[ad_1]

LAYERED ownership structures, accessed as part of Pandora Papers investigation, reveal the offshore footprints of the promoters of Bharat Hotels Group which was raided in connection with its “undisclosed foreign assets” by the Central Board of Direct Taxes (CBDT) in January 2020.

According to records of Trident Trust (BVI), a corporate service provider, investigated by The Indian Express, Bharat Hotels promoter Jyotsna Suri’s interests in hotel projects Dubai and London were held by an offshore subsidiary of Deeksha Holdings Limited, the largest shareholder (40.41%) in Bharat Hotels Limited.

In 2017, Deeksha Holdings was held 73% by Jyotsna Suri.

The balance was split between Suri’s Premium Exports Limited (8%), her brother Jayant Nanda’s since dissolved Panamanian company Richmond Enterprises SA (15%), and son Keshav (4%).

Deeksha Holdings set up a subsidiary Premium Holdings Limited in the Isle of Man in 1993. This entity owned 33.3% in Cavern Hotel and Resort FZCO (Dubai), a JV between Bharat Hotels and UAE-based real estate developer Nakheel, for developing a Dubai hotel.

In addition, Bharat Hotels Group held 16.67% in Cavern Hotel and Resort FZCO (Dubai) through its Indian subsidiary Prima Buildwell Pvt Ltd.

Premium Holdings (IoM), show records, also owned Grand Hotel and Investments Limited, a BVI company incorporated in 2005, where Suri was the “principal beneficiary”. This BVI entity was the sole shareholder of St Olave’s Limited, a UK company set up in March 2016, before transferring the ownership to her Dubai-based brother Jayant Nanda in December 2016.

Under a 10-year contract signed in 2017, shows a draft red herring prospectus filed with SEBI in 2018, Bharat Hotels Limited granted St Olave’s Limited the rights to use the LaLit trademark for its London hotel launched in November 2016 and took the responsibility of managing its operations for a consideration of 7% of the gross annual revenue of the hotel.

Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

Jyotsna Suri, Jayant Nanda and senior officials of Bharat Hotels Limited did not respond to queries from The Indian Express.

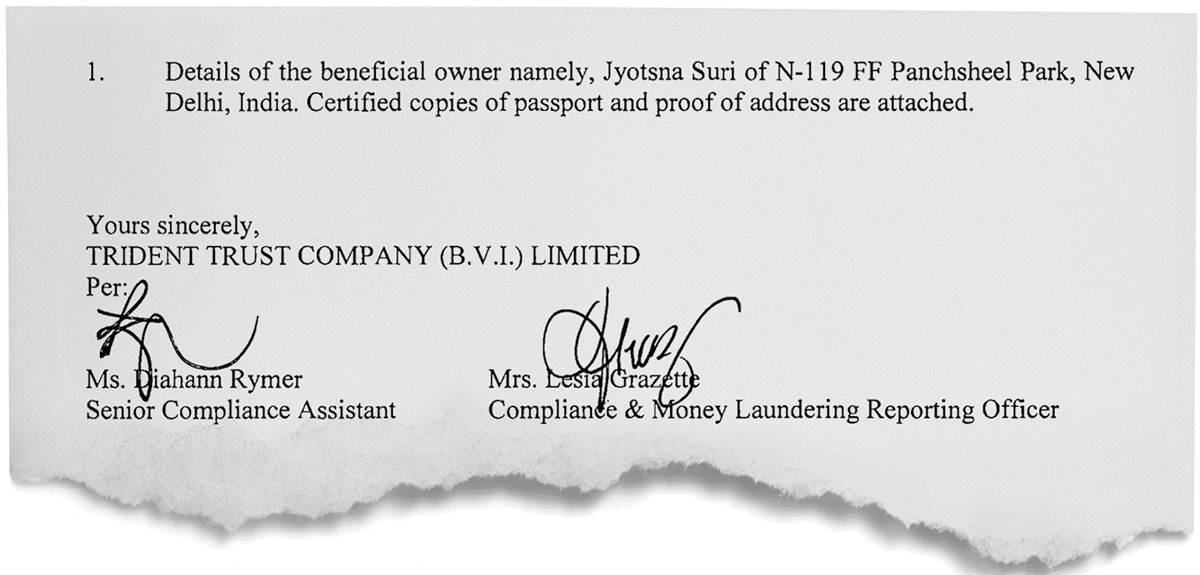

In July 2018, records show, Trident Trust (BVI) furnished information on Grand Hotel and Investments Limited (BVI) to the International Tax Authority set up under the country’s finance ministry (see chart).

Records have Suri as the beneficial owner of Grand Hotel and Investments Limited in BVI.

Records have Suri as the beneficial owner of Grand Hotel and Investments Limited in BVI.

According to the financial statements filed by St Olave’s Limited (UK), the company is reliant on financial support from Premium Holdings Limited (IoM). In 2019, Grand Hotel and Investments Limited (BVI) availed a loan from Yes Bank with St Olave’s Limited as the charger (mortgagor) of an unspecified charged property.

Subsequently, records show, “the balance owed to a connected company” (Grand Hotel and Investments Limited) was transferred to the “existing shareholder” (Jayant Nanda) of St Olave’s Limited and converted into 4,772,413 ordinary shares of £1 each. As of March 2020, Nanda held all 4,772,414 shares in St Olave’s Limited.

As reported by The Indian Express during the Panama Papers investigation, Jayant Nanda through his (now dissolved) Panamanian company Richmond Enterprises SA partnered Indian-born Dutch businessman Kul Rattan Chadha’s J&W Inc (Bahamas) until 2006.

Until 2016 when it was dissolved, records show, a BVI company, Perennial Investments Limited, held assets worth US$ 6.1 million in stocks and cash for Oasis Trust, which was set up in 1992 with Jyotsna Suri as Protector and her late husband Lalit Suri as Settlor.

Jyotsna, her son Keshav, daughters Divya, Deekhsha, Shradha, brother-in-law Ramesh and his wife Ritu, and brother Jayant Nanda were named as beneficiaries.

[ad_2]

Source link