[ad_1]

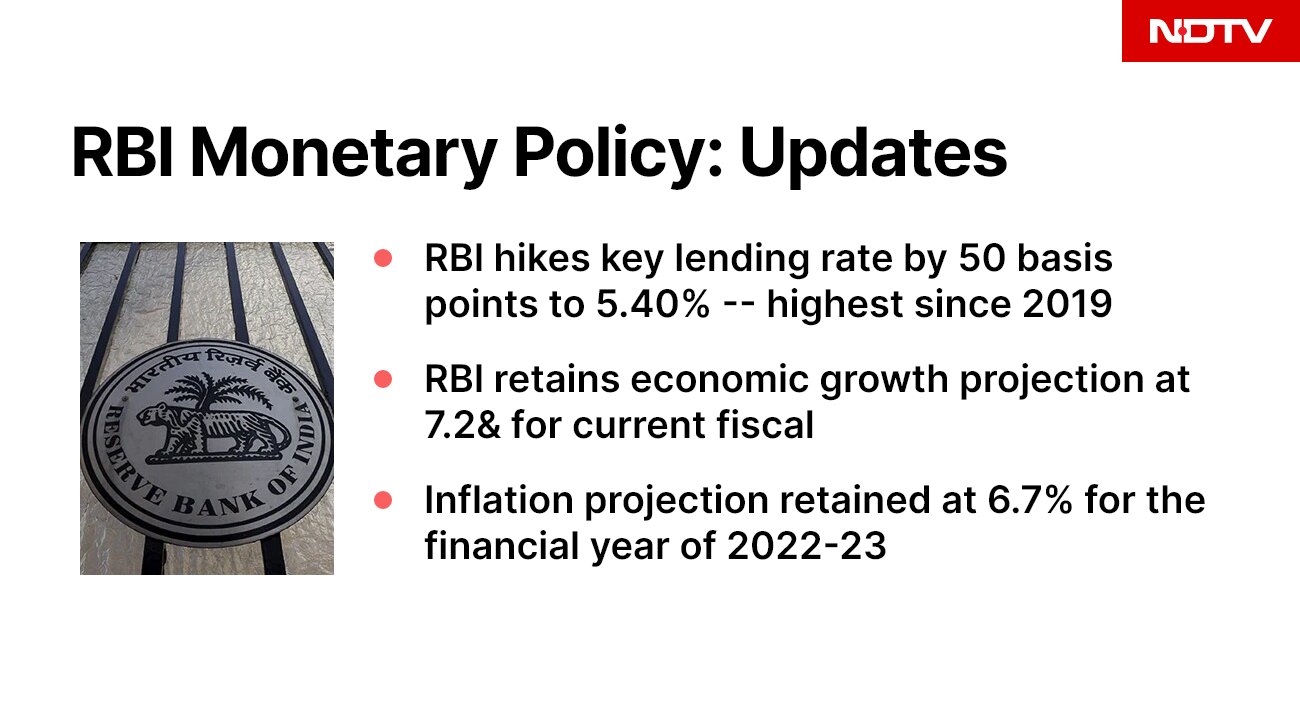

RBI Monetary Policy: RBI hiked its key lending rate by 50 basis points to pre-pandemic levels.

New Delhi:

The Reserve Bank of India hikes its key lending rate by 50 basis points to 5.40 percent, the highest since 2019 and for the third time since the beginning of the current fiscal year.

The Reserve Bank of India’s rate-setting panel on Wednesday began its three-day deliberations on the next bi-monthly monetary policy.

The central bank has already announced to gradually withdraw its accommodative monetary policy stance.

Here are the Highlights of RBI Monetary Policy:

Get NDTV UpdatesTurn on notifications to receive alerts as this story develops.

Update | The rupee reversed early gains to weaken to above 79 per dollar after the Reserve Bank of India painted a grim picture on inflation and responded with a 50 basis points hike to its key lending rate to the highest since 2019 and for a third time in a row.

