[ad_1]

Michael Blann/DigitalVision by way of Getty Images

Investment Thesis

PENN Entertainment (NASDAQ:PENN) is among the largest gamers within the industrial gaming trade within the U.S. Their intensive vary of conventional and on-line playing, betting and leisure merchandise create a differentiated portfolio which permits for a tangible financial moat to exist for the agency.

The big market selloff post-COVID has led to share costs dropping nearly 90% since early 2021. In the meantime, PENN has solely strengthened their operational talents and cashflow era potential.

Therefore, I imagine an actual deep-value play may very well be current due to the potential 66% undervaluation at present current in shares.

Company Background

PENN Entertainment (renamed from Penn National Gaming in 2022) is a North American supplier of built-in leisure, sports activities content material and on line casino gaming experiences. The firm is one of some market leaders within the trade and operates a formidable portfolio of on-line sports activities betting and that iCasino companies.

The gaming agency operates a number of properly acknowledged manufacturers together with Hollywood Casino, L’ Auberge and Barstool Sportsbook. Their enterprise technique revolves round sustaining a extremely differentiated portfolio with a major concentrate on maximizing cross-selling alternatives.

Recent acquisitions of Barstool Sports in 2020 and Score Media and Gaming (theScore) in 2021 have additional elevated the breadth and presence PENN achieves within the on-line betting market.

PENN has lately launched a extremely enticing loyalty program that reaches over 26 million members. The provision of unique rewards and presents to loyal prospects has been designed to extend member satisfaction ranges and create switching prices for customers trying to guess utilizing different platforms.

Economic Moat – In Depth Analysis

PENN harbors a sturdy and mid-sized financial moat pushed primarily by the numerous breadth of their product portfolio and the sticky nature of their rewards applications.

Through a number of acquisitions over time, PENN has grown to function greater than 43 casinos and racetracks, a number of market main sports activities betting websites together with a number of on-line gaming and that iCasino platforms.

The firm additionally operates resorts and built-in gaming resorts together with two omnichannel media companies which create content material beneath the well-known “Barstool Sportsbook” moniker.

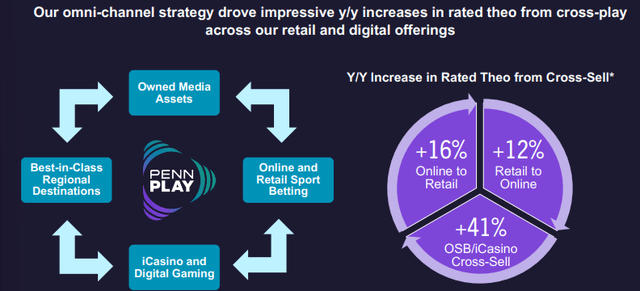

This huge strategy permits PENN to focus on a number of totally different gaming classes and leverages their energy to create natural cross-selling throughout these varied companies.

While gaming stays PENN’s largest enterprise section by income stream, the importance of their resorts and meals & beverage segments can’t be overstated.

I imagine these segments allow PENN to distinguish their merchandise from the competitors by providing prospects with the choice to interact in a extra holistic leisure expertise with their suite of product choices.

While a buyer could initially have interaction with PENN gaming manufacturers, the power for a similar consumer to then ebook a resort vacation at a PENN on line casino resort permits for the potential to vastly enhance the income earned per buyer.

PENN’s huge product portfolio additionally creates moatiness for the agency due to the high-profile and well-liked brands the corporate operates. Huge Casino manufacturers comparable to L’Auberge, Hollywood Casinos, Margaritaville and Plainridge Park are simply among the 12 retail manufacturers PENN operates.

Similar blockbuster-level names are current of their on-line gaming section with hollywoodcasino.com and PENN Play Casino. On the sports activities betting aspect, PENN now operates each Barstool Sportsbook and theScore Bet.

These big title manufacturers create important moatiness for the corporate due to the repute and curiosity these banners convey to the general portfolio. By attracting prospects into the enterprise with well-liked manufacturers, PENN is ready to effectively and successfully cross-sell merchandise from different model households.

