxpayers who have failed to file six returns in a row and blocking of credit for return defaulters.

Economists expect the healthy trend to persist in the months ahead. “The six-month high GST collections of October 2021 are a reflection of the healthy pickup in GST e-way bills in September 2021, led by pre-festive season stocking, as well as improved compliance,” said Aditi Nayar, chief economist at ratings agency ICRA. “With the October 2021 GST e-way bills expected to exceed the level seen in the previous month, the headline GST collections are slated to remain healthy in a range of Rs 1.25-1.35 trillion in November 2021. Overall, we expect CGST collections to exceed the government FY2022 budget estimate of Rs 5.3 trillion by up to Rs 500 billion.

“Although the supply issues related to semiconductor availability could continue to constrain the performance of GST compensation cess, we do not expect the budget estimate of Rs 1 trillion to be missed, with Rs 0.6 trillion already raised in the first seven months of this fiscal,” said Nayar.

[ad_2]

Source link