The Reserve Bank of India’s key policy repo rate was raised by 50 basis points on Friday, the third increase in as many months to cool stubbornly high inflation.

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, Mumbai

“The MPC’s decisions have been in line with our expectations. Given the increasing external sector imbalances and global uncertainties, the need for front-loaded action was imperative. We continue to see a 5.75% repo rate by December 2022.”

Garima Kapoor, Economist, Institutional Equities, Elara Capital, Mumbai

“To rein in inflationary pressures and anchor inflation expectations, the MPC hiked the repo rate by 50 bps and retained its stance on withdrawal of accommodation.”

RBI Governor Shaktikanta Das on forex reserves

India’s import cover remains the fourth largest globally. He had previously said the RBI would do what it takes to shore up the rupee and contain “jerky movements” of the currency.

RBI Governor Shaktikanta Das announces monetary policy committee decisions

In line with the global trend of monetary policy tightening to cool off inflation, the RBI has so far hiked the key repo rates — the rate at which the central bank of a country lends money to commercial banks — by 140 basis points.

“Rupee fared much better than many other currencies. Depreciation more on account of strengthening dollar than weakening domestic conditions. Thanks to RBI’s policy”: RBI Governor pic.twitter.com/XeA1rOZOMS

– NDTV (@ndtv) August 5, 2022

Here are the highlights of RBI Governor Shaktikanta Das’ address:

- IMF has revised downwards economic growth projection and expressed risk of recession

- Indian economy has been grappling with high inflation

- India facing USD 13.3 billion capital outflow in last few months

- Financial sector remains well capitalised; India’s forex reserves provide insurance against global spillovers

- MPC takes unanimous decision to raise benchmark lending rate by 50 bps to 5.40 per cent

- MPC decides to focus on withdrawal of accommodative policy stance to check inflation

- Consumer price inflation remains uncomfortably high; inflation expected to remain above 6 per cent

- Bank credit growth has accelerated 14 pc as against 5.5 per cent year ago

- Domestic economic activity showing signs of broadening; rural demand shows mix trend

- RBI retains its economic growth projection at 7.2 per cent for current fiscal

- Indian economy faces headwinds from global factors like geo-political risks

- Edible oil prices likely to soften further

- Inflation projection for FY23 retained at 6.7% on assumption of a normal monsoon and crude oil at $105 per barrel

- Rise in term deposit rates should increase liquidity for financial sector

- Surplus liquidity in the banking system has come down to Rs 3.8 lakh crore, from Rs 6.7 lakh crore in April-May

- Rupee has moved in orderly fashion, depreciating 4.7 pc till Aug 4; RBI remains watchful of INR movement

- FPIs after remaining in exit mode in first quarter have turned positive in July

- The rupee gains sharply early on Friday, reversing a sharp fall in the previous session, ahead of the Reserve Bank of India’s policy announcement.

- Bloomberg quoted the rupee at 78.9713 against the greenback, a gain of 50 paise from its previous close of 79.4713.

- PTI reported that the rupee rose 46 paise to 78.94 against the US dollar in early trade.

- The dollar struggled to gain a footing on Friday after falling by its sharpest pace in two weeks, as investors remained on tenterhooks ahead of the widely anticipated US jobs data and amid growing worries about a recession.

- The US dollar index, which measures the greenback against a basket of currencies, fell 0.68 per cent overnight, the largest fall since July 19, and last traded 105.79.

Just In| Sensex, Nifty gain marginally, but remain jittery ahead of RBI policy outcome

The government bond yields dropped on Friday, with the 10-year yield trading at a three-month low, after global oil prices fell overnight, while market participants awaited a Reserve Bank of India policy decision for further cues.

The 10-year bond yield was trading at 7.1141%, as of 0340 GMT, after ending at 7.1566% on Thursday.

The benchmark Brent crude oil contract ended 3.7% lower at $94.12 per barrel on Thursday amid worries over fuel demand.

- The rupee is expected to strengthen against the U.S. dollar at open on Friday as oil prices extended their recent slide to slip to their lowest since February.