I view PENN’s sports activities betting, iCasino and media companies as important future moatiness and income drivers. The rising popularity of those digital gaming mediums and PENN’s distinctive set of high-quality and trusted manufacturers in these markets ought to yield the corporate with important beneficial properties sooner or later.

PENN FY23 Q1 Presentation

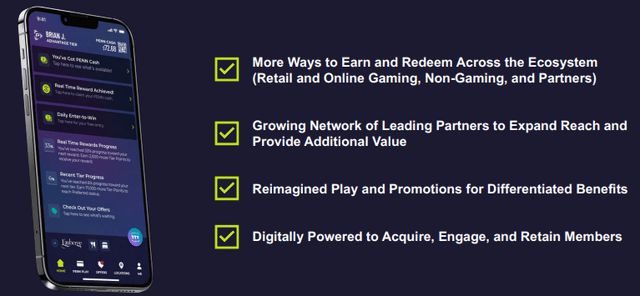

Another key driver I imagine contributes meaningfully to PENN’s financial moat is their intensive rewards program “PENNPLAY” (previously “mychoice”). This program at present presents round 26 million members with a novel set of rewards and experiences throughout a number of totally different enterprise channels.

The program permits members to obtain customized promotions and rewards starting from reductions at totally different resorts and resorts to extra PENN Cash and credit to make use of on the PENN Play Casino app.

PENN additionally presents prospects the chance to acquire a PENN Mastercard (MA) Credit Card which additional earns annual tier factors and PENN Cash when making conventional credit score purchases.

This rewards program is among the most intensive within the trade. In my opinion this rewards scheme significantly will increase the power for PENN to retain prospects who enter their gaming ecosystem.

Rewards applications are psychologically confirmed to be extremely “sticky” components customers contemplate when selecting the place to spend their discretionary earnings. Therefore, it ought to come as no shock that PENN is leaning closely into their new rewards program which creates motivation and need for customers to play extra.

Overall, I imagine PENN harbors a mid-sized financial moat that’s sturdy sufficient to supply the corporate with a tangible aggressive benefit over its rivals. While differentiation within the gaming trade will be tough, PENN’s distinctive set of manufacturers and broad product portfolio assist to realize a tangible degree of differentiation.

The breadth of their portfolio permits PENN to profit from a real omnichannel enterprise which goals to harness prospects throughout all kinds of digital and conventional mediums. When mixed with their profitable rewards program, I imagine PENN holds a strong set of assets primed for future worth era.

Financial Situation

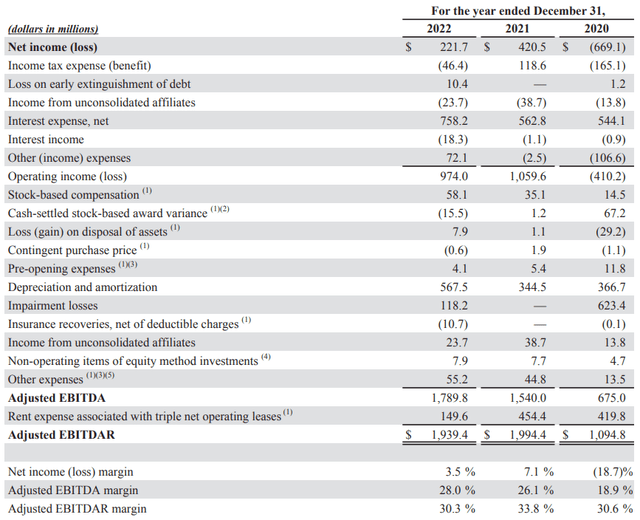

PENN FY22 This fall & Full Year Presentation

PENN has had a barely combined monetary history during the last 5 years. While 2020 was a really tough annum for the agency as a result of restrictions the COVID-19 pandemic positioned on many in-person companies, the post-covid interval has been considerably extra constructive for the agency.

