[ad_1]

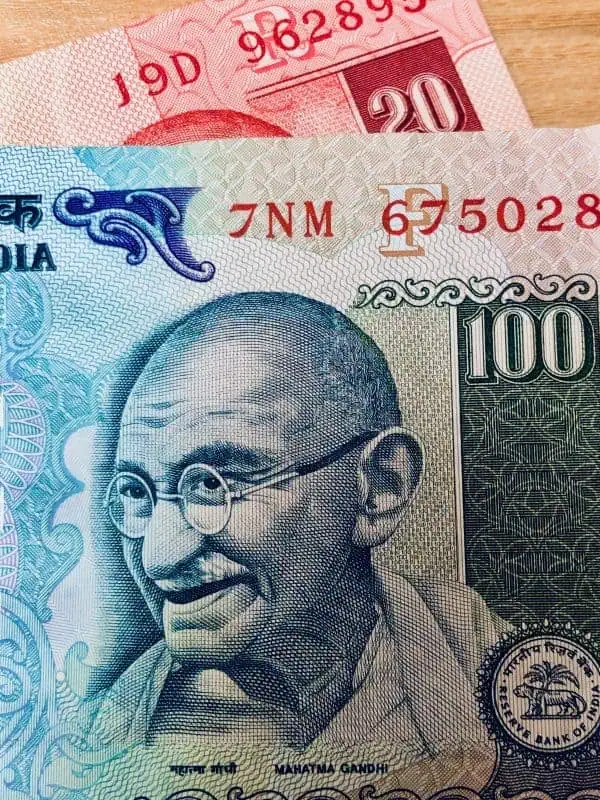

The Reserve Bank of India (RBI) has released a new report, titled “Technology Vision for Cybersecurity for Urban Co-operative Banks – 2020-2023.”

The Reserve Bank of India (RBI) has released a new report, titled “Technology Vision for Cybersecurity for Urban Co-operative Banks – 2020-2023.”

The RBI notes that the document makes recommendations or suggestions on how to improve the nation’s cybersecurity infrastructure of its urban co-operative banking (UCB) sector against the rapidly evolving IT and cyber threat environment.

The Technology Vision document for Cybersecurity for UCBs has been prepared after taking into consideration the feedback received from different stakeholders. It aims to achieve its goal by establishing a five-pillared strategic approach called “GUARD,” which stands for Governance Oversight, Utile Technology Investment, Appropriate Regulation and Supervision, Robust Collaboration and Developing (the necessary IT, cybersecurity skills needed in a virtual environment).

Ajit Doval, the National Security Adviser (NSA) to the Prime Minister of India, recently warned that financial crime and fraudulent activities have increased significantly and could continue to rise, because more consumers are conducting transactions online following the COVID-19 outbreak.

Doval said that the country would be launching a national cybersecurity strategy, which will aim to create and support a safe, secure, trusted, and resilient online environment for Indian consumers.

Earlier this month, an Indian Finance Ministry official recommended that Fintech service providers must enhance online security, as digital payments are on the rise in India.

As reported in late August, banks and government offices had been targeted by malicious P2P botnets that were mining privacy-oriented cryptocurrency Monero (XMR) by hogging the computing resources of targeted computers. These types of attacks are also a very serious cybersecurity threat affecting the operations of companies across the globe.

Cyberattacks in the UK and the US have also increased as more consumers and businesses conduct financial transactions online following the COVID-19 outbreak.

[ad_2]

Source link