- The Reserve Bank of India (RBI) policy decision will set the intraday direction for the rupee, traders said.

- The rupee will likely open at 79.15-79.20 per dollar, up from 79.47 in the previous session.

- Brent crude on Thursday fell 2.8%, taking its losses this month to over 14%. Oil prices have come under pressure amid concerns over demand, pushing Brent crude to its lowest since before Russia’s February invasion of Ukraine.

- “The ongoing correction in oil prices will be a major relief for the rupee. Specially right now, when worries over the trade deficit are significant,” a trader at a private sector bank said.

- “Oil will help rupee to open higher and from there it will be down to what the RBI does.”

The RBI meets today and is expected to take rates 35bp higher to 5.25%. We think there is a chance they move by only 25bp as the gap between Indian rates and inflation is not that big now, and there are signs it could narrow further in the months ahead.

- India’s central-bank watchers agree that interest rates will be raised to pre-pandemic levels on Friday, yet they are split on the size of the increase aimed at fighting inflation and propping up a weak currency.

- Sixteen of 36 economists surveyed by Bloomberg see the Reserve Bank of India’s six-member monetary policy committee lifting the repurchase rate by half-point to 5.40%, a level last seen in August 2019.

- Fourteen of them predict a 35-basis point hike, five a quarter-point action and one for a 40 basis-point increase — with any of these moves seen enough to return borrowing cost to late 2019 levels.

- With Federal Reserve officials signaling a pause is out of the question until they see evidence of inflation easing, RBI watchers will be closely monitoring Governor Shaktikanta Das’s remarks for any guidance on the pace and length of the monetary tightening cycle as he seeks to ensure a “soft landing” for the economy.

- The central bank has increased the key rate by 90 basis points since May, including a half-point hike in June.

- The rupee may decline to a new lifetime low versus the U.S. dollar if the Reserve Bank of India on Friday decides to opt for a smaller rate hike, a trader said.

- The RBI is widely expected to raise the repo rate as it continues its battle to control inflation.

- Economists, however, differ on the size of the rate hike that the RBI will deliver as the central banks aims to strike the right balance between inflation and growth.

- The estimates range from 25-basis points rate hike to 50-basis points.

- “We think there is decent chance that rupee will see a record low tomorrow,” a trader at a Mumbai-based private sector bank said. “A 50-basis hike will not do much for the rupee, while anything less than that will take the rupee well below 80.”

The Reserve Bank of India will hike its key interest rate on Friday, economists polled by Reuters said, but there was no consensus on the size of the move given the absence of any clear guidance from the central bank.

With inflation running at a near-decade high and the rupee trading near a record low, the RBI, which only began raising rates in May, is expected to front-load subsequent hikes to catch up with its global peers.

Predictions from the 63 economists polled between July 25 and August 1 ranged from a 25 basis point hike to one of 50 bps when the RBI meets on August 5.

Over 40 per cent of economists, 26 of 63, expected the RBI to go for a hefty 50 bps hike, taking the repo rate to 5.40 per cent. More than one-quarter of respondents, 20 of 63, forecast a smaller 35 bp hike. About 22 per cent, 14 of 63, said 25 bps while the remaining three said 40 bps.

- The Reserve Bank of India is expected to raise interest rates today for the third time since the beginning of the current financial year, to bring down inflationary above the upper threshold of the central bank’s target since January.

- The focus shifts to the RBI’s growth and inflation outlook and the tone of the monetary policy path.

- The Monetary Policy Committee (MPC) meeting started on Wednesday abd the RBI Governor Shaktikanta Das is scheduled to announce the Monetary Policy Committee decisions at 10 am.

- The RBI had said, it was removing the policies introduced as COVID-support, and if the central bank hikes by a minimum of 25 basis points then interest rates will rise to pre-pandemic level.

- While the hike in policy interest rates is almost certain, analysts and economists have different opinions on the extent of the rate hike.

- It varies between 25 basis points to 50 basis points.

[ad_2]

Source link