Average ROIC and ROE for the 2 years post-pandemic have been 5.1% and eight.3% respectively. PENN’s internet and working margins (imply common) for a similar interval had been 4.98% and 17% respectively.

The final two years have seen PENN turn out to be a considerably extra worthwhile and fiscally environment friendly firm than what was final seen pre-COVID-19.

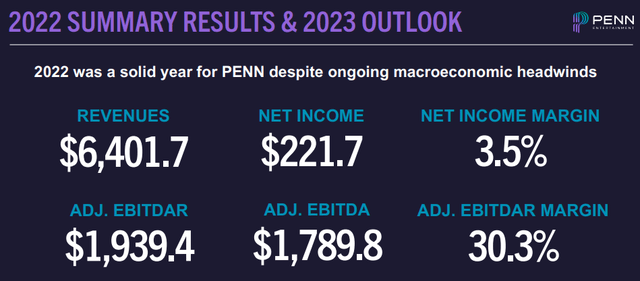

2022 was a stable yr regardless of ongoing macroeconomic headwinds within the type of provide chain disruptions, important ranges of inflation and ongoing labor shortages.

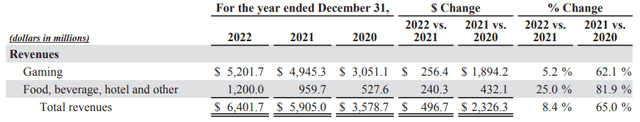

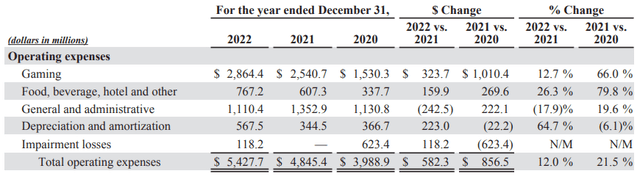

The agency managed revenues of $6.4B which represented an 8.3% YoY development in comparison with FY21. This was pushed by important development of 6% and 33% of their gaming and meals, beverage and lodge segments respectively.

PENN’s key geographic income driver remained their Northeast Segment which noticed whole revenues enhance by $143.5M YoY totaling $2.7B. This was primarily as a result of inclusion of working outcomes from Perryville which was acquired again in July of 2021.

The opening of each Hollywood Casino York and Hollywood Casino Morgantown in 2021 additionally contributed considerably to the Northeast segments outcomes.

Unfortunately, enhance COGS within the Northeast section noticed adjusted EBITDA lower 190bps (0.7%) YoY. Many of those prices are linked to the extremely inflationary market surroundings at present impacting firms throughout the globe and subsequently shouldn’t plague the corporate indefinitely.

PENN’s West and Midwest segments additionally noticed sturdy income development of 11.6% and 5.2% respectively. Adjusted EBITDA margins within the west elevated a wholesome 40bps regardless of the short-term closure of the Zia Park property as a result of lingering COVID-19 restrictions.

The West section additionally recorded important will increase in spending per visitor on gaming and elevated visitation numbers at their meals and beverage retailers. These sturdy outcomes had been earned regardless of the sale of the Tropicana Las Vegas property to Bally’s in September of 2022.

Unfortunately, working bills as a proportion of income elevated by 3% YoY. This was primarily as a result of elevated COGS of their gaming and meals, beverage and lodge segments.

Overall, internet earnings decreased 47% down to only $222.1M in FY22 as a result of a major enhance of $196M in internet curiosity bills. The major issue that led to this big surge in curiosity expense was the $171.3M enhance in Master Lease curiosity prices as a result of adjustments in lease classifications.

This induced PENN’s internet earnings margin to lower from 7.1% to three.5%.

However, with out this important curiosity expense (which is normally tax-deductible for firms), PENN’s EBITDA elevated a wholesome 16% to $1.789B in FY22. This left the corporate with an adjusted EBITDA margin of 28% in comparison with simply 26.1% in FY21.

Ultimately, diluted EPS dropped from $2.48 in FY21 to $1.29 in FY22.

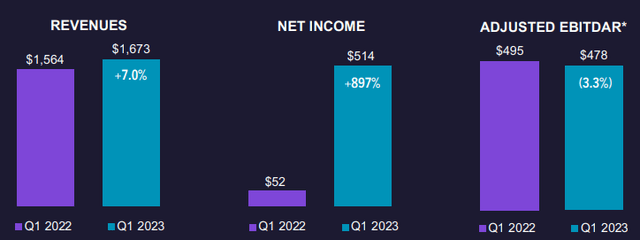

Q1 of FY23 has been massively constructive for the corporate with precise income of $1.67B beating analyst expectations by $82.94M. The quarter additionally noticed internet earnings margins enhance to 30.7% with an adjusted EBITDAR margin of 28.6%.

Revenue development YoY was 7% with internet earnings growing a whopping 897% from simply $52M in Q1 FY22 to over $514M in Q1 FY23.

This sturdy quarterly efficiency was largely as a result of sturdy revenues earned by their Northeast geographic section which offset barely softer (on a YoY foundation) outcomes achieved of their South Segment.

This sturdy Northeastern efficiency was achieved regardless of gaming tax being the best on this section at a mean of 41.8% in comparison with simply 22.3% of their South section.

Q1 additionally noticed PENN’s Interactive section (primarily on-line betting and that iCasino platforms) earn document revenues of $233.5M due to sturdy efficiency from Barstool Sports together with their iCasino companies.

While the section nonetheless produced an EBITDA of detrimental $5.7M, the section is slowly however absolutely nearing profitability.

Most impressively, these comparatively small losses are actually minute in comparison with what PENN’s closest opponents comparable to MGM Resorts International’s BetMGM (MGM) are capable of obtain. In Q1 FY23, BetMGM earned MGM a lack of $81.9M.

This illustrates the highly effective moatiness PENN has earned of their on-line gaming enterprise which continues to supply elevated revenue era skill for the agency. I imagine their differentiated on-line product together with the intensive rewards program are primarily answerable for the sturdy outcomes earned by the section, particularly in relation to their opponents.

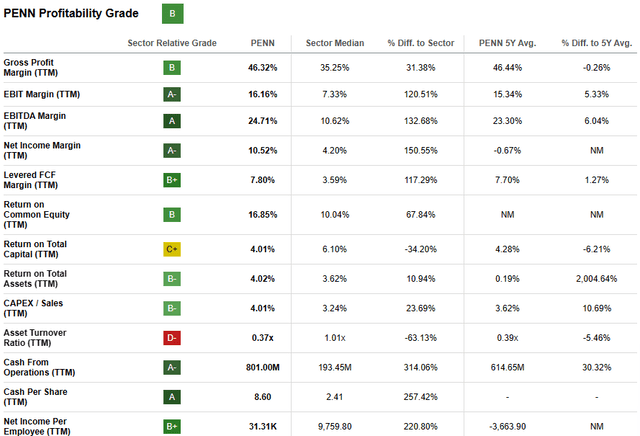

Seeking Alpha | PENN | Profitability

Seeking Alpha’s quant assigns PENN with a “B” profitability score. I imagine this score is a consultant snapshot of the corporate’s present revenue producing talents.

From a steadiness sheet perspective, the scenario at PENN seems to be largely steady for my part. With $1.75B in whole present property and solely $1.27B in whole present liabilities, it’s secure to say PENN faces no short-term liquidity points which is welcomed information for traders.

This is supported by the corporate having a fast ratio (present property minus stock divided by present liabilities) of 1.24x. The fast ratio is a superb indicator of an organization’s short-term liquidity place and illustrates that PENN ought to face no points assembly their short-term obligations.

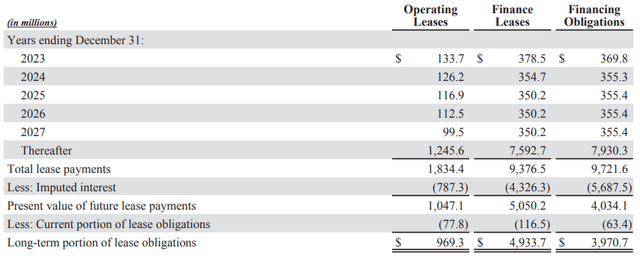

The firm’s general debt/fairness ratio is 2.80x as a result of PENN having a comparatively giant variety of long-term maturities on their arms.

Nonetheless, I imagine PENN’s general long-term debt scenario is essentially beneath management. The majority of their debentures are maturing after 2027 with a superb portion of notes being at fastened charges of 5.625% and 4.125% respectively.

I feel this protects PENN comparatively properly from the more and more tough high-interest charge surroundings and may enable the corporate to take care of stable profitability regardless of the difficult macroeconomic surroundings.

Valuation

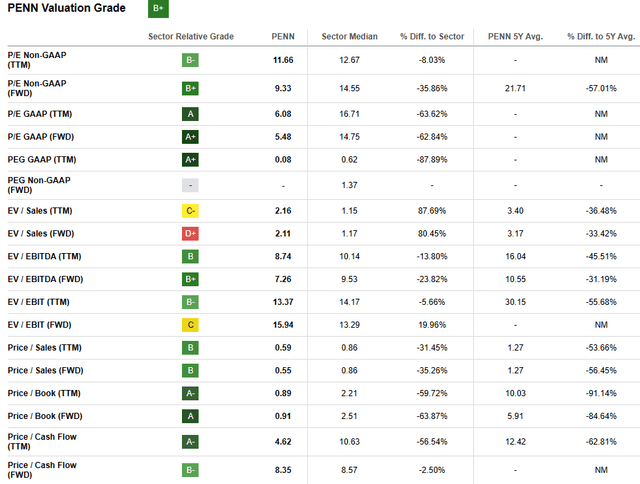

Seeking Alpha | PENN |Valuation

Seeking Alpha’s Quant assigns PENN with a “B+” Valuation score. I imagine this can be a comparatively good indicator of the worth at present current in PENN shares.

The agency at present trades at a P/E GAAP FWD ratio of simply 5.48x together with a P/CF TTM of 4.62x. Their FWD EV/EBITDA of seven.26 is sort of affordable particularly when contemplating their Price/Sales FWD of 0.55.

While these metrics already recommend that PENN may very well be buying and selling at considerably of a reduction relative to their price, I imagine you will need to delve slightly deeper to develop a good higher goal understanding of the scenario.

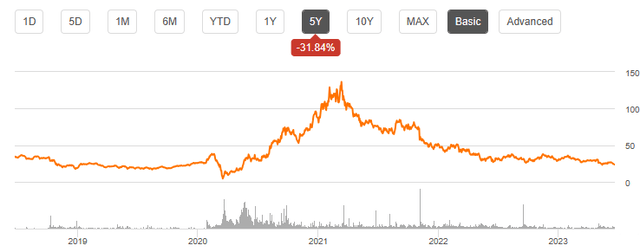

Seeking Alpha | PENN | Summary Chart

From an absolute perspective, PENN is buying and selling at traditionally low costs. Shares have fallen round 83% since their highs of virtually $140 in early 2021 to only $23.00 as we speak. This has largely been as a result of PENN experiencing a large post-pandemic rally as earnings recovered sharply.

However, I imagine the following market selloff has been extreme given the long-term profitability current on the gaming agency.

The Value Corner

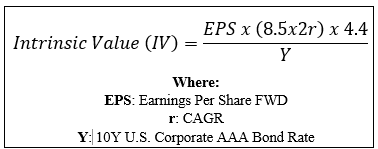

By using The Value Corner’s Intrinsic Valuation Calculation, one can higher perceive what worth exists within the firm from a extra goal perspective.

Using PENN’s estimated 2023 EPS of $4.43, a conservative “r” worth of 0.04 (4%) and the present Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.67%, I derive a base-case IV of $68.90. This represents a whopping 66% undervaluation in shares.

When utilizing a extra pessimistic bear case CAGR worth for r of 0.02 (2%), PENN nonetheless seems to be undervalued by round 55% with an intrinsic worth of $52.20.

Considering all of those valuation metrics holistically, I imagine PENN is completely buying and selling in deep-value territory. The significant growth into additional on-line sports activities betting companies and that iCasino operations ought to yield PENN a moat which they will use to drive future profitability.

In the quick time period (3-7 months), I’m reluctant to make too many predictions on what the inventory will do. While the present market valuation appears unfounded, forecasting the timescale on which a short-term market correction could happen is nearly not possible.

Much will depend on the developments prevailing macroeconomic circumstances take transferring into H2 of 2023 and the speed at which investor sentiment improves for PENN.

In the long-term (1-3 years), I imagine PENN might make for an ideal funding given the undervaluation at present current in shares. The pricing mistake made by Mr. Market post-Covid has opened the door for a doubtlessly profitable worth play in PENN shares.

Risks Facing PENN

PENN faces a mess of dangers stemming each from their final publicity to a cyclical market surroundings in addition to ESG associated threats arising from the gaming surroundings by which they function.

A chronic financial downturn within the U.S. might result in PENN struggling to stay worthwhile. The industrial gaming trade within the U.S. is especially exposed to cyclical downturns with recessionary durations traditionally resulting in very poor returns for the sector.

Despite PENN’s significant differentiation and tangible aggressive benefits, I don’t imagine the agency could be proof against such a macroeconomic occasion. Given the growing likelihood for the U.S. economic system to enter a recession in 2023, this risk might expose PENN to a very sharp short-term danger of poor profitability.

Furthermore, the growing requires stricter regulation of the industrial gaming trade as a result of results gaming addiction have on people might hurt PENN’s general enterprise mannequin. PENN depends on sustaining their playing licenses in numerous states to permit their operations to proceed. While the governance risk of states eradicating these licenses is minute, the arguably “ethically gray” trade by which PENN operates raises another ESG considerations.

Socially PENN should proceed to make significant steps to stop gambling habit from harming their prospects lives. While this accountability should be balanced together with their cross-selling technique and general need to extract the utmost income per buyer, its significance can’t be overstated.

Furthermore, I imagine a acutely aware and accountable strategy from administration will additional assist the corporate differentiate from the competitors and place them in a greater place transferring forwards into the long run.

From an environmental perspective little threats come up that would create tangible danger for the agency. While a extra devoted strategy to reaching net-zero carbon emissions could be good to see, the general detrimental influence of their operations on the surroundings is sort of small.

Given the comparatively critical social and governance dangers related to PENN’s operations, I’d not simply suggest PENN to an ESG acutely aware investor.

Summary

PENN has had a combined set of outcomes for the final couple of post-pandemic years. Shares received obliterated post-COVID as a result of extreme valuations attain throughout the 2020 bull run. This led to the large market selloff which finally brings us to the present scenario at PENN.

While shares costs have been broken the elemental enterprise PENN operates has solely grown stronger in my opinion. A collection of sensible and future-oriented acquisitions have allowed PENN to distinguish their vary of merchandise kind an in any other case homogenous market which helps earn the corporate a point of financial moat.

I imagine this moatiness will probably be key to PENN reaching higher profitability transferring forwards.

Given the numerous 66% undervaluation that exists in PENN shares utilizing a base-case CAGR, I imagine an actual worth alternative exists within the gaming large.

Therefore, I charge PENN a “Strong Buy” given the merely rock-bottom costs reached by shares. Intrinsically the agency appears to be price considerably greater than the market at present believes which I feel presents value-oriented people with a basic lagging market sentiment alternative.

[adinserter block=”4″]

[ad_2]

Source link